First and foremost, DataQuick has changed their methodology for identifying an “arm’s-length” transaction. The change results in a “roughly 10 percent increase, on average, in [DataQuicks] historical monthly sales totals” and “a roughly 1 percent difference in the all-home median sale price historically.” We’ll be adjusting our methodology to reflect the change. That being said…

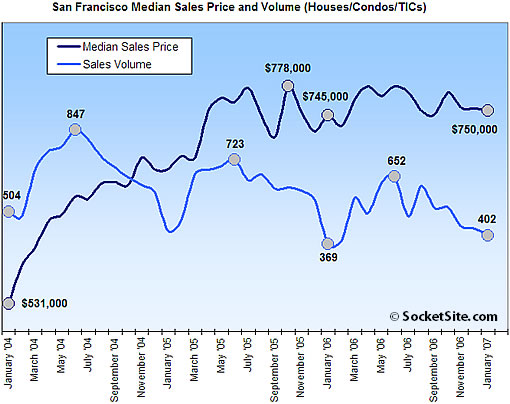

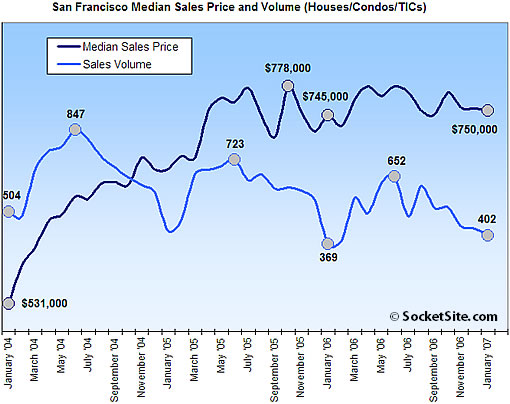

According to DataQuick, the median sales price for existing homes in San Francisco was $750,000 last month, up slightly (0.7%) compared to a revised January ’06 ($745,000), but down slightly (0.4%) compared to an unrevised December ’06. And for the first time in well over two years, sales volume increased (8.9%) on a year-over-year basis (402 sales in January ’07 versus a revised 369 sales in January ‘06).

For the greater Bay Area, the recorded median sales price in January was $601,000 (down 1.5% year-over-year) and sales volume was 6,168 (down 4.1% from a revised 6,434 sales in January ’06). And at the extremes, Sonoma county recorded a 10.4% reduction in median sales price year-over-year, while Marin county recorded a 10% year-over-year gain.

∙ Bay Area home prices edge down [DataQuick]

∙ Change in Statistics Methodology [DataQuick]

∙ San Francisco Home Sales Fall, Median Prices Relatively Flat [SocketSite]

SF home sales up, while techinically correct, paints a very different picture of the market then the DQ numbers seem to support.

“Home sales in the Bay Area fell for the 24th month in a row in January as prices slipped to their lowest level in a year and a half, a real estate information service reported.

A total of 6,168 new and resale houses and condos sold in the nine- county Bay Area last month. That was down 26.3 percent from a revised 8,372 in December, and down 4.1 percent from a revised 6,434 for January last year, according to DataQuick Information Systems.”

So my dream of one day buying a shack to retire in up in Napa/Sonoma is roughly 10% closer. Nice.

What’s happening is a continued decline in the exurbs, like Sonoma, Napa, and Solano, while the market has firmed up in the City.

Buyers are taking advantage of the slowed market to buy closer to work. Plus the exurbs have more unsold new homes competing with resales.

I think dan is right; and matt lanning had a pretty fair post on his blog abuot the market, which I agree with also. The market is looking normal, with sellers who need to sell, selling, and buyers who need to buy, buying. First time buyers stretching into homes are gone; and speculatitive sellers are also gone.

The market seems to be finidng its balance, but still hasn’t felt the full effect of the over-leveraged buyers. Depending on the economy as a whole, this may or may not materialize.

I still think that late 07 or early 08 will be the best time to get into the market if you are looking to buy.

Nice of dataquick to tip their hand that they aren’t so impartial: they are here to promote real estate.

So as the sales tank due to loan standards increasing, and 20% of the loans from last year evaporating as unavailable, Dataquick suddenly decides to “adjust” their methodology to increase the number of sales by 10% to make the comparisons with last year seem less gloomy.

As for these numbers, they are really meaningless. The mortgage business once constrained buyers, pulling them back from entering the market in an overconservative way, then for a period, pushed buyers into buying in a reckless way, and now is heading towards the earlier approach. These numbers don’t take into account that change, and so they really are indicative of nothing.

The tide only started turning in January, and so that just meant if you couldn’t get a loan from the small handful of out-of-business lenders, there were still plenty of others. The effect of the mortgage market changes will take a few more months to get baked into dataquick’s numbers.

In the same way that the numbers from the late 90s were meaningless in 2003-2006, because the mortgage industry is changing back, the world is going to be a very different place in about 4-6 months.

But through thick and thin, Dataquick will continue to be the industry cheerleader it always has been. As things go from hot to mild, they are changing their methodology. I trust them to change it more and more as things go from mild to cold, all in the quest for “higher accuracy” that didn’t seem to be quite so important last year.

I wouldn’t beat up on DataQuick too much…they’re about as impartial as they can be given where their revenue stream comes from. But I agree about methodology changes undermining credibility.

One thing unexplored is how much collateral damage there’ll be to the SF market if burbs, exurbs, and even Sacramento lose considerable value. I think people underestimate this. After all, how many San Franciscans own investment property in these areas? I know plenty of locals who rent here and have bought property elsewhere, hoping to flip and buy something in the city in 1-2 years.

Tipster,

I didn’t interpret Dataquick’s methodology change that way. I think that they restated historical prices to reflect the higher number as well, so year-over-year comparisons are still applicable (i.e. – apples to apples). Also, if you compare to the archived Dataquick sales releases – the current ’06 sales count is around 6% higher than what they reported last year this time… further suggesting that they restated historical actuals.

BTW, I found your point on the impact of liberal mortgage underwriting to be interesting. I guess the argument there would be that it artifically increased demand for houses, which makes sense to me. Have you (or anyone) ever seen any analysis on what the impact could be to overall home prices?

Here are the stats I’ve heard:

Roughly $1.1 trillion of adjustable and option loans will be adjusting in ’07 and ’08, with the split at like 800/300. These are national figures. No way to predict how many people will be able to make higher payments or refi, or if they have sufficient equity to sell out if they can’t. So the answer is: nobody knows what the impact will be.

Locally, I’ve heard that about 2/3 of all mortgages in the Bay Area are either ARMs or option ARMs.

The resets are going too be more tricky (and probably won’t have that big of an impact by themselves, at least for another year. My bigger concern is that about 20% of the market used more exotic loans (ARMs aren’t exotic) that in another month or two will be essentially impossible to get for all but the most credit worthy buyers. What’s the impact of pulling 20% of the buyers out of the market? Practically overnight?

Probably greater than anyone thinks because those 20% were financially irresponsible people who weren’t as careful in their bids. Their presence requried everyone else to ignore any sort of sound principles and make preposterous no-contingency offers into the stratosphere. And then that fed the belief that whatever price you offered would be fine in a few years, so that caused even more irresponsible behavior.

So that irresponsible behavior will evaporate, the number of buyers will greatly diminish, and the number of sellers who need to sell will tick up more than usual as the resets occur, all at the same time. We’ve never seen anything like this, so it’s impossible to predict. It can’t be good for sellers. But all of this is really just starting, and we’re at the very tip of the beginning of all of it. 6 months from now, life is going to be very different.