Purchased for $11.1 million, or roughly $3,350 per square foot, in April of 2016, the cooperative apartment #1601 at 1750 Taylor Street (a.k.a. The Royal Towers in Russian Hill) returned to the market listed for “$9.5 million” this past September, a price which was quickly upped to $11 million on the MLS.

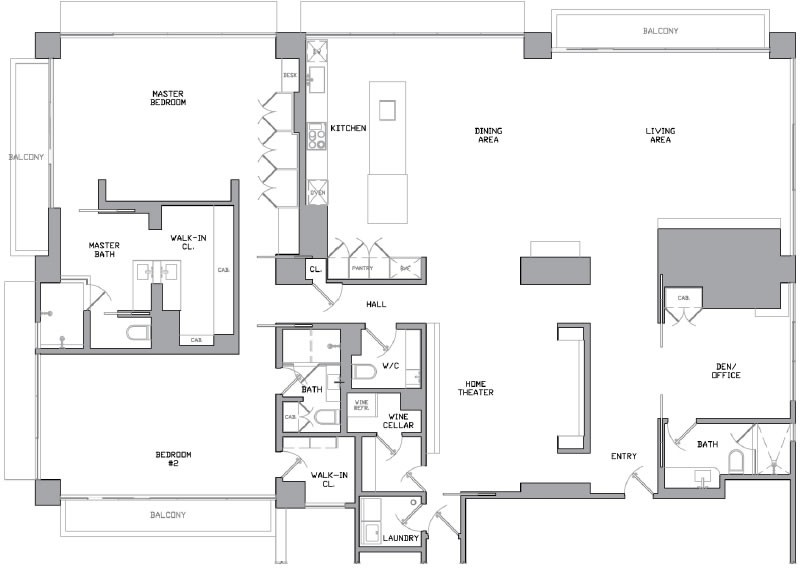

As plugged-in readers might recall, the former three-bedroom Imperial Floor Plan unit was taken down to the studs, reconfigured and rebuilt as a high-end “two-bedroom” unit with a den/office, to maximize the space, take advantage of its panoramic views and “accommodates today’s lifestyle” back in 2011/2012, after which it quietly traded for $9.1 million in April 2015, prior to the 2016 sale.

And yesterday, the re-sale of 1750 Taylor Street #1601, which “could very well be the best residence in one of San Francisco’s preeminent buildings,” closed escrow with a contract price of $11.25 million or roughly $3,390 per square foot, representing total appreciation of 1.4 percent for the high-end unit on an apples-to-apples basis since the second quarter of 2016 or 0.2 percent per year (versus appreciation of 22 percent from 2015 to 2016 despite the “short-term hold”).

The widely misrepresented Case-Shiller index for “San Francisco” condo values is up 19.4 percent over the same period of time, up 28.5 percent since April of 2015.

The Case Schiller index is a regionwide index. Not just SF. It includes Alameda, Contra Costa, San Mato and Marin counties. It is an averaged index which overstates SF proper as the East Bay has seen significantly higher home and condo price appreciation. Condo prices in SF have been generally flat for several years so this outcome is within expectations.

This is why I don’t see RE as a sound investment. My Etrade account has appreciated 2,600% in that period of time.

Totally agree with Dave. The apple picking on this website somewhat distorts broader real estate trends in the Bay Area. And while I may not know SF, I know The Oakland/Berkeley/Piedmont market well and so I’ll offer my own example of a non-muted apples to apples sale that supports the significant rise in bay area housing prices: 449 Mountain Avenue in Piedmont.

That said, I’d keep my money in stocks ahead of real estate as historical rates of return have always been much higher for the former ☺️

If we’re not mistaken, 449 Mountain was partially remodeled between sales, including an upgraded kitchen, so it wasn’t actually “apples-to-apples” but an impressive result.

Regardless, we completely agree that there has been a significant rise in Bay Area housing values over the past two years, at least on average. But the gains haven’t been evenly distributed. San Francisco proper has significantly lagged the “San Francisco Index” (which is a key point, not distortion, of our apples-to-apples comparisons). And even the Bay Area trend has started to slip.

Which brings us back to the high-end apartment at hand.

If every $50K kitchen renovation (I asked my neighbor who was the former owner how much he spent) resulted in a $1.6 mln gain, I’d renovate every house I owned. That said, the bigger reason for the impressive gains on this recent sale was the surprisingly low (pocket) sale price of the home in 2019. Best deal in Piedmont that year for a house that was superficially outdated but in otherwise good condition and with no red flags. Kudos to the recent seller for his tasteful update. Guess mid-century still sells.

And renovations and additions (don’t forget the landscaping, new outdoor shower and soaking tub and updated living room) add value, beyond their costs. But unfortunately, they’re not “apples-to-apples” or representative of appreciation per se.

I have done both stocks and real estate investing. I’m even with both at 6 million each.

You should find a new broker.

For which asset class?

I’m uncomfortable just looking at photos of the floor-to-ceiling windows. I wouldn’t be able to go near them, so in terms of price per sq ft of usable space, I’d be paying over $5,000 sq ft.