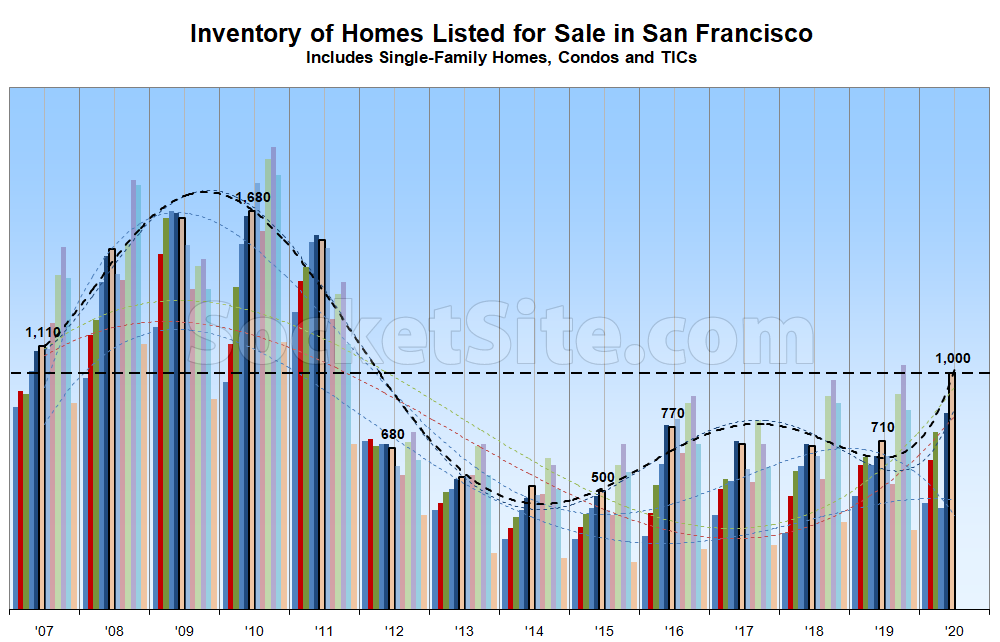

With the number of homes newly listed for sale in San Francisco having outpaced the number of purchase contracts that were inked for the eighth week in a row, there are now 1,000 homes listed for sale across the city.

That’s 40 percent more inventory than at the same time last year, another 9-year seasonal high, and within 4 percent of hitting a 9-year high in the absolute (keep in mind that inventory levels typically don’t peak until October), a jump which shouldn’t catch any plugged-in readers by surprise.

At a more granular level, the number of single-family homes currently listed for sale across the city (310) is currently 27 percent higher than at the same time last year while the number of condos (690) is up by nearly 50 percent. And the percentage of listings which have undergone at least one official price reduction has been ticked up to 20 percent, which is five (5) percentage points higher than at the same time last year.

We’ll keep you posted and plugged-in.

Yes, I do notice a LOT of price reduction lately… Funny that where I live (south bay), we dont seem to have as many price reductions….

The “Great San Francisco Real Estate Exodus” has begun. IMO you can lay most of the blame for the exodus on a few disruptive lifestyle changes caused by the current state of affairs effecting workers and their lifestyle in San Francisco. Work from anywhere. Loss of entertainment and eating establishments. Loss of city services due to a $2.5 billion dollar budget deficit. Influx of additional homeless into the city. All caused by the effects of the Wuhan Flu.

I sense some sellers may be in panic mode and want to get out of SF ahead of the herd of sellers that may materialize from the social unrest and lock down mentality. A rush to cash out and a rush to find an affordable replacement home outside of the Bay Area, perhaps outside of the state.

I also think that savvy owners who are paying attention to the political landscape in CA see that their property rights are under attack. There is a movement to overturn Costa Hawkins. A movement to bring single family homes and condominiums under rent control restrictions. A movement to increase the SF property transfer tax on homes sales over $1,000,000 million dollars. Some may sense that the city will have no choice but to raise taxes and fees on it’s population.

You lost all credibility at the phrase “Wuhan Flu.” Might as well post a fact-free screed from Tr*mp or Breitbart. “Won’t someone think of the poor landlords!” LOL

Yeah, I stopped reading at the “Wuhan flu”. I’m glad there are flags like this that people can use to let us know the [comment] is not worth taking seriously! I only wish he would have led with it, that would have saved even more time.

true, but I kind of think meh- don’t feed the trolll. People use that expression in hopes of getting a lot of irritated replies just to stir things up and somehow that makes them happy. It fits in with the whole thing: SF is terrible, liberals are terrible (liberals = disagreeing with trump on 1 or more out of a thousand issues (there is no center, only communist/liberals or trump supporters).

