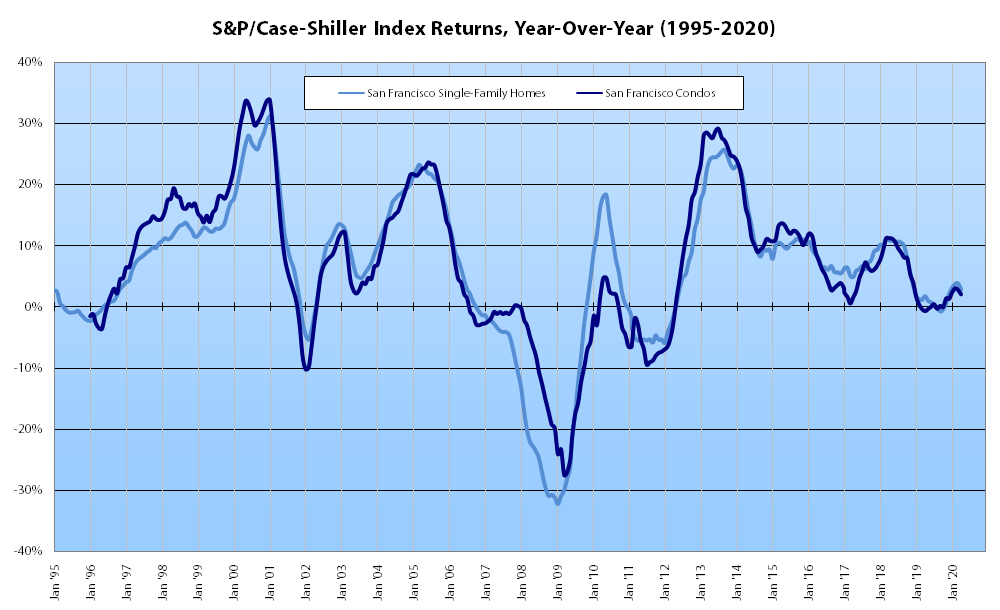

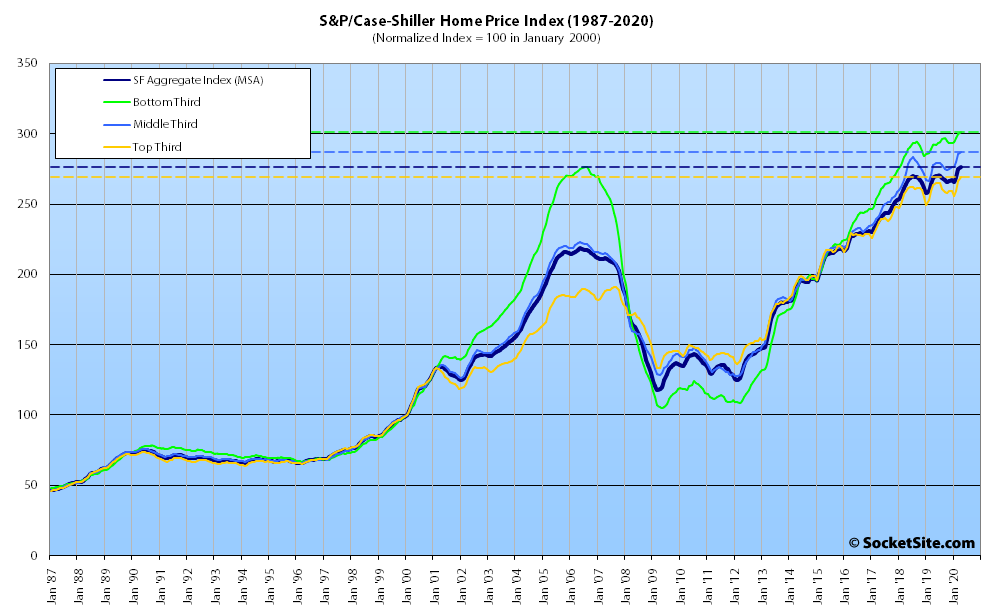

Having ticked up an upwardly revised 2.1 percent in March, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up another 0.7 percent in April to a new all-time high, but the year-over-year gain for the index ticked down a (1) percentage point to 2.8 percent.

