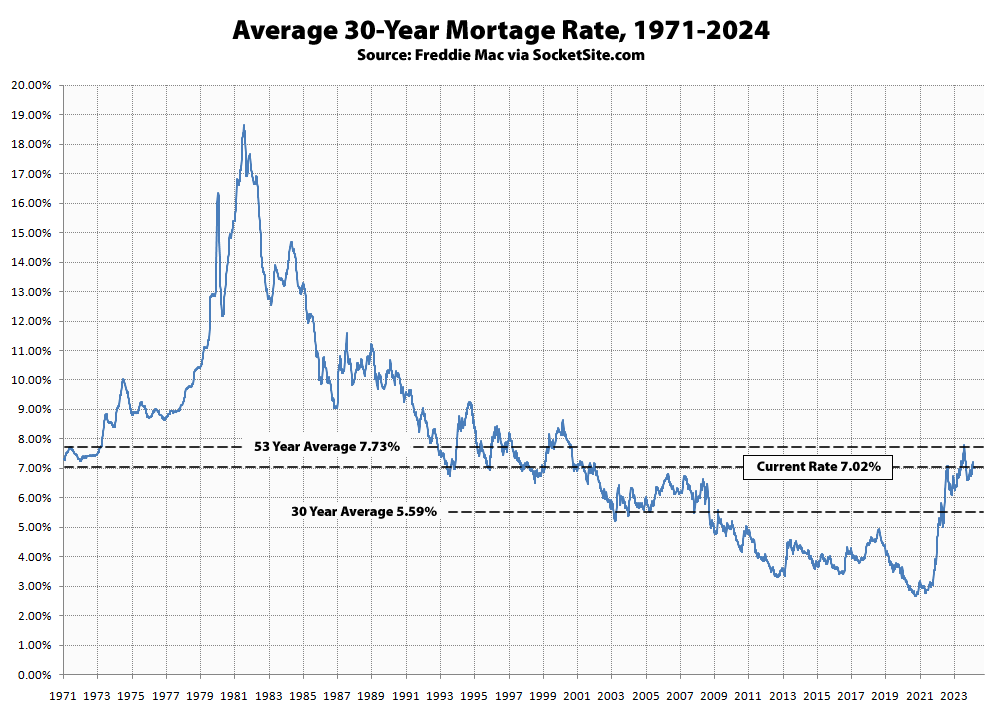

Continuing a trend that shouldn’t catch any plugged-in readers by surprise, the average rate for a benchmark 30-year mortgage ticked down 7 basis points to 7.02 percent over the past week but remains 63 basis points higher than at the same time last year and 165 percent higher than its all-time low of 2.65 percent in January of 2021 but 71 basis points below its long-term average of 7.73 percent and not “historically high,” despite plenty of misreporting to the contrary.

At the same time, based on our ongoing analysis of the futures market, there’s a 90 percent chance that the Fed will adopt at least one quarter-point rate cut by the end of the year, with the probability of at least two rate cuts having inched up to around 60 percent and the probability of no rate cuts (for you) having slipped under 10 percent, probabilities that are being priced-in to current rates. We’ll keep you posted and plugged-in.

UPDATE: The average rate for a benchmark 30-year mortgage ticked down another 8 basis points over the past week to 6.94 percent, which is 37 basis points higher than at the same time last year but 79 basis points below its long-term average of 7.73 percent and not “historically high.”