As we wrote five months ago with respect to 270 Castenada:

Asking $3,890,000 and briefly in contract before being withdrawn last April, listed at $2,995,000 today. Still touting “too beautiful to describe” despite Maybeck’s (and the Vernacular Language North‘s) attempt.

Reduced to $2,595,000 in May before being withdrawn from the market without a sale, 270 Castenada is now seeking a tenant at ten thousand a month.

In related neighborhood news, a plugged-in reader notes that 398 Castenada closed escrownon June for $1,225,000 after being bought back by the bank in April, purchased in June of 2004 for $1,495,000 (a 17% drop in value over the past five years).

Its the new paradigm, ala south park underpant collecting business “Phase 1: Collect Underpants, Phase 2: ?, Phase 3: Profit!”

Phase 1: List real high

Phase 2: Drop price, but stay way above the market

Phase 3: Try to rent at an astronomical price

Phase 4: ?

Phase 5: Foreclosure!

You’d think people would try something different, given the lack of success of this “strategy”.

The owner of 270 Castenada is making every mistake in the amateur playbook. And that’s great!

1) I love the trees around this place.

2) I’m somewhat surprised. this was one of the very few houses that had nearly universal excellent reviews by socketsiteers. and then it went into contract so quickly.

things must have really changed for it to have fallen so low. (70% off initial list price, which was admittedly sky high but they did go into contract at that price).

was there just one insane buyer who then thought better of the “deal”?

suburban or not, this sale indicates a lot of pressure on the SF market.

however, the foreclosure happened in spring and the sale in early summer, so perhaps the market is a little better right now due to the “green shoots” over that time period.

not sure what to make of this “apple”.

No one is going to pay $10K/mo to rent 270 Castenada. Someone might pay a little more to “own” a Maybeck, but no one is going to pay a premium to rent one.

Cut the rent to about $5-6K/mo and there should be some nibbles. If the plan is to try to wait out this downturn “until the market comes back” they should cut to below $5K/mo in exchange for a long term tenancy.

ex-SFer, I think you might be mixing up 270 and 398? 270 was discounted 33% and then withdrawn. 398 went for 17% under 2004 prices, i.e. circa 2002 prices. Sounds about right to me for a fairly nice part of SF right now.

I don’t get the owners of this place. With lots of the MLS withdrawals-gone-rental we see, the explanation is pretty obvious. The owners are stuck/screwed. They cannot lower the price to a level where the place will sell because they cannot afford to bring the sizable check to the closing. So they are just passing through tipster’s 5-step business model. They have no alternative.

But the current owners of this place bought in 1996 at about $1.25M, and it’s pretty clear they are not underwater, unless there is some big second that I’m not aware of (certainly a real possibility). This place would sell with another reduction that would still fetch far more than the 1996 price. All I can figure is that they are all beat up because they were “so close” to roping in that $3.9M buyer and they just can’t bear to sell for less than the recent $2.6M listing price — which I suspect they thought would spur a bidding war. So now what? Just “wait it out” for the market to “come back?” That’s going to be a long, expensive wait, and a long period of chasing the market further down.

@ex SFer

Unfortunately, there are no green shoots in CA real estate. Unless you consider another massive wave of defaults a foreclosures green shoots.

http://www.loanperformance.com/infocenter/library/FACL%20Negative%20Equity_final_081309.pdf

I guess we can take comfort in not being the worst performing state in America.

Hey, Cali is in 4th-worst position instead of its usual dead-last performance nationwide! We’re moving up the ranks!!

Now if only we could do the same for education and taxes.

LMRiM, the real estate professional, telling us what amateurs do wrong. Did you go to real estate school after working in hedge funds, you’re the real estate professional now? Or maybe you are! A little slip of the tongue when you called others amateurs! Are you driving down the price to be able to buy more homes with all the money you got managing opm. Starting to see why you had to leave the fund industry. 😉 Of course, you never left.

Now just an idea here about some “overpriced” places. We all know there are people who just love to shop for real estate, drop in at every open house, spend their weekends driving from house to house just to see what is inside, this site wouldn’t exist without that urge… So, why can’t some people just like putting real estate on the market that they have no intention of selling. Seller psychology can be just as warped as buyer psychology.

ex-SF’er: “70% off initial list price, which was admittedly sky high but they did go into contract at that price”

I don’t see the 70% reduction in list price. 270 Castenada, orginally listed at $3,890,000, withdrawn after being reducted to $2,595,000.

Are you making the mistake I first made which is confusing it with the nearby property later mentioned, 398 Castenada? That’s the one that just sold at $1,495,000.

whoops, that should be sold at $1,225,000, too many numbers and no edit function.

“real estate school” – LOL, I’m a reasonably bright guy, shmoey, but even I don’t have that many brain cells to kill.

Ever take a look at what a real estate licensing exam session looks like? The Mos Eisley bar scene from the first Star Wars comes to mind. I’m not certain, but I think it’s still the case that you don’t need a high school diplome to sell real estate. Has that been changed?

About your idea that the would be seller of 270 Castenada is an example of “putting real estate on the market that they have no intention of selling”, doubtful. A greater than $1M price cut from last year (following the market down) and now the attempt to rent it shows that the owner wants out.

Trip hit it on the head. It looks like a classic example of “anchoring”, well known in the investment/trading world.

http://en.wikipedia.org/wiki/Anchoring

It’s a typical cognitive bias that all of us have to struggle with. Here, the owner may well have structured his thinking around the idea that he owned an asset “worth” more than $3M, and it’s taking some time to make peace with the idea that the market disagrees (and the market decides, of course).

Also, renting a nice place like this (with historical and architectural significance), is risky. It’s not a cookie cutter box that will be easily repairable. A smart renter who presents a low risk profile to the owner – and let’s face it, renters who can afford to and are willing to pay $5K+ per month are going to be pretty smart on average – will recognize this and demand a coordinate discount.

