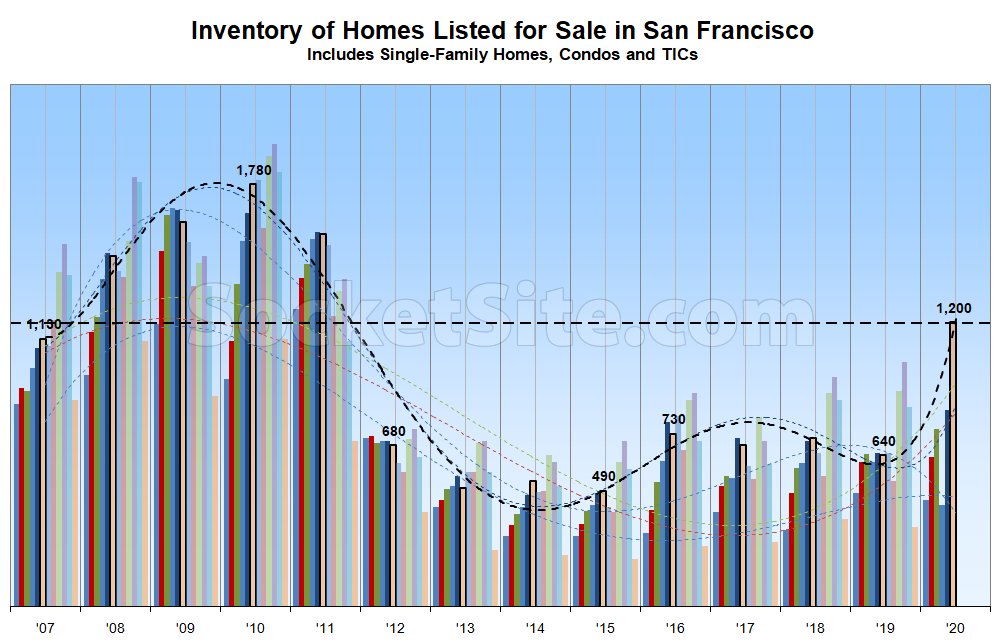

The number of homes on the market in San Francisco, net of new sales, continues to climb and just crossed the 1,200 mark for the first time in 9-years.

In fact, there are now 90 percent more homes on the market than at the same time last year and nearly 150 percent more inventory, in the aggregate, than in mid-2015. And the marked jump in inventory levels, which were already on the rise prior to the COVID-19 hit, shouldn’t catch any plugged-in readers by surprise.

At a more granular level, the number of single-family homes currently listed for sale in San Francisco (350) is now running 57 percent higher than at the same time last year while the number of condos (850), which tends to be a leading indicator for the market as a whole, has doubled.

And with roughly 30 percent of the homes on the market having been listed for under a million dollars, there are now 70 percent more sub-million dollar listings in San Francisco than there were at the same time last year and the most, in the absolute, since the fourth quarter of 2016.

And a quick check on Redfin shows that a whopping (8) SFH are available north of 280 in San Francisco are listed for less than $1M, and (5) of those however right at $1M.

Anecdotally, it seems there is more availability in the $1M to $1.5M range than there was a few years ago.

And factually speaking, there’s now more availability in the sub-million, $1 million to $1.5 million, and over $1.5 million ranges than there was a few years ago.

ha, right! you have the numbers 🙂

There were 119 sub 1M sfr sales 1/1 – 6/29/19 at $773/ft.

This year there have been 60 such sales at $809/ft.

In short: sales down, inventory up and the mix of what’s sold has shifted.

Well, shifted, sure, shifted to more expensive stock in terms dollars per foot.

Take 1.01M to 1.5M, year over year: 2019 935/ft. 2020 has been 953/ft. Yes, volume is down from 314 to 229. But that’s also conversant with 2 1/2 months of relatively glacial activity.

So you’ve got the sub 1M higher year over year. Then you’ve got the next echelon higher year over year as well.

Look at June ytd.1.01M to 1.5M. It’s 43 sales last year at ~945/ft, to 37 this year at ~1010/ft.

By the looks of things June 2020 might even be a hotter market all together over June 2019 as far as 1.01m to 1.5M. There are a lot of pending sales in the price range.. Let’s see what tomorrow brings.

That was a month and a half, really. The stark difference in YoY volume lives between 4/1 – 5/15.

Don’t confuse “more expensive stock” with the stock having gotten more expensive.

And keep in mind that the average sale price per square foot over the past quarter is down for the sub-million and $1-1.5 million segments of the single-family home market, both quarter-over-quarter and compared to the past year, and that’s despite the aforementioned shift in mix.

“Don’t confuse “more expensive stock” with the stock having gotten more expensive.”

Well, I’ve shown that the sub 1M market has sold for more per foot. And I’ve shown that the next rung up has sold for more per foot. So I’m not sure what you’re getting at?

and this ?

“And keep in mind that the average sale price per square foot over the past quarter is down for the sub-million and $1-1.5 million segments of the single-family home market, both quarter-over-quarter and compared to past year”

Not so. Q1 2020 1M – 1.5M: 137 sales $~961/ft

Q1 2019 1M – 1.5M: 130 sales $~937/ft

So we see that pre-covid the 1M to 1.5M SFR outperformed 2019.

And the sub 1M ? 2019: 55 sales $724/ft

2020: 31 sales $800/ft

With respect to “the past quarter,” were referring to the previous three months or effectively Q2.

And it might help to look at the distribution of what has recently sold in each of those segments, particularly with respect to location and size. Keep in mind that smaller homes tend to fetch a higher price per square foot (as do homes in better neighborhoods).

I don’t need to keep anything in mind, thanks. I know what I’m looking at. I’ve broken this out in multiple ways at this point and I’m finished. The narrative that SFRs in the sub 1M to 1.5M range are trading for less money, YoY, is not supported by sales data.

Once again, the average sale price per square foot over the past quarter is down for the sub-million and $1-1.5 million segments of the single-family home market, both quarter-over-quarter and compared to the past year. And that’s based on sales data and despite the aforementioned shift in mix.

Oh wait. Right. Case Shiller. The database where time, wear and tear, gentrification, and improvements are not things.

or style trends or taste shifts … or city planning for that matter… also not things in Case Shiller …

I’m struggling to figure out the difference between the inventory data you posted (1,200+) and the NAR’s number for “active listings” of 756 (up 15.6% YOY). OK, the NAR’s number is for May, and your is more current and would therefore be higher, but that’s still a big difference.

Is your data straight from the MLS? Is the NAR deducting some inventory for whatever reason to get its “active listings”? What am I not looking at here?

When in “May?” There was a 60 percent swing from the first week to the last. And by mid-month the accurate count was already over 800 (which was up from closer to 700 the week prior and 35 percent higher, year-over-year).

And in addition to simply being more current, our accounting normalizes for local listing patterns which can swing inventory levels by 10-20 percent simply based on the day of the week on which they’re taken and compared.

Thanks. “When in May” — that’s a good question. I assumed it was the inventory on the last day of the month. But it could be an average figure to avoid the issue that you mentioned. I should check the NAR’s methodology.