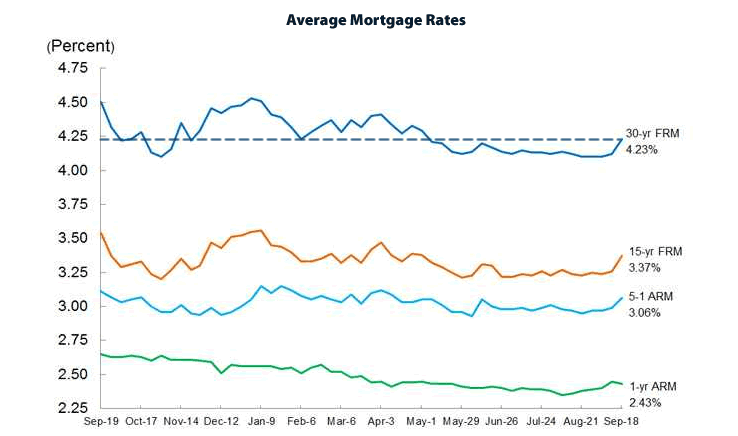

The average rate for a conforming 30-year fixed-rate mortgage jumped from 4.12 to 4.23 percent over the past week, the highest rate since the beginning of May and the biggest one-week increase since the beginning of the year.

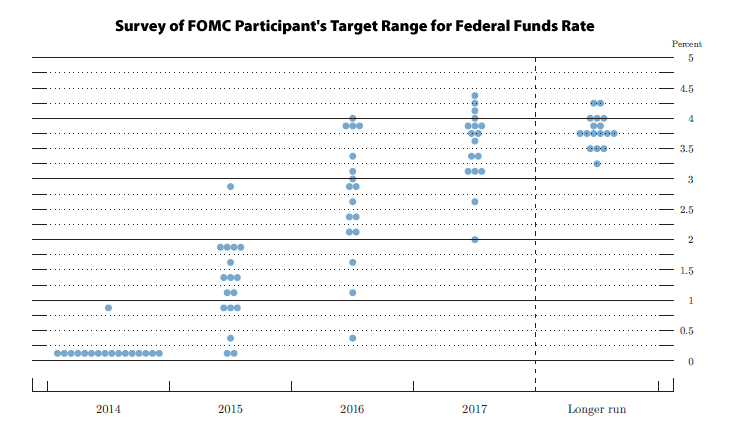

Speculation that the Federal Reserve might start raising rates sooner than expected helped fuel the jump. And while the Fed ended-up reiterating its intent to maintain a low-rate policy “for a considerable time,” it also suggested that rates might be raised faster than expected once the hikes begin to occur and with the majority of participants judging that the hikes should begin next year.

Having forecast the average rate for a 30-year fixed mortgage would begin rising in the second half of 2014 and end the year at “around 4.6 percent” in May, Freddie Mac lowered their forecast in July and now expects the average 30-year fixed mortgage rate to end the year at “around 4.4 percent.