As we outlined last week, while the average rate for a benchmark 30-year mortgage had slipped back under 7 percent for the first time since mid-April the expected value of the Fed’s rate cuts over the next seven months had subsequently dropped, based on our analysis of the futures market, and was poised to push the 30-year rate back up, not down.

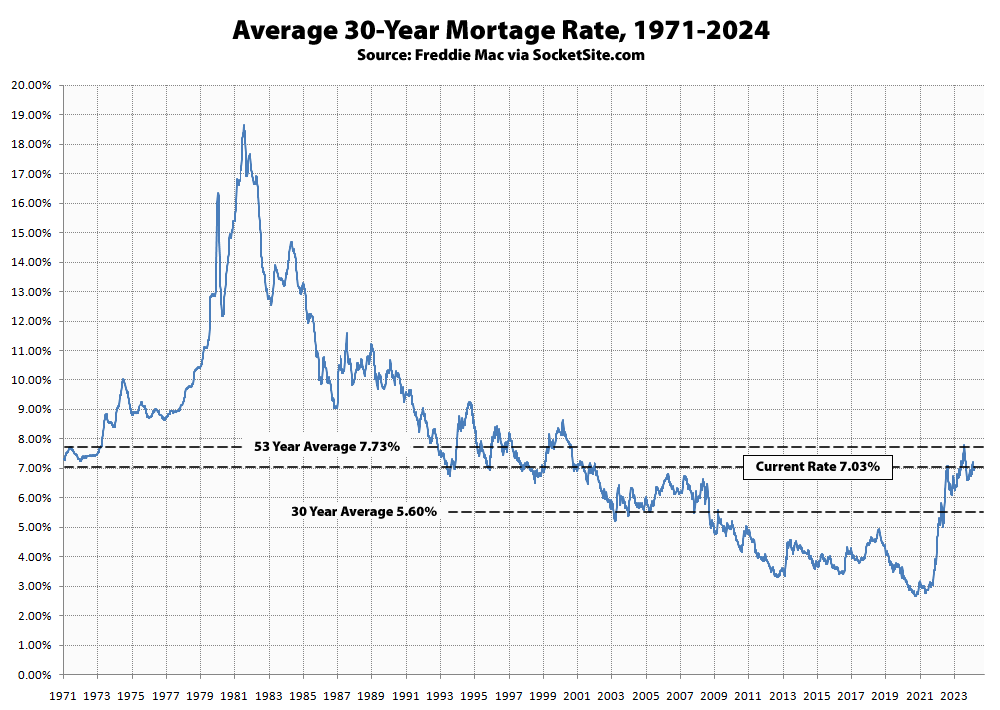

And in fact, the average rate for a benchmark 30-year mortgage has since inched back over 7 percent, ticking up 9 basis points (0.09 percentage points) over the past week to 7.03 percent, which is 24 basis points higher than at the same time last year and 165 percent higher than in January of 2021 but 70 basis points below its long-term average of 7.73 percent and not “historically high,” despite plenty of misreporting and expectation mis-setting elsewhere. We’ll keep you posted and plugged-in.

UPDATE: The average rate for a benchmark 30-year mortgage inched back down 4 basis points (0.04 percentage points) over the past week to 6.99 percent, which is 74 basis points below its long-term average of 7.73 percent and effectively average for the past year, having averaged 7.01 percent over the past 52 weeks, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.