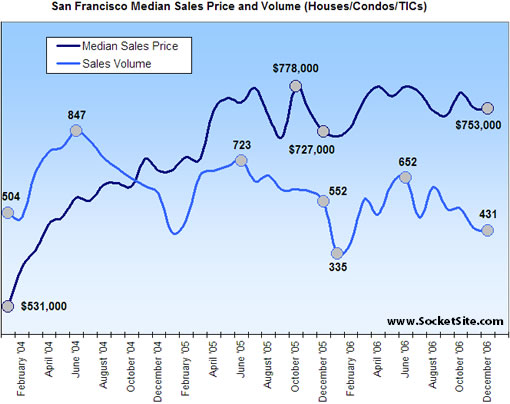

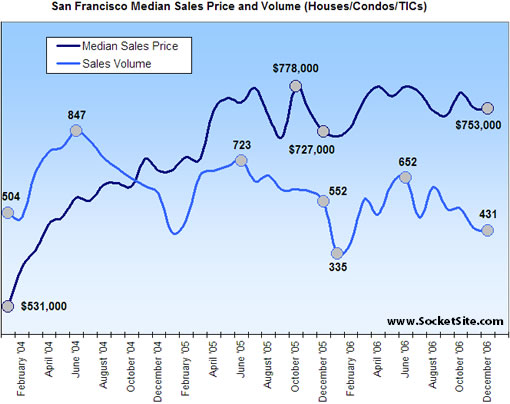

According to DataQuick, the median sales price for existing homes in San Francisco was $753,000 last month, flat compared to November ’06, but up 3.6% year-over-year ($727,000 in December ’05). Sales volume was down 21.9% year-over-year (431 sales versus 552 in December ‘05) and fell 2.3% compared to the month prior (441 sales).

For the greater Bay Area, the recorded median sales price in December was $612,000 (up 0.5% year-over-year, but down 0.6% from November ‘06) and sales volume was 7,488 (down 19.5% from December ’05, but up 3.9% from November ’06). Year-over-year, Napa county recorded the greatest slowdown in sales (down 27%) while Sonoma recorded to greatest decline in median sales price (down 6.3%).

∙ Bay Area home prices flat, slow sales [DQNews]

∙ San Francisco Sales Volume Falls (Median Sales Price Stagnates) [SocketSite]

Before we get into the same old argument about prices up/down because of mix and volume changes, I’d like to point out that the Case-Schiller index for the city is down to 215.42 for October of ’06 after peaking at 218.37 in May. So down 1.4% off the peak and rougly flat to October of ’05. It’s on a 3-month delay so October is the most recent number.

This is the definitive index of home values, and tracks the same properties selling repeatedly over 3-5 year cycles.

Dude, thanks for the stat. Although I don’t think that there is a definitive index of home values, anywhere. For me, price per sqft and subjective relative value are the best indicators. I also find the sales volume statistics very interesting as they cannot be manipulated or skewed so easily. I would love to see a spread on asking versus selling price; and more complete statistics on expired / withdrawn listings, relatative to all listings.

The C-S index is very good, but it doesn’t capture everything because it will use public records data. That data doesn’t adjust for help with closing costs, which was non existent last year, givebacks under the table, or the value of an inspection and having the seller repair or provide a giveback under the table for repairs. That can be worth another couple fo percentage points off the top of the home.

Those things are also not reflected in price per square foot, medians or anything else when you are trying to compare one year with another. So prices being flat means prices are really down.

Last time I checked, the $753,000 median price in Dec 2006 is higher than the $727,000 median price in December 2005. Am I missing something?

I’ve seen three newsletters showing an increase of 3-8% in prices in 2006, and I look at what has sold in my neighborhood, and i think 3-8% is pretty accurate.

How is it some people think that if prices are up, they are really flat, and if prices are flat, they are really down, and if prices are down, the world is coming to an end?

Am i living in a parallel universe? Prices are up people, and the chart above shows it.