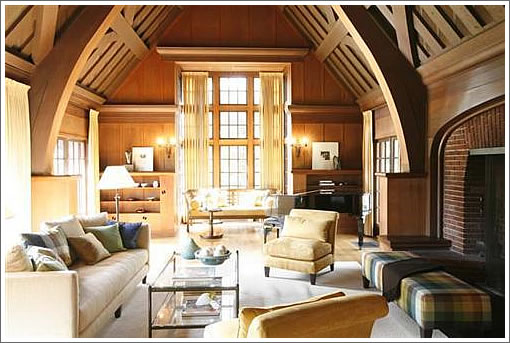

The interiors are stunning. If there was enough “interest”, I’d rent this in a heart beat and turn it into a discreet “Eyes Wide Shut” style voyeuristic enterprise.

I am sure there are plenty of peeps in this City who would pay top $$$$ to be members of this exclusive club 😉

How is that for a business idea ?

“So, why can’t some people just like putting real estate on the market that they have no intention of selling. ”

joe shome (or is shmoe?): an open-home window-shopper invests 30 minutes of his/her time and $2 of gas to drive around. Sometimes I play that game too just out of curiosity/nothing better to do. Maybe 50% of all open home traffic is dead wood?

On the other hand, a seller invests real $ and time and pain when putting the house on the market. Not saying it isn’t possible that they have no intention of selling, but it’s highly unlikely. Maybe 2% fall in that category?

In the absence of other info, remember, credence goes toward the most likely course of events and motivations.

I do a bit of window shopping myself. Among window shoppers you have to include neighbors. I know a few retirees in Noe Valley who will go most open houses a few blocks around, mostly to size up the Joneses or get ideas for their own place. One of them is also participating in organized tours where you see several gardens in one area. She’s a great gardener but always hunts for ideas from others.

This is a strange one. The house is owned by Kent Nagano, long time conductor of the Berkeley Symphony, and his wife the international pianist Mari Kodama. In 2007 he announced he was leaving the Berkeley Symphony in 2009 and taking appointments conducting the Bavarian State Opera and the Symphonic Orchestra of Montreal. They were still living in the house when it was on sale in the spring of 2008. Then a couple of months ago the SF Business Times reported they bought a property on Divisidero, if I remember correctly, for much much more than the Maybeck is going for.

It’s actually amusing to think of that blueball moment for the owner when the 3.95m offer fell through.

LMRiM, that was a very nice non-denial!

Now really, the price reduction could just be what was needed to keep realtors involved and the staging furniture there. The owners just might like saying, “We have a Maybeck on the market.” Similarly, realtors may play along because it is always nice to say, “Well, I have a beautiful Maybeck on a large lot, want to take a look?” There could even be a certain sick thrill to getting lowball offers and rejecting them, “Ha, ha. You can’t have it!”

But anyway, I will point out, LMRiM has not denied being a professional or having a professional interest in the bay area market. It is interesting that he tries to pump up the idea of renting in Marin, because that might drive up his rent.

Now LMRiM, accepting your story that you are not a professional, you are not managing money, and you are just a humble renter in Marin… Does your wife or your son ever long for a place to call home, a place where your son can imagine he’ll one day bring his girl to meet the folks, a place your wife can imagine growing old with you. Or maybe a place where your son can nail up a basketball hoop without having to hear about the security deposit. And maybe your wife has some home decor desires– a color she would like to paint a room– that you’ve never heard about. Just curious, because those are the sort of reasons people own homes instead of renting. Is it solely your decision to rent (since from your story we all presume you could easily own), or was the whole family consulted?

Or maybe a place where your son can nail up a basketball hoop without having to hear about the security deposit.

Really? That’s the argument in favor of overpaying for a property by hundreds of thousands of dollars? Come on, LMRiM and others around here are not weak-minded fools. Your old Jedi mind tricks aren’t going to be effective on them.

ohhh!!! now it makes more sense!

duh. I are smart.

anonm,

No Jedi mind trick, just another point of view. I am not saying buy a Maybeck and turn the living room into a basketball court (which could be very cool), I am just pointing out that renting has some real limitations. Part of the premium you pay for ownership is to be king of the castle. When a light fixture breaks, I replace it with what I want. I don’t have to ask a landlord to replace it and hope I like it. It may seem like a little thing, but if you are a long term renter you will surely see the landlord replace appliances and be at the whim of the landlord’s tastes/budget. Of course none of that may matter to LMRiM, maybe he and his family are not particular… Other people like to be able to do what they want with their space. And of course, I don’t face the prospect of the rent rising when the economy picks up (or if a relative of the landlord wants to move in).

LOL, it sounds like shmoey is henpecked at home!

Seriously, shmoey, I didn’t grow up in the lap of luxury on Park Avenue with Monets on the walls like you did, but if I had, I expect that I wouldn’t have been such an unaware chump as you to imagine that everyone didn’t live like that (I remember your post, “I never knew we were rich”). Having grown up with not much, I found that once I could afford what I thought I wanted, it just didn’t seem all that important, and I guess I found a wife who thinks along the same lines.

If we “longed” for a place to “own”, we’d just buy one. It’s really not such a big deal, and I’m surprised that someone like you with means would act like it is. Your post caused me to reflect a bit on raising children, and it occurred to me that we don’t have a single friend or even more than casual acquaintance where at least one parent wasn’t full time stay at home. I’d think that is more important than whether someone “owns” a place (really, for most out here, just renting it from the bank). I don’t know how to else to put it, but at our desired level of consumption relative to our means, we feel zero chance of being “priced out”, zero need to try to keep up with inflation, zero desire to “get on the housing ladder”, zero fear.

