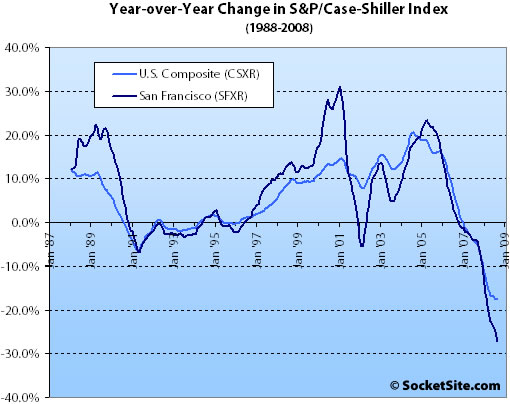

According to the August 2008 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 3.5% from July ’08 to August ’08 and are down 27.3% year-over-year.

For the broader 10-City composite (CSXR), year-over-year price growth is down 17.7% (having fallen 1.1% from July).

Both the 10-City and 20-City Composites have been in year-over-year decline for 20 consecutive months. Of the 20 regions, 13 of them had their annual returns worsen from last month’s report. As seen throughout 2008, the Sun Belt markets are being hit the most. Phoenix and Las Vegas are both reporting annual declines in excess of 30%, and Miami, San Francisco, Los Angeles and San Diego are all in excess of 25%.

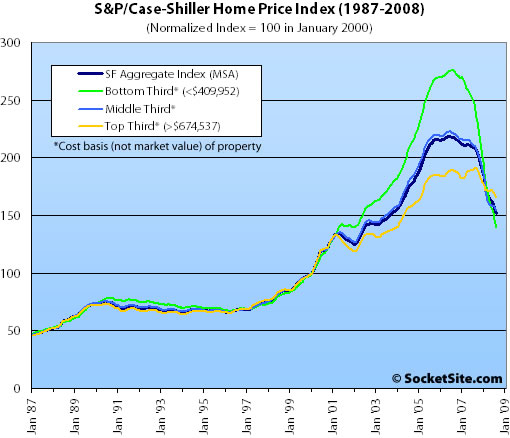

Prices fell across all three price tiers in the San Francisco MSA with the rates of decline accelerating across the board.

The bottom third (under $409,952 at the time of acquisition) fell 4.8% from July to August (down 42.7% YOY); the middle third fell 2.2% from July to August (down 26.3% YOY); and the top third (over $674,537 at the time of acquisition) fell 2.1% from July to August (down 13.6% YOY).

And according to the Index, home values for the bottom third of the market in the San Francisco MSA have retreated to December 2001 levels, the middle third has returned to October 2003 levels, and the top third has fallen below February 2005 levels.

The standard SocketSite S&P/Case-Shiller footnote: The HPI only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ National Trend of Home Price Declines Continues into the Second Half of 2008 [S&P]

∙ July S&P/Case-Shiller: Pace Of San Francisco MSA Decline Continues [SocketSite]

“the real” SF is clearly special.

but there does come a point where surrounding locales are so cheap that people have no option but to consider them.

clearly I would rather live in SF for $1M than a comparable Daly City pad for $800k.

however, if Daly City drops 30% down to $560k then it starts to become attractive.

Yes, you will likely need a car. But $440k is a lot of transportation coin, especially $440k plus interest charges and higher taxes etc etc etc.

Remember all that plaintive, “Oh, I really feel bad for the surrrounding areas with gas going ever higher, good thing we live in Noe” back when oil was $140+ a barrel?

Deflationary depression will have its “benefits”.

Bottom 1/3 is at 2001 prices

Middle 1/3 is at 2003 prices

Higher 1/3 is at 2005 prices

The bottom 1/3 starts to look really cheap.

The m-o-m decline of the SF MSA at -3.5% looks to be the largest decline of all the MSA for the latest period (the series is actually a rolling 3-month average of prior months).

And what about, “when the lines cross at 160, that’s the bottom”? We’re now at index level 151. Looks like we blew past the 160 and are just getting out of second gear, accelerating to the downside, and all these data are of course prior to the latest stock market collapse and even before the region has really sunk into deep recession.

The bottom 1/3 starts to look really cheap.

are you sure? My gut feeling is that prices have a good chance at “bottoming” at 2001 levels. but I’m still not sure those are cheap levels.

Remember that in 2001 RE was at the end of the tech boom. RE was CRAZY expensive back then. You would have been hard pressed to find someone say that RE prices were “cheap” in 2001. The only thing that makes them look cheap now is that they got even crazier from 01-07.

FWIW: I have abosolutely no idea how low or high RE will go. I just have a hard time calling 2001 prices “cheap”.

Let’s not forget that this data is showing values for more than two months before the equity markets cracked (assuming that it is based on closings, which take place a month after the price is agreed upon.) I’ll guess that by the time we’re looking at November data (published at the end of January) we’ll be looking at values set back two more years!

ex SF-er: true for SF. Prices were already expensive at the time IN SF. But the bottom of the market was still pretty low and hadn’t caught up price-wise with the higher segments.

Today, do a search on the MLS for SFHs under 200K in SF. Apart from the quality/location/issues with these 2 places, what’s incredible is that you actually have listings at this price range and they are simply sitting there. People are pickier and pickier, which means there are more opportunities to be taken everywhere and there will be more in the coming months.

Now, for the top 1/3, that’s another story. Prices are sticky at the top and it’s still way unaffordable to the median income. People can (or think they can) wait off the downturn. But for how long? 1 year, 3 years, 5 years, more? It’s definitely a gamble and with the bear market in WS, there’s less wiggle room for taking chances.

It’s in the disclaimer in every single one of these posts: the ‘San Francisco’ MSA “…includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda”

One could (and I would) make the argument that our local economy is based on the overall health spread throughout those counties, because it’s all interconnected. So, in the sense of an general economic barometer, the MSA works fine.

However, I think that it is not an appropriate source of data to use when attempting to assess what a reasonable value for a home might be, if you were looking. At one time, prices may have been going up at similar rates everywhere, and the spread may have been much smaller (when the lower third is at 275 and the upper third 175, the gap in prices is much smaller than it was in 2000). However, as things implode and head downward, per district specifics control the local situation much more than the trend in the MSA.

No, I am not going to say that the ‘real SF’ is not going to fall or that ‘I haven’t seen my home value go down’, but I will say that it is going to fall at a different pace to a different bottom than someone else’s.

In essence, the mean, which is all we are seeing, is no longer representative of the distribution, which, I believe is seeing a higher variance and is perhaps experiencing a mode and median far from the mean.

