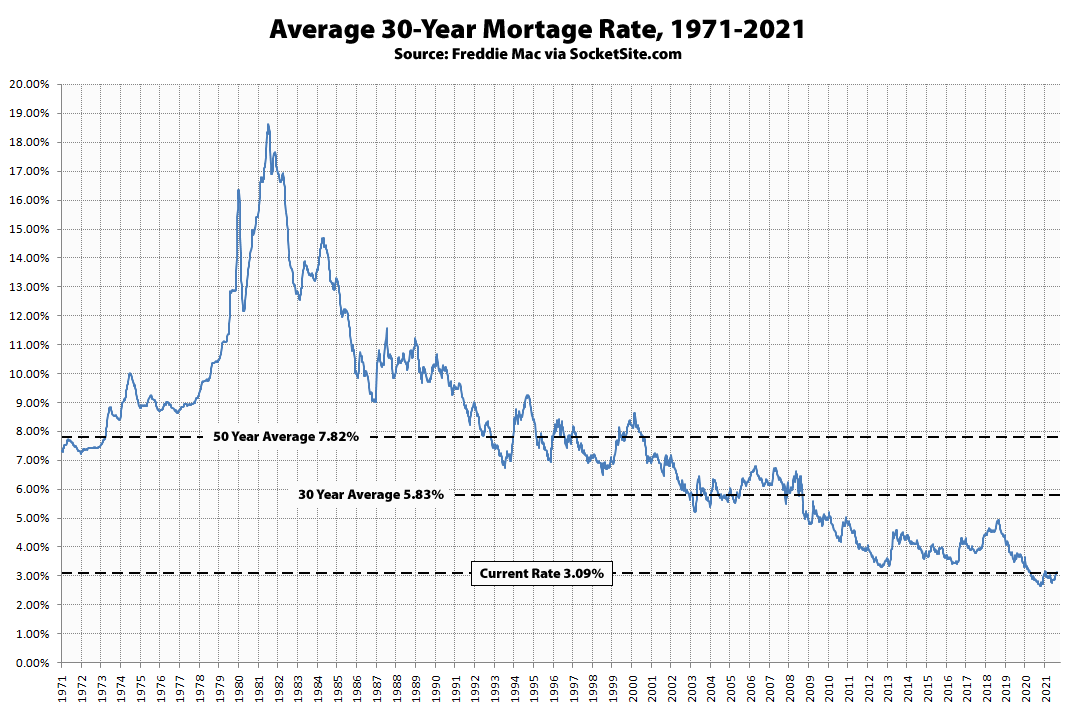

The average rate for a benchmark 30-year mortgage inched down 5 basis points (0.05 percentage points) over the past week to 3.09 percent, which is 31 basis points above its mark at the same time last year, 44 basis points above its all-time low of 2.65 percent this past January and within 10 basis points of a 16-month high.

Keep in mind that the average rate was measured prior to the Fed’s announcement yesterday, which effectively confirmed expectations of the Fed starting to taper its bond-buying program, which was already priced into the market, followed by a rate hike next year, and the yield on the 10-year treasury, which drives the 30-year mortgage rate, is effectively back to where it was prior to yesterday’s announcement.