About the “technical” aspects of your post. First, “security deposit”. Are you kidding? We treat the house we rent as our own – if we wanted to paint a room or change something around, we’d just do it (in our SF rental we ripped off some wallpaper and painted a bathroom, painted the kitchen a color we liked, and I rewired a part of the garage for my workshop, but feel no need to change anything in our current situation). I could not care less about a $2800 security deposit – it is less than a rounding error, as is the rent itself. If it doubled, it would still be a rounding error. If it tripled, and we still wanted to be in Marin, we’d probably just buy the house, which we could do out of cash reserves. All that being said, we’ve NEVER had a problem with getting a security deposit back (we’ve never even had a rent increase out here), and with my legal background and chip on my shoulder from growing up in the Bronx instead of Park Avenue like you, I’d fall on a landlord who tried any monkey business like a collapsing house. And I certainly have the time 🙂

Second, I have zero professional interest in the SF Bay Area housing market. It’s just a fun asset class to watch as we ponder returning to the working world at some point. The SF Bay Area been a fun place to be “semi-retired” for the last 7-1/2 years, but probably not the right place to raise kids in the end, and I will appreciate not having to pay a realtor a large commission on a money loser house when we go 🙂

The flipside of your “non-financial reasons for owning” argument, joe shmoe (which has been discussed here before) is the convenience of renting.

As a renter, I’ve never had to cough up big $ to replace a roof, fix a cracked foundation, redo a hardwood floor, etc. I spend Sunday morning being hung over and watching sports, or riding Paradise Loop, rather than pulling weeds, sanding, painting. I’ve owned a house before, and am keenly aware of the amount of maintenance that goes into it (as well as the amount of money that follows, both of which folks here tend to understate, IMO).

So the non-financial benefits of owning are negated by the blithe convenience of renting.

Joe S., you realize that it’s only during the recent bubble years that the concept of an “owner’s premium” developed. It makes no sense, which is why it never existed and is now fading into bubble history. It is almost always more expensive to rent than to buy a comparable place. That is how landlords make money (otherwise they’d all sell at an “owner’s premium” and invest their fortunes elsewhere — I’m always amazed at how many SF landlords didn’t do that during the bubble).

Renters have historically lacked the down payment or access to credit to buy, so they paid a “renter’s premium” to a landlord with such resources so they’d have some roof over their head. When prices were reaching 2X or 3X the comparable rent (because there were no longer any down payment requirements or credit limitations), one knew we were in a big, nasty bubble that was primed to pop.

Renters live very full, happy lives — financially better than recent homebuyers (not too many renters getting clobbered by falling housing prices) and they are not nearly as restricted as your post suggests.

While on the subject of Forest Hill homes for sale and for rent, here is another one on Magellan. It seems there is a lot of resistance to true price discovery.

Reduced asking price $1.295M, montly Rent $4000, you do the math:

Redfin Listing:

http://www.redfin.com/CA/San-Francisco/75-Magellan-Ave-94116/home/1921942

Craigslist:

http://sfbay.craigslist.org/sfc/apa/1328080367.html

Great find, West Portal. That place looks roughly equivalent to the place we rented ($3100/mo) in terms of nabe and space from mid-2002 thru mid-2008. (Ours was probably a little nicer overall, but bathrooms were not as nice.)

75 Magellan was purchased for $1.45M in late 2004, so they are eating a pretty good sized loss. In fact, if it sells here (probably doubtful as they are seeking a renter), the loss + commission on the 4-1/2 year hold would have more than covered 6 years of rent, and you wouldn’t have had to pay taxes + mortgage interest! And you wouldn’t be sweating the sale, and contemplating becoming an “accidental loanlord”. There are certainly benefits to being a renter when carrying costs are twice your rent, as people are rediscovering.

LMRiM, so semi-retired. When you are posting your picks here, are you working professionally at the same time? Does your or your employer’s liability insurance cover that?

LMRiM, if you go back to that post you will see I was 5 when I was becoming aware of how other people live… I think that is probably a very age appropriate time to gain that awareness of the surrounding world.

All I can say, is thank goodness I don’t know the name of the bar in Star Wars and casually drop it in a socketsite posting. It reminds me of a time I was at the Banana Court Bar and everybody whipped something out, but that is another story…

And just a little thought here: A lot of people have good experiences renting in good times, but in bad times is when the security deposit disappears, the appliances don’t get replaced, and the landlord decides to do a walk-thru so he can bill for damages. Or the bank takes possession of the leasehold. And don’t let your landlord know you could afford more! Moving is a pain and if I were LMRiM’s landlord reading this, I’d see some leeway to make more money off him.

Joe Schmoe sounds like a bitter landlord. You should have been listening to LMRiM during the past few years instead of berating him.

Increase the rent? Tell me how well that works out for you in this market. I predict that will happen sometime around the “5th of never”.

JS, in downtimes, tenants are precious. Moreover, any landlord trying to steal a deposit can get sued — treble damages.

Renters have many rights here and tend to be well-organized and litigious. They also tend to be better represented in court. As a town of 2/3 renters, it’s not the case that tenants are poor and uninformed. San Francisco is the only city I’ve been in in which tenants have a better understanding of their rights than landlords do, and tend to be better represented in court. Certainly they win the vast majority of cases.

From what I hear, suing landlords is generally fun and free, and a meaningful source of income for many. I know of one that funded the downpayment on a house by suing his landlord — “religious discrimination”, unlawful entrance, as well as some deposit silliness. They settled for 6 figures, all pro-bono work for the tenant.

If you want to know more about tenants’ rights or legal services available to tenants, take a look at:

http://www.sftu.org/

http://www.hrcsf.org/tenant_info.html

LOL, shmoe, you really don’t understand much about the landlording business – especially if you think the period 2004-2008 was the “good times” for renters. I thought “rents were screaming” – I could swear I heard that on SS a number of times….

About as much it seems as you knew about irrevocable trusts (you thought you’d only seen one in all your experience) when you first pulled the nonsense questioning of my knowledge and integrity. That sort of suprised me; if the story about your parents is true, you’d be the beneficiary of at least one, and you certainly would have set one up for your kids if you really had the means you imply (as part of an estate plan). Maybe you have “people” to do that thinking for you.

Oh, and btw I say “semi-retired” only because I haven’t yet decided to retreat to a life of golf permanently. I should probably say “retired for now” to make it more clear.

If I were LMRiM’s landlord and knew what identities he was currently using on socketsite I would raise his rent because Satchel would need to hire movers, find a new place, possibly change schools for his son. And the way he just posted here would make me have second thoughts about renting to him anyway… “chip on shoulder” does not make a good tenant. I would bet I could raise his rent $500/month without him moving, too much trouble to deal with movers over “a rounding error”. Satchel has made the critical game theory error of giving his opponent (his landlord) very useful information. Perhaps something like that is why he left the hedge fund industry.

