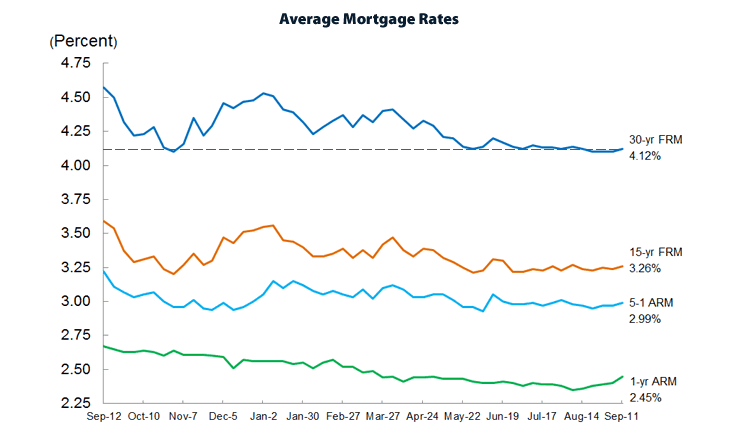

The average rate for a conforming 30-year fixed-rate mortgage ticked up a nominal 2 basis points, from 4.10 percent to 4.12 percent, over the past week. With little movement over the past three months, the 30-year rate remains near its 62-week low, having last dropped below 4.10 percent in June of 2013.

Averaging around 6.7 percent over the past twenty years, the 30-year rate hit a three-year high of 4.58 percent in August of 2013, and an all-time low of 3.31 percent in November of 2012.

Having forecast the average rate for a 30-year fixed mortgage would begin rising in the second half of 2014 and end the year at “around 4.6 percent” in May, Freddie Mac lowered their forecast in July and now expects the average 30-year fixed mortgage rate to end the year at “around 4.4 percent.”

Wells Fargo has great rates. 3.75% no points and even covering some closing costs on 3.875. Just locked 3.75 recently with no points.

Mission, was that for conforming or non-conforming? And was that a re-fi or new purchase?

New purchase, non-conforming.

30 yr fixed?

Yes, 30 year fixed. I just check to see if the rate was still available and he said it’s probably with a .25 point today. That’s still pretty good as the points are deductible up front on a purchase mortgage.

Must be an ARM. Nobody is providing 3.75% jumbo fixed rate loans with no points. About .5% higher than that.

Still a decent rate.

Which is why I sit quietly on the sideline with my 4.125% 30 year fixed multi-unit jumbo.

It’s a 30 year fixed. Agent did say it was best pricing since sometime in 2012. May be gone already but even before we locked 3.75% 30 yr fixed was available with only .25 points. ARM’s have even lower rates.

Wow, I thought we did well securing a 30-year fixed at 4% even, no points on a non-conforming (~1.5M) loan a couple months ago. Also from Wells.

we also bank with WF and had to do autopay. Not sure if that matters. We were pleasantly surprised particularly because the mortgage on the house we sold was at 3.25 and it was tough to give up that low payment.

I got quoted 4.0 on a 30 year with I believe a quarter point a few days ago at Wells. I agree that 3.75 with no points sounds incredibly low. Rate on a 7 year ARM was 2.75 by the way.

I will say that there is a negative spread now on jumbos though, so 3.75 is not out of the question. Either way, congrats on the great rate.

I’ve done a bunch of refi’s too and prices on these things change quickly. There’s some luck involved on when you lock. We were working with someone who was on the ball and called us when the pricing changed favorably. He said “you have to take this now because I’ve never seen pricing like this except for maybe one week in 2012”.

We did a re-fi mid-2013 at 3.25 and no points on a fixed jumbo 30 year with a local credit union. So might be worth checking those institutions out as well. Thinking about moving but hard to leave that rate behind.