It sort of feels like when someone’s ex breaks up with them and ten years later, they are still talking about how terrible the ex was and how they don’t miss him/her at all.

Until recently it was not that uncommon to name pathogens by their area of origin. West Nile virus, Marburg virus, St. Louis encephilitis, MERS Middle East Respritory Syndrome, the list goes on and on. China didn’t like the PR from the name Wuhan virus, so people changed it. It’s not that big a deal either way.

banon, these are mostly pretty old except for MERS. And MERS did spread but not globally and was overwhelmingly in Saudi Arabia.

West Nile 1930’s,

St Louis encephalitis, 1930s,

Marburg, 1960’s.

H1N1 was discovered in the US and if I recall it took six or seven years to definitely prove that it originated in Mexico. But there was never any talk of calling it the American Swine Flu.

“Wuhan flu” has two parts and is used almost exclusively by Trump supporters echoing him and trying to shift 100% of blame to China (and for sure the CCP sucks). G7 rejected the name. Other countries don’t use it. Scientists don’t use it. The second part is the “flu” to try to get people to think that this whole thing is overblown and just another flu even though it is a novel virus.

It is only used by people who in adopt Trump’s specific lexicon and “thoughts”.

All caused by the effects of the, by the numbers, worst response of any developed country in the world. A virologist with no experience leading a major gov’t organization to be the second appointee to head the CDC (first one had to step down); the most important qualification was his kowtowing to his boss. 472 tests done total by the CDC from Jan 21 to Feb 29. Just unfathomable levels of incompetence and failure. And a myriad other major mistakes in handling this- just too many to get into here. We missed our window to save lives, jobs, businesses, and the economy overall.

SF is flawed in so many ways but geez it is still a great and beautiful to live.

Markets go up and down, governments will come and go and SF will continue to have social issue like everywhere else. But San Francisco will continue to have stunning scenery and perhaps the best climate on the continent soon. When it’s 110 degrees in the summer most other places it’ll be 78 degrees here.

The evenings have been stunning lately!

Gee with all the remarkably intelligent remarks posted above not a word of substance about the gist of the story…..”That’s 40 percent more inventory than at the same time last year, another 9-year seasonal high, and within 4 percent of hitting a 9-year high in the absolute (keep in mind that inventory levels typically don’t peak until October)”

Words…..”The secret of being boring is to say everything.” -Voltaire

A number of factors are driving this. One that is overlooked is the near historically low mortgage rates. People who were considering moving out of SF – especially after their first child – are now incentivized to make the move to the burbs. A couple I know were planning on moving to the Orinda area once their kids were set to enter school. They decided to make the move now/early because of the interest rates. Expect more of that now as families choose the more open areas of the suburbs over the cramped city.

Small time real estate investors are a factor. If they knew what they were doing they should have got out a while ago. Many didn’t however – betting on year after year of near double digit appreciation – now the writing is on the wall. Likely statewide rent control with no exemptions for single family homes or condos.

SF’s financial future is not guaranteed and certainly, in the medium term, there will be more taxes/fees levied on residents. With a parallel reduction in city services. The jobs exodus will, IMO, be significant. Not just due to permanent tele-work at many companies but the more difficult time companies will face getting workers into the city. As public transportation is eschewed by some due to fears engendered by the pandemic and, if BART social distances on its trains for an extended period, it will physically impossible to bring in the numbers that BART did prior to the pandemic. Of note, NYC is facing a similar transportation bottleneck and now iconic condo tower One57 is seeing huge drops in its condo prices.

I’m trying to think of some reason why the numbers of purchase contracts might be lowered. This post doesn’t mention any. Do you think the fact that SF has been under orders to shelter in place for almost three months, and it is quite difficult to visit a home for sale, and it is far more difficult than usual to get in touch with lenders for financing, might have something to do with it? Just a hunch. But maybe it’s just that few people want to buy a home in SF anymore, and the obvious consequence based on good old supply and demand would be greatly lowered prices rather than the recent record high prices we’ve seen. I guess we’ll see in the coming months. Fortunately there are good indexes available that measure such things.

>Do you think the fact that SF has been under orders to shelter in place for almost three months, and it is quite difficult to visit a home for sale<

It's actually pretty easy. There are no open houses, but you can schedule an appointment pretty easily.

