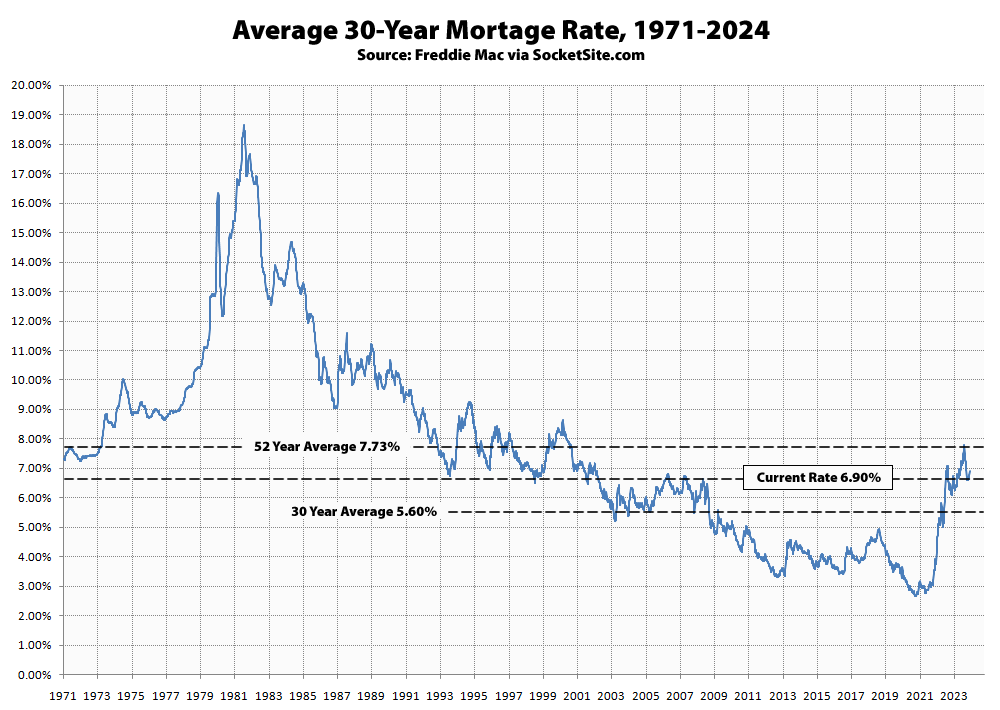

Following a key trend that shouldn’t catch any plugged-in readers by surprise, the average rate for a benchmark 30 year mortgage ticked up another 13 basis points (0.13 percentage points) over the past week to 6.90 percent, which is 40 basis points higher than at the same time last but still 83 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo having ticked up to 7.16 percent and continuing to put downward pressure on both sales volumes and values.

At the same time, the expected value of the Fed’s interest rate cuts this year, which had already dropped over 50 basis points since the start of the year, has since dropped another 10 basis points. We’ll keep you posted and plugged-in.

“Long term average” of 52 years is a very long term average. So long, I wonder how useful it is? What is one to take away from a 52 year average? Since so many mortgages are 30 years, I wonder if the 30 year average is more helpful for comparison reasons. $1 in 1972 is $7.46 in today’s terms and the average cost of a US home was $28k. Maybe we’re around the 52 year average, but we’re well above the 30 year.

You needn’t wonder: the peculiar number – why not 50 years? – strongly suggests that’s the entirety of the data set. Happily, they’ve included more recent dates, to make interpreting the data less of a random exercise and more of a meaningful one.

That’s incorrect. The recent period of ZIRP driven rates was as anomalous as the inflationary 70-80s, which the long-term average for a 30-year term loan, the average duration of which is actually closer to 10 years, helps to balance out. The key point is that 6 percent rates aren’t “historically high,” despite what many have been mislead to believe, and there’s a very real cost of capital reckoning at hand.

You seem to be responding to a comment that doesn’t exist: my comment pertained mostly to the curious – i.e. non-decennial – time frame. Nowhere did I imply, or seek to imply, that today’s rates are abnormally high.

As for the observation that interest rates correlate to inflation: yep, they do (or more precisely to expected inflation). This is, of course, known as the “real interest rate” and while that rate has been below average for the past decade, there’s a debate as to whether that deviation is naturally occurring, or an artifice of government policy.

Now back to the topic hand: S.F.’s moribund real estate sector.

Going by the U.S. Federal Reserve definition of a “prime-age” worker (and related BLS definition of “Labor force participation”), you only get 29 years for a career length to support paying back a mortgage. So while 52 years might be within memory, it’s significantly longer than most mortgagors time in the workforce.

And it bears mentioning that the duration of the average mortgage was significantly shorter prior to early 1950’s, because the 30 year mortgage didn’t exist at all in the U.S. before then.

It’s almost like longer term mortgages developed in reponse to – and helped sustain, in what might be seen as a self-reinforcing cycle – rising home prices. Imagine.

UPDATE: The average rate for a benchmark 30 year mortgage inched up another 4 basis points (0.04 percentage points) over the past week to 6.94 percent, which is only 29 basis points higher than at the same time last but still 79 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo having ticked up to 7.20 percent, “continuing to put downward pressure on both sales volumes and values,” none of which…