If you’re truly “plugged in,” you should already be familiar with SocketSite’s Complete Inventory Index (Cii) for San Francisco. As we wrote last September:

The goal of the Cii (pronounced “see”; we’re hoping Nintendo views it as flattery) is to paint a complete picture of housing inventory and new development in San Francisco; listed, unlisted, pipeline, and potential. In fact, we believe it represents a fundamental shift from the abstract to the tangible with regard to what’s in the works throughout San Francisco.

Over the past quarter, we have doubled the size of our new development database and SocketSite now tracks the size, status, probability, pricing, sales, and available inventory for nearly 125 new developments in San Francisco (15,000+ condominiums in total). We also track 10,000 “net new housing units” (including rental units) that are either proposed or on the drawing boards. And all told, we are actively keeping tabs on a potential inventory of 25,000+ housing units (i.e., San Francisco’s overall housing pipeline).

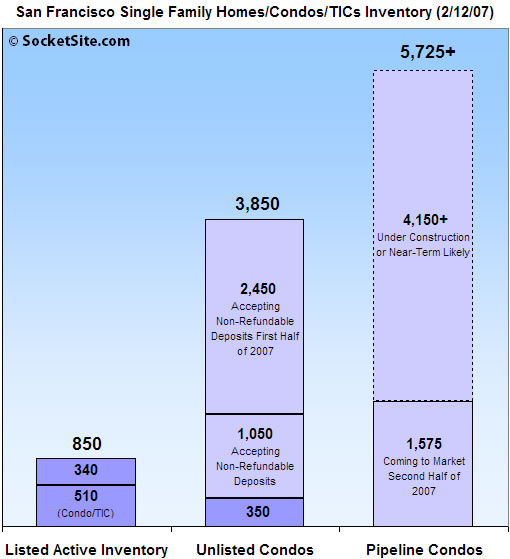

As it stands, in addition to the roughly 325 San Francisco condominiums that are listed and available for sale on the San Francisco MLS, we estimate that there are approximately 350 new condominiums that are not listed, but are currently available for purchase and immediate occupancy. These condos include unlisted inventory in buildings ranging in size from The Glassworks to The Beacon.

We also estimate that there are currently an additional 1,050 available condominiums that are actively competing for the attention of buyers and accepting non-refundable deposits in sales offices throughout San Francisco (examples include The Infinity, Heritage on Fillmore, and Arterra). And within the next six months, we expect to see an additional 2,450 condominiums begin marketing, accepting deposits, and competing for sales as well (think The Potrero, Symphony Towers, and The Bay).

Looking forward to the second half of 2007, we see an additional 1,575 new condominiums that are likely to start marketing/selling before the end of the year (or relatively soon thereafter). And for 2008/2009, we see 4,000+ units that have a shot of making it to market (and 2,000+ that will likely fall by the wayside).

Beyond that, well…you’ll just have to keep “plugging in.”

∙ SocketSite’s Complete Inventory Index (Cii) [SocketSite]

∙ Glassworks (207 King): 3 Years Paid HOA And Further Reductions [SocketSite]

∙ The Beacon: Sales Office Incentives [SocketSite]

∙ The Infinity: Online Floor Plans And Condo Specifications [SocketSite]

∙ Heritage On Fillmore: The VIP Scoop [SocketSite]

∙ Evidence Of A Price Reduction At Arterra? [SocketSite]

∙ The Potrero (451 Kansas): Sales Center Opening In February [SocketSite]

∙ Symphony Towers: From The $300,000s [SocketSite]

∙ The Bay (329 Bay Street): Complete Pricing [SocketSite]

I’d be curious to see more details on the pipeline numbers. I know of a few big projects whose viability is questionable at this stage (ie: on the chopping block). The banks and equity investors that finance these deals are cautious about proceeding if there’s too much uncertainty about the future. But if the first brick is already laid…

Everyone seems agreed that nobody can predict exactly what the market will do.

But I’ll take a stab anyway. Watch for the left column to crest 1,000 by April, if not sooner, and keep climbing. Then watch median prices stagnate and start to fall when trailing data shows the busy spring selling season never materialized. By end of ’07 medians will be approaching $700K in the city, down from $750+ recently. I’ve been wrong before, but that’s my prediction at this point. Mid-to-late 2008 will be a great year to buy.

