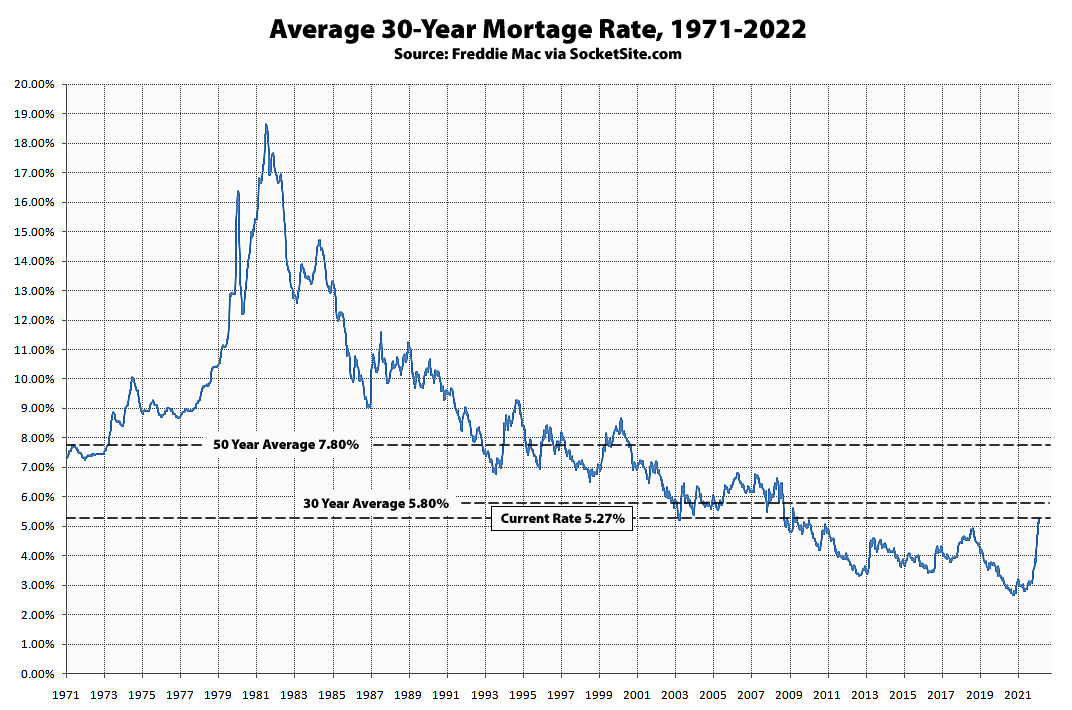

Measured prior to the Fed’s rate hike yesterday, the average rate for a benchmark 30-year mortgage had already jumped another 17 basis points to 5.27 percent, which is 231 basis points and nearly 80 percent higher than at the same time last year and the highest average rate since August of 2009, a trend that shouldn’t have caught any plugged-in readers by surprise.

At the same time, the yield on the 10-year treasury has inched up around 3 basis points since the Fed’s announcement, indicating the near-certain hike was already priced-in and should moderate any significant jumps in mortgage rates over the next week. But the probability of the Fed raising interest rates by another two (2) full percentage points, in addition to yesterday’s half-point hike, by the end of the year is currently running at over 95 percent, which should continue translate into even higher mortgage rates over the next six month, even less purchasing power for buyers, a continued slow-down in sales, and downward pressure on home values.

I think we need to clarify real versus nominal. Interest rates are actually really low. I wish the Fed would raise them. This time last year inflation was roughly 6% and now 8.5%. Went up 2.5%. Mortgage rates went up a similar percentage.

Like if you made $100k last year and 105k this year, you really didn’t get a raise. Money only has value on what it can buy. Wish the Fed would actually do something .

When I was born Dow was 1K now it’s like 30-40k range. I have young kids. DOW will be 1,000,000 when their my age. Late 30’s

A second line series with CPI or some other inflation measure on this chart would be illuminating.

Here you go: 30-year mortgage rates and consumer price index change from year-ago, on one graph.