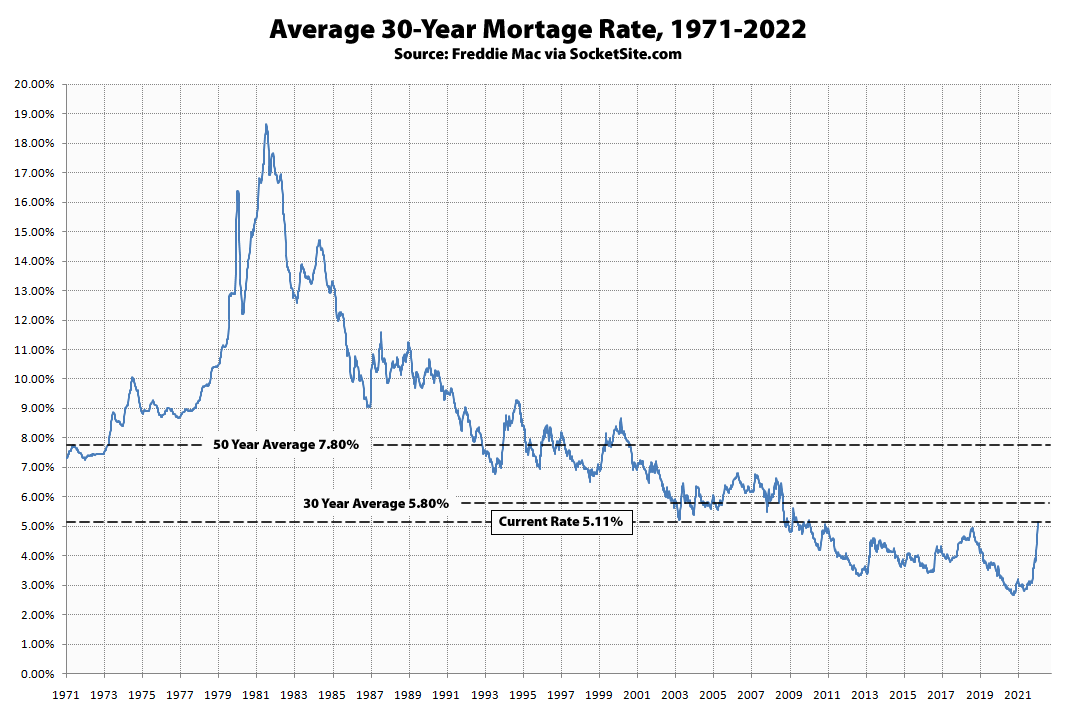

Having hit 5 percent for the first time in over a decade last week, the average rate for a benchmark 30-year mortgage has since ticked up another 11 basis points (0.11 percentage points) to 5.11 percent, which is 214 basis points and over 70 percent higher than at the same time last year, over two (2) full percentage points higher than in January of last year, and the highest average rate since April of 2010, a trend that shouldn’t catch any plugged-in readers by surprise.

At the same time, the probability of the Federal Reserve raising interest rates by another two (2) full percentage points by the end of the year is up to 99 percent, which should translate into even higher mortgage rates, less purchasing power for buyers and downward pressure on home values.

CPI is at a 42 year high.

And there’s a school of thought that the fed will need to raise interest rates above the inflation rate to really get inflation under control. As you’ve pointed out before if you can borrow below the inflation rate you have a negative real rate. Being paid to borrow money hardly works to put the brakes on the economy. Rates may need to go higher then some people expect.

Let the housing crash begin!!!

The hopes and dreams of so many here are with you, with fingers crossed.

Even when prices come down, purchase affordability will be worse because of much higher mortgage rates.

What a great service (!) has been done by market pessimists who convinced people not to buy houses with 30 year 2.6% debt.

“What a great service (!) has been done by market pessimists who convinced people not to buy houses with 30 year 2.6% debt.”

But that’s just the point. With 2.6% debt and 6..7..8%.. inflation people would(were?) buy like crazy. Even with 5% mortgage rates and 8.5% inflation as you pointed out last week people would perceive that as negative real rates and that would fuel demand.

On the supply side, lenders are probably more driven by forward inflation expectations inferred by the bond market. Which right now has spiked to a 7-year high of 2.67% last I checked. But even at 2.67% that probably isn’t high enough to choke off supply of money lent out at 5%.

There’s some truth to the fact that mere words from the fed can influence inflation expectations. But I think we are way beyond that point. Just throwing out some pessimism will not really curb people getting mortgages at what they percieve to be negative interest rates.

Correct. I am being facetious about this site and other pessimists doing anyone a service by dissuading them from purchasing a house with phenomenally cheap money.

You’re wrongly assuming that current prices are justified.

Remember what happened the last time? I know, I know, it’s different this time… no liar loans, banks are tighter, blah blah. _Some_ truth to that, but now we have that little thing called inflation, which in conjunction from a money-printing crazed Fed, giving out PPP loans to shell companies, created an “everything bubble” that is slowly deflating.

