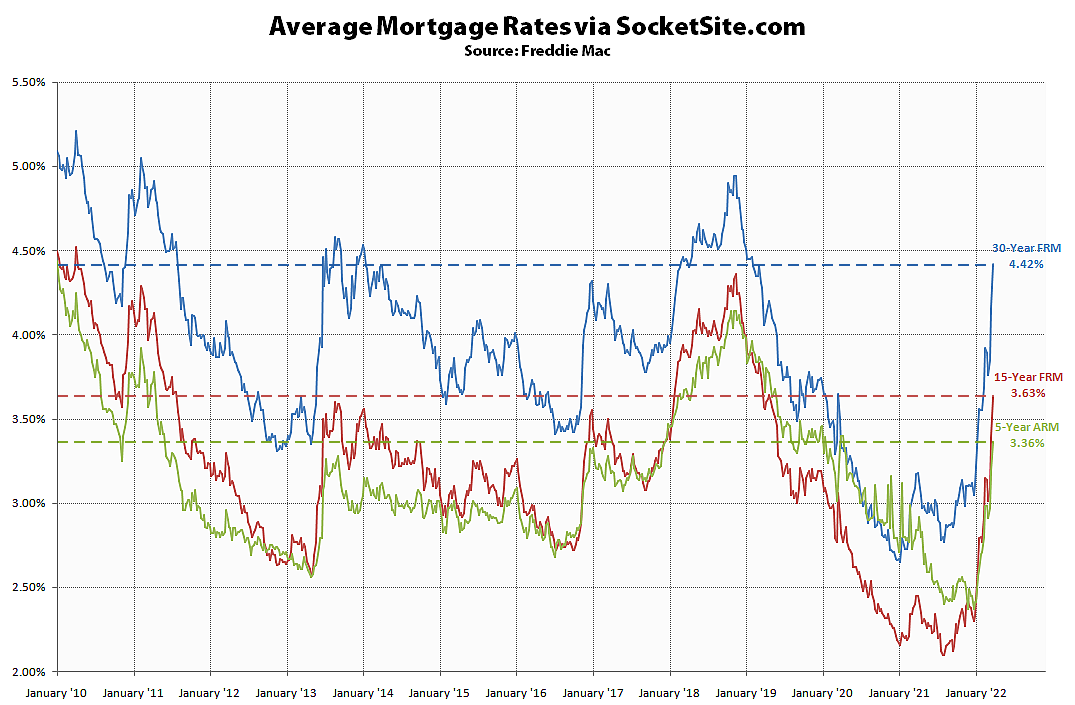

The average rate for a benchmark 30-year mortgage jumped another 26 basis points (0.26 percentage points) over the past week to 4.42 percent, which is nearly 40 percent (125 basis points) higher than at the same time last year and the highest average rate since January of 2019.

At the same time, the probability of the Fed adopting at least seven, if not eight, more quarter point rate hikes by the end of the year – which should translate into even higher mortgage rates, less purchasing power for buyers and downward pressure on home values – has jumped, none of which should catch any plugged-in readers by surprise.

Forgive me for the naivety, but how do the Fed rate hikes exert downward pressure on home values? Is it because the borrowing rates to buy a home go up, and so that reduces demand?

Higher interest rates makes it more expensive to borrow money, so you can afford to pay less for the home. So in a sense that reduces demand by reducing people’s buying power.

A person’s homeowning cost is essentially split b/w the financing cost (interest) and the ownership cost (principal + Taxes + operating); so as the former rises the (portion that can go to) the latter will fall; and since the principal – which is determined by the home price – is the biggest component, the imputed home price will fall.

Obviously there is some complexity – R/E taxes are tied to price, and one can always reduce a principal payment by extending the term – but in general, and the all-important ceteris paribus, the price of an asset is inversely related to interest rates. Which is why may reasonable people think the Fed is

1083%much responsible for the (alleged) “affordability crisis”.it’s a sort of ‘second-order’ or even third-order effect. the impact of higher short-term rates tends to push long-term treasury rates higher. most mortgages are tied to long-term treasury rates, so their rates will go up also. and since most homeowners can only finance as much as they can qualify for on a monthly basis, higher rates means a lower loan amount for the same monthly payment so that leads to lower offers and thus lower home sales prices. all this takes a few weeks or even months to fully manifest.

mind you so far the fed has only raised a quarter point, but since the fed is all but guaranteeing what the rates will be for the next year, so rates are zooming up in anticipation (which actually works great for the fed – the mere mention of higher rates is much cheaper for the fed than having to go to the market to directly move rates around)

what can put a dent in all this is if people can get higher wages from their employers in order to be able to afford higher mortgage payments. bay area tech employers have had the luxury to keep bumping up employee salaries over the last 25 years or so which keeps them able to offer still higher and higher prices. this pretty much comes at the expense of all the employers who can’t or refuse to bump salaries and then either suffer employee resignations or just decide to just relocate out of the bay area entirely (often claiming it is for ‘tax reasons’, but mostly it is salary, the #1 expense for most firms).