Jorge, no bitterness as a landlord. As I said I am a commercial landlord out of state– and if you’ll recall commercial tenants are responsible for most care and maintenance of the leasehold so it is really effortless. My tenants are things like Micky D’s, a supermarket, and liquor stores. Ten year leases, stable rents, when we go to the table to set the new rent there is usually no discussion– liquor stores can’t move or they need to go through a public process, the grocery is hard pressed to find a space of the same size and doesn’t want to free a space for a competitor (The only nice thing I have to say about WFM, they’ve made it easy to raise the rent on the local incumbent), and the McD and other franchise people love the location. So I am not a bitter landlord in the least, I am a very happy commercial landlord with properties filled with what would be called anchor tenants in ideal locations. And we’ve never even tried charging for parking on our huge lot (Estimated revenue potential of $3M/yr without building a structure)! No, I wouldn’t listen to LMRiM about this, because these commercial properties are in great locations and only a fool would sell them… They’ll keep my family fed for generations. And as for my homes, they are my homes and I like them. What they’ll go for when I’m gone, I don’t know, but that will be for somebody else to deal with.

LMRiM, so you’re admitted to every bar? There is an old style of irrevocable trust in some states that I was referring to. If you do some research, you’ll see what I’m talking about (duh, in case you can’t figure it out, where the asset becomes fixed and cannot be traded… the heirs of one long ago famous Wall Street person were stuck with such a trust and it finally went bust after nearly a century of dividend revenue). If you look into my story, you’ll recall my dad left me nothing. Ol’ Gran’ Dad treated me better.

You seem to be getting into interesting reasoning, landlord business bad, renting good. Keep that up and you’ll convince your landlord to sell. Clearly they could rent someplace cheaper and then re-rent it for more. Or are you saying your landlord is a fool?

You don’t seem like the golf type, LMRiM.

And we’ve still never heard the story of your departure from the hedge fund industry…

Give it up on trusts, shmoey – you’re way out of your league.

About game theory, again, you really haven’t thought it through. Think about it. We don’t work – that means that landlords will want to have some assurance that we have the assets to live and pay rent during the term of the leasehold. The landlord is well aware of what we could pay, but that doesn’t mean that we would pay it. We negotiated down from $4K/mo. wishing rent (we heard from the gardener that they originally sought $6K/mo!!) to $2800/mo, and you’ve got to have some finesse in the negotiation when the landlord is well aware that you are wealthier than the landlord is.

As to whether (theoretically) a $500 increase would be judged as not costly enough to incur the switching costs in finding a new place, well (1) we keep a light footprint – no need to impress a bunch of suckers who fly in from Park Avenue with our living style – so it really wouldn’t cost all that much; and (2) the real question from a game theory point of view is whether the landlord would risk losing a good tenant with the means to live in a much nicer place (and there are plenty available) over $500/mo. As I’ve mentioned many times, we rent from very long term owners who pay nothing in property taxes (thanks prop 13) and whose primary motivation is to preserve the asset in reasonable repair so that they can pass it at the grandfathered tax basis to succeeding generations (thanks prop 58). Notwithstanding that we’ll paint or change appliances if we wanted to, we are excellent stewards of the property. I like to look at our role in this as simply arbitraging a distortion – long term owners have an interest in retaining the asset (due to the low carry cost) and we have an interest in having recent purchasers subsidize us through their outsized property taxes. Everyone wins 🙂

It’s all an academic discussion anyway. There is a little-known legal interest known as the leasehold, generally reflected in a written contract commonly termed a “lease”. When we signed our lease last summer (and I drafted it), we negotiated a unilateral right to extend the lease for another year, at no increase in rent. Perhaps we simply outsmarted the property owner, or perhaps the owner understood how few qualified families are really out there looking to rent average-type (for Tiburon, that is) places. Probably a little of both.

About golf, my son and I were at the driving range just this afternoon for an hour or so after market close. Marin definitely has some advantages for kids and their “retired for now” dads.

“LOL, it sounds like shmoey is henpecked at home!”

Nice. No wonder women don’t post here much.

We tried to find a place to rent in Tiburon but the tract houses were just too McMansionesque. (I guess that makes sense — the area did used to be a railroad terminus, so the neighborhoods are newer — though they were build before brownfield conversion laws — d’oh!). Also, one would have to drive to do any shopping, and I detest driving. Where are the places with character in Tib? Any hints? Belvedere was much nicer, but the streets are very steep, alas, and getting down to the ferry was a bit of a slog from all but a few properties.

Satch, I never played golf, but I understand San Francisco has some great golf courses.

Why are you raising kids in the bay area if you don’t think it is a good place to raise kids? You have economic freedom; move before your kids get older. Where is a good place to raise kids anyway?

I’m not a huge golfer either shmoey – just a duffer who picked it up and played a bit when I lived in London more than a decade ago.

About moving, we’re working on it and won’t be CA residents for tax purposes in 2010 (if you can believe it, when we just renewed our lease, I negotiated the ability to terminate it early – unilaterally – on 45 days’ notice, so the switching costs are even further reduced!).

Raising kids is an interesting process. At least for us, we began to see living here very differently as we got to know other parents with whom we otherwise would not have come in contact absent our kids’ interactions and participation in schools. We don’t have many familial ties to the Bay Area, ao it was sort of a discovery process for us. There are certainly many plusses to being here, but on balance it makes more sense to move on – especially in light of tax issues now that the trading environment has changed so dramatically from the 2002-2006/7 period.

When we’re gone, I’ll still check in on SS from time to time, but until then it’ll still be fascinating to watch the bubble unwind.

Satch, you’ve explained why you want to leave, but where is that better place? So is it the parents or what you’ve learned from the parents that is driving you away? Will you time your move just right, or will you be stuck in that murky number of days where your old and new states both think you need to pay resident taxes?

Hey, LMRIM, I thought you thought Marin was a good place to raise kids. What about your interactions with other parents there has you thinking otherwise? Curious because we are considering the move north “for the schools.”