I echoe Dude’s sentiment. My suggestion for prospective condo buyers is to continue to rent for the next year or so and just wait until other projects come on the market and compete with those still languishing on the market.

I’m glad to see that the plugged in readers take into consideration HOA fees and parking in their evaluatation of the affordability and desirability of condo projects.

I wonder about the viabiliy question

Is it that expensive to develop in SF that the projects become suddenly unprofitable with a small (relative) decline? Is the land, taxes, fee exactions and constuction costs that high?

Or could we see more modest projects?

This is an amazing amount of research that is not available at any real estate brokerage, website, or even paid subscription service – so thank you Socketsite for bringing it to the forefront and making an effort to bring the numbers current. I’d say one of the metrics to keep an eye on is the “months of inventory” figure. Dataquick shows an average of approximately 640 unit sales in SF per month for all of 2006, so that’s still a pretty low current supply at 2,250 units (850 listed active inventory plus 1,400 unlisted units), or under 4 months of supply. If and when this number goes past 6-8 months of current supply, then you’ll see a significantly softer market around here.

Anne – these projects are not as profitable as you might think. Construction costs are very unpredictable, land, insurance and financing are expensive, and markets uncertain. They underwrite well when values go up 15% every year. When markets slow, the margins shrink fast and projects get dropped by thier sponsors and financial partners. There’s a reason only a handful of San Francisco developers have stood the test of time.

Looks like if you count all of the unlisted units it works out to about 6 months. Why exclude the projections?

How about breaking the numbers down by district? It seems that the bulk of inventory is in District 9 Soma, South Beach, Potrero. A couple of building in District 8, a couple in District6. Isn’t the lack of inventory in the other districts then become more valuable due to lack of supply? The price pressures are only on District 9 as an appraiser cannot go out of the district for comps.

“We also estimate that there are currently an additional 1,050 available condominiums that are actively competing for the attention of buyers and accepting non-refundable deposits in sales offices throughout San Francisco (examples include The Infinity, Heritage on Fillmore, and Arterra).”

Am I correct in assuming that 1Rincon was not included in the above-reference examples because substantially all of their units are already spoken for or are they no longer accepting non-refundable deposits in sales offices?

Nony – if you want to add in the supply that will be coming available over the next six months, you have to add in the sales that will occur over these six months on the other side of the equation. So to keep it an apples to apples comparison – one month sales number versus what is available that month. If you want to make it a 6 month projection, then you have to assume that 6 months of sales at 640 units, or 3,840 sales will occur over that same six month period with the larger inventory. And to Anonymous at 10:32 – yes, most of the new development is in the SOMA/South Beach/Mission Bay area – they actually break down the areas where the new development will be if you go over to the Housing report on the SF Planning website. However, we spoke about this before in the Socketsite discussions, in that value is relative throughout the city. If the value of a nice 2 bedroom condo goes down (for example) by say 25% in SOMA, it will affect the value of condos citywide by providing a comparatively better value until surrounding neighborhoods decline in value to be competitive with that pricing. So yes, the neighborhoods have less new development and should have better supply/demand characteristics, but they are not completely immune from a potential over-supply city-wide.

Thanks for the explanation; I should have paid attention in Econ.

Would it be fair to say that even within the condo market there are different micro markets? I am not so sure the candidates that are buying Victorians on Portrero hill, lofts in the soma and mission, and high rise luxury condos are in the same market. It especially seems that the high rise condo market is its own market attracting its own type of buyers.

Just a thought.

In answer to Anon at 2:15 PM, I agree with this earlier comment:

“So yes, the neighborhoods have less new development and should have better supply/demand characteristics, but they are not completely immune from a potential over-supply city-wide.”

For example, we’ve read here about projects such as the Beacon and Palms that cannot move units. But, I live in a large hi-rise building on one of the more established “hills”, and units don’t stay on the market long (and despite some pretty formidable HOA dues!).

