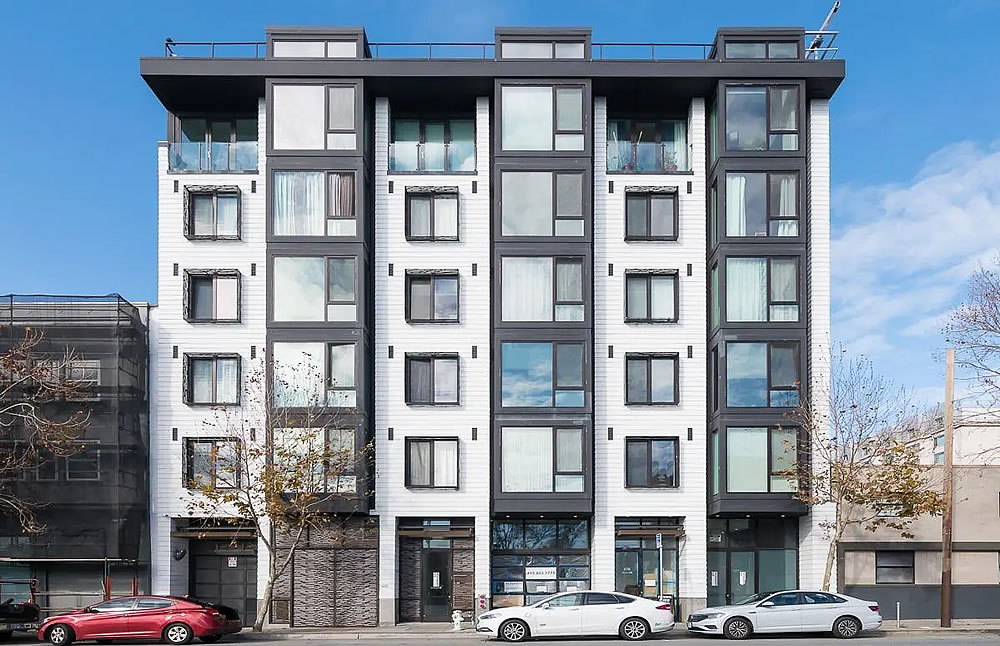

Purchased for $685,000 in January of 2015, the 628-square-foot, one-bedroom unit #301 with a deeded parking spot at 870 Harrison Street, which was built by JS Sullivan and “offers a perfect blend of sophistication, style, and convenience…in a location with easy access to major highways, public transportations, and an array of amenities,” returned to the market priced at just $649,000 five months ago.

Dropped to $599,000 after a month on the market, the re-sale of 870 Harrison Street #301 has now closed escrow with a contract price of $585,000, which was officially “within 3 percent of asking!” according to all industry stats and aggregate reports but down 14.6 percent on an apples-to-apples basis from January of 2015, with a 20.8 percent drop in value for unit #206 at 870 Harrison from March of 2016.

And yes, the frequently misreported index for “San Francisco” condo values is “still up 37 percent!” over the same period of time.

The bedroom has larger, better windows than the living room? Huh.

Sorry, not a regular reader. May be a dumb question.

In what way is the Case-Shiller index misreported?

And what explains why the index is up while listings like these are down?

Peninsulite: if you follow that hyperlink, you’ll find that the editor highlights the fact that The S&P/Case-Shiller home price index for “San Francisco” is defined pretty expansively and includes outlying cities, but some national media outlets report the index as if it applies to San Francisco proper.

Also, San Francisco has a substantially higher proportion of dedicated flippers participating in the real estate market than other similarly-populated cities nationally, although some real estate market participants that read this site would dispute that. Homes sold here (at least until recently) are more likely than other similarly-populated cities to have been value-engineered up the up the yin yang since the prior sale. This site’s editor consistently mentions that the index is “imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best)”. Other sites that report the latest index change hardly ever mention this.

“Sophistication, style and convenience”

Yeah…sure. It’s a small cookie-cutter apartment, not unlike most new construction. But, for 600k, some might think it’s worth it as a starter place.

The street scene on that block was never good but it has become worse in the last few years.

yes, i would think the deterioration of the street conditions alone would bring this down 20% or more.

The building looks like it was drawn up in Revit using the popular ChatGPT San Francisco Generic Condo module: “Chatty, drawn me an unimaginative, soul-crushing SOMA condo, stat! Make it look like the thousands of other ugly POS built since the mid-90s that have turned what was once one of the world’s architectural gems into an international laughing stock.”

What I learned from a realtor when trying to sell an unconventional two-level loft, is that most buyers prefer cookie cutter.

Right. And what many, many buyers are told when looking for a unit to purchase, is that if they want to maximize the amount they make upon future resale, they should preferably buy a unit that’s cookie cutter. So real estate agents are on both sides of the market, pushing a line that propels both buyers and sellers in the same direction, and along the way making real estate agents look like economic divinators when the market bends in that same direction.

The same phenomenon applies to white box Victorians.

Are you suggesting that they encourage those looking to maximize resale value to seek out something bizarre…even repellant?? (When that buyer comes along – finally! – seeking flocked avocado wallpaper, well, now, they – and they alone – will have all the power)

Real-a-tors have much to answer for – they’ve historically pushed bigotry and snobbery and even today many property descriptions make Guy de Maupassant look unimaginative – but c’mon …they aren’t all bad.

I get the humor you’re going for here, but No.

What I’d prefer is for fewer people to be in the position where they feel they have to “maximize resale value”, because their agents have the idea that everyone buying in S.F. is just a transitory resident out for a short-term cash grab and are told what to do with their homes on that basis.

One doesn’t have to embrace bizarre interiors to understand that not every Victorian in the City needs to be a generic open white box and not every family wants to live in a home that has a layout that is indistinguishable from an Apple Store’s.

Again, I’m not questioning that far too many agents are far too willing to pander to the far too many people who see their home not as a place for living, but rather a set of NPV calculations, but….blame those far too many people.

Maybe I’m a sentimental softie, but I think somewhere out there are agents who work with people who have knowledge and ideas (taste per the old and somewhat patronizing phrase). I don’t know how these two rare breeds find each other – is there a real estate equivalent of “gaydar”? – but I think it happens. Occasionally.

More brutal comps. I think it’s high time for every single SF realtor to have a ‘come to Jesus moment’ with their seller clients.

The building is fine.

That block has historically been light industrial and doesn’t have residential look or feel to the street. It is situated at major freeway interchange on-ramp / off-ramp.

Nice unit, rough location. Would not want to overlook the freeway on ramp 24/7.