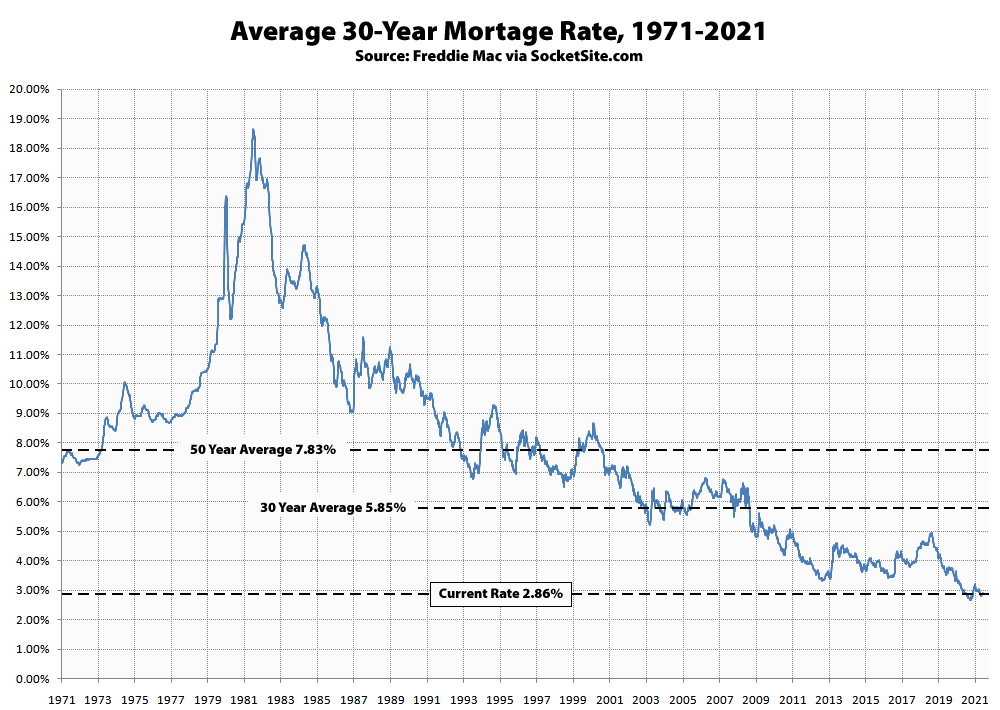

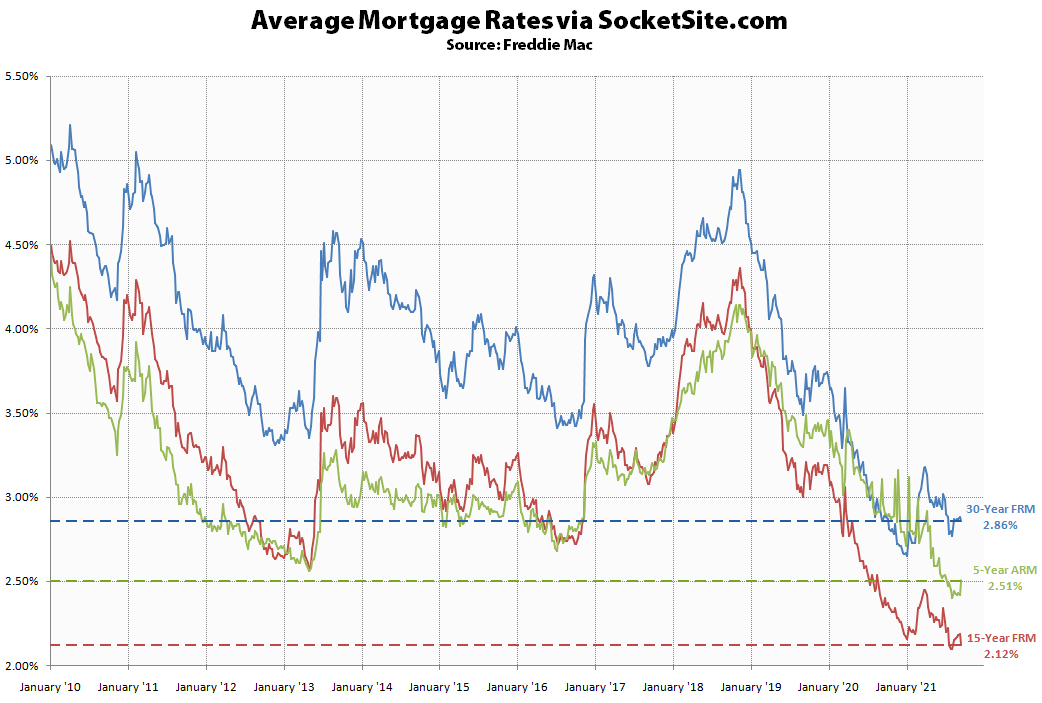

The average rate for a benchmark 30-year mortgage inched down 2 basis point (0.02 percentage points) over the past week to 2.86 percent, which is effectively even with the prevailing average rate at the same time last year (2.87 percent) and within 21 basis points of its all-time low.

At the same time, the average rate for a 5-year adjustable rate ticked up 9 basis points to 2.51 percent but remains 45 basis points below its mark at the same time last year, and within 11 basis points of its all-time low, while the average rate for a 15-year fixed-rate mortgage ticked down 7 basis points to 2.12 percent which is 23 basis points lower than at the same time last year and back to within 2 basis points of its all-time low.

And with rates hovering near their historic lows, purchase mortgage activity in the U.S. is down 12 percent on a year-over-year basis and pending home sales activity in San Francisco, which peaked in April, just slipped on a year-over-year basis for the first time since June of last year.

This will be the case till 2030 in my mind. I don’t see how they will ever raise it.

UPDATE: The average rate for a benchmark 30-year mortgage inched back up 2 basis points over the past week to 2.88 percent which is 2 basis points below its mark at the same time last year.