Right, but most rational people don’t WANT to interact with strangers indoors right now if they don’t have to. Got it?? So much willing ignorance.

Don’t forget the HUGE tax increases that will have to be implemented, coupled with an enormous reduction in services. The state deficit has grown too large, and as businesses run out of their PPP dollars and fold, the tax situation will get even worse.

Most of my wealthier friends are looking to move out of state. And of course, once that happens, it becomes a downward spiral, with remaining residents poorer and so taxes have to rise even faster, so even more people take off. The work from home idea made it clear how possible it really is to do most jobs from any state. No one in tech has to be in the bay area any longer.

The other thing to watch is Proposition 13. Commercial property will no longer be protected by 13 if the initiative to separate out these types of properties from 13 passes in the fall. The additional monies from taxing commercial properties at their current valuations won’t be enough to fix things in terms of California’s balance sheet. The residential roles, if taxed at current value, would provide a massive influx of desperately needed cash to the state. The next step will be to end 13 altogether – whether that can only be done buy initiative or if the governor could declare a fiscal state of emergency and “temporarily suspend it I don’t know.

I just checked Scottsdale, AZ and Las Vegas inventory to see if they were up 40% YOY like San Francisco: both places are down 27% in inventory from last year.

So it’s clear that people are absolutely flying out of the state. You can get a 3 bedroom house with a pool in these cities for $2000/month after taxes. And working from home next fall to spring will be way better in a big house with a pool, compared to an apartment that is 1/3 the size and costs twice as much and has all common amenities closed.

Does anyone even make it out to the pool when it is one hundred and eight degrees fahrenheit outside, as it will be in Scottsdale this weekend?

>Does anyone even make it out to the pool when it is one hundred and eight degrees fahrenheit outside, as it will be in Scottsdale this weekend?<

Having been to many Scottsdale pool parties, then answer is definitely yes. By your take, Palm Desert would be a wasteland of nothing. Instead it's full of expensive homes where lavish parties happen year round. It's great until the music festival each year. Scottsdale is like a less tolerant, more economically unequal Palm Springs.

The comparison to Palm Spring is interesting, but Palm Springs gets lots of traffic from weekend homes. I’m assuming that requires being driving distance from places that with livable climates outside the weekend.

I moved away from SF to San Diego and looking to buy my first house. While not as expensive as SF it is still ridiculous that $500,000 will get you a basic ranch house in one of the least desirable areas of SD, and prices just go up from there.

It’s absolutely hilarious to see what the SF real estate boosters have been reduced to:

“But the weather and scenery are gorgeous.”

“Did you see the sunset yesterday? Stunning!”

Too funny!!!

Tipster mentioned people fleeing the state. There is another dynamic which Bloomberg headlined today “Wealthy Havens Lure Homebuyers in Mad Rush From San Francisco”. This is more well to do San Franciscans “fleeing” to Sonoma, Marin, Napa and Lake Tahoe They noted increased demand in those counties while San Francisco has seen a decline in demand. This is happening in Manhattan too.

Not everyone who leaves SF will skip the state. I know a Twitter worker who has finalized her permanent tele-work status and is moving to St. Helena. Her rent will drop by about a third for a far nicer place. These changes will have repercussions on all the planned residential towers in SF What if they build a 960 unit tower in the Hub and no one comes? As it is 1550 Mission is having to offer a month’s free rent to attract interest. As the Paramount is also doing.

While I think it would be wonderful if the proposed 960 unit tower in the Hub gets built and no one comes or very few people move in (and prices drop to accommodate the new equilibrium), the more likely scenario is that the developer’s demand models would predict that occurrence and they would either delay the project or sell the entitled parcel prior to construction and thus no additional supply would reach market while sufficient demand was unavailable.

But you already know this.

Marketing and PR already underway to lure Taiwan and Hong Kong to the 960 unit Hub.

I read that article. You kind of knew in advance that when the expression “mad rush” was used it would be a realtor trying to sell/pump up a real estate sector. In this case, that realtor was talking about Sonoma and Napa. No matter the situation, the great machinery of the NAR continues on.

Here at Crazy Eddy’s, we’re rolling back prices like it’s 1999! Need a condo? We got it! Want a single family home? We got those, too! If you need it, Crazy Eddy has you covered. If you’re in the market for a home for you and your stuff, don’t look anywhere else other than Crazy Eddy’s City ‘O Home Bargains, right here in San Francisco. Make other people’s’ pain your gain today!

