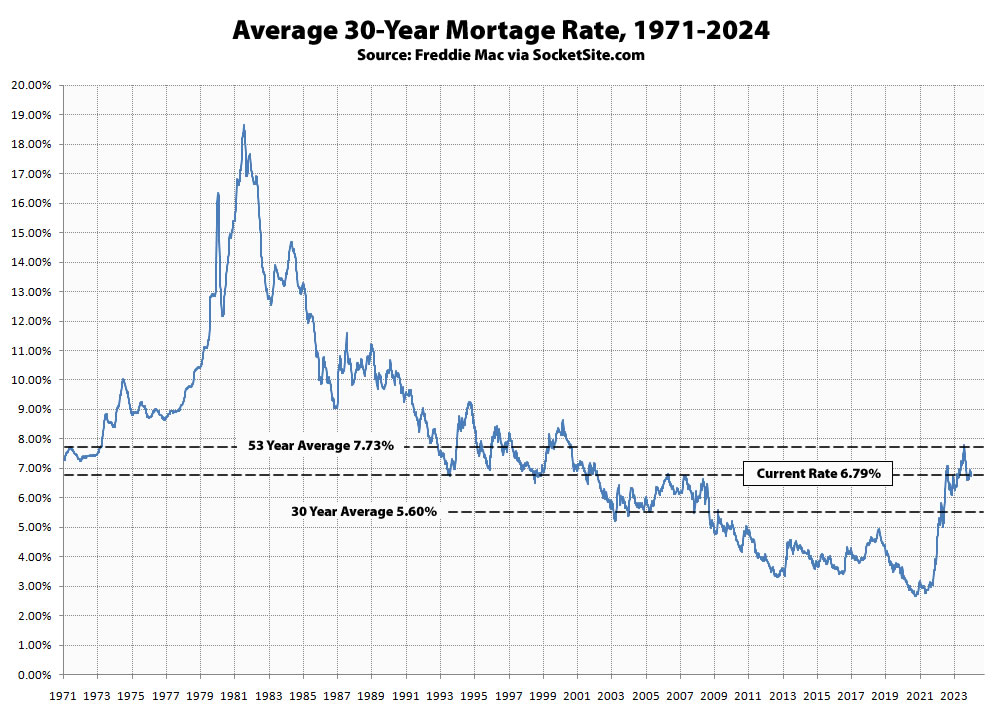

With the expected value of the Fed’s rate cuts holding at a total of three (3) quarter-point rate cuts in 2024, as we first calculated a few weeks ago and is being priced-in to rates, the average rate for a benchmark 30 year mortgage has inched down to 6.79 percent, which is 47 basis points (0.47 percentage points) higher than at the same time last year and 119 basis points higher than average over the past 30 years but 94 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo now holding at 7.14 percent and the number of homes for sale in San Francisco (a.k.a. inventory) having hit a 13-year seasonal high, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

UPDATE: The average rate for a benchmark 30 year mortgage inched back up 3 basis points over the past week to 6.82 percent, which is 54 basis points (0.54 percentage points) higher than at the same time last year and 122 basis points higher than average over the past 30 years but 91 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo having inched down to 7.06 percent and Freddie Mac suddenly “not expect[ing] rates will decrease meaningfully in the near-term.” Who could have seen that coming?