LMRiM: What about those parents was eye-opening?

Is it “keeping up with the Joneses,” hyper active PTA, lily-white homgogeneity?

just curious,

No real “bad” interactions with Tiburon parents – it’s really a great place and if you’re happy in the Bay Area overall it seems a very good choice to raise kids. My wife especially has been very involved in the local public school, and with the slight caveat that one really should take the time to be involved, I can recommend it enthusiastically!

Sorry if my post suggested something unpleasant – just my poor writing. The only slight negative is that there is a bit of an “entitled” mentality among some portion of the adult population that filters into the kids, but you are going to find that in many if not all wealthy suburbs I guess (or wealthy enclaves within a more urban environment). I guess that’s about as much as I want to say about it.

If you’re going to buy a place, just curious, please don’t pay over a “2002” price, which is about where places are near as I can tell (the sample size is small). As with many desirable areas of the Bay Area, the newer cohort of owners is far wealthier than the earlier cohorts and has overpaid dramatically. I think waiting to buy another year or two will pay off nicely.

About your questions, shmoe, all will be revealed in the fullness of time. No need to worry about taxes for us – I know FTB 1031 and 1100 like the back of my hand, and not working or owning a place in CA gives us great flexibility as to timing!

Shifting back to 270 Castenada, for Mr. Nagano to afford all his houses: I didn’t know music paid so well! Seems like he came from humble beginnings, attending UC Santa Cruz and SF State (wikipedia). Looks like the wife came from money, growing up in Paris. Impressive power couple.

Nagano makes at least 1 million a year from the Montreal Symphony. He is director of several other orchestras as well.

Can’t think of a better place to bring up children than New Hampshire. Unless it’s Alaska.

“joe shmoe” and “LMRiM”, quit squabbling like juveniles…. next thing we know, on of you will pull a Matt Pyke on the other.

Let’s be civil folks. SS is a great site and let’s keep it that way !

OK, Chad you’re right. I’ll stop. We don’t want any SS murders here 🙂

I am actually enjoying the back-and-forth between LMRiM and JS. I find it refreshing and quite instructive, too. Seriously, no ill-hidden sarcasm here.

The history of civility on socketsite is limited.

Just one thing to seriously consider. Satch’s analysis is flawed because he is ignoring all the liquidity that we have pumped into the economy. Yeah, we may not be at the bottom yet, but we are close and when we get there, the fire of inflation will begin and it will apply to housing too. The road up is likely to be as wild and sudden as the road down.

Now briefly returning to the property in question, it is starting to look like I am right and that there is no hurry to sell and owners are firmly in the black with cash flow to carry.

Again, I hate it when people name the property owners and look into their lives here, but in this case the owner is actually a public figure without the normal expectation of privacy. But it did show us that once again, for many people a house is a house… Kind of like cars, some people rent a Hyundai, others got to own the Lotus. Where does the wisdom of LMRiM come down on that issue? Rent or buy and do you write those contracts yourself too?

Yawn, shmoey. Again, you are way out of your league. My analysis is flawed because I ignore “all the liquidity that we have pumped into the economy”?

Your current post reminded me of your astute analysis almost two years ago on the role of interest rates, inflation and what the fed was going to do from , and I think it’s right on point here:

“Anyway, be aware that the only way the fed can fix this problem is to raise rates and which will produce inflation. If they don’t raise rates, we’ll have a falling dollar and hyper-inflation. Take your pick, the price of everything will go up.

Posted by: joe shmoe at December 15, 2007 2:56 PM”

I’m not sure it is possible to have been more wrong. I hope you’ve enjoyed the past year and a half – I sure have. It’s always fun to be on the right side of the trade. I trust that the regular readers of this blog will well recall my analyses from late 07/early 08 – when it could have made a difference for people looking to protect their gains from the prior 4 years.

(Sorry, Chad 🙂 )

LMRiM,

I do pity you. You’ve called your neighbors and their children entitled and the reason you want to move out of the bay area. Um, I’ll just leave it at that.

People shouldn’t treat their houses as an investment, or at least a high growth investment. Realistically, we can’t all be trading options and futures and going for that supercharged gain all the time– and if we all were, bona fide economic activity would stop… I like the fact that I start businesses, let people pursue their dreams, and put people to work, I’d never give that up to become a trader. There is a long history that suggests that pulling 8% on your assets is about the best you can hope for in the long run (Ben Graham, Buffett’s mentor, went even further by siding with the fallacy of compound interest). Other sage advice suggests unless you want your money to rule you, have at least a ten year time horizon on your decisions. Satch, I’m not wrong yet, you are just impatient to prove yourself right.

Satch/LMRiM, if everybody had listened to your advice, nothing would have changed, the SF housing market would have dropped faster (Wall Street like volatility), there would have been a glut of supply causing prices to decline and everybody who felt they needed their real estate liquidated would have been in the same hole.

Anyway, what would you advise people to do? Evidently you do not believe in recovery ever, should we short the world? And what is that thing keeping you from taking opm so we can all benefit from your trading skill, why did you leave the hedge fund industry? If you really care so much about people’s economic well being, give it up all ready and start a fund.

Oh well, shmoey. A Park Avenue trust fund baby with Monets on the wall pities me. I’ll get over it I’m sure 🙂

I don’t know about everybody else, but I think we learned a lot. There’s still more to learn, but we’ve made progress. Our 50 minutes is up. Next week we’ll figure out if Satchel rents or owns his wheels.

Another example in our neighborhood –

http://sfbay.craigslist.org/sfc/apa/1326211712.html

Bought for around 1.8MM, IIRC.

good memory — 220 magellan 1.805 in 2007…

Geo, do you live in the neighborhood too ? We live right on Castenada, and were highly amused when Nagano tried (and almost succeeded) to sell his place for around 4 MM in 2008.

It went into contract almost immediately and then fell out of escrow quickly enough.

Forest Hill, do you know what’s happening with 45 Montalvo? It looks like they’re fixing it up for sale.

Forest Hill: I am across the tracks in “The Wood”. When we were hunting for a place, we were very interested in Forest Hill as well, there are a lot of really nifty places there.

