If you’re a regular reader, you probably know that we always include the following caveat on our San Francisco Inventory Updates: “Not including unlisted inventory.” Well, that’s about to change.

Over the better part of the past year we’ve been building a database on over 60 new developments ranging in size from 5 to 600 condominiums (6,000+ units in total). We track size, status, pricing, sales, and available inventory. And today, we’re finally ready to publish the beta version of our Complete Inventory Index (Cii).

The goal of the Cii (pronounced “see”; we’re hoping Nintendo views it as flattery) is to paint a complete picture of housing inventory and new development in San Francisco; listed, unlisted, pipeline, and potential. In fact, we believe it represents a fundamental shift from the abstract to the tangible with regard to what’s in the works throughout San Francisco.

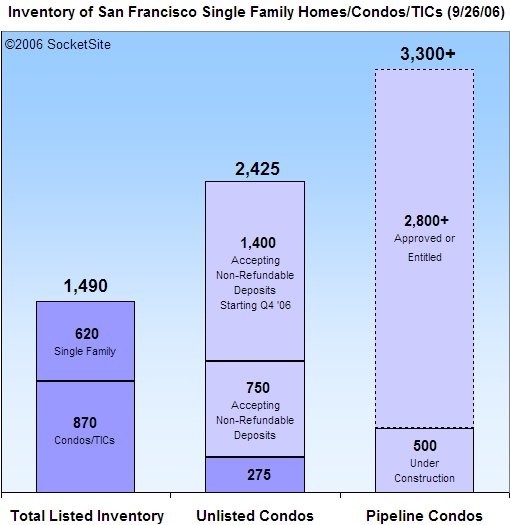

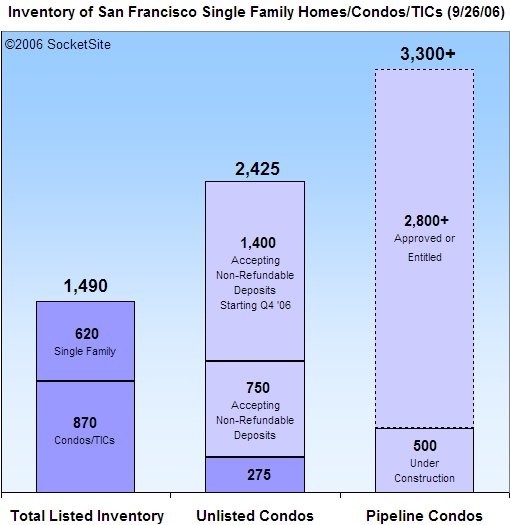

For example, we estimate there are currently at least 275 condominiums that are not listed on the MLS, but are available for purchase and occupancy. These condos include unlisted inventory in buildings ranging in size from Glassworks to The Beacon. And based on recent sales activity, represent about a month’s worth of condominium inventory.

We also estimate that by the end of this month, there will be at least 750 condos actively competing for the attention of buyers and accepting non-refundable deposits in sales offices throughout San Francisco (examples include Broderick Place, The Infinity, and Arterra). For perspective, that’s effectively another two to three months of inventory. And by the end of the year, we expect that number to nearly triple as buildings like the Heritage on Fillmore, 888 Seventh, and The Hayes begin accepting deposits.

Beyond that, we’re tracking another 500+ condos that are under construction, nearly 3,000 that are in the works, approved or entitled; and a growing list of other large projects that are on the drawing boards. We’ll continue to refine (and build) our database and methodologies (hence the “beta” tag) in order to keep you “plugged in.”

And yes, we do plan to invest in some better charting tools…

UPDATE (9/27/06): Please keep in mind that our “pipeline” only includes developments which we consider to have a relatively high probably of breaking ground and competing for buyers in the not too distant future. Our numbers pale in comparison to the 25,000+ “net new housing units” that are considered to be in the overall housing pipeline for San Francisco. And last year alone, over 300 projects (representing well over 6,000 units) were filed with the planning department.

∙ The Glassworks (207 King Street) [SocketSite]

∙ A Sales Office Shakeup At The Beacon? [SocketSite]

∙ Broderick Place: 83% Sold [SocketSite]

∙ The Infinity: A Study In Contrast [SocketSite]

∙ Arterra First Release: September 30 [SocketSite]

∙ The Heritage On Fillmore (1300 Fillmore) [SocketSite]

∙ 888 Seventh Street (f.k.a. 601 King) [SocketSite]

∙ The Hayes “Special” Open House (And Signature Cocktail) [SocketSite]

∙ Five Years Late (And One “N” Short) [SocketSite]

∙ The Californian on Rincon Hill: 375 Fremont St. [SocketSite]

Given the large number of projects coming on line, it will be interesting to track what happens with the “pipeline” condos. Until they start putting real money in the ground, anything could happen, and I wouldn’t be surprised to see many of the pipeline projects to stay in that category for a very long time given the recent slowdown in the market.