Nony – if you want to add in the supply that will be coming available over the next six months, you have to add in the sales that will occur over these six months on the other side of the equation. So to keep it an apples to apples comparison – one month sales number versus what is available that month. If you want to make it a 6 month projection, then you have to assume that 6 months of sales at 640 units, or 3,840 sales will occur over that same six month period with the larger inventory.

Not so fast. If you’re talking “apples to apples” don’t forget that you’d also need to account for new re-sale inventory that would hit the market over the next six months as well. Re-sale inventory looks to be up over the past couple of weeks/months, which means that new listings are actually outpacing new sales. As such, you could probably expect to see at least 3,840 new re-sale listings over the next six months as well. And that puts us right back to at least six months of new supply.

Absolutely – that was the point that if you start including supply from 6 months down the road then you have to include the demand during that period. Forecasting out all those 3 elements – new units coming available, resale units coming available, and sales activity over 6 months in the future starts veering more toward the wild a** guess side of things, so that’s why the currently available figure versus the one month average sales rate is typically used.

The good news for buyers is that a lot of the new buildings have units priced below $550k. With all the attention paid to Infinity and One Rincon, the impression is that new developments are all just a “playground for the rich.” Second and third home-buyers, etc.. Not so. The hype is going to those buildings because they’re more glamorous, but in 2007 and 2008 the entry-level buyer will have more choices than ever before!

Speaking of micro-markets, check out http://www.tdsf.blogspot.com. That is where the writer posts the section of the newsletter they are doing for “nano-markets”. He’s calling it the “Tour de San Francisco” because they’re checking out all the districts in sf, one by one. He seems to have a pretty good grasp of the city as a whole. It’s pretty cool.

I agree that a buyer that’s interested in a condo in districts 5,7, and 8 is a very different buyer than in district 9. There is no new housing going into those districts so values will always hold up there.

Could the micro luxury condo market be driven in part by out of town buyers or people who are buying a second place? Is it just a rumor that a lot of the people who are buying these luxury places are from out of town? Is it enough to push the demand beyond just the local buyers?

There is no new housing going into those districts so values will always hold up there.

What? Drive up Van Ness in District 7 and then turn up Lombard and look at all the new construction on lots that have been vacant for years. More new housing in district 7 this year than ever before.

How about breaking the numbers down by district? It seems that the bulk of inventory is in District 9 Soma, South Beach, Potrero. A couple of building in District 8, a couple in District6. Isn’t the lack of inventory in the other districts then become more valuable due to lack of supply? The price pressures are only on District 9 as an appraiser cannot go out of the district for comps.

Umm, SOMA South Beach and Potrero are in District 6. So that includes the Infinity, Rincon Hill, the bulding on Folsom at Second, all the units near the ballpark, etc.

I also don’t think there’s a rule that an appraiser cannot go out of the district for comps. That’s nonsensical.

[Editor’s Note: You’re both right. SOMA, South Beach and Potrero are located in political district 6 ( http://www.sfgov.org/site/bdsupvrs_index.asp?id=4385 ), but they are also located in real estate district 9 ( http://www.sfarmls.com/docs/areamaps.htm ).]

An appraiser first has to look for comparables in the same building first. Then to surrounding buildings in the same district. You can not use comps in district 7 for a sale in district 6!

Even if they are right next door to each other? I find that either hard to believe or a stupid law. That would defeat the purpose of an appraisal.

Forgot to add…..

Aren’t comps done by distance?

If there are recent sales in your subject’s building (6 months ago or more recent) then you use the comps in your own building – assuming they are not screwy and are relatively comparable to your subject (like you wouldn’t compare non-view comps with view sales in these high rise buildings). Then if there isn’t sufficient data in your own building, you go to nearby similar buildings. Generally, the closer the better for comps outside of your building, but there is no legislated distance that you can’t go past (remember this is a much more regulated industry than brokerage with state licensing and federal guidelines that an appraiser must follow). You go as far as you need to get comparable sales that are similar to your subject, but that’s not going to be the Marina for SOMA sales as there are plenty of sales in SOMA these days. Lastly, there are rules that you can’t get all your comps in the subject building for a new development – you have to get some of your sales from other comparable buildings during the initial sellout of the project, but then once the building is all sold out and occupied, you can get all your comps from the subject building.