The only other RE market I have experience with is the Twin Cities. There, I expect things to be behaving much nearer the mean throughout the metro, except perhaps the extreme exurbs, as people’s choices depend more on the life style they choose to live (suburban and commute, far from city noise and traffic, or in the bustling city close to everything) and less on the size or style of home (not being constrained by a peninsula and ocean means that all homes have large yards and the size distribution of available units is similar everywhere, in the city or elsewhere). None of that is true in the Bay Area.

FYI The Feb 2009 CSI Futures contracts traded on the Chicago Mercantile exchange stand at 139.6.

You can check them out here

[Editor’s Note: Let’s try not to steal all our thunder. And if you’re not familiar with the CME and S&P/Case-Shiller futures market, please consider reading this first: They’re Betting Against Us (San Francisco) On The CME.]

rr:

I disagree with your assessment of the TC. I own property in the Twin Cities. We too are seeing huge variability in RE prices throughout the metro.

some places are taking an absolute beating such as the bad neighborhoods (north minneapolis and the St. Paul downtown hoods) and also the warehouse district (think tons of new and very expensive condos that reached $800-1000/sq ft) and exurbs (20-50 miles away from Mpls/st paul) whereas other areas are only down slightly. (like Southwest Mpls, the lakes areas, and Prime St Paul).

there is a clear difference between housing stock in the city (tends to be 50-100+ years old, around 1000-1800 sq ft) as opposed to the burbs where it is newer stock, large yards and large homes (2000-5000 sq ft).

The same thing is true for Chicago. The nicer hoods are holding up (North of the Loop) whereas the newer condo towers are getting slaughtered as are the further suburbs and the far flung suburbs and of course the bad parts of town (south chicago)

Obviously, the prime parts of all metro areas will always hold up for longer than the non-prime parts. location location location! The problem is that there are a lot of transitional areas that people thought were prime.

So I’d guess that Cow Hollow, Pacific Heights will hold up. I’m still not so sure about Noe, but I am in the considerable minority, and my perceptions are colored by me being an “old time” SFer that thinks of Noe as working class despite the obvious change. But there are a lot of other areas in SF that have been billed as prime that really aren’t. I won’t name them.

Oh come on, name them.

Do these longitudinal home price comparisons factor in inflation? It doesn’t appear that it does, but that would seem pretty elementary.

If it doesn’t, that means, for instance, that the “bottom third” is ACTUALLY notably lower than 2001 prices not equivalent with it, considering that something has to gain value commensurate with inflation to just stay even. Home prices that are equivalent in nominal terms over several years is steadily losing value. Inflation has averaged about 2.5% between 2001 and 2008. $500,000 in 2001 would be $588,000 in 2008. So if you paid $500,000 in 2008, if that place was more than $430,000 in 2001, it lost value.

Case-Shiller should use inflation adjusted figures, or it’s pretty meaningless.

August data! wow, that sure was a long time ago.

Wow, a lot has happened since August. This is gonna get ugly…

ex SF-er: off-topic, but how would you compare the relative stages of price decline in the Twin Cities as opposed to SF. As it happens, my wife and I are debating whether to stay in SF and buy something next year or move to the Twin Cities. We were house-hunting there last weekend and were somewhat suprised at how robust the prices were in the SW MPLS area.

No, C-S does not adjust for inflation (although it’s easy to find inflation-adjusted charts via Google). However, in fairness none of the other major reporters (OFHEO, DQ, HUD, NAR) do, either.

Also, keep in mind that the CPI does not measure “inflation” — it measures changes in the total cost of a basket of goods and services and does not include the cost of R.E. (it only includes owner-equivalent rent).

Interesting to note that if CPI was calculated with the same methodology used in 1980, current CPI would be about 9%/yr.

Mark: (sorry to others for the OT)

SW Mpls neighborhoods are the prime area of the Twin Cities. They are the Pac Heights/Cow Hollow of Minneapolis.

I have seen very little movement price wise in the SW neighborhoods (anything within a few miles of “the Lakes” basically… anything south of I394 and west of Lyndale Avenue)

However, sales volumes are way down from prior years.

it would be a TOTAL guess, but I would say Mpls is about 1 and possibly 2 years ahead of SF in its downturn. but it’s hard to compare them because Mpls did not behave like SF did on the way up (it was more gradual and persistent as opposed to spiking).

In general, there are several different markets.

-You have the multimillion dollar mansions on the lakes that have had volume slow way down but prices have barely moved.

-The nice homes ($400-999k) also have slowed considerably but prices aren’t moving. (and these are nice homes… most are a few blocks off the Lakes, may have 3-5 BR and 1800-3000 sq ft).

-New construction has taken a beating. especially condos. almost no movement and some going back to the bank. but they often have eye-popping prices (some condos on Lake Calhoun were offered at $3M as example).

-flips have also gotten beaten down if they were overdone. (example: house bought for $400k, size tripled, put on market for $1.5M, just sits there)

Newly gentrified areas of southwest are starting to get hit in a significant way (I specifically mean the Eastern part of Southwest, between I35 and Nicollet, between Franklin ave and 50th st)

I don’t know much about the SW suburbs as I rarely go there (Edina, Eden Prairie, etc) but I believe they’re doing fine. again though, lower transactions and prices holding. and newer construction getting hit more than existing.

new condos are a blood bath. nobody wants them. The further suburbs are also a blood bath.

Mpls/St. Paul did not have the subprime or the Alt A problem that California had, and the rent:own ratio didn’t get as out of wack as it did in CA either. (that does not mean there won’t be pain, there will be)

My guess is that we can use the stats of high alt a/subprime loans to see which parts of the TC metro will get killed

Here’s some info for you, you can see a map of high subprime/Alt A loan use:

that said:

if you’re coming from SF you’ll be amazed at how “cheap” the housing is. You’ll also find that the rent to buy ratios are not very far off. and you’ll find that your income will not drop much from your SF income, if at all. (ours is significantly higher in MN than CA).

another nice thing about the TC area is that it’s not as important out here what type of house/car/etc you have. So you could plop down $400k and have a very nice home in a safe area with good schools and live by normal people who wouldn’t care if you have a Beamer. if you want you can buy a newly remodeled McMansion of course and drive a Benz too. but people wouldn’t ooh and aah about it.

the thing that makes me happy is that the cost to own is so cheap relative to incomes, thus one can absorb a RE loss.

It’s not like in SF where a 10% decline is huge (10% x 1.2M is 120k!!!)

Here a 10% decline might be on a $400k house which would only be $40k.

my house cost 1x annual household salary. my mortgage is 0.6x annual household salary. Thus far, no comparable house has sold for less than what I bought my home for in 2003. that said, I’d guess my house has lost about 5-10% from peak (which was in 2006).

