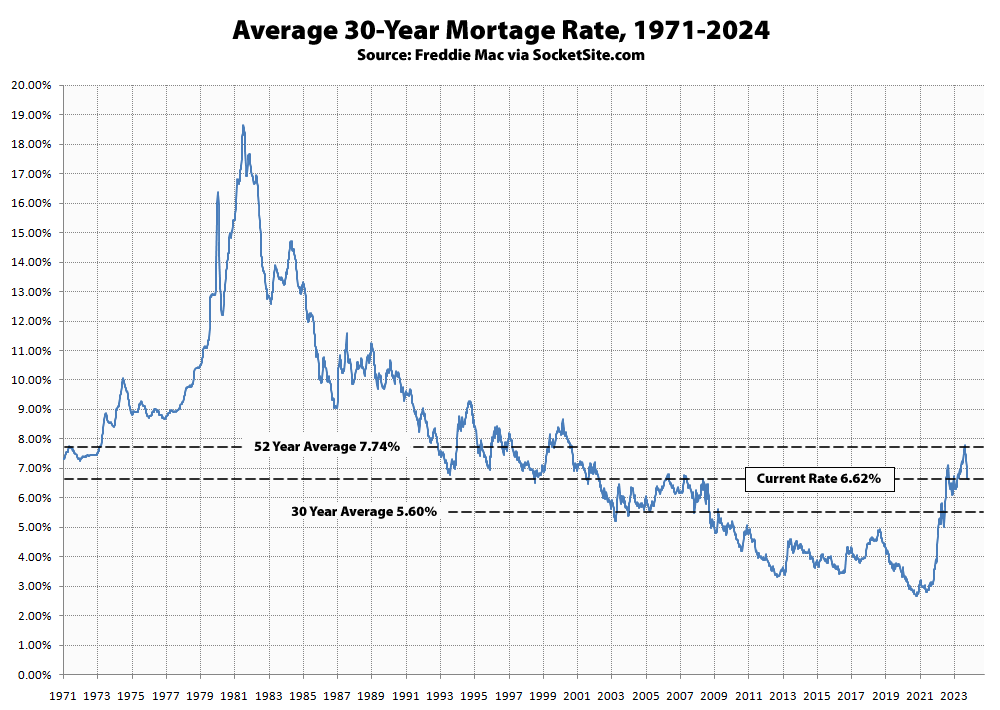

Having dropped to a six-month low of 6.61 percent at the end of 2023, the average rate for a benchmark 30-year mortgage has since inched up a (1) basis points (0.01 percentage points) to 6.62 percent, with the average rate for a 30-year Jumbo having inched up a (1) basis point to 6.86 percent as well and the total expected value of the Fed’s interest rate cuts over the next 12 months, which is being priced-in to current rates, having slipped.

As such, the average 30-year conforming rate is still 14 basis points higher than at the same time last year, 102 basis points above average over the past 30 years, and 397 basis points higher than in early 2021.

And despite mortgage rates having dipped to a six-month low at the end of last year, purchase mortgage activity has continued to drop and is still down over 50 percent over the past two years, both nationally and locally, none of which should catch any plugged-in readers by surprise.

UPDATE: As we noted last week, the total expected value of the Fed’s interest rate cuts over the next 12 months had slipped. And the average rate for a benchmark 30-year mortgage has since inched up, not down, another 4 basis points (0.04 percentage points) to 6.66 percent.