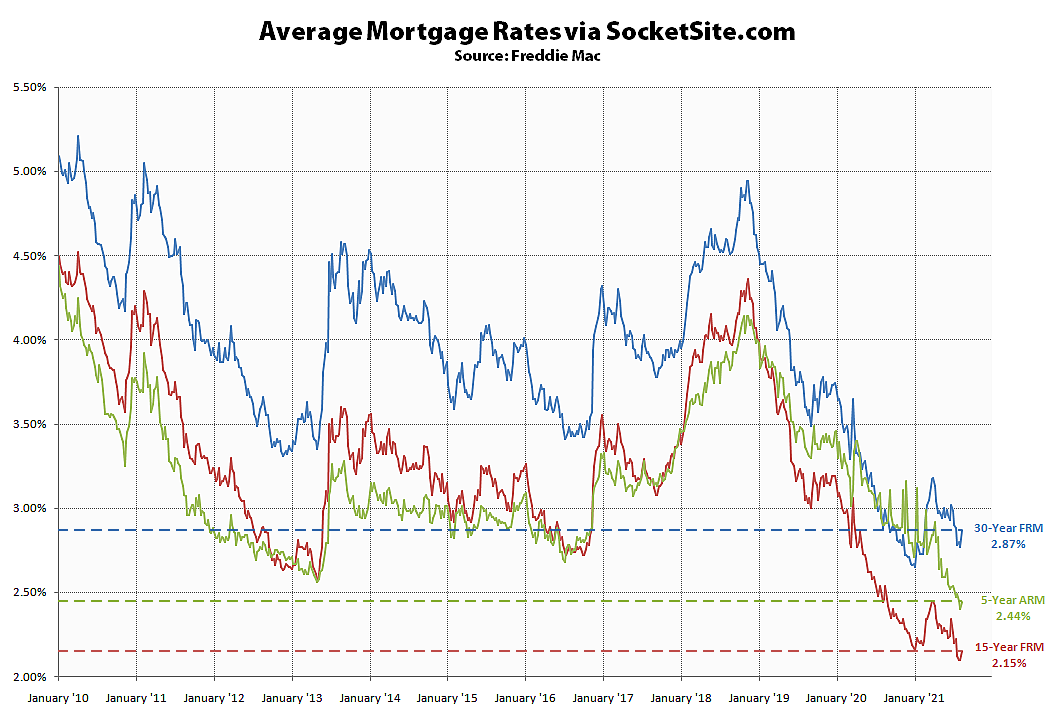

The average rate for a benchmark 30-year mortgage inched up 10 basis points (0.10 percentage points) over the past week to 2.87 percent, which is still 9 basis points lower than at the same time last year and within 21 basis points of its all-time low.

At the same time, the average rate for a 5-year adjustable rate mortgage inched up from a record low of 2.40 percent last week to 2.44 percent, but is still 46 basis points lower than at the same time last year, and the average rate for a 15-year fixed-rate mortgage inched up from its record low of 2.10 percent to 2.15 percent, which is still 31 basis points lower than at the same time last year.

And while mortgage loan application volumes in the U.S. ticked up 3 percent over the past week, purchase mortgage activity is still down 18 percent on a year-over-year basis for the fourth week in a row.

UPDATE: While mortgage rates were little changed over the past week, with the average rate for both the benchmark 30-year and 5-year adjustable rate mortgages having slipped 1 basis point (0.01 percentage points) to 2.86 and 2.43 percent respectively, and both are still lower than they were at the same time last year, by 13 and 48 basis points respectively, mortgage loan application volumes in the U.S. were down 19 percent on a year-over-year basis.