$400k will get you a nice old house in a good SW neighborhood. $650k will get you a nice house in a better SW neighborhood. In 1997 those would have cost $200k and $400k though… so there was a bubble here.

i anticipate housing prices to continue to fall here just like everywhere else. unsure the eventual amounts, just like I”m unsure how much SF will drop.

and the winters are F-R-E-E-Z-I-N-G.

sorry editors not trying to steal anyones thunder … look on the bright side the CME traders could be totally wrong 😉

Oops, my link didn’t go through:

Here’s some info for you, you can see a map of high subprime/Alt A loan use:

From the Mpls Fed

you can see that SW Mpls did not have much of that. But the suburbs and exurbs did. as did North Mpls.

Notice how the 2001 nosedive turned into a big V shaped recovery all of a sudden around the start of 2002? Not so this time. This one is a package deal: We now have to write down the excesses since 2003 plus the write downs from 2001 that have been hanging around ever since. All this dead wood is going to jam the river.

ex SF-er, thank you very much for all the information. You’ve reinforced our general perception. Your post comparing SF to Daly City describes our situation pretty well. My wife and I would prefer to stay in SF, but when we what kind of life we can afford in MSP relative to SF, we have to think about it.

look on the bright side the CME traders could be totally wrong

You forgot to mention that the (very thinly traded) SF Bay Area C/S futures market is showing a bottom in Nov. 2010 at 130. Happier days are only 2 years away!

And since we are talking about the Twin Cities, Minneapolis (and Cleveland) were the only two metro areas to muster relative peaks in August. In previous downturns, there was always a local maxima in the summertime (usually August due to the 3 month averaging). I’d say it’s different this time…

Do we really believe the Case-Shiller indices??? They’ve been hollering about 20%-30% price declines for months (every month!) now. I’m not seeing it. Has anyone really examined their methodology and tested their results?

@EBGuy:

don’t you know, everybody want’s to live in Minneapolis and Cleveland! 🙂

—

@Mark:

You’re welcome. Depending on how long you’ve been gone you’d likely be surprised at what Mpls is like now. it’s nothing like what it was 5-10 years ago. The weather is the same though. freezing in winter. stunningly beautiful fall/summer/spring. overall we’ve found our quality of life is much better here than there, but that is specific to our personal lives and your mileage may vary. (our incomes are higher, our opportunities are higher, our COL is lower, we love our ‘hood, we have lots of winter vacation to sunny locales, etc). we’ve had several friends and family members move from SF to Mpls/Chicago in the last few years and thus far all are staying here and happy. you can always move and then move back to SF later.

FYI: you may not know this but we split time between Mpls and Chicago.

—-

@Thomas:

yes, I believe Case Shiller. It is quite accurate, but it has limitations. when analyzing data it is critical to understand what the data is saying, and more importantly from where it’s derived. see the disclaimers above. Case Shiller is especially problematic when trying to discover what is happening in SF proper. again see the disclaimers.

The top tier in San Francisco (which will include most SFHs in “real” San Francisco) reached its peak in August 2007. One year later, it is down 13.6%. I wonder what it’ll be like two years after the peak.

The bottom tier in San Francisco reached its peak in August 2006. One year later, it was down 11.8%. Two years later, it is down 49.5%.

Technically speaking, that line is going down faster than Lindsay Lohan on a blow dealer!

ex-SFer,

your description of Mpls makes me want to move there too! I’ve never been there, but it sounds completely idyllic – minus the freezing winters. I’m not looking to buy a mcmansion (don’t even care about granite and SS), but a 2000 sf house with a yard in a nice safe neighborhood with good public schools would be ideal. My husband grew up in a house in Sea Cliff with a view of GGB(which his father still owns and lives in) and went to Town School. I don’t know how we could offer our son anything remotely similar without moving out of San Francisco.

Information on Case Schiller methodology can be found here:

http://tinyurl.com/5e5xne

The index, by its nature, is biased towards properties that change hands a lot. I’m not a RE professional, but I would hazard a guess that, on the whole, properties that get sold often tend to be properties that are less desirable and are more likely to have problems with with traffic, noise, layout, crime, etc. than properties that trade less often. If this hunch is correct then the index will be skewed towards those properties that are most likely to have their prices affected in a downturn and thus will exaggerate the magnitude of any price decline.

Hmmm, all three lines crossed a while back and prices are STILL dropping…

I guess I need to send away for a different economics course…

‘Try to imagine all life as you know it stopping instantaneously and every molecule in your body exploding at the speed of light.’

“The index, by its nature, is biased towards properties that change hands a lot.”

If that were true, I would agree with Salarywoman’s theory. However, on page 7 of the full 40pg CS Home Price Methodology Report, it says, “High Turnover Frequency: Data related to homes that sell more than once within six months are excluded from the calculation.”

http://www2.standardandpoors.com/spf/pdf/index/SP_CS_Home_Price_Indices_Methodology_Web.pdf

Thomas,

The Case-Shiller index for the SF Area is regional. Meaning it takes data from all BA counties. It is far from reflecting what you see on the ground in any SF neighborhood.

A much better approach is what SS is displaying: divide the data into 3 tiers. SF (and some will say SF “proper”) is probably closer to what can be seen in the top tier. [675K+] is lower than the SF median.

If you look at data even more closely (actual sales), you’ll find some pockets, even large pockets where prices are stable, and incidentally sometimes higher.

But the closer you look, the more unreliable the data becomes. Just like you can’t judge SF from all the foreclosure-related activity in District 10, you can’t judge SF by the lofty all-cash deals in PH. District 10 has is own ecosystem, so does PH and all of SF areas.

I think looking at the top tier is as close as you can get to looking at the SF market.

[Editor’s Note: Keep in mind that the tiers are based on the value of the properties at the time of their acquistion rather than their most recent sale. And while the price tier breakpoints in the prose above are correct, the graph legend was not (since corrected).]

this is only through august, right?

Can’t imagine how much worse the october numbers will look

My husband grew up in a house in Sea Cliff with a view of GGB(which his father still owns and lives in) and went to Town School.

Was that your father’s parents first home? Do you expect your starter home to be a mansion in Sea Cliff?

Please.

I don’t know how we could offer our son anything remotely similar without moving out of San Francisco.

waiting2nest:

that’s why we moved. as others are fond of saying, I couldn’t hack it in SF even though I was born and raised there.

I love both cities for very different reasons. But before you think about moving to Mpls you need to come out in winter. It’s a killer for most people. I hate winter (Dec/Jan/Feb) with every fiber of my being, but we travel a lot and I love the spring/summer/fall. We also live in Chicago (Lincoln Park). Chicagoland is also very very liveable. in the longer term horizon we’ll likely move away due to the cold, but I’ve been saying that for years now.

