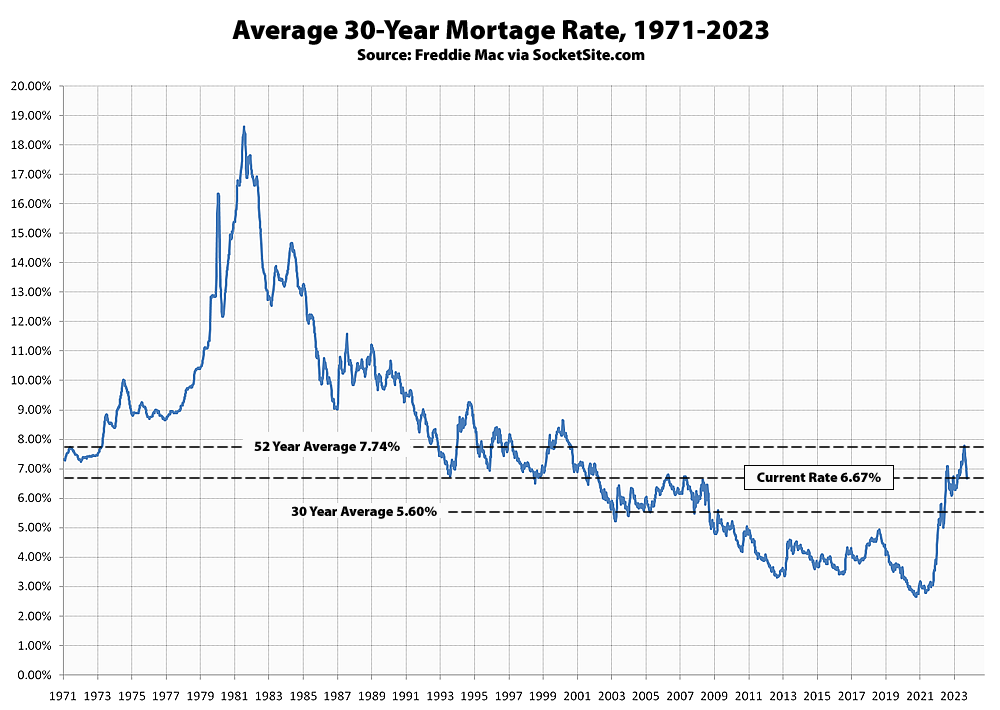

Having slipped back under 7 percent last week, the average rate for a benchmark 30-year mortgage has since dropped another 28 basis points (0.28 percentage points) to 6.67 percent, which is the lowest average rate in six months and over a full percentage point lower than at the start of last month, with the probability of the Fed starting to cut the federal funds rates in March holding at over 80 percent and the futures market predicting that the Fed is likely to cut rates by over a point by the end of 2024, as we first outlined a few weeks ago and is being priced-in to the yield curve.

At the same time, purchase mortgage application volume remains down, despite the recent drop in rates, as do pending sales locally, with the average 30-year mortgage rate still 40 basis points higher than at the same time last year, 107 basis points above average over the past 30 years, and 402 basis points higher than in early 2021, and the average rate for a 30-year jumbo still over 7 percent, none of which should catch any plugged-in readers by surprise.