Anon 8:26, everyone agrees with you that the stats above indicate that prices are up. I actually don’t think anyone on this forum thinks that SF is going to tank and take a 10-15% bubble hit. I don’t. But I do think that everyone agrees that the SF market is a bit different than other markets. I personally believe that people are getting more house/condo/TIC for their money these days. This is somewhat of an subjective statistical measure that really can’t be quantified.

Here is my general opinion on the current market in San Francisco:

I believe that the typical SF home buyer is willing to spend a certain dollar amount for a property in the Bay Area; and the market rate / price that people are willing to spend is driven by a lot of factors. In the past few years, the price that people had to spend was driven upwards due to a lot of economic factors (low interest rates, change in capital gain tax rules, exotic mortgages, etc.). I believe that those factors have driven the market rate to a point that is above the long term average. But now people are conditioned to spending a certain amount to get into the SF RE market. Unlike other areas, there is a higher level of wealth and income in this area and the competition for land / RE is tighter. So although we won’t see the price declines that other markets are seeing (e.g.,San Diego and Sacramento), there are some economic levers in place that can demonstrate weakness in the market. One example is the decrease in volumes of sold homes. Another, albeit, unquantifiable, are the givebacks at closing. Another, and this is the one that I truly believe is happening, people are simply getting a lot more house for their investment than they were getting in 2005. Only the best properties are moving and they are moving at more reasonable prices and not getting into over-bid / competition situations for the most part.

Anyway, this is a fun market to watch

“How is it some people think that if prices are up, they are really flat, and if prices are flat, they are really down, and if prices are down, the world is coming to an end?”

Why on earth should something that went up 100% in 7 years not also go down 10-20%? I am not saying it will, but I don’t see any reason why it couldn’t. Your comment “Am i living in a parallel universe? Prices are up people, and the chart above shows it” seems like whistling in the dark to me.

to Anonymous at 9:44…

More rhetoric. The quote you reference is an accurate reflection of what you see on this site day in and day out. Prices are up. Why is that whistling in the dark? Remember — this is not what MIGHT BE, but rather WHAT IS.

The one thing that concerns me is if the population of the city is less than what it was even ten years ago, the increase in housing costs can only be explained by junk loans and low interest rates perpetuated by a very irresponsible administration that refuses to pay with increased revenues for any of its decisions (especially wars). If rates ever start climbing back above 7 or 8%, and they usually do at conclusions to previous wars, how can anyone expect to sell at current prices?

Buffet and Gates saw this coming and dumped dollars for Euros almost two years ago. I think with the dollar continuing to fall, it makes real estate an ever safer investment and I would imagine foreign investors will enter the California market like they did in the early 90’s after the last downturn.

Real Estate values in the Bay Area have not gone up in Euro terms or price of oil or gold since 2000. In fact, they have gone down. It is the plummeting US currency which seems to make the market go up (other people call it inflation – which according to our government is running at 2% LOL).

All very valid points. 2 years ago the experts said the dollar could go no lower against the euro and pound, yet here we are.

In any case, expect mortgage rates to rise and lending standards to tighten due to rising defaults and government intervention in the business. There have already been 4-5 subprime lenders who have gone bankrupt in the last month or so, and the rate of defaults is increasing.

I don’t see foreign investors bailing out SF or any other US market. They’re not stupid – nobody wants to catch a falling knife. They can put their money elsewhere for 1-2 years and ride this out, just like a lot of locals are doing.

Sure, SF is “different” because we’re surrounded by water and don’t have much land left. Same is true for Japan, and what’s happened with real estate there over the last decade?

But anon at 9:44 summed it up best. Real estate values went up 100% in 7 years, something unprecedented since we became a nation in 1776. Maybe it is a new paradigm, but I wouldn’t be surprised if a good portion of those gains will be given up over the next few years.

“The one thing that concerns me is if the population of the city is less than what it was even ten years ago, the increase in housing costs can only be explained by junk loans and low interest rates”

The population of San Francisco is more than it was 10 years ago. The population dipped with the exodus of dot commers with the 2001 recession, but has been rising again.

“The estimated 2006 population of San Francisco is 798,680, surpassing the dot-com boom peak of 776,733 in 2000.”

http://en.wikipedia.org/wiki/San_Francisco

Anyway, total population is only a rough indicator of housing demand. Household size has decreased over the years, as fewer families with children live in the City.