I’ve lived in a lot of places, and really liked most of them. Seattle, SF, San Diego, Mpls, Chicago, Houston, Atlanta, Paris. (wasn’t huge on Houston, Atlanta was soso for me). There’s other places I visit a lot that I really like and could consider living in like Portland, Boston, DC, Manhattan, Austin, South Florida. and international cities too like Vancouver, Puerto Vallarta, Sydney, Madrid, Barcelona, London, Amsterdam, Rio de Janeiro, Buenos Aires and others.

There’s a lot of great places out there. all different but they all have their plusses. As I’ve said before, my favorite city is Paris. My fave american cities are SF, Chicago, Mpls, and Seattle.

in the past we yearned to go back to SF, but as we’ve been away for some years now the longing lessens somewhat, especially given some of the changes in the city. But we have family/friend ties in SF so we may still end up back in SF (at least part time) especially if our job prospects warrant it. given the way the economy is going, I’d guess it would be 5-10 years out earliest. but my true goal is early retirement, and so spending $1M on a starter home and $2.5M on a decent home doesn’t work FOR ME. but if we made $1M/year in jobs we loved that would be a different story!

I’ll stop talking about it now because people get angry with my pro-midwest stance and this is a SF blog!

If you guys don’t stop talking about Minneapolis, I’m going to twirl in a circle and throw my knit hat in the air!

“”The index, by its nature, is biased towards properties that change hands a lot.””

If that were true, I would agree with Salarywoman’s theory. However, on page 7 of the full 40pg CS Home Price Methodology Report, it says, “High Turnover Frequency: Data related to homes that sell more than once within six months are excluded from the calculation.”

That might possibly remove some of the bias but that’s not why it’s done. Here’s the rest of the relevant language from page 7:

“Historical and statistical data indicate that sales made within a short interval often indicate that one of the transactions 1) is not arms-length, 2) precedes or follows the redevelopment of a property, or 3) is a fraudulent transaction.”

Less desirable properties aren’t necessarily the ones that get sold again in 6 months (as indicated above, that’s usually for other reasons). They’re the ones that get sold 4 or 5 times in 10 years. Those are the properties that I think may end up skewing the index.

Ex SF-er: Are you like me and spend a lot of time going back and forth between Chicago and S.F.? (Just returned last night) I find over time that the “special” qualities that made S.F. unique are vanishing fast, and the quality of life in Chiacgo is getting better. Still, winter is horrible, but that is what airplanes and Hawaii are for. I was just explaining to someone on the plane last night that my condo in Chicago would be about 1.7m + in SF, even in this market. My condo in the Marina (bought in 91) would be about 250k in Chicago.

To keep the threadjack rolling a bit more, I visited Minneapolis once during a 7 hour layover. Not wanting to wait in the airport, I took the bus downtown to take a look about in the February weather. What really impressed me was seeing the Mississippi river frozen completely from bank to bank : unthinkable to someone who viewed that same river from Louisiana soil for years.

The frozen river made one impression. The other was the drunken antisemite needling me with accusations in a bar. (Don’t worry, I don’t stereotype a population based on a random drunk’s ramblings).

I have lived in the midwest for several years and know how _B_R_U_T_A_L_ those winters can be. When its -20F and windy you really can’t bear being outside for longer than a few minutes unless you’ve dressed for an Everest expedition. And the summers can be really uncomfortable as well.

I’ll never move back. The California climate has ruined my stamina. It doesn’t necessarily have to be SF proper : this state is loaded with locales that have fantastic weather.

I egged on the MSP discussion (sorry, folks), so let me try to segue back to Case-Schiller. The index shows a decline in Bay Area property values that shows few signs of abating. The uniqueness of a nation-wide decline and the severity of a Bay Area-specific decline create interesting questions for people like my wife and I who are contemplating a move. Suddenly questions like “Which region’s values are likely to see further substantial declines” or “How far ahead in the recovery process is Region A as compared to Region B” play significant roles in our thinking.

In consequence, people have started to return to the older perspective of houses being primarily places to live rather than financial investments. My concern for the Bay Area is that–as wonderful as life here can be–many of the gritty or inconvenient aspects of the area have been papered over by residents with spirits and loyalties buoyed by rising property values. I wonder how many SF-lovers like my wife and I or Waiting2nest (or even ex-SFer) see lifestyle comparisons in an entirely different light now that stretching for a home in the Bay Area no longer promises the kind of financial payoff that it once did. Ferry rides and plentiful ramen shops are great, but…..

“Was that your father’s parents first home? Do you expect your starter home to be a mansion in Sea Cliff?”

NVJ: Actually, it was their first home. He bought it in 1968 for around $110K. He and his wife were both interns at the time with a joint income of $25K or so. Even though they weren’t making very much money at the time, they were comfortable stretching to buy the house they fell in love with because they were both early in their careers and knew their incomes would increase significantly. They also borrowed $40K from their parents for the down payment. My F-I-L acknowledges that an intern today could not buy his home (or something even remotely similar)because the price of RE, especially in SF, has far outpaced rise in income.

Unlike my in-laws who bought their Sea Cliff house in their late 20’s/early 30’s, my husband and I turned 40 this year and we are more or less at the height of our professional careers. As such, we have probably also reached the apex of our earning potential. Now, I’ve mentioned my HHI before, and even at our income level, we still can’t afford to buy the kind of home that we’d like to buy (a nice modest 2000 sf home with a yard in a safe, non-foggy neighborhood with good public schools) in San Francisco. So no, NVJ, we are not expecting to buy a house in Sea Cliff, Pac Heights, Cow Hollow, or the Marina – – not even in Noe Valley because home prices in all of these areas are still too high. The fundamentals are still completely out of whack.

ex-SFer: When I was spoke about the possibility of moving out of SF, I had in mind Lamorinda or Rockridge. While Mnpls does indeed sound lovely, and it does indeed make me WANT to move there, our jobs are here, so we are staying in the BA — but not necessarily San Francisco. Sorry if the my previous posts on this thread were a little unclear.

Mark, I agree with your assessment. I absoltely LOVE San Francisco and prefer to buy a place here. Who knows how far home prices will fall, but if it doen’t fall far enough (in the “real SF” nabes that we want to live in), then we may be forced to leave. We want the kind of lifestyle that ex-SFer is living, mostly for our son’s sake, and that may not be possible for us here.

“The index shows a decline in Bay Area property values that shows few signs of abating.”

You mean other than the lines having intersected?!?!?

Correct, Treeman, other than the lines intersecting.