[Editor’s Note: Very true. In fact, we’ve already heard rumblings of at least two developers (700+ units) who seem to be getting cold feet.]

Wow, I’m seriously impressed.

Another footnote is that until the project is done, and the developer has to start paying hoa dues for all the units not closed, they aren’t as motivated and can sit afford to sit on their pricing.

It used to be the first people in a new development got the best pricing. I think we’re starting to see now its the last units on market that are making the best deals in new developments which is really new to this year(putting 88 King aside).

It will be interesting to see what happens when say the Infinity actually gets close to occupancy and what happens to pricing/credits there then.

Great info! Love the chart. The scary thing is, the first bar (Listed Inventory) is slowly catching up to the other two bars!

Curmudgeon is right, as he often is. What a shock it would be to see ‘ghost buildings” ala Bangkok in the 90s. Unlikely. Many of those pipelined will be sidelined. So there is another possible chart for ya, soon enough socketito. Call it “Groundbreak or Heartbreak.”

Wouldn’t be surprised if many conversions are scrapped and turned into repartments as well. The Rincon building (320 units) was recently sold and is supposed to be converted. On that note, I’ve heard rumors there’s some legislation under review which would force owners to pay renters something if they get thrown out due to conversion? Anyone know the details on this?

Not quite there “B” the HOA dues payments are a minor part of a new development’s cost. The biggest cost is the interest & financing cost and the outstanding loan principal is largest right at construction completion. Developer’s are the most motivated to sell units right when a project is completed to reduce their holding costs, especially when there are a lot of units. The idea is to establish sales velocity and strong absorption right off the mark which will carry through the rest of the sellout. The developer is actually least movitivated to lower their price in the last units as most of the development costs are already paid by that point and the last units represent mostly profit to the developer.

With hundreds of condo units under construction and thousands scheduled to break ground within the next year or so, there should be a couple buildings that stand head and shoulders above the rest when everything is said and done.

Which are the ‘winners’ and ‘losers’? I’d say the Infinity will be one of the premier buildings in SF because of the location and design. The rest – Beacon, Watermark, Met, 88 King will fall by the wayside and more or less forgotten…

And a lot of proposed developments (as socketsite said) will get cold feet and either be delayed or scrapped all together. This leave only OneRincon, Infinity, and Millenium as sure bets highrises to be completed in the immediate future…

With so many condos flooding the market just as the booming housing market is beginning its boomerang turn, I’m really starting to wonder if SF is finally about to see reasonable prices. And by reasonable, I mean where a typical young, working couple can buy in without overstretching themselves. I hope it happens. I don’t want to lose any more of my friends to Contra Costa County. *Shudder*

Also, it’s crazy to think about what the SOMA/Rincon/Mission Bay area will look like in a couple of years. There will be thousands upon thousands of new residents living in the thousands of condos we see in the charts above, bringing with them cars and gridlock and noise and the like. But, they will also be bringing restaurants, shops, pedestrian traffic, watering holes, and God willing, actual neighborhoods. It’ll be sickeningly yups at first, but after the first few years, who knows, it might actually work. In any case, it’s fun to see how new neighborhoods are born and formed.

Peace.

Does anyone have any thoughts on how regulation and fee assessments/exactment might influence the potential for some of these projects to not be built?

It seems that the bottom line is these guys have to make a certain return on their investment. With the sky high prices and strong demand for something slightly cheaper, even accepting that land is very expensive here, would indicate to me that there condos could be built for some time here if this environment wasn’t so over regulated

Just a thought I have after reading about the BOA extorting more and more from these developments. Anyone middle class who doesn’t own gets screwed

I personally don’t see a gloom and doom scenario for the area. So there are 3000 condos for sale in a metro area with millions of people. I believe it might put some downward pressure on prices for a while, but then with more people, more amenities, etc, more people will want to live there.

Look at Vancouver–they’ve been building towers for years and the prices have still gone up. From personal experience, my condo in Soma/Rincon Hill was down about 15% from when I bought until the Met came along–then the prices in the neighborhood starting going up.

Point taken ‘C’ about construction costs being far more expensive than HOA’s. I was thinking more to the buildings that are in the framing stage and pretty far from actual closings, so they have some time to play with sales prices early as the Watermark did.

