Despite the unemployment rate in San Francisco having declined from 6.7 percent in October to 5.7 percent in November, the number of people living in San Francisco with a paycheck actually dropped by 6,600 last month to 534,100, which is 44,000 fewer employed residents than at the same time last year.

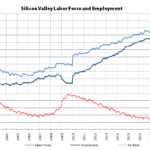

And in fact, the drop in the local unemployment rate was driven by a sharp decline in the local labor force which dropped by 12,800 in November and is now 23,300 lower than at the same time last year having dropped by 20,700 since the end of February.

The trend was roughly the same across the other eight Bay Area counties, with the unemployment rate across the East Bay dropping from 7.7 in October to 6.9 percent in November but with 12,300 fewer people now employed and the blended unemployment rate in San Mateo and Santa Clara counties dropping from 5.7 percent in October to 5.1 percent in November but with 13,200 fewer people now employed.

As such, while the blended unemployment rate for the Bay Area dropped from 6.6 percent in October to 5.9 percent in November, the labor force was down by 78,300 to 4,070,500 and the number of employed residents actually dropped by 42,500 to 3,830,500 which is 278,300 fewer employed residents than at the same time last year.

And keep in mind that the figures above effectively pre-dated the multiple rounds of reopening rollbacks in San Francisco last month and the stricter Stay Home order for the greater Bay Area which will be in effect through at least January 8, 2021.

Are there any data on how many of these people gave up on looking for a job vs how many moved out of the bay area?

Vir Biotechnology signed on to take 133,896 square feet of space listed for sublease at Dropbox Inc.’s new Mission Bay headquarters at 1800 Owens St. last month, the company confirmed in a filling with the U.S. Securities Exchange Commission on Tuesday.

The lease runs from Dec. 24 through August 30, 2033 and does not provide an option to extend. Vir paid an initial $500,000 pre-payment for first month of rent for each floor of the subleased space within the building, known as The Exchange.

Base rent for the property is $47.44 per square foot for the first year of the sublease and will increase by 3% annually.

curious if anyone knows how $47/sq ft compares to 2018/19 lease amounts

The going rate for average Class A office space in the fourth quarter of 2017 – which is when Dropbox inked their 15-year lease for the above-average Exchange campus – was closer to $71 per square foot.

wow. thats a 34% drop