The other metric I use is to compare the negative percentage drop in SF property values with the average negative temperature (F) of a Minnesota winter. When the two numbers are the same, my wife and I call the movers.

ex-SFer

thanks for your insight on the TC. I experienced most of my childhood there; my parents still own the house they bought at 37th and Pleasant in 1999. It has once tripled in value, and is now back to about 2-2.5x. The experience I get is from them and my many TC friends looking for a first home.

If the southwest side is holding steady, than that means that approximately 25% of homes haven’t fallen significantly, which is a large section compared to what you have here.

If people let up on the “foggy” aspect of there search then the cost of housing goes way down. Just sayin’. Besides it has been sunny EVERYWHERE in the city for the past few weeks.

Regarding evaluating the convergence of the tiers here is the story of why there are three tiers of home sales. Link.

“If there are a lot more homes sold on the low end and fewer on the high end, the median price is bound to drop dramatically,” NAR Chief Economist Lawrence Yun said.

I believe then the convergence of tiers is that the decline is quite real. Naturally the upper tier will decline less and eventually be intersected by the volatile subprime infected bottom tier. I’m not convinced that this intersection reflects an abatement of property value declines rather than an indication of the credit crisis working on the real estate market by locking out less desirable mortgagees that previously had access. There are dramatically fewer buyers if what I am hearing is correct.

waiting2nest,

Seacliff is certainly foggy. So you want a place in some ways nicer than the one your husband grew up in. San Francisco is much more desirable place to live than it was in 1968, so it is not surprising that home prices have gone up. Also, as urban areas increase in population, the value of land in the core tends to go up.

You could certainly afford a 3/2 in Noe, I see many of them under $1.5M these days. I don’t know if you think that is worth it or not.

Lamorinda has not really gone down that much either, maybe 10%. I also would probably move to the part of East Bay I would want to live in (not Lamorinda though — Claremont in Berkeley for me) if price per sq ft dropped to half what they are in Noe. I don’t really expect that to happen, but it might.

Re: NoeValleyJim’s suggestion that Waiting2next can afford a 3/2 for under $1.5 million.

The definition of “afford” has become very elastic. In an area like MSP, for example, the equivalent of a Noe Valley 3/2 would run closer to $400K and could be “afforded” on one income. In SF, two full-time professional incomes are required, and on top of the mortgage payments we would have to consider possible child care costs, private education expenses, house cleaning fees (since both parents are working and want some leisure on their weekends), etc.

This goes back not only to the issues raised by the Case-Schiller index, which still shows prices high relative to their historical levels, but also to NoeValleyJim’s assertion that San Francisco has become a more desirable city in which to live. At a certain price point desire/demand decreases.

for those looking for an inflation adjusted CSI graph you can find it here

You forgot to mention that the (very thinly traded) SF Bay Area C/S futures market is showing a bottom in Nov. 2010 at 130

And we are at 150 now, so C/S is predicting another 15% or so drop and then a leveling out?

That seems about right to me.

May 2011 C/S futures are at 128.8 for the SF MSA. That sounds pretty reasonable/conservative. I would bet on steeper drops than that, and the trends seem to indicate higher-end homes (> $1 million) will drop the furthest given that the pool of buyers is a fraction of what it was and conforming loan limits are dropping.

Salarywoman has it right. The index is highly skewed by properties that turnover rapidly. The 6 mo or less removes instant sale/purchases. Besides, a property that sells every 7 months is desireable? Nope. The CS indexes have serious methodological flaws that will be revealed in due course, but as is our society’s inclination, we don’t really like to think critically about the b.s. that is being shoveled our way.

The SF Bay Area is not down 30%. Those that believe that are people who didn’t buy and now want to and are cheerleading the market lower. It’s probably down 10%-15% with very undesireable pockets down the amount shown by CS.

This is just how the bubbles got started in the first place — the mobs latch onto a piece of data that reinforces their views without any real understanding of what it means and how valid it is.

Silly bears, you just don’t get it, do you?

Go on Trulia right now, and search for how many homes are available in Marina+PacHeighs+RussianHill.

What is the grand total? 172.

That’s it. That’s about half as many units as one would find in ORH alone.

Oh, and it gets better. This is not the type of real estate you find in Soma: a 30-story skyscraper with an open inventory of 60 identical units, each of which can downbid the other.

These are 172 fairly unique units, most of which have extenuating characteristics. Some don’t have parking. Some are in the eight-figures. Some are on a steep hill. Some require you to walk up three flights of steps. Whatever. For the TYPICAL buyer, only a small fraction of those 172 are actually ‘in play’.

The “real supply” for anyone who wants to buy a home in the nicest parts of this city is about 8 – 10 units, total.

Now go to Mission Bay and tell me the same thing. That tiny, bum-infested part of our city has as much open real estate as Pac Heights, and all of it is in play for the typical deal seeker.

And in case you don’t believe me, I challenge you all…

Go on Trulia, type in the characteristics that matter to you: Price (+/- $200k), parking, etc.

You’ll find *maybe* 10 units that match your search.

Silly bears, you just don’t get it, do you?

Actually, I think we do get it.

Use your example. Now look at the prices of those homes. Now look at your income and/or job stability. Wow. Now the number has shrunk from 172 down to 8-10 that were “in play” all the way down to 0, since people can’t afford them.

nobody is talking about the northern part of the city not being “unique” or having restricted supply. What we’re talking about is that those areas have ALWAYS been like that, and have ALWAYS had a certain price premium. But the asking prices deviated from their historical norm (soared higher) for no apparent reason in the 2000’s

and now we are going into what looks to be a very nasty recession.

in most markets (house/stock/bond, you name it):

asset value significantly above historical trend PLUS impending recession EQUALS asset devaluation (in real dollar terms).

This is what the bulls have missed for the last 18 months or so (and evidently you continue to miss). Although Real estate IS local, it is constrained by the general economy.

Areas of high SF wealth:

1) banking. not doing so well. lots of job layoffs nationwide and likely lower bonuses/salaries

2) financials. not doing so well. lots of job layoffs nationwide and likely lower bonuses/ salaries

3) hedge funds. more will blow up this year than ever before. AN estimated $50 Billion will leave Hedge Funds this year due to the antiquated 2/20 scheme. Those that survive will need to lower fees. Which means LOWER salary and bonus

4) Venture Capital. No IPOs the last quarter. First time ever. VC profits under siege. bonuses/salary will be lower

5) Private Equity. Will be tough year for them. Banks aren’t lending as they once did to PE. without the leverage the PE boys are in a pickle. lower salaries/bonuses.

