As we wrote in March with respect to 270 Castenada:

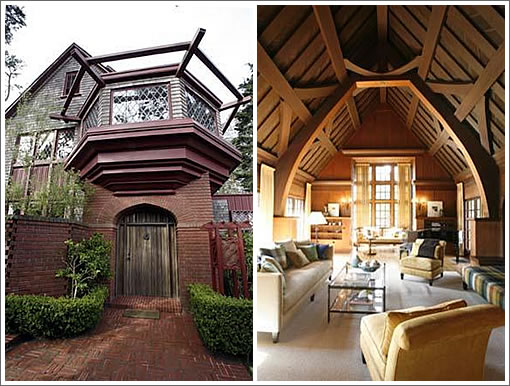

Asking $3,890,000 and briefly in contract before being withdrawn last April [2008], listed at $2,995,000 today. Still touting “too beautiful to describe” despite Maybeck’s (and the Vernacular Language North) attempt.

As we added in August:

Reduced to $2,595,000 in May [2009] before being withdrawn from the market without a sale, 270 Castenada is now seeking a tenant at ten thousand a month.

As a observant tipster adds today, it’s three months later and they’re still seeking a tenant, only now at $7,500 a month. And as previously noted by a plugged-in reader:

The house is owned by Kent Nagano, long time conductor of the Berkeley Symphony, and his wife the international pianist Mari Kodama. In 2007 he announced he was leaving the Berkeley Symphony in 2009 and taking appointments conducting the Bavarian State Opera and the Symphonic Orchestra of Montreal. They were still living in the house when it was on sale in the spring of 2008. Then a couple of months ago the SF Business Times reported they bought a property on [Divisadero].

And with respect to being but a renter of this Maybeck, it’s not like you were going to paint those walls anyway.

I wonder if they’d take a short term rental. It would almost be worth 7,500 just to live in this for a few weeks.

I’d like to rent it for just a couple hours.

Assuming the bedrooms are furnished.

A couple of points:

1. I can find no deeds of trust on this property, so it looks like this Naganos own this free and clear. Long term landlords determine market rates; their property taxes are less than $20k on this place.

2. That said (I know, I’m not supposed to say that), the Naganos current Ess Eff pad was $8million+ and there is a “relationship” with BofA on that one. I don’t think celebrity conductors come out of this downturn unscathed, so it could be interesting to watch what happens.

Re: Long term landlords determine market rates

How do you figure? I’d imagine market rates are determined by the vacancy rate and by what people are willing to pay.

The economic theory is that markets are made between sellers with a low elasticity curve and buyers with a high elasticity curve. Thus, the landlords with low carrying costs are most flexible and can drive rents lower, and the dot com worker that throws around lots of money that raises rents.

As with every economic theory, it’s only partly true.

Did they sell the buildable lot next door?

That living room may be lovely, but this is a tough house to live in. It may be one of the few with a kitchen designed for caterers and a service bar

Now reduced another 296k to 2,299,000, and still for rent at $7500.