Zig, I am no developer…but I have enough of an understanding to know I would never want to be. This city puts you through hell and many of the reasonably priced developers have high tailed it to Oakland – which is at the beginning phase of a massive condo construction boom itself.

I think Mike makes a very good point. I see a lot of this develoment as adding to the cache of living in The City. Very probably prices will stall or maybe go down a ‘bit’ but in the Bay Area SF is still going to be the place to be if you can afford it. (and that, of course, is THE big ‘IF’)

You really think the Millennium building is going to complete as condos, Rincon Fan? They could end up as apartments if they need to.. which is what I’ve been wondering since there’s been no announcement of presales, and no branding for the building yet. I don’t even think they’ve said what hotel would be going in yet, have they? They’re just as far along in construction as Infinity and One Rincon, but in marketing — what’s going on at the Millennium?

As for The Infinity doing well… you think so?? The numbers that have been released so far don’t seem impressive. I’d be nervous if I were the developer, and would begin to look at the apartment option.

Vancouver is not really an appropriate comparison (with SF), since that city’s property boom was fuelled virtually entirely by the exodus from Hong Kong. SF does get Pacific Rim migration, but nothing to the extent of Vancouver. If the US economy experiences a downturn (not unlikely), where will the demand for 3,000 new condos be filled from?

“Vancouver is not really an appropriate comparison (with SF), since that city’s property boom was fuelled virtually entirely by the exodus from Hong Kong.”

Perhaps originally, but HK was handed over in 1997, and they’re still building (I own 3 units there and new buildings are going up all the time).

My point was that the more building there is, the more desirable the area is. 3000 new units isn’t really all that much. If it becomes a real neighborhood people will choose to live there over somewhere else.

The question of # of units is too simplistic. What about the average cost of the unit vs. average income in Vancouver? I’ve never been to Canada, but I’ll wager the average Canadian doesn’t have to pay 10x median income to buy a 1-bedroom condo. And what about population trends? SF has been losing people, on a net basis, for many years now, while Vancouver is likely growing.

Dude wrote, “SF has been losing people, on a net basis, for many years now…”

Not true– SF’s population was growing from the 1980 until 2000, and has only declined in the past 5 years. While the 2005 census estimates for San Francisco showed a sharp decline, down to 739,426, from 776,733 in 2000, the population in the 2000 Census was an all-time high for San Francisco, surpassing the previous census count high of 775,357 in 1950. The current population is still substantially higher than it was in 1980 and 1990, despite the exodus after the dot-com bust. The population peak of 2000 was achieved with a near 0% vacancy rate for apartments at the dot com peak, which was not sustainable.

just noticed the update above: “Please keep in mind that our “pipeline” only includes developments which we consider to have a relatively high probably of breaking ground and competing for buyers in the not too distant future. Our numbers pale in comparison to the 25,000+ “net new housing units” that are considered to be in the overall housing pipeline for San Francisco. And last year alone, over 300 projects (representing well over 6,000 units) were filed with the planning department.”

so much for “3000”…

Thanks Dan for pointing out that San Francisco has been growing until recently. I would also add though it’s clear that there are fewer people in town since the height of the dot-com boom, there isn’t universal agreement that population has plunged to 739 K. The census bureau used a sampling procedure to estimate city populations for 2005 (as opposed to the complete count used in decennial censuses), and experts don’t think the resulting numbers are really very dependable. (short story…we have to wait til the results of the 2010 census to really know).

Also in response to Dude…I believe that incomes in Vancouver are on average significantly lower than SF’s…while real estate is quite expensive. Many of my professional friends in Vancouver also live in TINY condos that would be barely acceptable even in expensive SF. So I am guessing that Vancouverites actually pay MORE of their income, and possibly more per square foot as well. But I don’t have numbers at my fingertips.

I was curious and did some checking, and curmudgeon is right. My checking actually consisted of Googling “Vancouver housing prices,” and the only things that popped up were bubble pages and blogs about how insane the cost of living there has become.

Good points about the Vancouver analogy (prices vs incomes & population growth), but I still don’t think 6000 + units is too much inventory, particularly as it will be doled out over the next several years.

If the Bio tech industry gets a bit of a spark sometime in the near future – and all the elements are in place to help facilitate it – then that area where most of the new construction is going on would see a decent influx in population.

Correction, rather than population, I meant Soma, S.Beach, Mission Bay oriented residents…the population issue has been debated nicely thank you all I learnt something new today.

Another factor comparing affordability of condos in Vancouver vs. in SF:

Mortgage interest in Canada is not tax deductible.

Damion, good point about the Millennium. I registered on their website a couple months ago and received no updates or news. Really, what’s going on at the Millennium??