Nice place near me at 251 Waller St. just closed. $150,000 below asking, so a bargain I guess. But at $4,500,000 it was $400,000 more than the selling price two years ago. Just anecdotal, but good luck to anyone looking for steep price declines in all this inventory out there. Maybe you’ll find them.

It’s worth noting, or perhaps omitting, that the 2018-era sale was “off market” and there has been some remodeling and upgrading of the home, in terms of its interior, since.

And as always, if the value of an upgrade was simply equal to its cost, there wouldn’t be a market for flipping nor development in general.

By “some remodeling and upgrading,” ScoketSite is trying to use a wet bar and deck extension to help justify $500k in appreciation in what should be a down market.

$4,500,000 – $4,100,000?

Fair point — $400,000. I misremembered the last sale. Regardless, my point still stands.

Actually, there were other changes as well (including the moving of windows). And again, it was an off-market transaction in 2018.

I am (was, technically) coworkers with the 2018 buyer, and there were no non-monetary considerations which make the 2018 transaction not a useful benchmark. The sellers did not believe they could get a better price than $4.1m.

Regarding the potential price hit condo towers may take over the next few months. I’m a HOA board president. When the Wuhan Flu hit and the CDC issued social distancing guidelines our lawyer advised us to post notices on all our elevators advising the residents that only one person at a time or one family at a time should use the elevator with the caveat “use at your own risk”. Obviously this has a significant impact on residents living in towers served by elevators.

If you are considering purchasing a unit in a 10, 20, 30, 40 story condo tower this social distancing is going to matter. If you are selling a unit in one of those buildings social distancing going to have a impact on foot traffic and buyers psychology when considering buying in a high rise building. I think sellers might panic once a potential buyer senses a opportunity to make a low ball offer due to the elevator issue. Maybe I’m wrong…but if I were looking for a bargain and willing to take a risk that the virus will eventually die out I’d sure use this as a bargaining chip when making my offer.

Best to hope that the reports emerging about the lifespan of the Wuhan Flu are true and the virus is beginning to weaken it’s virulent impact on humanity. If the virus dies out like SARS then there is a chance the SF condo tower market will remain somewhat stable.

If next year the virus is as strong as it was in the beginning of the Pandemic, those towers are going to take a major price hit.

I suggest that developers begin exploring ways to sanitize empty elevator cars with UV-C light. This may not have an impact on how many people can ride in a car, but it may give occupants some sense that the car is at the very least sanitized before they enter the elevator car. This technology is now being used on airplanes before passengers board the planes. Banks and lenders may even require the use of this lighting technology in their loan documents.

I’m just left scratching my head. Not sure where things go from here

One thing that will likely change – much more permanent telework and less need for uber expensive office space in SF – and uber expensive condos/rentals in 40 story buildings. Pandemic continuing or not, this will be looked back upon as one of those transitional points in how we work and where we live. Technology will advance and make remote work even more seamless.

Oh look , it’s already begun (of course even the Town’s newspaper-of-record took pains to explain how this is less trophy-landing than huddled-mass housing; but b/w Square, Blue Shield and this, perhaps it’s enough to fill up a private dining room…if we ever reach that stage (Stage 3b, I believe)

More than a room – a thousand here, a thousand there. Don’t forget Square moving 1200 or so jobs, Uber apparently relocating to Texas which will be thousands of jobs and Twitter likely to decamp SF. Another thousand or so. PG&E hopes tech companies will take its SF buildings for a nice price – that remains to be seen, It’s hard to see major tech firms moving jobs to SF going forward.

For years on this site, I’ve been kindly allowed to dyspeptically declaim the folly of putting all our job eggs in one basket. Now those eggs are coming home to roost (c’mon, that’s good writing :-p). It’s not easy to work from your 1BR beanbag when you’re in production, distribution, or repair.

We could have had a healthy mix of white-collar, blue-collar, and no-collar (ever seen a coder in a collar?) jobs, but the banker/builder/realtor/landlord axis had a historic real estate bubble to blow.

So we here are, ladies and gentlemen, facing an austere future of vacant commercial buildings and emptying residential towers, as company after company bails on SF, and trailers line up to haul the koder kidz and their pingpong tables back to kansas.

Take a bow, banker/builder/realtor/landlord axis, well done, well done!

It’s not called the Wuhan flu and you’ve been told why several times by now.

At this point, pay him no mind. When people know it’s incorrect, offensive, and has sparked racist incidents and still persist with this nonsense, they are persisting for these reasons.

