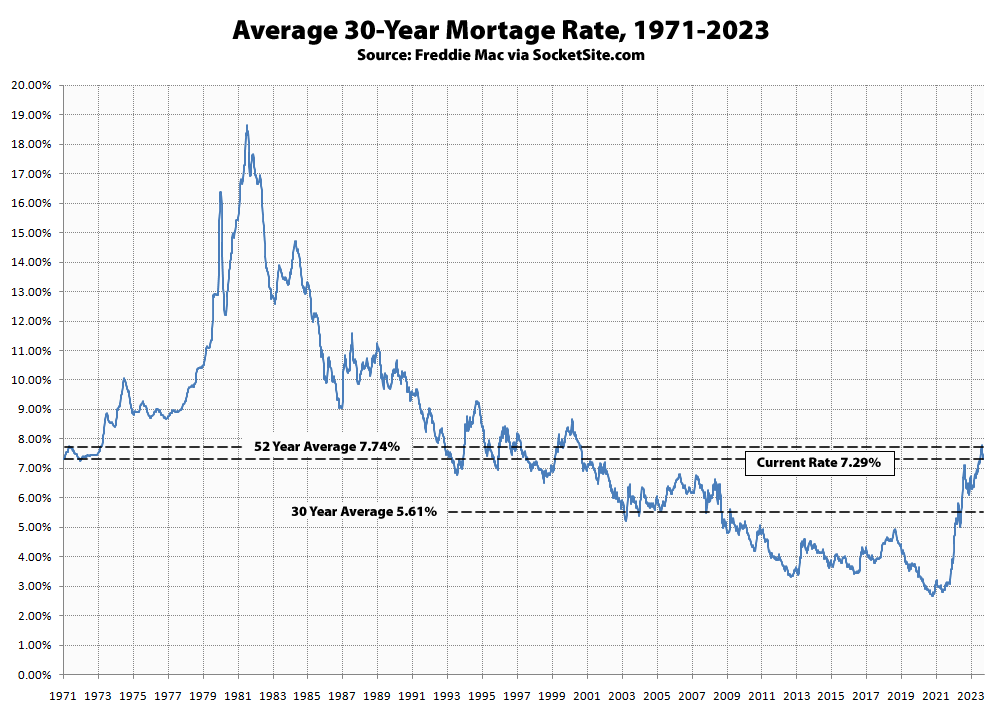

The average rate for a benchmark 30-year mortgage has ticked down 21 basis points (0.21 percentage points) over the past two weeks to 7.29 percent, which is 71 basis points higher than at the same time last year but 45 basis points below its long-term average of 7.74 percent and 50 basis points below its 28-year high of 7.79 percent at the end of last month, with the futures market still predicting that the Fed isn’t likely to start cutting rates until mid-second quarter of next year and then only nominally, save a recession.

At the same time, the average rate for a 30-year jumbo has dropped from 7.65 to 7.51 percent, which is 121 basis points higher than at the same time last year (at which point the average jumbo rate was around 40 basis points lower than conforming).

UPDATE: The average rate for a benchmark 30-year mortgage ticked down another 7 basis points (0.07 percentage points) over the past week to 7.22 percent, which is 73 basis points higher than at the same time last year, with the futures market now predicting that the Fed is likely to start cutting rates in March, but only nominally, save a recession.