6) tech. the high flying tech stocks are beaten down badly. thus, techies that have their wealth in stock options aren’t very wealthy right now. (e.g. GOOG stock is lower than it was 3 years ago… so all those stock options given out the last 3 years are essentially WORTHLESS). and I’m sorry but a measly $200k-300k/year isn’t going to buy you the property you want in those unique areas.

7) Tourism. Most of the toursim jobs are working poor or middle class at best. That means you’re a renter.

8) people’s net worth. Hmm… stocks down 40% in the last 1 year.

9) bonds: many have gone bankrupt.

10) Treasuries. Low yields.

11) loans. Jumbo loans still available but getting harder to get with more onerous terms. 0% down teaser rate loans aren’t as plentiful, and you’ve gotta DOCUMENT now.

12) “rich” foreigners. Have you seen the Asian or Russian or European Markets lately. We’ve gotten hurt and they’re taking a beating. Russia may default on its debt again (making it essentially bankrupt). Multiple Eastern European countries have already needed to be bailed out by the IMF. Asian countries are screaming in pain. There is a small possibility the Euro will break. The dollar has soared vs other currencies in the last month or so. so those infamous foreign buyers will not be much interested in American RE I’d guess.

also: let’s see what happens to taxes next year. Remember, under Obama “rich” people above $250k will see their taxes increase. that’ll decrease their funds available for housing. Also, capital gains taxes may go from 15 to 25%. again, less cash for housing.

long story short: yes, SF properties are “unique”. And so are properties all over the Earth. but consumers need $$$ to buy those properties, and that $$$ is in more constrained supply and likely to get worse for the near term (1-2 years)

This can all change of course. Much now depends on what government does. A few select people will decide the fate of RE (bernanke, paulson, president, congressional leaders, etc). But it will be a POLITICAL decision. And there is not much support nationwide to give “rich” people mortgages for million dollar homes. and the line for govt funds is very deep as I’ve already said on prior posts.

But the asking prices deviated from their historical norm (soared higher) for no apparent reason in the 2000’s

Real Estate is cyclical. You might as well state that “asking prices deviated from their historical norm (stayed flat) for no apparent reason in the mid-90’s.” Over the very long term (since WWII) SF and California real estate has gained about 6% nominal or 3% real. Just as you can’t count from the peak to the trough and call that “average”, you can’t count from the end of the last down cycle either.

Going back to 1987 at 50, a 6% yearly appreciation would put 1999 prices at 100 but we were really at 80 by Case/Shiller, so SF area real estate was under the long term trend. By 2005, we should have been at 142, but we were at 210, clearly overpriced.

Now we are at 150, but a 6% gain from 1987 would put us at 180, so we have already overshot on the downside. Economic cycles tend to be like that.

Now you can argue that it is “different this time” and that the long term trend is broken, but you have to give a compelling reason why. Since the 70’s we have been the center of the computer chip revolution, the personal computer revolution, and the Internet revolution. Is the region out of ideas, doomed to never come up with another game changing innovation? Will we follow Detroit in the 50’s to oblivion? Many Socketsite posters argue this, but none of them have made a compelling case, imho.

I think there are only two things that could possibly change the long term upward trend of California real estate:

1) A major change in our immigration laws. Most of the increase over inflation has been due to population pressure. California has been growing at about 500k/yr. This puts a constant upward pressure on prices for reasons that I hope I don’t have to explain. Most of this gain (and all of it in the last decade) has been from external migration. Will this change? I highly doubt it, if anything, it seems likely to me that the new Administration will make it easier to immigrate and gain citizenship.

2) The end of innovation in the Bay Area. With half a dozen major research institutions, Sand Hill Road and an entrepreneurial culture second to none, it is hard for me to imagine R&D here drying up. All over the world they are trying to create the next “Silicon Valley” but so far, we have The One. The big worldwide growth engine in the 21st Century will remain China and San Francisco is going to benefit from that more than any other American city.

#2 is probably more subject to debate than #1. But how many Fortune 500 firms have started in the Bay Area in the last 20 years? More than any other region, I bet.

I am so sick of this false argument made by the bulls.

Ex-SFer is NOT saying that the LONG TERM 20 YEAR TREND for pac heights isn’t good.

He IS saying that the SHORT TERM 1-3 YEAR TREND for RE all over SF is bad.

So if you are going to buy that Pac Heights SFH and hold it for 20 years, yeah you are going to do ok.

NO ONE IS SAYING ANYTHING DIFFERENT.

What bears, like myself, are saying is that for the next few years, even in Pac Heights, sellers are going to have a difficult time finding willing and qualified buyers which is going to result in lower prices.

And guess what? Every RE indicator agrees with the bear POV. You just have to look at 2505 Divisadero and you can see that Ex-SFer is absolutely right.

On the flip side, NoeValleyJim’s 20 year prediction is also, very likely, right as well.

Comparing the short term outlook with the long term outlook is a FALSE ARGUEMENT.

also: let’s see what happens to taxes next year. Remember, under Obama “rich” people above $250k will see their taxes increase. that’ll decrease their funds available for housing.

This is actually a pretty good argument for the expectation that the upper tier will get hit harder than the rest of SF real estate. It is likely that various government changes in tax and spending will advantage the middle class over the top 1%, reversing some of the wealth disparity changes of the last 25 years.

Some of the change in wealth distribution is structural, mostly due to technology, some of it is due to globalization and some due to policy changes. We can argue endlessly about which proportion is due to which element, in fact I can point you to a dozen economist’s blogs where they mostly talk about this, but there is no doubt that some of it is due to government action. This is very likely to change course in the next year or so.

Good point ex SF-er.

I am not sure if I am being accused of being a “bull” by bdb or not here, but I always try to be a realist. I think further up I suggested that SF real estate was likely to drop 15% before it hit bottom. If this qualifies as a “bullish” POV then your perspective is pretty skewed.

Bulls or bears, I think what is becoming increasingly clear to all of us (I hope) is that SF real estate is no longer the path to riches that it was for some over the past 10 years.

Perhaps that will change, and the SF housing bubble will re-inflate. More likely, IMO, the next bubble will be somewhere else entirely. This will leave the decision to buy a house as a decision about whether or not to, well, buy a house.

The smart money has already left housing searching for the next big thing; people who think (or hope) otherwise will be sadly mistaken.

NVJ: “Over the very long term (since WWII) SF and California real estate has gained about 6% nominal or 3% real.”

I don’t have a great data source for this, so others feel free to chip in, but I have been led to believe that the nominal return and not the real return of housing has historically been 3% (i.e., close enough to inflation that the real return is zero). This would obviously make a big difference in where we can expect prices to settle.

From Shiller:

“From 1890 to 1990 home prices went up an average of 3% annually. Most of the big gains were made after World War II and since 1998.”