Re: the Wuhan Flu, normally I would say don’t feed the troll.

Here I’ll modify that to say don’t feed the racist troll.

“If next year the virus is as strong as it was in the beginning of the Pandemic…”

My guess is any wave starting 2021 will be less severe due to increases in immunity. That doesn’t mean that we aren’t due for another perhaps bigger wave in a few months.

There might be a spike in highrise sales prices short term but I don’t see this as a longstanding stain on that class of properties unless there’s some evil genetic engineers out there ready to increase novelty.

Stay safe and be well.

the bay area likely has less than 3% with immunity. this little immunity will have no impact on spread. the death rate will be lower because we are more prepared with PPE and hospitals have experience, but we dont have enough level of immunity to affect growth rate in cases. the story in NYC is differnt where there is likely 20% of people with antibodies that will slow spread by roughly 20%

Wow a lot of schadenfreude! SF is like the Yankees, Patriots and most recently the Warriors lol. Agree to disagree and we’ll just have to watch and see what happens.

This in from the Harris Poll…Americans are eager to move to new areas. This survey (Wave 11) was conducted online within the U.S. by The Harris Poll from May 8 – 10 among a nationally representative sample of 2,030 U.S. adults.

The Rising Interest in Rural and Small-Town Real Estate…see name link for story… same for my comment above.

Percentages don’t lie but with roughly 390K units in San Francisco, and 32 percent of those are single family homes, I would hazard a guess that there will always be a high demand for units in SF, and likely be more insulated from value fluctuations, than other areas that have had higher speculation, Florida, NV, AZ and others.

If my math is right, even at 1,000 units represents less than a single percent of total units, understanding that rent control and protected tenants will skew that number a bit.

Maybe what this is telling us is that SF’s real estate won’t be a great investment return, and will follow other cities in America where house values remain reality flat over a generation, although with a much higher entry point and yearly tax bill.

Re: Geube

With the battle over Prop 13 brewing and the same for Costa Hawkins, single family homes and condos will befall the same fate as the rest of San Francisco’s housing stock. Who in their right mind would want to own a property controlled by the state? I think housing values in general are going to plummet across the state once the housing activist are through with their attack on owners and landlords. The flip side of the knife…loss of tax revenues for cities from falling property value. Loss of tax revenue from job losses and retail sales losses. Excessive public spending on “social justice ” issues. The spending can’t go on forever because the spigot is going to get turned off at some point. The Fed is not going to bail out CA or as Newson fondly calls it “his nation state”.

I think the the drain plug has been pulled on California and with all the social unrest occurring it’s just a matter of time before the sink empties out. Work from anywhere is the new normal. And with all the high taxes levied on it’s workers, California won’t be home to many.

You’re describing the potential outcome of the Prop 13 split roll initiative as … a loss of tax revenues for cities? A loss? Good grief. That’s comical.

SF multi-unit rental property has been under Prop 13 for 42 years. Could anyone credibly claim that this “property controlled by the state” has been a bad investment over that time period? If there is any impact at all from extending rent control protections to houses and condos, my bet is it will just be a decrease in rental stock as units switch to owner-occupied, and less new construction. For a variety of reasons, there simply is not enough housing here to meet the demand. I’ll take the other side of your bet that housing values in general are going to plummet across the state . . .

“This proposed amendment would require California to tax commercial and industrial property based on the market value, raising taxes on those properties by up to $12 billion per year statewide. The amendment would not apply to homes, farmland and owners of commercial or industrial property with a combined value of $3 million or less.”

re: housing advocates

I suppose revolution could happen, but I doubt it. If Prop 13 is gutted, and housing prices fall in CA, SF would be at the tail end of that it’s just too dang pretty. Sure that 1bd 1bath condo with a view of it’s neighbor’s bathroom will see it’s value readjusted. It might not be a good place to be a landlord, but folks will always pay a premium to live in SF over other places. As families continue to move out, my bet is SF trends towards Monaco an enclave of the super wealthy, and not Detroit.

prop 13 will not be gutted for primary residential property for many years, if ever. and there will be signifiant protections. i could see it being applied only to homes over x amount for instance. maybe starting with $2M+

Hard to disagree that at this point in time, we have over 1000 active listings vs the same point in time last year (a bit over 700). The question I have is whether or not this is a result in timing (supply coming back online at the same time following shelter in place withdrawn listings) or demand. By the same metrics, if you look at YTD unique properties that have come on the market, we are down 14% YoY 2700+ vs 3100+ last year.