“Anyway, total population is only a rough indicator of housing demand. Household size has decreased over the years, as fewer families with children live in the City.

Exactly. There are fewer families with children, but more singles and couples with disposable income for housing. Even assuming the population had actually declined (which the US census figures still claim), that wouldn’t necessarily translate into a decreased demand for housing.

“Demand” is up, yet sales are down? How does that work?

I remember when I first moved to SF in the late ’80s, there were news reports about the challenging housing market. I recall a particular television profile of a couple who had purchased a unit at Opera Plaza a few years earlier and were unable to sell it for what they had paid–I think around $150k. Of course, the tone of the report was DISASTER!, but within probably 5 years of that report, the unit had likely doubled in value. And, that was before the dot-com boom. To me, this example illustrates that longer-term vision is needed to accurately assess growing real estate values. What I see frequently on this site (and elsewhere) reflects this same knee-jerk approach toward understanding residential real-estate, whether from an investment perspective or purely from the standpoint of wanting to own rather than rent your home. First, never say “never.” Just a short time ago, it would have been impossible to convince most people that the SF market would slow or stall. Second, speculation is an equally reactionary approach to both an escalating or declining market. Its funny to me that despite what multiple sources of reporting indicate, some people will search for all types of arguments to support that what clearly is happening (i.e., prices holding) really isn’t.

Meanwhile, I frequently see knee-jerk reactions of people citing examples like yours with little economic support. Compare the median price in the late 1980s to the median salary, and make the same comparison today.

According to my numbers, the median salary was $25,736 per person in 1989 here, or $51K per household. Median home price for an SFR (I don’t have condo data) was $261K. That’s a multiple of 5.1x.

Today the median price is $753K while the median income is $49,653, or $100K per household. The multiple is now 7.5x vs. 5.1x in 1989.

In other words, housing is now 47% more expensive than it was in ’89, dollar for dollar.

More importantly, the price/income multiple has fluctuated in a band of 4.5x to 5.0x since 1988 (I only have data going back to 1982). In 2000 it broke 5.0x, went to 5.9x by 2002, 6.5x in 2004, and we all know the rest.

So the big run-up only started in 2000. San Francisco was never affordable compared to national standards, but it’s gotten even less affordable in the last 5 years. While population has been somewhat steady and housing supply has actually increased. Where’s the disconnect?

I’ll agree that, for the moment, prices are flat. But unless we all get 47% raises in the next year, expect prices to fall or stay flat until incomes catch up. Based on economics.

“I remember when I first moved to SF in the late ’80s, there were news reports about the challenging housing market. I recall a particular television profile of a couple who had purchased a unit at Opera Plaza a few years earlier and were unable to sell it for what they had paid–I think around $150k. Of course, the tone of the report was DISASTER!, but within probably 5 years of that report, the unit had likely doubled in value.”

Between 1989 and 1997 the market went down about 15% in nominal terms. Given the high inflation in the late 80s, the real drop between 1989 and 1997 was more like 50%. So how could the property have doubled in value within 5 years? During inflation everything gets more expensive. That seems to be a good thing, or is it?

Anonymous at 10:23–

I stand corrected about the 5-year time period. That unit at Opera Plaza probably would have gone for about $165k in ’98. However, the core of my posting was that a short-term perspective isn’t the way to understand real estate values, which are really about longer-term trends.

“I stand corrected about the 5-year time period. That unit at Opera Plaza probably would have gone for about $165k in ’98.”

If the unit sold for $165K in ’98 and inflation was running at 3% annually between late 80s and late 90s, the buyer lost about 20% in real terms (i.e. after inflation). I consider 10 years long term. So how was that a good long term investment? The stock market return in that 10 year period by far outperformed the real estate market. So here is my point: depending where you are in the real estate cycle, real estate investment may or may not be a good investment – even 10 years out. And I guess I know where we are in the current cycle……

Dude and Anonymous: Can’t argue with your points. But again, refer to my original post and you’ll also see that I mention the desire to own one’s home rather than rent it. For some (but not everyone), there are quality-of-life advantages to ownership that are equally as valid as the value of one’s stock portfolio.