I just noticed 21 Castenada has been relisted.

Nothing says welcome to Forest Hill like 465 West Portal (at Portola). According to RealtyTrac, it appears to have been taken back by the bank for $824,500. Can someone with “access” confirm?

I want to make clear that I had no problems with the comment by nnona that was removed. It made me laugh and I thought we could all learn something about nnona from it.

@West Portal: We love the Wood as well. The two areas my wife loves are SFW and Forest Hill. Your HOA meetings are held at our club house, correct ?

Love your courts though, you don’t have to travel all the way downtown for a game of tennis. Not being elitist, just a factual statement.

@94114: 21 Castenada is an interesting one. Second try for this property. We haven’t seen it in person.

@anon: 45 Montalvo has been under renovation for what seems like ages. Wasn’t it listed with Prudential in late 2007 – maybe ?

465 West Portal – this location is well outside Forest Hill or SFW.

Hey you can at least look at SFW from there… How about this a little closer to home. What’s up with 135 Mendosa? It looks like some folks were playing hot potato with the property. Scheduled to hit the auction block on Sept. 11 for ~$1.5 million.

1.8MM in early ’08. Wonders will never cease!

There is a certain individual who keeps buying properties in D4 and then trying to sell them at outrageous prices – not affiliated with any agency. Some of you may know who I am referring to. 135 Mendosa may be another of this person’s ‘anti-midas’ touch properties.

135 Mendosa is technically Golden Gate Heights, not Forest Hill. Am I correct?

465 West Portal – that’s directly cross the street from St. Francis, but it’s a pretty big street! (Portola) It’s one of the worst spots in the whole nabe imho; it’s located on a narrow triangular corner lot, with one street being fast moving Portola an the other the beginning of West Portal Ave. It’s directly across from a muni stop that runs on the street, so you hear the brakes squealing and see the people mulling about all day.

Oh, and it’s a church, or it’s owned by a church. See the mapjack link and pan around to see the muni stop:

http://www.mapjack.com/?rJsmWzmnbFHBADjA

Looks like the church refi’d to get the $825K foreclosed loan balance, as the tax value is around $300K, so at least they got some $$ to continue their mission. See? No ethical considerations at all with throwing the keys out the window. “Render therefore unto Caesar the things which are Caesar’s; and unto God the things that are God’s”. Smart move imo.

Correct – 135 Mendosa is not in Forest Hill proper.

@LMRiM: Yes, this is one of the worst locations in SF. And it is across the street from SFW, which means zilch in terms of location.

I love it when some posers advertise their properties as ‘St Francis Wood’ and a closer look reveals they are on that oh-so-elusive border …

Speaking of SFW, whatever happened to those monstrosities on Yerba Buena ? The duo for which they had to move one of the SFW signs ?

No idea about the Yerba Buena monstrosities – when I lived out there the whole “park like grounds” of Yerba Buena Court (lol) were a great place to walk the dog – easily accesible through the chain link fence that didn’t close off the entrance from Yerba Buena Ave.

It’s a joke that those developers thought they’d get $10M+ for each of those (that was the original plan apparently when it was conceived way back in 2000 I think – way before my time out there). If this place can’t get $5M in St Francis, those yerba buena McMansions sure can’t!

http://www.redfin.com/CA/San-Francisco/299-Santa-Paula-Ave-94127/home/689725

135 Mendosa is curious — bought in ’03 for $1.15; sold in ’06 for $1.58, then flipped 6 months later for $1.75 in 1/07, then sold again in 4/08 for $1.995…that place sees a lot of action.

Yerba Buena — do you mean the new one built into the hill that is accessed by the alley/easement off of Yerba Buena?

Did see you that 1 San Marcos just closed at 1,490,000? It was listed for 1,590,000.

That’s the one, Geo. If you walk up Santa Paula, you can see one of the big monstrosities – all grey and looking like a giant deformed WWII pillbox – hulking over the neighborhood. Maybe they’ve painted it by now? Like I said, I haven’t been there in over a year so maybe they’ve been sold and/or completed?

It’s actually a nice spot, notwithstanding that you have to sort of squeeze through two houses on Yerba Buena to get to the pair. Great views. And dogs love it down there!

@94114: 1 San Marcos – IIRC, the place with just 2 bedrooms, a bit odd, but I suppose it works for some.

@Geo: Here’s the background on the monsters …

https://socketsite.com/archives/2007/05/the_scoop_on_168_yerba_buena_avenue_and_st_francis_cour.html

https://socketsite.com/archives/2007/06/its_not_always_fun_and_games_at_the_top_16668_yerba_bue.html

The saga of 135 Mendosa is indeed curious. I don’t much care, since it’s not really part of our neighborhood ! 🙂

LM — Yep, I know that one. my understanding is that it will owner occupied in the end. They have not finished the painting, but it was getting there. It is a continuation of that Faux mediterrean stuff.

Personally, for the $$, I think it is a brutal spot with the house behind you looking right down on you and you looking right down on the house below you. She is a big one though. I think it is owned by the “lower house” IIRC.

94114: I did not see 1 san marcos closed escrow, so thanks. That is about $630+/ft² if i remember, so not too bad. nifty place for sure.

^^^I guess that’s why the renderings all had *tinted windows*, Geo. Sounds like you can’t walk your dog down there anymore if they’ve actually started working on it again 🙂

If you still can, though, it’s worth a walk around there. The view from the “patio” in front of the northernmost of the pair was pretty nice as I remember. The terrain is so steep that all you see of the houses below are their roofs, and I don’t think the houses above you would see too much other than your roof because of how close the houses are set into the cut-away hillside. My memory could easily be off, though. Certainly not enough “park-like grounds” for those size houses. For the money, I’d infinitely prefer 299 Santa Paula, where you literally have a park in front of you!

LM: absolutely 299 is the better buy. They have been working hot and heavy on it over the past year, so no dice walking around there.

