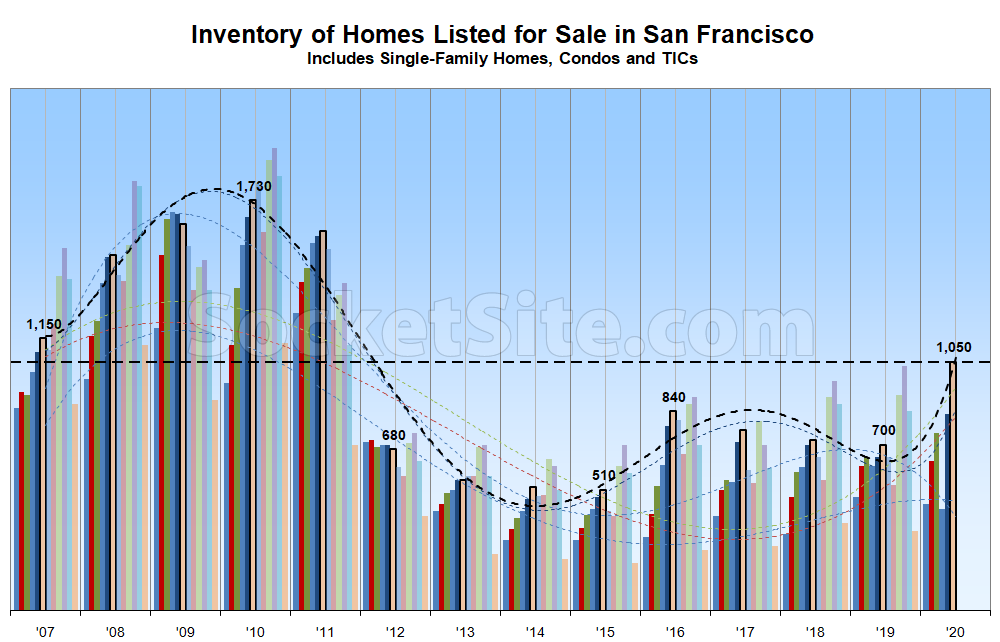

While the number of homes newly listed for sale in San Francisco having outpaced the number of purchase contracts that were inked for the ninth week in a row, there are now 1,050 homes listed for sale across the city.

That’s not only a 9-year seasonal high but a new 9-year high in the absolute and 50 percent more inventory than at the same time last year, a marked jump which shouldn’t catch any plugged-in readers by surprise and despite the fact that inventory levels typically don’t peak until October.

At a more granular level, the number of single-family homes currently listed for sale across the city (310) is currently running 31 percent higher than at the same time last year while the number of condos (740), which tends to be a leading indicator for the market as a whole, is up by 60 percent.

And the percentage of listings which have undergone at least one official price reduction has been ticked up another two percentage points to 22 percent, which is five (5) percentage points higher than at the same time last year, for twice as many reduced listings on the market in the absolute on account of the jump in inventory levels.

When you use the term “homes”, as in the latest post about inventory, you mean SFD”s, condos and TIC’s all together. Right?

That’s correct and as opposed to “houses” or “single-family homes.” And while inventory levels for single-family homes alone aren’t currently at a 9-year high in the absolute, they are at a 9-year seasonal high (and on the rise).

Things are starting to look real bad. It seems like every condo building I see in SF has 5+ units for sale with multiple price drops; and it’s only June!

This came on the market, initially priced under its 2015 purchase price.

When things come on and they are under the price paid in 2015 as their initial asking price, you can bet the realtors are telling the sellers to either price realistically or chase the market down further.

7.5% of all leases in San Francisco have been broken in the last three months (name link). As the owners of older buildings bought 20 years ago first try to hold, then cut, then cut the rent, well below the costs of condo owners, those condo owners will throw in the towel and sell. When that wave of selling happens, prices will take the next step down.

As we first reported nearly two months ago, listing activity for apartments – which is correlated with vacancies and turnover – was jumping (and continues to rise).

What are the chances this is just another head fake like in 18? I’ve been a perma-bear for many years but now I have been beaten into submission by endless fiscal and monetary stimulus. Price discovery is gone, the free market is dead. Enter the long, slow, painful flat decline of America.

Prices are sticky in the Bay Area. Both rent and ownership. 7.5% vacancy rate is average for a lot of markets. Owners who can afford to will renovate empty units. They will take advantage of the lower contracting prices available now. 6 months ago most contractors just didn’t return calls at all.

Note, I didn’t say 7.5% vacancy rate, I said 7.5% of all leases were broken sometime during the lease term. You don’t get to 10% lower rents in three months on a 7.5% vacancy rate.

25% of the leases came up for renewal during that period and I’d expect some multiple of 7.5% of those were not renewed: they didn’t need to be broken. If it was 20% of the 25% that came up, that’s another 5% vacancy. Then add in the 3-5% vacancy rate that is normal when this all started, and you’d be looking at 15+%. Several people I know have told me that ~15% of the apartments on their floor have moved out in the last 3 months and the apartments haven’t been rerented.

Although some people would just have moved from one place to another, which would reduce the rate, it’s certainly well north of 10%, as I’d expect most of the people moving out who didn’t leave the area would have moved to a cheaper city.

And PPP money is keeping a number of startups afloat. That’s about to run out. Even Google just rescinded offers to thousands of contractors, leaving the contracting companies on the hook. The numbers will rise.

UPDATE: Number of Homes on the Market in S.F. Continues to Climb