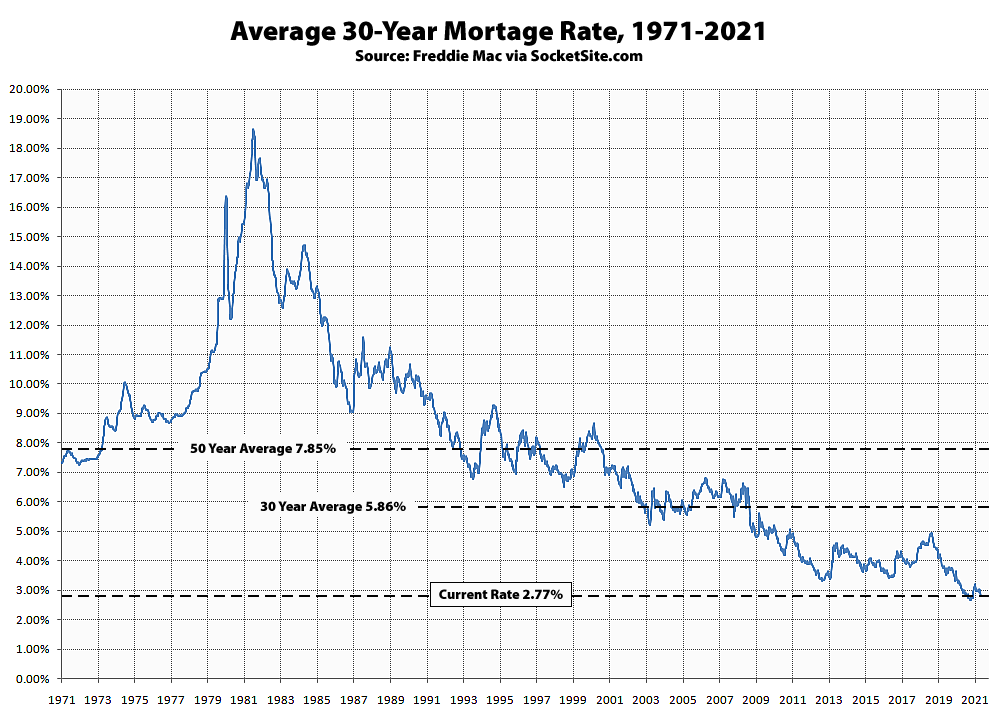

The average rate for a benchmark 30-year mortgage inched down 3 basis points (0.03 percentage points) over the past week to 2.77 percent, which is 11 basis points below its mark at the same time last year and within 12 basis points of the all-time low rate of 2.65 percent set in January.

At the same time, the average rate for a 5-year adjustable rate mortgage ticked down 5 basis points to a record low of 2.40 percent, which is 50 basis points below its mark at the same time last year, and the average rate for a 15-year fixed-rate mortgage held at its record-low mark of 2.10 percent it set last week and is 34 basis points lower than at the same time last year.

And once again, despite the drop in rates, mortgage loan application volumes ticked down 2 percent across the U.S. over the past week, with purchase mortgage application volume down 18 percent, year-over-year.

Every modern economy is now the Japanese economy.

I think I only kind of understand that, can you expand? Like the fed is trying to juice the economy, but they’ve run out of tools? Or is there more to your point?

Anyone seeing 10/1 interest only lower than 2.75%

Yes! BofA has great rates right now. I got a 7 yr at 2.375 with no points.

I actually understated how good the rate is. I got closing credits, so it is actually -40 bps in points. I’m obviously very happy with the rate 😉

wow. was that a jumbo , can you pay interest only, and was it for a refi or a new purchase?

Jumbo refi. The principle + interest is amortized over 30 years. Apparently rates jumped a lot this week though, so it does seem like these record lows are about to end.