@ the start year: Down 20% YoY from same point in time last year

Mar 13: YTD Inventory actually surpassed the prior year from a supply side YTD to +4%

Shelter in place took inventory YTD levels from +4% down to a low of -18% by mid May

As of today, we have still not caught up with YTD levels at -14%

The next question is what the change in demand is as a ratio to supply.

Food for thought: On supply v demand YTD numbers (Demand problem)

If you compare YTD # of listings that go on the market versus YTD # of listings going into contract (Ratio)

Last year, you saw the ratio climb into the Autumn to about 0.7 (The number of listings that have gone into contract YTD divided by the number of listings that have gone on the market YTD). By April 11, 2019 the ratio is about 0.6, May 24, 2019 it hits 0.7, and Sept you hit around 0.75.

This year, however, the ratio tops out at 0.53 in April and declines from there. Today it is 0.51. Will see where it goes from there

Our tracking takes into account both listing and sales activity, yielding true inventory counts (not simply “listings”) and trending over time. Inventory levels go up when listing activity outpaces demand, they drop when it’s the other way around.

Keep in mind that inventory levels were ticking up prior to the COVID-19 hit, and have actually been on the rise since 2015, trends which shouldn’t have caught any plugged-in readers by surprise. But the magnitude of the change, at least currently, is likely being amplified by the aforementioned “timing” as was the drop in April.

Taken separately, the volume of unique properties that have come on the market (pure supply) YTD is less than the volume of unique properties last year that have come on the market (pure supply) YTD. On a purely “how many owners have wanted to sell this year versus last”, we are still pacing less than last year.

You are looking at the available supply at a given moment in time which is, as you state, dependent on demand, withdrawn listings, and the time selected for analysis. Listings that are no longer active (ie in contract, sold) also slightly lags when listings come on the market. If a lot of listings come on at once due to a delay with Covid, you will certainly have more inventory (which is what we see here). The question is if demand will cause the inventory to normalize thereafter -or- allow the inventory to remain elevated. As of now, the demand is tracking at a lower ratio to supply compared to last year

As I followed up, the ratio of demand versus supply also appears to be down YoY

“Wanting to sell” and actually listing are two different things. Listing activity tends to drop when demand is down. And quite simply, our inventory metric ticks up when “the ratio of demand versus supply” is down.

Not sure your point — I wasn’t at all stating anything against your post, though you continue to play defense. I was just pointing out some additional characteristics of the data. In addition, my numbers are actual listing activity, as you state — I was describing supply side in layman terms. There’s a lot of reasons why listing activity may drop besides an assumption of demand — such as Covid and shelter in place rules.

As for inventory metrics ticking up when the ratio of demand versus supply is down. Not so. You can have listing activity go down, but demand drop at a faster rate. You will have less inventory, and the ratio of demand versus supply be down. But you are right, your inventory metrics tick up when the ratio of demand versus supply is down, because that’s when you decide to post about inventory

So much dreadful speculation! Stop worrying! SF is going to be just fine. Don’t forget, this city has been shaken, burned to the ground, rocked by social unrest, ravaged by epidemics, looted by political unrest, shaken again, haunted by serial killers & cults, and sold out to prospectors all along the way. It’s survived all that. It will survive this. Maybe even be the better for it. If the top earning class are moving out, and global warming is making our summers warmer, maybe we’ll shift culturally, and spend less time scrambling to clock in overtime at work, and more time just enjoying our lives. Sounds nice 🙂

How did THIS one sneak by everyone’s attention? Yeah, yeah, I know: purely anecdotal, a sample of one, “they’re probably not doing well”… All arguably true; but last year it was Blue Shield and Square, this week it’s PG&E and Stitch Fix, next year it could be Wells, Quilp and XYZentric. Then it’s like water over Niagara.

I don’t know. How has Paypal’s stock performance since SIP began snuck by everyone ?

If you joined Paypal in January of 2018 and traded $100K in salary for $100K in yearly RSUs, you’re up about $230K, and you’ve paid about $80K in taxes, leaving you with $150K to buy your dream house. Don’t spend it all on one place!

PP’s stock has done handsomely. Unfortunately the number of people the stock itself actually employs is…well, I won’t keep you in suspense: zero. The company the stock belongs to seems to be engaging itself with ‘social justice’ and helping businesses actually survive SIP. I’m not sure where “enlarging our footprint” and ” helping out overextended property owners” is in the queue, but it must be no better than #3.

As expected: Most Homes on the Market in San Francisco in Nine Years