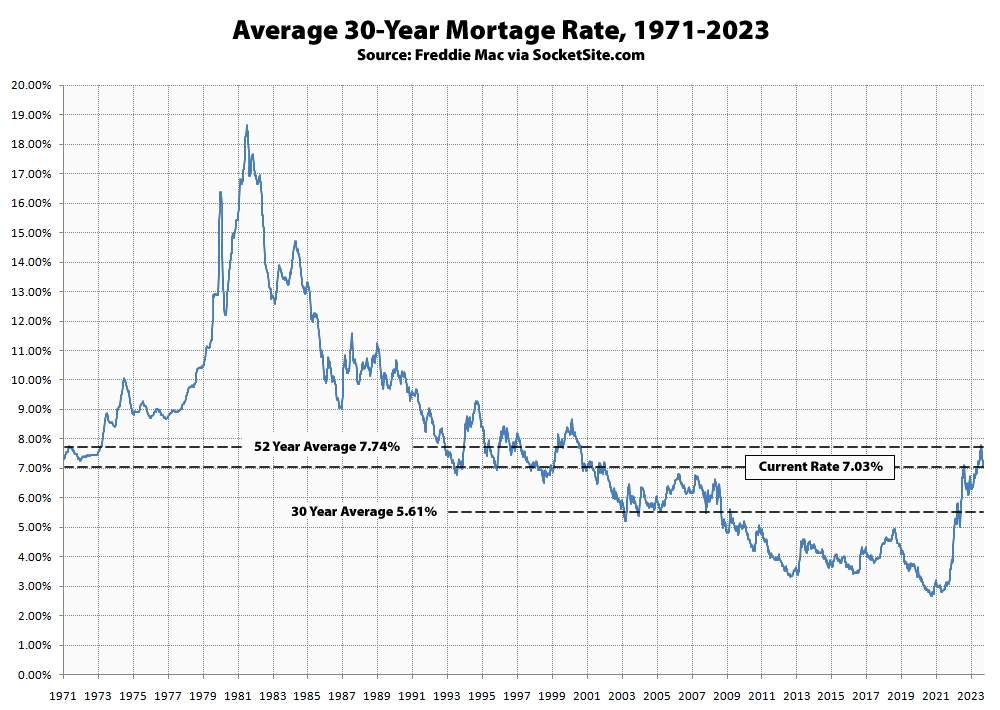

The average rate for a benchmark 30-year mortgage dropped another 19 basis points (0.19 percentage points) over the past two weeks to 7.03 percent, which is 71 basis point below its long-term average but is still 70 basis points higher than at the same time last year, 142 basis points above its 30 year average and 438 basis points higher than in early 2021, with the average rate for a 30-year jumbo having dropped to 7.35 percent (which is 127 basis points higher than at the same time last year, at which point the average jumbo rate was around 15 basis points lower than conforming).

At the same time, the probability of the Fed starting to cut rates in March has ticked up to 63 percent, with the futures market now predicting the Fed will cut the federal funds rate by a total of 1.25 percentage points by the end of 2024, which is being priced-in to current rates and the resultant yield curve. We’ll keep you posted and plugged-in.