I stand corrected on the population statistics for the city, but an increase of about 20,000 people should not cause prices to go up almost 100% in 6 to 7 years. I heard that the all time population high for the city was around 850,000 people around 40 years ago but I am not able to find this statistic at the moment. It would be interesting to see which neighborhoods in the city have the greatest population increase. I have a feeling the largest growth is in the Mission District.

“Demand” is up, yet sales are down? How does that work?

Simple affordability is down …

It is not the population growth that pushed the prices higher. Easier loans, higher debt to income, more money flowing about, good ole fashion inflation, dollar loosing value relative to euro, Chinesse willingness to loan us money, kinda a perfect storm for the values to increase.

Didn’t that also happen in San Diego, Vegas, Sonoma, Florida, and Sacramento?

What % of SF residents earn over 100K. I would guess it is over 10%.

The vast majority of housing stock is rental. I think over 60% of population are renters…The higher income people have shown a desire to purchase. The more people make, the older they get, the less they want to be renters. May not be completely rational, but for a % of the population I beleive this to be the case. At some point, a guy/girl has to step up and own the roof over their head. This goes beyond the economics and plays a person’s desire for status, control, accomplishment, and the pursuit of the american dream.

Dude,

It did. I don’t think values in SF went up as fast as San Diego and vegas. Did not buy in either market so not sure. Also, as a % of housing stock, SF has not had the increase in inventory (new units) as Sac and LV. Not sure about SD. See my last post, SF is a renter’s town. Those with money that rent want to own. At least they have in the past. And they want to live in SF.

I have seen many dinks double their housing expense going from rental to owners (similar size, location, nicer interiors for owned unit) and be extremely happy about the move.

So have I. Recently (in the last year) I’ve seen three become miserable because of it. In all three cases they bought at or near the absolute peak and leveraged themselves up the wazoo.

One couple I know paid $800K for a property in late ’05. It was a bidding war, they got emotional, etc. The market dried up quickly thereafter. Next comp after them went for $650K months later. Can you say ouch?

That sucks big time. There are going to be more than a few bad burns from the bidding wars. Offers due on x date, 16 offers. How could you not over pay in this model? Although the first condo I bought in 99 had 14 offers. I was the jack ass that one that bidding war. I felt like a sucker. Turned out ok on that one for me.

I hope they make it out whole. 20% seems like a big hair cut. I would not be talking about the market with them.

“I heard that the all time population high for the city was around 850,000 people around 40 years ago but I am not able to find this statistic at the moment.”

The highest (every 10-year count)census figure ever for the population of San Francisco was 776k in 2000. The previous high was 775k in 1950. If estimates are correct, more people live in SF now than at its 1950 peak.

http://www.census.gov/population/cencounts/ca190090.txt

DQ News shows San Francisco up 3.6% YoY in December 2006, and corroborating 3 other newsletters I saw.

Are we just going to ignore this data? San Francisco is up.

http://dqnews.com/RRBay0107.shtm

Are we just going to ignore this data? San Francisco is up.

Average selling price, which most seem to agree is fraught with problems, might be up as compared to December ‘05, but it also looks like it has yet to return to a peak around October ’05. Last month it was down 3% from that peak. In fact, it’s looking damn flat since around June ’05.

As you said, don’t ignore the data. And perhaps live by the sword, die by the sword.

How does what has been selling affect the median sales data? In the last year it seems to me that there has been much more new condo sales than in the past, which will skew median and average prices higher. Later this year in the months when all the Infinity and 1 Rincon sales close I expect there will be a large upward blip, but that doesn’t really indicate what’s been happening in the rest of SF. It would be interesting to see what the median price would be with South Beach sales backed out. Also, incentives backed out (free HOA, loan buydowns, etc.).

“Are we just going to ignore this data? San Francisco is up”

San Francisco _median_ is up. Without knowing the mix of houses that sold and the level of incentives involved, it’s difficult to postulate that this size of median increase translates into houses having actually increased in price.