Shiller is talking national averages, I am talking California. I do not have time to post my sources today but I can dig them up and post them tonight if anyone is curious.

I am also only interested in post-WWII, which is when we went off the gold standard.

The period from 1980 or so until 2005 or so was an aberation. Interest rates fell on a secular long term basis, and availability of credit inflated on a level never before seen in the history of mankind. Interest rates only go from 18% to 1% once, and the path back up will be tough on leveraged asset values that are already completely removed from reality.

Expect the entire period from post-WWII to about 2025 or so to demonstrate approximately 0-1% real returns to real estate, consistent with very long term trends. Since the real returns were so outsized 1980-2005, draw your own mean reversion conclusions as to what the next 20 years will bring.

This will only become apparent gradually, and it is very understandable that people who bought recently in SF (say, the last 8 years) are going to have a very tough time with the idea that such a future is possible. But markets care little for people’s feelings and politicians are powerless to prevent the tide from going out.

Boy, I’d like to see Satchel’s take on all this. Satchel….Where are you?! Come back!

NVJ:

You have some very valid points for the long term SF outlook.

I agree with you but I do have one caveat:

overall the American population (not SF specific) has outspent it’s earning potential for some time. we consume more than we produce, as evinced by our trade deficit and federal budget deficit. This has been occuring for some time, but especially the last 25 years or so.

this did manifest itself in housing as structures got larger and more ornate. As example, it is hard to imagine a 1983 home with 3Br and 3 Ba and granite countertops and in-unit speaker systems and all the other hooha that we see routinely now. as example: in the 1970’s the average home was 1100sq ft and the average family had 2-3 kids. These days except in places like SF having 3 kids in 1100sq ft is considered child abuse.

thus, part of the long trend housing appreciation is the result of increasing land values (the majority) but some is due to a change in housing types spurred by our increasing consumption patterns. (larger homes, more gizmos like Central Air etc).

going forward it will be interesting to see if we will as a nation start consuming less than we produce. if so, it would put longterm financial pressures on housing.

but I am not convinced our populace will do this. I never bet against the American propensity to overconsume.

I have no longterm forecast for any area right now, until I see what happens with the global economy, the Bretton II Currency Arrangement, the status of the dollar as the reserve currency, global trade patterns (specifically protectionism), and immigration (since our population growth is significantly related to legal and illegal immigration).

“The period from 1980 or so until 2005 or so was an aberation

Oh really? Roughly half of the entire post-War era was an aberration? Why was the other half normal? ? Further, why 2005 and not 2003 (the last time the discount rate was 1)? Why were ’47 to 80 so normal?

Do you expect 3 unit buildings in the Inner Mission to cost 350K again, like they did in 1996? So wouldn’t that make ’96 to 2005 the aberration?

Please. What a load of crap. If you want to talk about 2001 to 2005, then fine.

Cities change, economies shift, workforces react accordingly. Where is the line between easy credit increase and new era SF employee buying power? That’s the question. The lag time between “real SF” value reduction and the rest of the nation was not for nothing. This is getting sorted, right now, before our eyes. But spare us the arch macro bollocks.

Oh, and Seattle is also doing relatively well, thank you very much: http://seattlebubble.com/blog/

fluj:

I agree with you that the word “aberration” is not necessarily a good word.

however there were some significant factors that changed from 1980 to present that may not be true going forward. (FWIW: the first 2 of these factors were also present in the immediate post WW2 era as well)

First: The 1980 to present saw a rather steep rise in dual income households. thus more disposible income.

Second: The average American home in 1950 was 983 square feet (source) and, according to Census data (PDF), the average American household size was 3.37 people. This means that in 1950 the average American had 292 sfpp (square feet per person). In the years that followed home size gradually grew and household size gradually fell until, in 2006, the average American household of 2.61 (source) shared a house of 2,469 square feet (source). So, in 2006, the average American had 945 sfpp. FWIW, in 1973 the averagehome was 1660 sq ft…)

source of average sq ft from 1973 to present from census

third: Americans have overconsumed at a more rapid rate than ever before, briefly hitting NEGATIVE savings rates earlier this decade. The lowered savings allowed for higher home expenditures.

fourth: world trade blossomed since 1980 which allowed for cheaper supplies than ever before. (think cheap chinese goods). this may or may not continue. we have always had international trade, but never before the huge trade imbalances supported by a partner that massively devalues its currency (China)

fifth: mortgage deduction started in 1997 (when many people feel the bubble in RE started)

sixth: financing arrangements happened like never before, with “innovative” financial products that significantly expanded the pool of buyers (through no down and low interest rate products).

seventh: the boomer generation blossomed into housebuying age.

going forward:

-I’m not sure we can increase household income by increaseing dual income household percentages… at least not by significant amounts

-I have a hard time believing that avg square footage of homes will continue to increase. (which is part of why homes appreciated)

-I have a hard time believing we’ll get back to negative savings rates… but I never bet against the american consumer’s ability to do financial suicide and overspend.

-we may not see the willingness of foreign players to finance our trade imbalance to the same degree going forward, especially in housing since they were burned with Fannie/Freddie and also with other financial products.

-we MIGHT see more tax incentives to spur on housing… so this might continue or improve housing’s chances.

-I doubt we’ll see 0 down 1% teaser rate mortgages soon… but I wouldn’t rule it out as govt might force it for political (not econimical) reasons.

-we may or may not have problems as the boomer generation retires. it depends on if the next generation buys houses as prolifically as the boomers did. we would need increased immigration for this to occur.

I personally think macroeconomic trends were very different in the US during WW2 time, post WW2 1950s to 1980s, then 1980’s to 1997, then 1997 to present, for the reasons elucidated above.

I don’t think any of them were “normal” or “aberrations”

Here is an interesting analysis on a blog I found by Googling:

http://freeby50.blogspot.com/2008/05/more-on-historical-home-appreciation.html

I have not checked his figures, but these look right. The Case/Shiller numbers, which use similar sized homes to compensate for the increased size effect, have home prices going up at 5.45% a year *nationally* since WWII.

Notice how different the numbers are before WWII and after it? Do you know what happened in that interval? We went off the gold standard.

The only way long term trends from post-war to 2015 could drop to 0% real rates would be for home prices to unwind 70 years of home appreciation. At 5.45% a year that comes out to something like a 40 fold drop. This will happen the same time that we go back on the gold standard and set the dollar fixed back to $25/ounce.

Which, not incidentally, is about what the current price of gold divided by 40 is.

(Hint, this isn’t going to happen.)

I will keep digging, I think I actually came up with the long term San Francisco home price increase rate myself and posted it to the patrick.net blog, but I am having a tough time finding it now.

