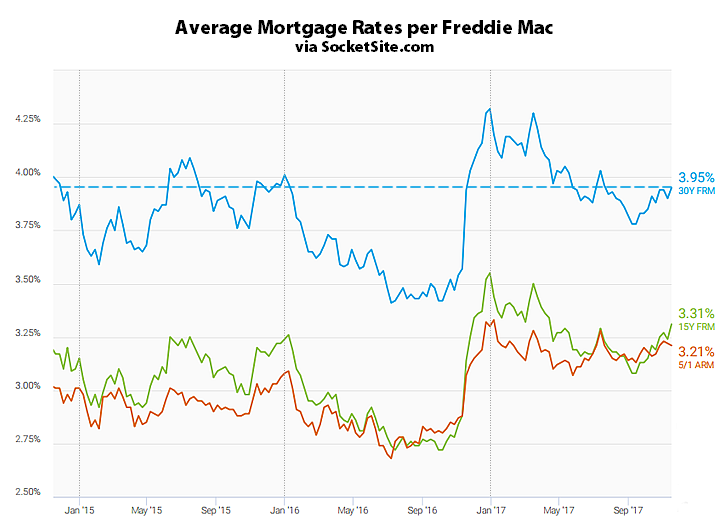

The average rate for a benchmark 30-year mortgage ticked up 5 basis points over the past week to 3.95 percent, which is the highest rate in nearly four months, within 1 basis point of the 3.96 percent rate in place at the same time last year, and 54 basis points above last year’s low of 3.41 percent, according to Freddie Mac’s Primary Mortgage Market Survey data.

At the same time, the probability of the Fed instituting another Federal Funds rate hike by the end of the year, which had dropped to around 30 percent in September before starting to rocket last month, is holding at 100 percent according to an analysis of the futures market with another hike now expected (i.e., probability over 50 percent) in March.

How about including the Fed Funds rate on the chart? The 30Y FRM is right about where it was 3 years ago even though the the Fed Funds rate increased by 1%. The correlation is weak at best.