I just wanted to take a minute to explain why I have been going after Satchel/LMRiM so hard. Mainly, it is that his story does not add up and I have a real problem (as do the SEC and CFTC) with traders going around posting their trades without any fiduciary responsibility. The markets LMRiM is trading are zero sum markets, meaning that unlike the stock market where there are earnings and dividends whenever LMRiM makes money another participant must lose money. I have not seen LMRiM ever post that key fact, that he is luring amateurs into zero sum markets dominated by professionals like himself. He is not a certified financial planner and he is encouraging people to engage in extremely risky trading activity. I can only speculate on his motives. I also doubt that he is a lawyer because a lawyer would know that he could be sued by anyone who took his online advice and lost money (even if they did not follow his advice to the letter).

I doubt that LMRiM was actually in the fund industry. If he was in the hedge fund industry, I suspect he left under bad circumstances. This is an industry that is hard to leave– a bad fund manager, one who really, really sucks, will typically pull in high six or low seven figures. The best managers make in excess of 1/4 Billion in annual take home pay. If LMRiM is the hotshot he claims to be and is not banned from the securities industry, his returns from trading on his own account would make it very easy for him to seek investors. If you can make 11%/year you are almost guaranteed to be able to earn eight figures because 11%/year will attract $1+B in capital. Your 2.5% management fee on $1B is $25M/year, even after paying for your office, equipment, and support staff you are looking at take home of $20M. If you are as good as LMRiM claims, you’ll break your “high water mark”. That is typically set around 20%, if you get gains of more than 20%/year, as a manager you are entitled to 20% or more of those gains… That’s how people end up making 1/4 Billion a year.

So what is a guy with nine figure earnings potential doing bragging about the money he is saving by renting and posting trades on a real estate blog? That’s all my beef is and LMRiM has never really had a good explanation.

I’ve never filed a complaint with the SEC or CFTC about Satchel/LMRiM’s postings on his trading activity because I believe socketsite is a useful resource and don’t want to put socketsite in the position of getting subpoenas because the expenses of complying with that type of investigation could make the site untenable. However, be aware that if anyone were to make such complaints with the SEC or CFTC, or were to sue LMRiM, it would be a big headache for socketsite’s owners though they have done nothing wrong. (Socketsite, don’t remove Satchel’s trading posts or if you do preserve them in an archive with ip addresses to avoid charges of obstruction of justice).

So there’s the scoop. I hope I did not create too big a kerfuffle, but when something smells fishy I have to get to the bottom of it and I think LMRiM/Satchel still has a lot to come clean about.

Joe Shmoe, After one of your earlier postings, I asked you if you were a realtor and you said “no”. Now I have to say I think you’re a realtor and making a very clumsy and asinine attempt to shut lmrim down or scare SS into shutting him down.

I will be blunt, Joe. In some of your recent postings you tried to show you were comfortable with your re holdings and had a secure income. Whether that were true or not, anything that SS or any poster write here and/or advocate here will not change that. You are suffering from excessive paranoia. Get some help.

Editor, I don’t see how personal attacks such as the un-informed speculation posted by “Joe Schmoe” should be allowed. He is guessing earnings and careers of other people without any knowledge, when for the most part they are talking about real estate, not their own life history. LMRiM is posting about declining values of various properties and where he is investing his money, what is so wrong about that?!

Again and again when someone brings up facts about various listings, especially if they are in DECLINE, they are personally attacked instead of responding to their points.

I am posting from Northwestern University in Chicago but also own real estate in San Francisco (inherited). Do I have to post documents for Joe Schmoe to believe me? Would I only then be allowed to post?

I value LMRiM’s posts and knowledge and hope that the attacks are withdrawn.

Hi Joe. We don’t give a shit. Not about any of it. He’s not our investment advisor, so we just don’t care if he’s been banned or he’s the chairman of the SEC. See: we just don’t give two hoots. He explains a lot of things that are foreign to us, and so we appreciate his posts. There was a meltdown and he correctly predicted the results, fully explaining who would be saved and who would be thrown overboard and he was dead on.

I think a lot of us do not believe this crisis is over. We think it is being papered over, which is possible, but only for a while. The problems will soon return. Having him around was quite valuable as he explained just what was going on. Having him around come February of next year will be just as valuable.

If we never heard from *you* again, Joe Scmoe, ever, none of us would be any worse off, because you generally contribute nothing at all, but we can’t say the same about LMRiM.

He is interested in SF real estate, and pretty knowledgeable about it too, and that’s what we all have in common, so we all post here, as anyone, even someone who contributes pretty much nothing, like you do, is welcome to do.

It’s also generally populated by smart people, and that also makes it interesting. The intelligence of the poster generally comes out after several posts. We kind of know who is intelligent and who isn’t. He’s pretty much at the top of the list on the forum.

Sadly, we cannot say the same for you. You’re just a real estate cheerleader that most of us want to stay away from:

If you are buying a home to live in for ten, fifteen, twenty years, this is a good time to buy.

Posted by: joe shmoe at December 15, 2007 2:56 PM

Prices are down about 20% citywide since you made that statement, Joe. I think we all wrote you off a long time ago. You don’t really have the level of intelligence that most of us are looking for, Joe. As for LMRiM, he’s been right on. So if living outside of SF gives you the correct perspective, we’ll take his, thanks. If he’s been a lawyer or not, whether he’s retired or banned, just doesn’t matter to us. As long as he’s smarter than you, which is a pretty low standard to meet, we’ll keep listening to him no matter what his background.

Now go find some NAR-sponsored site and espouse buying SF real estate in 2007. LOL!

No, as passionately as some of you guys feel about realtor conduct, I feel the same way about securities law. Satchel/LMRiM has repeatedly posted his trading here which is a really dicey thing. I’ll put it this way, if I see any new postings by Satchel about his trades, I’ll file a complaint and it won’t shut down socketsite, just wind Satchel in a load of trouble (assuming socketsite has revenue to for counsel and the rigors of electronic discovery). It is just the sort of thing the obsessive people do here about inaccurate listings and manipulated mls photos, but here there is in fact federal law on my side. Of course, the feds might choose to seize the servers hosting socketsite, but that’s not my problem. So it is up to Satchel/LMRiM, his conduct will determine the future.

