Home sales in San Francisco and the median price paid for a property in the city both dropped a little over 5 percent in August versus July. Over the past decade, home sales in San Francisco have increased an average five percent over the same period of time, and home sales in the city are currently running 20.3 percent lower on a year-over-year basis, according to DataQuick.

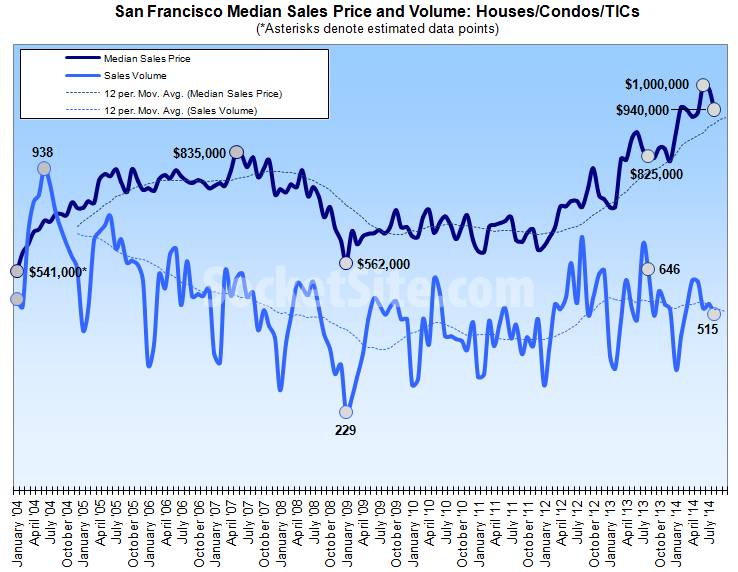

Having hit a record $1,000,000 in June, the median price paid for a property in San Francisco dropped to $940,000 in August, down 5.1 percent from the month before. And while the median typically drops from July to August, the drop has averaged a little over 2 percent over the past nine years. That being said, the median price paid for a home in the city remains 13.9 percent higher on a year-over-year basis and 67 percent higher than the recent low-water mark of $562,000 recorded in January of 2009.

Across the greater Bay Area, homes sales slid 10.6 percent from July to August and are running 12 percent lower on a year-over-year basis. The median sale price for a Bay Area home was $614,000 last month, down 1.6 percent from July but 12.4 percent higher versus a year before, and 112 percent higher than the low-water mark of $290,000 recorded in March of 2009. The Bay Area median home price peaked at $665,000 in July of 2007,

As always, keep in mind that while movements in the median sale price are a great measure of what’s in demand and selling, they’re not a great measure of actual appreciation.

At the extremes around the Bay Area in July, Napa County recorded the second highest drop in sales volume behind San Francisco, down 18.2 percent versus the year before with a median price that’s a nominal 1.6 percent higher, year-over-year. San Mateo recorded the smallest drop in home sales versus the same time last year, down 1.3 percent with a median sales price of $800,000, up 10.8 percent year-over-year.

And while the number of homes sold in Alameda dropped 13.9 percent last month versus the year before, the median price paid was 19.1 percent higher, the greatest percentage increase across the Bay.

DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.”

Matches what I have been seeing. Summer was slower than usual. Listings not generating as many offers unless they’re exceptional or underpriced.

Huh? I wish that were the case, having bought this summer. But prices and interest were clearly way up versus last summer.

I think scarcity remains the problem. Look at the dollars per feet in D10 summer 13 vs 14. It’s up about 15 percent this year. Multiple offers on nearly everything, etc, everywhere.

shza, you bought a house? Congratulations! You must have been elevated to partner 😉

Scarcity is a huge reason for the elevated prices, but I also think Summer was slower than Spring (partiallly due to normal seasonality). Alot of inventory just hit the market in SF, so it will be interesting to see what happens to rate of sales and prices over the next few months.

I actually think it’s a sign of strength that normal seasonality seems to be coming into play – suggests the market has real foundations in my opinion compared to years such as 04-06 where the effect seems less pronounced.