At a more granular level, the index for the least expensive third of the market inched up 0.5 percent in April while the year-over-year gain for the tier slipped to 3.1 percent; the index for the middle third of the market inched up 0.4 percent while its year-over-year gain dropped from 5.6 to 3.2 percent; and the index for the top third of the market ticked up 1.0 percent in April and its year-over-year gain inched down to 2.2 percent.

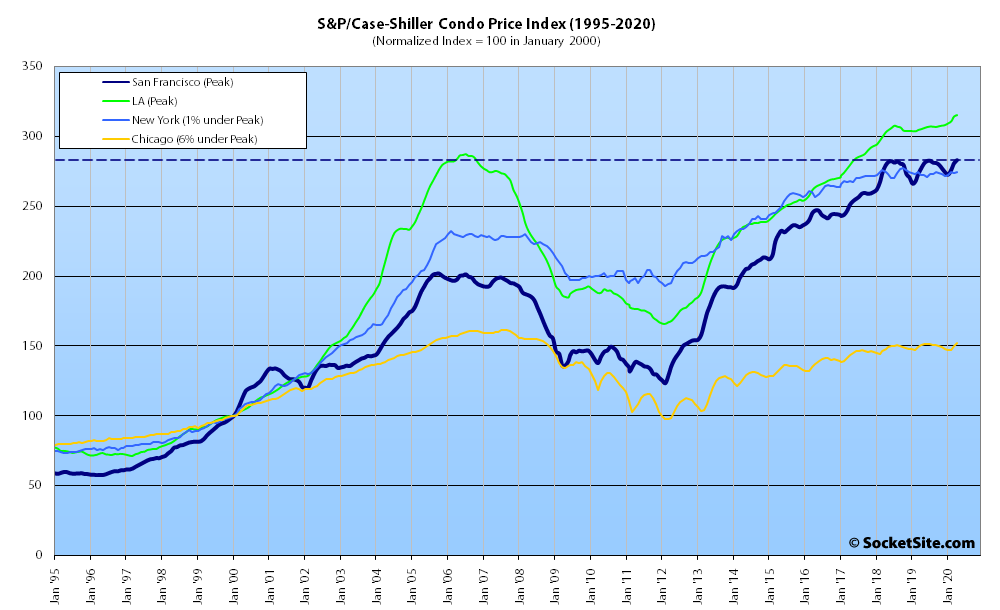

At the same time, the index for Bay Area condo values inched up 0.8 percent in April and is back above the peak it hit in July of last year by 0.2 percent.

Nationally, Phoenix still leads the way in terms of indexed home price gains (up 8.8 percent on a year-over-year basis), followed by Seattle (up 7.3 percent) and now Minneapolis (up 6.4 percent), with the year-over-year gain for Las Vegas matching the national average of 4.7 percent and only Chicago (up 1.4 percent) and New York (up 2.5 percent) lagging San Francisco’s 2.8 percent gain.

All that being said, keep in mind that while the April index does include sales through the end of April, along with sales which closed in February and March, April sales are typically the result of contracts that were written in March and the impact of the “governmental suppression of economic activity in response to the COVID-19 pandemic” really didn’t take hold until halfway through the month.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Once again, another new record high for housing prices in April for both houses and condos and in all price tiers. Not really a surprise to those looking at sales data in an objective manner, but still astonishing as March saw the stock market plunge and we’ve been in the middle of a pandemic. Maybe we’ll see prices drop going forward, and I certainly would have predicted that, and continue to do so, but the chatter that “prices have already dropped” to below 2019 or 2017 or 2015 levels was plainly wrong.

The Bay Area, in general, has certainly outperformed San Francisco specifically since 2015, as has the least expensive third of the market across the board. But the index for condo values and the middle of the market, into which the majority of San Francisco properties would fall, effectively peaked in mid-2018 (with total net changes of 0.2 – 1.0 percent since). And of course, when the index drops we’re well past the point of leading indicators, the “anomalous few” or even “some” segments of the market having declined – it’s then representative of the majority.

The lagging nature of this index helps to explain why futures contracts based on the index value have not become popular portfolio hedging tools.

> the year-over-year gain for the tier slipped to 3.1

> percent; the index for the middle third of the market

> inched up 0.4 percent while its year-over-year gain

> dropped from 5.6 to 3.2 percent

So this index is up 3 percent this year, that beats the S&P 500! May is when the tech layoffs hit, June is the unrest, lots of prognostication here said that the exodus would increase even further due to those factors. We shall see.

I’m going keep my prongs buried to the hilt in the socket for that data