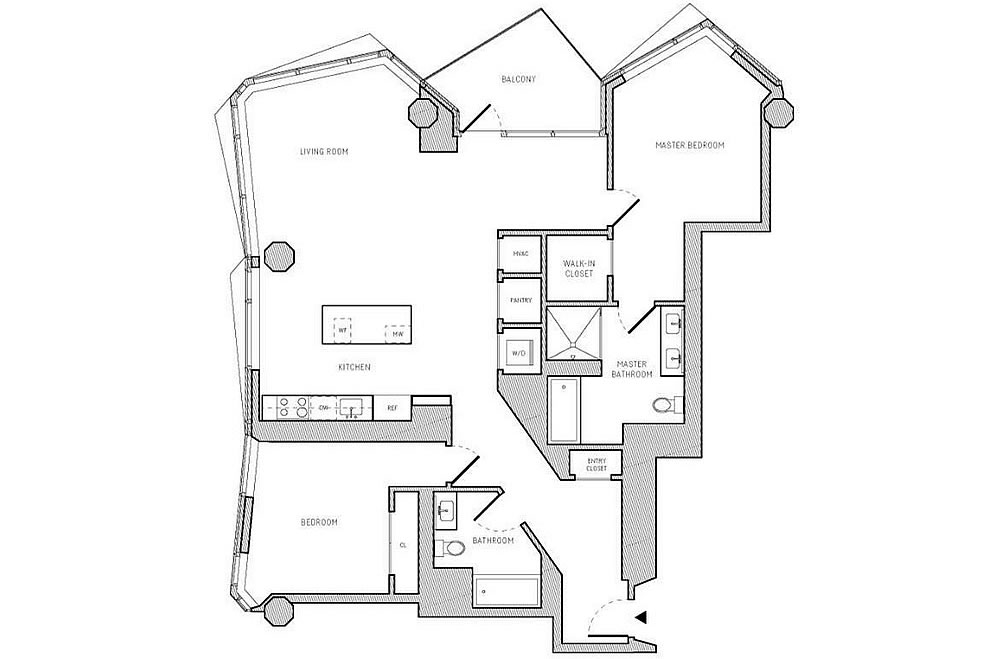

Listed by the sales office for $2.525 million or roughly $1,686 per square foot in November of 2021, the model two-bedroom, two-bath unit #30A in the twisty MIRA tower at 280 Spear Street was relisted for $2.495 million early last year.

Removed from the MLS and then relisted anew for $2.185 million this past April, the sale of 280 Spear Street #30A has now closed escrow with a contract price of $2.04 million or roughly $1,362 per square foot for the 1,498 square-foot corner unit, which was “within 7 percent of asking” according to all industry stats and aggregate new condo reports.

And once again, while $1,362 per square foot certainly “isn’t cheap,” which is a popular refrain, it’s 19.2 percent cheaper than the asking price per square foot for the model unit in 2021, an asking price which would have been set relative to the other new units in the building, the prices for which had already been “adjusted” prior to 2021.

My guess is that we’re getting closer to the bottom in terms of these downtown condos.

– Interest rates seem unlikely to go much higher, and are likely to go slightly lower in the next year or so.

– Companies have started seriously enforcing the number of days in office by monitoring badge swipes. It seems like 3 days is where things are landing on average. This will incentivize people to move back to downtown.

I still think there’s room to go downward because closures of services such as the Westfield Mall could continue to hurt desirability, and it seems we are just getting started on that front. However, maybe return to office stops that bleeding?

Westfield isn’t closing, it’s a change of ownership / back to the bank.

The mall may not be closing but many of the stores contained therein are closing.

It very likely will be repurposed. Mayor Breed last week suggested tearing it down and building a soccer stadium.

I’m not sure she understands how anything works. The city of San Francisco doesn’t own the property, can’t afford to buy it, can’t afford to tear it down, and can’t afford to build a stadium.

My interpretation of her comments last week are that she understands that The City doesn’t own the property and also can’t afford to buy it, much less redevelop it. I think she was suggesting that, once the property goes back to the lender and the asset is marked to market, a deep-pocketed entity with patient investors acquire it and redevelop it. This would leave both City coffers, the neighborhood and the property owner better off than a moribund mall with lots of empty retail spaces.

I completely agree with her that the time to start thinking about how to actively fight back against the Detroitification of San Francisco is now, so we can take appropriate action once properties like the one we’re discussing change hands.

That’s an ironic choice of metaphors, because Detroit is exactly the kind of city that puts a sports stadium in (what would otherwise be) prime downtown real estate…tho this would be even more “prime” that what was done there.

Perhaps we’ll all be better off if this ill-considered remark is forgotten and we just concentrate on the more general concept of repurposing.

If you’re evaluated on your badge swipes you’re not at the pay grade that’ll get you into a $2 mil condo

That’s not true at all. I know people making big money across Finance, Tech in downtown SF who are having their badge swipes monitored.

For what purpose?? Don’t they make themselves known in other ways ??

Seems like 3 days required is wishful thinking. Is there data supporting this?

All sorts of anecdotes out there.

Yes, there are all kinds of anecdotes, mostly gathered from large companies, that folks in the S.F. real estate “game” are hanging their hopes on, like this list of major companies requiring employees to return to the office:

You can count up the companies requiring 3 days a week.

I agree with the earlier comment from Daniel. High-level (and highly compensated) executives seem to be able to work remotely with impunity as a perk. At the company I worked for, with offices it was leasing at 525 Market St., the member of the Exec Board who announced the RTO policy (of 3 days required, and 5 days required if you didn’t want to be forced to share a “hot desk”) did so during a Zoom call which he participated in from his 2nd home which he straight-up told us was in S. Florida. Plainly visible in the background was the boat tied up at his private dock on the waterfront. I didn’t have the temerity to ask him if he even knew where his badge to get into the office was.

That badge-swipe ‘threat’ from employers is a bit of a joke, and everyone knows it. Leadership is not going to demote or fire anyone who’s otherwise performing well because the cost and time involved with training new staff is a serious drain. On the whole, employees are making more of an effort to come downtown, but not enough to require moving there — who wants to make this kind of investment in SF anymore? Or at least right now?

I hear from FAANG friends that people often game the badge swiping by getting coworkers to do it for them.

I read through the list. I wish it were so, but it is not convincing in the least that an RTO wave is upon us. Much of the data is old and vague. Data that is updated monthly about ave. days/employee would be convincing.

As someone who colored inside the lines as a kid, this unit would drive me crazy!

Also, the twisty/in-motion feel of this building, based on a recent in person visit, really is marginal. I can’t seeing this ageing very well.

It should have gone for no more than 800 sq ft