Of the record 71,000 residential units in the pipeline of development across San Francisco, roughly 10,000 of the units, or 14 percent, fall within the boundaries of the city’s Greater Downtown (which includes most of the burgeoning Transbay District but only a sliver of Central SoMa). And of the 2,600 net-new residential units that came online in San Francisco last year, 34 percent (880) were built Downtown.

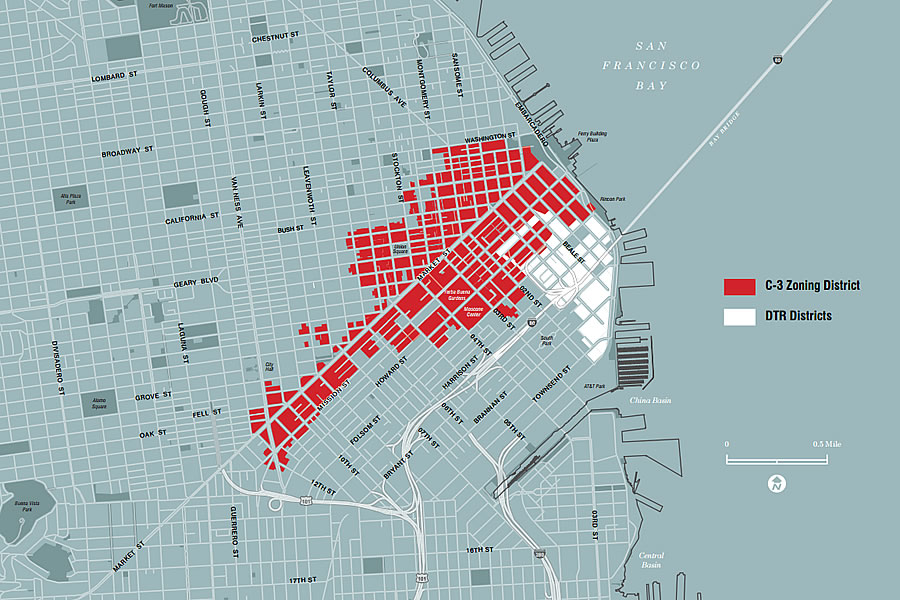

At the same time, according to the latest Monitoring Report for Downtown San Francisco, which will be presented to the City’s Planning Commission next week, the number of people working within the boundaries of the city’s old-school Downtown, the classic C-3 District as mapped above, increased 5.4 percent in 2018 to 294,000, which is up 26 percent since the end of 2011 (233,500) and represents 41 percent of the now 725,000 jobs in San Francisco (which is up 2.0 percent over the past year).

The share of all jobs citywide increases to 44 percent (321,000) when the Transbay and Downtown Residential districts (DTR) are included as well.

And once again, while a quick query of the report or underlying job data would suggest that the number of people working in Downtown offices only increased by 5 percent over the past year to 189,000, versus a 13 percent increase for people now employed in Production, Distribution and Repair (PDR) type jobs (37,000), a closer look at the raw data provided by the California Employment Development Department reveals that several large tech firms engaged in activities that may be considered PDR, the actual nature of work happening at their downtown locations “are likely office uses,” as we first noted last year.

“the number of people working within the boundaries of the city’s old-school Downtown, the classic C-3 District”

I wonder how including the workers doing all this construction would increase these numbers.

Putting this together with the number of “San Franciscan with jobs” (566,200) we can deduce the net inflow into SF is ~160,000. (And yes there is an assumption here that the term “job” is defined in the same way in both data sets).

Would be interesting to see the distribution of where these “immigrants” work: if most of them are in the hi-lighted area – and I’m thinking they are – then they could make up as much as half of the workforce. It’s also an indication of the impact on regional transportation of adding jobs without housing: every 15-20,000 would be an increase in travelers of ~10% over current levels; it might not sound like much, but it’s significant it the systems are already near saturation.

That may be a good observation, but there are still a lot of couples out here living together in one location but with jobs in different areas so it wouldn’t necessarily cut down on commuter miles if they moved to SF DT – it could actually increase traffic if they have kids.

Yes: mine was an uber-imperfect – pardon the phrase – measure, I was just trying to put some specific numbers to the usually vague comments here that the Office/Residence imbalance we see in new developments is worsening congestion; could do something similar by adding up bridge traffic and public transit numbers …both readily available, but not the topic to this post.