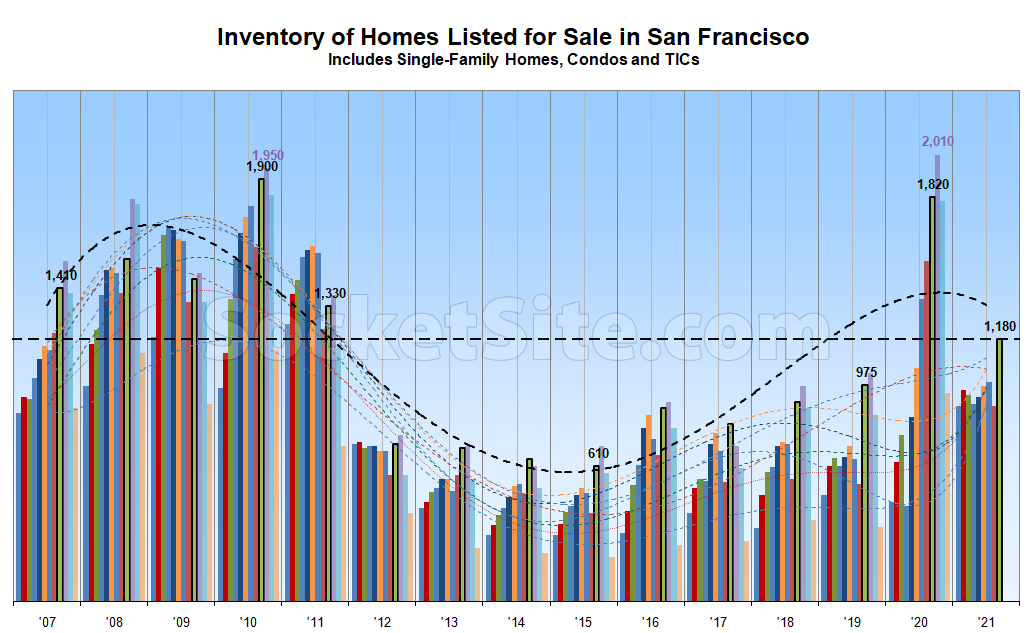

Having jumped last week with the most new listings in over 15 years, which shouldn’t have caught any plugged-in readers by surprise, the net number of homes for sale in San Francisco (i.e., inventory) has since ticked up another 11 percent to 1,180.

While inventory levels in San Francisco are still down 35 percent on a year-over-year basis, there are now 21 percent more homes on the market than there were at this time of time of the year in 2019, prior to the pandemic; 71 percent more homes on the market than there were at this time of the year in 2015; and the most homes on the market in a decade, save for last year.

Expect inventory levels to continue to climb through October before dropping again in November, and through the end of the year, as unsold inventory is withdrawn from the market and reductions tick up.

sellers getting off the fence with prices up strongly for SFH

Indeed. Inner Sunset was $800/ft in July 20. Now regularly @ $1,100-1,200/ft. Amazing.

Figure supply will become an issue at some point….

The average price per square foot for single-family homes in the Inner Sunset has been running around $1,040 over the past year, which is actually up around 5 percent from $990 per square foot the year prior (which includes July of 2020).

“$800/ft in July 20” represents a gross misrepresentation of the market.

Amazing? or Inflating?

Inflation has hit 5.3% YoY which puts real psf for the Sunset just about flat per the editors numbers. We’ve spent a long time with inflation in the 0’s,1’s & 2’s so it’s been easy to neglect it. But it looks like that might be changing.

I’ve seen arguments both ways about this being a transitory inflation blip vs a longer term uptrend. How that argument ends up is going to make a big difference. People with jobs that have wages rising with inflation can make out great with a long term fixed rate loan if inflation keeps up. Variable rate, shorter term and rent controlled investment properties can be economic boat anchors during inflationary times.

Interesting times.