There’s a lot of muddled thinking and info in that post, NoeValleyJim. And a huge analytical error.

A return to 0-1% real returns does not require unwinding asset prices back to those prevailing in 1933. Most people use some measure of CPI (typically “Median CPI’, but sometimes CPI-U) when thinking about these real rates of returns. To reestablish 0-1% real returns over the period 1980-2025, it would therefore require rolling asset prices back to those that prevailed in approximately the mid-1990s, depending on the evolution of the CPI measure going forward and how quickly the asset gets there.

The US dollar was never fixed at $25/oz. of course. Prior to the Gold Reserve Act and related legislation of 1933-1934, it was set at $20.67. (Prior to that, in the late 19th century, about $19, with some slight revals in there.) After that legislation, it was set at $35/oz. Of course, FDR stole all the gold from the population that he could before he officially devalued it.

Nevertheless, of course, the dollar was on a “limited” gold standard from 1934 until 1971-73, during which time Nixon step devalued the dollar to $42 before abandoning it entirely. It was limited because only foreign central banks and industrial users could buy and sell from the treasury. There was a run on the window starting in the late 1960s, as foreigners realized (among other things) that LBJ’s (and leter, Nixon’s) policies were crazy. That occasioned Nixon’s abondonment of the dollar fix.

You are probably confusing the WWII dividing line with Bretton Woods I (1944), at which the major currencies were to be tied to the dollar in fixed exchange rates, which of course meant they were all tied to gold (as the dollar was still tied to gold).

If you really drill down into house price data, you will probably find that the early 1970s will make a nice dividing line as to nominal rates of increase. If you want to think about the huge difference between REAL rates of return, I suspect you will find the early 1980s a useful dividing line. That’s because of the credit inflation that flowed from the secular fall in interest rates post-1982 or so (on a trend basis).

Of course, since the debt that was built up on the back of all that credit creation cannot be paid back, the excess real return cannot “stick”. The only question remains whether nominal prices will stay the same as median CPI increases dramatically, or whether nominal prices fall dramatically while median CPI (or whatever inflation measure you care to use) stays relatively flat. It’s taken a while, but most people seem to be more worried about deflation these days.

Welcome back Satchel.

Here’s something that the bears have not considered: supply reduction.

We’re reading about it each and every day. ORH has just cut its supply in half by canceling the second tower. Many other planned projects are being stopped.

When no ground gets broken for a 2-3 year period, that shifts the supply curve to the left (to use an old econ graph), and pushes prices up (or holds them steady if demand shifts left too).

People talk about 10 year cycles in Real Estate. This is an outdated notion. Markets correct themselves much quicker in the 21st century. More information, quicker decision making, etc.

All of the canceled groundbreakings will make themselves felt after 2010. Those remaining units at Symphony Towers will be reduced and filled by this Spring, and after that, no new construction for 24 months.

Yes, the next year will be hard.

Then the subsequent year will hold steady.

And by 2011, starving buyers will be clamoring for a new home to celebrate Google’s $1000/share price.

STARVING.

I was pretty young in 1974, but I was just telling my wife yesterday how much economic times today remind me of then. I ran across this Time article:

http://www.time.com/time/magazine/article/0,9171,908956-1,00.html

It is really kind of amazing how much everything old is new again. At least we had Disco back in 1974. Be Thankful For What You Got.

Hee hee. NewBuyer, that is some terrific satire! At first I thought you were being serious.

If you can stand the cold weather and have a source of income, move to Cleveland. We moved here in late 2001 (after selling our upper Collingwood Street 3 unit bldg. for almost 3M) and bought a 3,000 SF unit (in which we live) and a 1600 s.f.2 br. and an 800 s.f. 1 br. unit in a fantastic lake-front 30 story full-service condominium bldg. for a grand total of $650,000. We did a high end remodel on all three. Add another $200,000. We have the rentals leased to great long-term tenants, and our maintenance fee for our 29th floor place with view balcony and five indoor parking spots in a wonderful 60’s era bldg. in tip-top shape is @1200/mo. Includes all utilities. There’s virtually no traffic at all, we are seven minutes from downtown, and there are enough good restaurants to keep us fed. Since we bought, prices have declined about 17%. There are some incredible bargains. If you can tolerate the weather, come on down!

They say a picture is worth a thousand words so here’s the inflation adjusted Shiller graph of home prices since 1890.

How far has it fallen since then?

about 20% on the composite index from its peak (around June 2006 – right around the time of that chart).

so, depending upon what measure of inflation is used to perform the adjustment, in real terms the decline has been on the order of 24-27% from peak.

this implies that half the real decline is over, from index level on the chart of 200 to approximately 150 on the chart, although an undershoot is likely.

of course, the next half of the fall will feel even worse than the first half did, because it will be from a lower base (ie, if the first half of the real fall was 25% from peak, say, then the remainder of the fall will be 33% from the current lower value).

an undershoot will feel even worse.

SF, you are at the top of a very steep decline..if you have a choice sell NOW. This is from eariler in the year but still completely accurate:

“Values are down and these are interest only loans, therefore, many are severely underwater even without negative-amortization on this loan type. They were qualified at a 50% debt-to-income ratio, leaving only 50% of a borrower’s income to pay taxes, all other bills and live their lives. These loans put the borrower in the grave the day they signed their loan docs especially without major appreciation. These loans will not perform as poorly overall as sub-prime, seconds or Option ARMs but they are a perfect example of what is still considered ‘prime’ that is at risk. Eighty-eight percent of Thornburg’s portfolio is this very loan type for example.

One final thought. How can any of this get repaired unless home values stabilize? And how will that happen? In Northern California, a household income of $90,000 per year could legitimately pay the minimum monthly payment on an Option ARM on a million home for the past several years. Most Option ARMs allowed zero to 5% down. Therefore, given the average income of the Bay Area, most families could buy that million dollar home. A home seller had a vast pool of available buyers.

Now, with all the exotic programs gone, a household income of $175,000 is needed to buy that same home, which is about 10% of the Bay Area households. And, inventories are up 500%. So, in a nutshell we have 90% fewer qualified buyers for five-times the number of homes. To get housing moving again, either all the exotic programs must come back, everyone must get a 100% raise or home prices have to fall 50%. None, except the last sound remotely possible.

What I am telling you is not speculation. I sold Billions of these very loans over the past five years. I saw the borrowers we considered ‘prime’. I always wondered ‘what WILL happen when these things adjust if values don’t go up 10% per year’.

“I always wondered ‘what WILL happen when these things adjust if values don’t go up 10% per year’.”

You knew exactly what would happen. You just didn’t care as long as you were raking in the green.