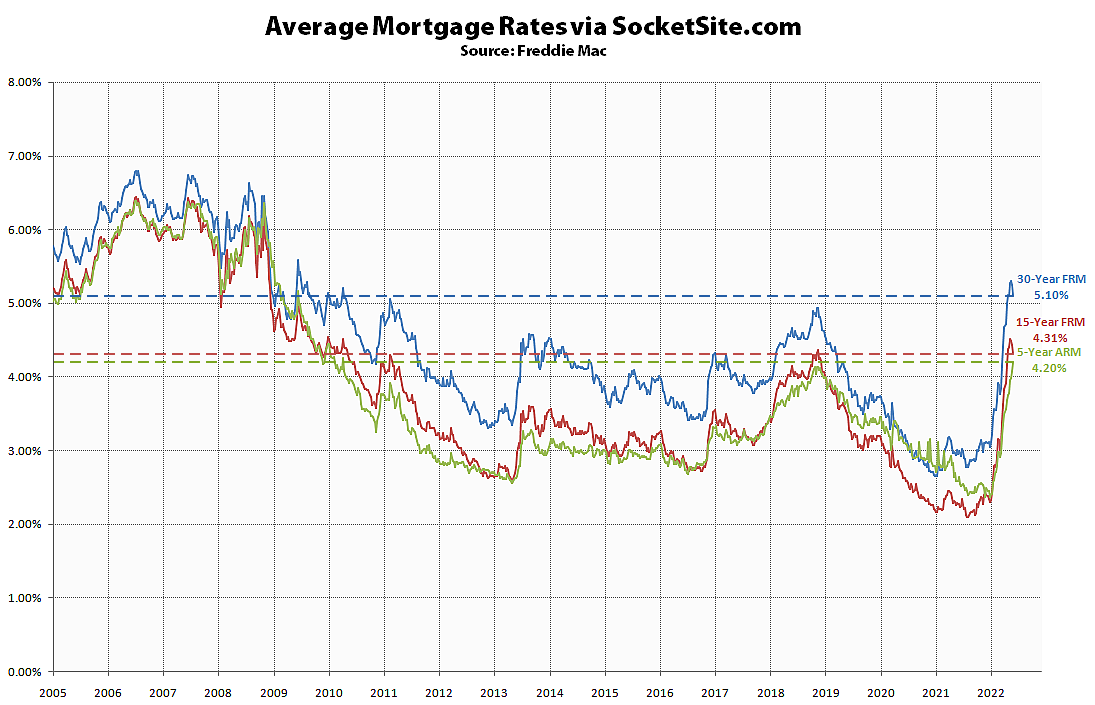

Having hit 5.30 percent two weeks ago, representing a 670-week high, the average rate for a conforming 30-year mortgage has since ticked down 20 basis points (0.2 percentage points) to 5.10 percent.

That being said, the current 30-year rate is still 215 basis points or over 70 percent higher than at the same time last year and the average rate for a 5-year adjustable rate mortgage (ARM) has ticked up to 4.20 percent, which is 161 basis points and over 60 percent higher than at the same time last year, nearly 60 percent higher than the average 30-year rate in January of 2021, and the highest average rate for a 5-year ARM since April of 2010.

Compared with a 3.0% rate, which could have been had for much of 2020 and 2021, the monthly payment on a 30-year FRM has increased 28.8%. Less obviously, the amount amortized at the end of 10 years is 23% less (18.4% at 5.1% vs 24.0% at 3.0%).

The opportunity costs of paying cash have plummeted. Relevant to a lot of SF area purchases.

Except stock and crypto 50% lower so circa 2 years ago, and opposite the 50% real estate gains in the same period.

Actually, the Dow is up around 30 percent over the past two years; Bitcoin is 213 percent higher; and the index for Bay Area house values, which has significantly outperformed San Francisco proper, is up 33 percent with a 6 percent gain condos. Which brings us back to the emerging impact of the sharp rise in rates…

With regard to the value of Bitcoin, yes, it might be up over that specified time period, but it’s early days yet. The bubble hasn’t yet popped, and what&hellipit’s down just over twenty four percent over the past month and Ethereum is down even more.

I won’t say that it’s going to go to zero, but I think trading that 895 Bitcoin for the infamous home at 651 Dolores Street in July of 2018 is going to look like a prescient trade when we arrive at the cryptocurrency market bottom.

I think you’ve got your logic backwards. ‘Buy Low and Sell high’ and all that.

The more things correct the more you’ll be able to get from your cash and thus the higher the opportunity cost. Inflation erodes the value of cash, so you’ve got to account for that too. Complicated times.

I believe what s/he meant was returns on alternative investments have declined, so the “(lost) opportunity” or “cost” (of not pursuing them) has declined as well.

Whether/not this seems like a valid argument, or (yet another) plug for how great buying SF real estate is, I’ll leave up to you to decide.

UPDATE: The average rate for a 30-year mortgage inched down another basis point over the past week to 5.09 percent, which is 210 basis points, or roughly 70 percent, higher than at the same time last year, shrinking the potential homebuyer pool (demand). At the same time, supply is on the rise, particularly with respect to unsold new construction.

6-3-22 Change 52 Week Range

Rate Previous 1 Year Low High

30 Yr. Fixed 5.44% +0.01% +2.31% 2.78% 5.64%