I doubt the Infinity will convert some of the condos to apartments. The builder – Tishman Speyer is large enough has the financing in place and the resources to sell at a more leisure pace than say OneRincon which needed to sell a minimum amount of units quickly as possible to lock down their financing.

Last I heard, Infinity had ~200 units reserved or under contract. Not bad considering Phase 1 of the project has just ~350 units.

Most of the top floors with the best views have been reserved long ago in the earlier releases (and at much lower prices). I think sales have slowed because they raised prices too high for the lower floors…

Come to think of it, if the Millennium did turn into apartments instead of condos, then the better it will be for Rincon and Infinity since it’ll reduce the inventory of highrise condos by several hundred!

Dear RinconFan,

No developer in San Francisco would ever build an apartment, unless he was forced to by the politics of SF. Even though all new rental apartments, built since 1977 (when the rent control ordinance was put in place) are not under rent control, no developer would ever trust the city planning or supervisors not to change the law regarding rent control.

Therefore almost all housing projects are built as condominiums, which are protected by state laws from being part of rent control. The developer may rent the apartments initially, but if that developer or some entity that buys that project wants to sell those condo’s to owners and not renters, they can do it.

That is what happened at The Beacon.

The State of Calif. wants SF to increase its housing stock by 10% each year. That has not been done since the 1920’s when the population was also in the 750,000 range.

So.

6,000 new units or even 25,000 new units may alter the prices in the future. More importantly, as to future prices will be the interest in those new condo’s by buyers that are tired of a 1 to 3 hour commute each day from the burbs! Those same buyers may also like the “new” buildings, finishes and other amenities of those buildings. And they might also enjoy the other unique aspects of San Francisco.

In addition to Vancouver, look at all the new condo’s in Chicago, and ever Las Vegas or Florida.

Where have all those new owners come from??

The best is yet to come for San Francisco!!

Go check out The Westfield Center.

Not sure if I agree with that. I work with several burbanites who wouldn’t move into the city regardless of condo prices. They live in the burbs so they can have their own yard for the dog and BBQ, and so their kids can go to public school. They’d be tough pressed to sell a 4-bedroom house in Rockridge just to buy an 800 sq. ft. condo in SOMA, regardless of how many plasmas you put in the bathroom.

As for Vegas, not sure if that’s a good example…last time I checked, half the condo projects there were getting cancelled altogether while the other half sat 80% empty.

Thanks Frederick. Good points. The new Westfield mall is spectacular. Definitly a plus for San Francisco.

Regarding the suburbs – Over the last 1/2 dozen years or so, there have been a mass migration out to the suburbs. Look at places like Brentwood, Tracy, Mountain House, Antioch, Gilroy, etc… Those place are booming with new developments. I know of several people that commute 3-4 hours a day from those communities to SF, Oakland, SJ, etc… I know it’s nice to have your own yard, driveway, garage, etc., but how nice is it really when you’re never home? And on the weekends, you’re busy mowing the lawn, landscaping, running to Home Depot, Walmart, etc?

I guess it comes down to lifestyle. Some people don’t mind the commutes and enjoys the work that comes with owning a house.

But I predict over the next few years some of those suburbanites will tire of the grind and start migrating back to the cities. They will be lured by the maintenance free living, amenities of the condo complex and surrounding neighborhoods, lack of commuting, and all the cultural and entertainment attributes that make San Francisco such a wonderful city!

Totally agree with you – that’s why I live in the city as well instead of in Concord. But how many kids do you have? Tough to imagine a family of four or five selling a house to move into a condo. From my personal experience, most people in that situation look for jobs closer to home rather than selling their house to move closer to work.

Yes I agree it would be hard to move larger families to the city. I really meant professional couples and/or small families. Certainly finding work near your home is the most ideal situation. For the ones that must work in Silicon valley or in the financial district, migrating back to the city may be their only choice given the long commutes and worsening traffic situation…

I was close to buying a large home in Brentwood in 2004, but after trying out the commute a few times from the Bay Point bart station I decided against it (it was a good hour drive from the bart station back to Brentwood during the evening commutes!)

I read in San Francisco magazine that over 50% of the purchasers of the Soma condo explosion were ’empty nesters’ over 50, and that a majority of the rest were the extremely wealthy, purchasing a second or third home.

This seems greatly at odds with the rest of san francisco, and also begs the question of whether the amenities and commerce that such a group will bring would bring on the supposed middle class rennaisance that is being proposed here.

Frederick: The supes cannot impose rent control on newer buildings because state law prohibits that. Also, the cutoff is June 1979, not 1977.