Recap of the past in SoCal by average price:

2007 $505,577

2008 $318,075

That’s a 37% haircut with inflation only running around ~2.9%, China growing like weed, and most importantly, in a world of NO quantitative easing.

(cue the laughter)

Anyone who thinks this type of correction isn’t possible again (or realistically, much more) with a Fed on a mission to stamp out inflation during an election year, at the same running $95b PER MONTH off its balance sheet, AND tightening into a global slowdown… well…

I got some oceanfront property in Arizona…

Your SoCal example, and SoCal is a massive region with thousands of micro-markets within it, isn’t even close to what happened here in SF.

So who are the weak hands in the real estate market now? I don’t dispute that prices could go down, but it’s always challenging to see who will be the forced sellers.

I don’t think there is political appetite for another wave of foreclosures, and if borrowers are sitting on loans from 2 years ago, they are in good shape rate-wise.

What ‘forces’ prices to come down? People who have to liquidate their dogecoin positions?

Jobs are plentiful now, so everyone who wants to work and save their house can, can’t they?

Yes, jobs are plentiful now, so everyone who wants to work can do so and save their house, but the now inevitable recession hasn’t begun yet.

The relentless hiking of the federal funds rate over the next six months and on into next year is not going to do anything about the high prices for commodities, or the supply chain issues caused by the feckless capitalists in the U.S. forcing consumers to depend on almost everything coming over on slow ships from China. So they have to destruct demand by increasing unemployment, because that is the only mechanism they have to address high inflation. When the recession gets going, almost by definition unemployment will rise significantly, because that is what The Fed has to do in order to rein in inflation.

So when people are forced out of work, they will have to sell their homes, at a time when supply of homes for sale are increasing and that in turn is what will force prices to come down.

It essentially comes down to a big bet on how quickly the fed will get inflation under control.

As we’ve seen in the past, if inflation drags on for a long time at a high rate then having a large fixed rate loan and a secure job whose wages float up with inflation can be a huge financial windfall.

But as Brahma points out if the fed forcefully and successfully attacks inflation then many people lose their jobs, the wage inflation never happens and you’re just stuck with a very large debt. Not just job loss, but regular life factors ( job transfer, desire to relocate, divorce, more kids, kids moving out,…) might not “force” a sale, but can strongly push people to come to the market with their property.

The Fed finally seems to be taking inflation seriously, but even the small measures taken so far have had a big effect on the stock market and home sales. And if rates need to go above the inflation rate to really win the fight, I do wonder if they’ll have the stomach to follow through.

All this QE and other stimulus has gone on far past when it should have ended not because people don’t know any better, but because nobody wants to be the bad guy that takes away the punch bowl.

Even now in the midst of this huge inflationary surge, look at Newsom’s proposal to send out $11B in payments to offset rising gas prices. I’m sure it polls well, but the idea of essentially printing more money during a period of high inflation is obviously counterproductive. And the proposal to cancel $10k (or $50k) of student debt is the same bad idea on a much larger scale. Canceling debt is essentially printing more money, popular I’m sure but working against the fed getting inflation under control.

I think it’s far from a certainty which way it’s going to land.

Point of fact: Gavin Newsom cannot print money. The state of California has a huge surplus and is figuring out what to do with it. This is not the same as printing money.

(I would agree that there are good ways to spend this and bad ways. We shall see how the state of California decides to spend it.)

Good. I’m waiting to buy. 🙂

Just in Alameda county so competitors please stay away.

We have moved back to the range of the 1950s and 1960s. In 1971, inflation was about 4.4% and the 30-year mortgage was about 7.5%, according to my Internet research. Interest rates could be reverting to long-term historical norms. If so, I would expect an extended sideways market without homes becoming any more affordable.

Except that in your example there is a normal spread of mortgage rates being higher than inflation. If inflation is 7% mortgage rates need to go from 5% to 10%.

You are assuming that the current inflation will persist. The bond market does not agree with you.

I would suggest taking cheap money from the bond market while it lasts.

If you borrow at rate X and then rates drop lower you refinance at less than X with little to no penalty as an owner-occupier. Or rates continue higher and you are glad you owe cheap money.

The bond market may be right or wrong, but typically hard assets like real estate tend to do well in inflationary environments.

Curious about everyone’s thoughts on the mortgage market in SF, every broker will tell you that the luxury SF buyer pool (3mm – 6mm) is not influenced by higher rates (implying a larger portion of cash buyers that, I guess, are buying out of liquid savings). BS or is there truth to that?

I know several people who bought SF $3M+ single family homes during the pandemic (including myself). Some bought “cash” and then financed after close. Rates matter even for the wealthy. If rates are cheap, why sell tech stock (or whatever) and pay cap gains when you can let it ride and pay <3% interest.

Maybe SOMA condo buyers are different. I don’t know too many of those people (I know two people who sold $2M+ SOMA condos to buy homes, one in Noe another in Hillsborough. Both had significant loans)

Today 30yr fixed closed at 5.28% down from last Friday’s 52 week high of 5.45%. And as noted last week, lenders like Wells Fargo & Co. have begun cutting staff in its mortgage lending business as rates soared above 5% in recent weeks, putting the brakes on refinancings.