Hey now, I actually called Satchel out about giving specific trading advice a year or two ago (right before he changed his handle to LMRiM or whatever it just was) and he admitted that he shouldn’t ought to be doing it.

Investment professionals are ethically prohibited from doing this, folks. Doesn’t matter how incredibly useful it might sound to us non-professionals (of which I am one — at least in the financial and real estate worlds!).

You just aren’t supposed to give stock picks or futures picks or anything of that nature if you are a pro. Sure, Motley Fools are all over the place, but they are *amateur discussion boards* and ya gotta be an amateur to play there. And Satchel or whoever is not (or at least that’s what we think, I guess? Who really knows? Nobody knows you’re a dog on the Internet.)

The rules are in place for a reason: your protection. Anyhow, that’s the point. Though it is far removed from the topics at hand, my profession has ethical codes; the real estate profession does also (as we have heard here); and there are standards to be upheld in finance as well, no matter the scale.

P.S. to enough already: I am not talking about real estate advice — I’m just fine with Satchel/ whoever giving real estate opinion on a real estate blog, of course! That is entirely appropriate I’m talking about occasional posts re. options and futures trading, and the rabid soliciting thereof by the readership.

@joe shmoe

You have really strange priorities. While you have the likes of Jim Cramer actively touting Bear Stearns on CNBC shortly before its stock collapsed, you are worried about the possibility of someone losing money from reading LMRiM’s posts on SocketSite. Have you ever considered channeling your public service energy in ways that may benefit the public even more? Like going after CNBC or volunteering at a soup kitchen for homeless people?

@I noticed this, too

Can’t speak for LMRiM, but I got the impression that he did his professional trading outside the US and a long time ago. Why do you think he wouldn’t be considered just another “Motley Fool”?

“likes of Jim Cramer actively touting Bear Stearns on CNBC shortly before its stock collapsed”

but Jim remembers to chant the magic mantra,

“in my opinion…

in my opinion…

in my opinion…”

which keeps the SEC asleep while allowing one to be an utter shill, leading fools down the garden path for the benefit of your corporate paymasters.

Wow, joe shmoe. I suppose this is to be expected. As the crash progresses, those whose ox is being gored will lash out with ad hominem attacks and litigious threats, rather than confront facts. It changes nothing about economic reality, and this board has not been squelched in the past by such tactics from you and your ilk.

The SEC reading your complaint would see it for what it is: some twerp complaining about some other twerp on a twerpy message board somewhere. You probably know this (pity you if you don’t), and have no intention of extending effort for such pointlessness.

If you dislike LMRiM’s message so much, perhaps you should just post more astute commentary of your own to counter him, like your gem from 2007 “raising rates will produce inflation.”

motley fool incorporates appropriate disclaimers into their user license agreement. Just odd, discourage people from buying houses with money, attract cheerleaders by singing a song everybody wants to hear, drop the occasional zero-sum market “tip”. Nice confidence man, evidently he’s proving p.t.b. right.

Doesn’t LMRiM say he trades on his own account? He’s never said he is currently doing anything other than managing his own money. If his background it true, then he might not be an amateur but hardly seems an active professional.

Like many others I appreciate LMRiM’s postings and have learned much. Mostly they are a good departure point for learning more about a particular subject. I can assure you, Joe, I have yet to be lured into making highly risky zero-sum, complex trades based on an anonymous poster’s musings. And if I did, maybe that would just be a fine example of financial Darwinism….

And Joe Schmoe, you yourself said “I doubt that LMRiM was actually in the fund industry.”

Editor, make sure you hang on to THAT post for when the SEC comes a knockin’!

Don’t feed the trolls…

Robert, you are so right. Shouldn’t have taken the bait….

Plus I just wasted valuable time that I could have spent setting up complex derivatives trades that I don’t even understand!

West Side Story: Good, then you are wise. I was worried about some who were asking for specific timely trading advice at a time when Satchel was actively trading.

I’m certainly neither a trader nor an investor in real estate or in anything else (and would not know how to begin to invest myself). I really dislike the bubble because it changed the character of the city and priced my friends and colleagues right out. Now, I’m just a lurker who will return to lurking forevermore — being a virtual lookie-loo into houses is fun, along with marveling at the amounts people will pay for all sorts of places these days (still!).

It don’t matter if Satchel was in the industry or not. If not he has misled people and claimed credentials and experience he doesn’t have while he dispensed advice. If he was in the industry or has a law degree, the administrative action would assume guilt because industry participants and lawyers are expected to hold to a higher standard.

It is interesting that every time somebody points out the questionable nature of Satchel’s tips, he gets a new id and lays low… he seems to think there is something to this.

I agree Jim Cramer is a total piece of c–p, why would he abandon money manager’s salary for a cable broadcaster’s salary?

Now Satchel, let’s see if you’re really from the Bronx 70s: Did you get rich by drinking c&c or white rock?

So Joe Troll, are you just going to continue the personal attacks or are you going to dig up some FACTS to dispute LMRiM’s points and sources? Your comments are usually ONLY threats to other readers, posters, and even the editor himself. How is this welcome or helpful? Meanwhile, I look forward to comments by LMRiM who digs up some interesting backround information on many of the properties presented here in on this site.

dissent stirs ghosts come

for hating debate idol

naked in winter

anon (August 20, 2009 10:44 AM),

This thread seems to have taken a turn for the worse, but regarding 45 Montalvo, it is also for rent:

http://sfbay.craigslist.org/sfc/apa/1340379441.html

Thanks West Portal for the tip!

“I agree Jim Cramer is a total piece of c–p, why would he abandon money manager’s salary for a cable broadcaster’s salary?” Maybe he was ready for a change… something a bit less stressful or wanted to do something he actually loved or always wanted to do when given the opportunity? It’s not always about money ya know Joe Shmoe Realtor? Also, no need to bash LMRiM’s advice here. LMRiM gives great investment advise and has mentioned that he trades on his own account several times. Who cares if he was actually a money manager? The SEC would not give much credit to your report. Take a look at yahoo finance message boards and find someone there to tattle on.