As noted below, keep in mind that the impact of rising rates extends beyond affordability.

Last March 30yr fixed mortgage were 2.76%. Today rates topped off the day at 4.75%.

I’m betting rates reach 5% by April…anyone disagree?

I am in east bay and see home values skyrocketing. Super competitive and everyone in a rush to buy before next set of interest rate hikes.

Perhaps it’s different in the East Bay, but the pace of sales in San Francisco has dropped despite the popular “rush to buy before next set of interest rate hikes” narrative. Pending sales are down nationally as well, with “fast-changing conditions ahead.”

All true from the standpoint of basic economics. But the supply/demand/price factors involve way more than interest rates. Overlay a home price chart over this interest rate chart and you’ll see there isn’t that much correlation (or inverse correlation) between home price trends and interest rate trends. Regardless, very happy I refinanced at 2.35% for 30 years a little under a year ago.

Of course “the supply/demand/price factors involve way more than interest rates.” But the impact of rising rates on the demand side of the equation extends beyond affordability. And there is correlation between values and interest rates, despite what you might have tried to eyeball.

Yep – rising interest rates definitely raise borrowing costs. By definition. As for a “correlation between values and interest rates,” I’m not really sure what that means, but there is little (and perhaps no) correlation between interest rate trends and home price trends, particularly in a specific market over a shorter duration. One would think there would be, but there are many, many other factors that go into home sale prices besides mortgage interest rates. As just one example, falling interest rates (lowering mortgage costs and increasing buying power) tend to accompany weak economies (lowering buying power) and vice-versa. So the relationship is extremely complicated.

Yes, “the relationship is extremely complicated.” No, “there [isn’t] little (and perhaps no) correlation between interest rate trends and home price trends.” And once again, rising interest rates don’t only impact affordability but the rent versus buy, and thus demand, calculus as well.

I think the issue is that the relationship between interest rates and home prices is not something you can just eyeball.

It’s been a while since I looked at [this working paper] in detail, but I believe they found a 1% drop in short term interest rates led to a 5% rise in home price after 3 years. You can probably find many papers with different styles of analysis, using short term vs long term rates, real or nominal, different home price metrics,… You’ll probably find a range of results, but in my opinion you’d find a few common themes.

Just like this paper found, I think you should expect to see small but persistent changes in home price appreciation/decline that build up over time. Home prices have momentum and rate changes take time to percolate through the economy. If the fed raised rates 1% tomorrow I don’t think you should be looking for an immediate 5% drop in home prices. This paper found that the effects of even short term rate changes could take as long as 5 years to flow through to home prices.

Yes, interesting paper. So, from this, what will have the most (if any) impact on San Francisco housing prices over, say, the next one or two years? The rate decline in 2019-2020? The rate increase in 2017-2018? The 2022 rate increases? As this paper appears to conclude – who knows?

We must admit, that’s a rather impressive pivot from “there is little (and no perhaps no) correlation between interest rate trends and home price trends” to…sure, there’s correlation, despite what I previously stated, but “who knows” what it means.

In the meantime, while you’re trying to figure it out, pending sales are down, inventory is up and price reductions are on the rise.

I think you misunderstood the “who knows” comment, and you should read the linked paper. What it finds that on a national scale, there may be some loose and small correlation between interest rate trends from some years ago and housing prices years later. That’s econ-speak for “there is little (and perhaps no) correlation between interest rate trends and home price trends, particularly in a specific market over a shorter duration.” SF housing prices may rise or may fall in the near future, granted. Will that have anything to do with these interest rate changes? Probably not (this paper suggests that, if anything, rate declines from a couple years ago will have the effect of increasing prices in the near future: “Our conservative estimates would predict a bit more than a 1 percentage point fall in real house prices 10 quarters after the equivalent interest rate change [increase]”). There are many, many other more important factors.

I don’t believe high mortgage rates will have much impact to home sales in SF per se because SF is the city of the rich. But working families are getting crushed with $5 dollar a gallon gas and high CC interest rates and now high mortgage rates.

I’m now betting mortgage rates exceed 5.5% by the end of April, anyone disagree?

“working families are getting crushed with $5 dollar a gallon gas and high CC interest rates and now high mortgage rates” is the recipe for a recession, which typically affects home prices.

That said, the recent news about non-affordability of rental housing in San Jose could put some additional steam behind the home-buying market. I’m very glad to have made the switch three years ago.

At the same time, the weighted average asking rent for an apartment in San Francisco slipped around 2 percent in February to $3,340 month, which is roughly 6 percent higher than at the same time last year but still 19 percent ($760) lower than prior to the pandemic and 25 percent below San Francisco’s 2015-era peak.

I live in Marin and don’t like landlords. I’m very happy to know what my housing expense will be over the long term and to avoid intrusive LLs.

It wasn’t about a short term rent vs buy calculation. I wanted to be able to remodel and have a dog.

Also, I got lucky and refinanced at the end of last year from 4.25% to exactly 3.00% (30 years). I covered the remodel and my mortgage payment hardly budged.