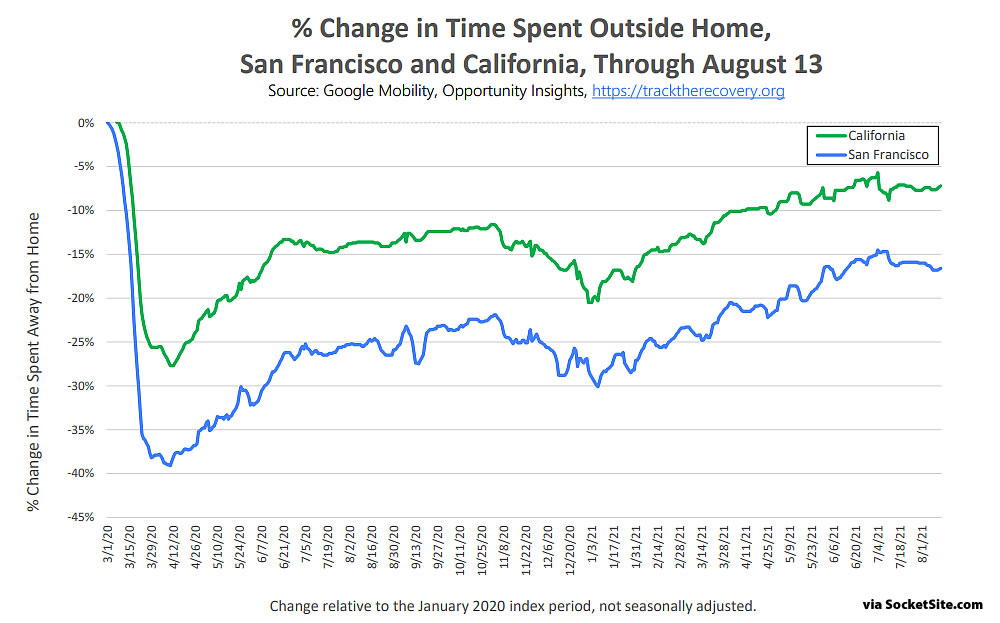

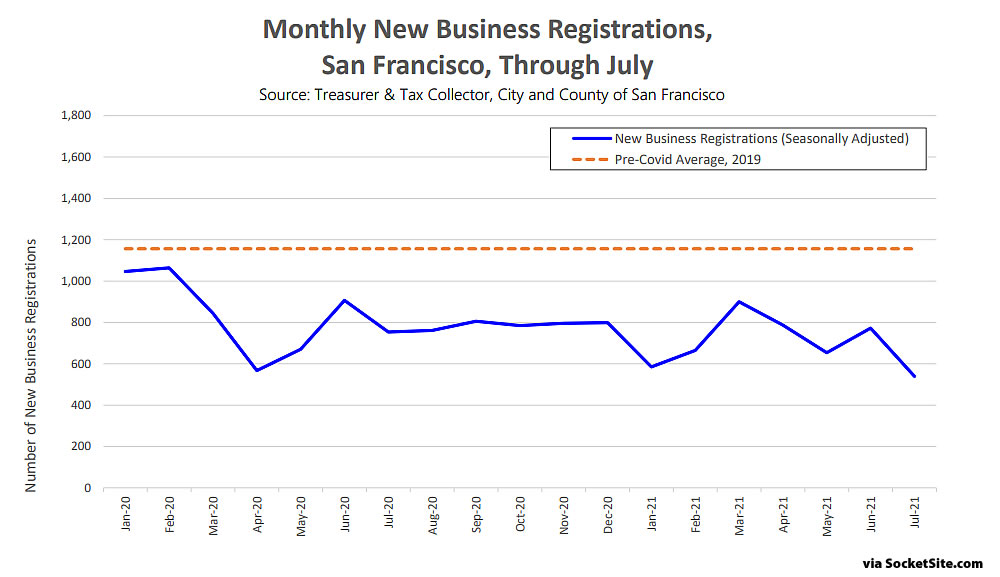

To quote a new report from San Francisco’s Office of the Controller and Economic Analysis, “the emergence of the Delta variant has stalled aspects of the city’s economic recovery,” with a pullback in the amount of time residents have spent outside their homes; another dip in office attendance; and a downturn in small business sentiment and new business registrations, which were half their pre-COVID average last month.

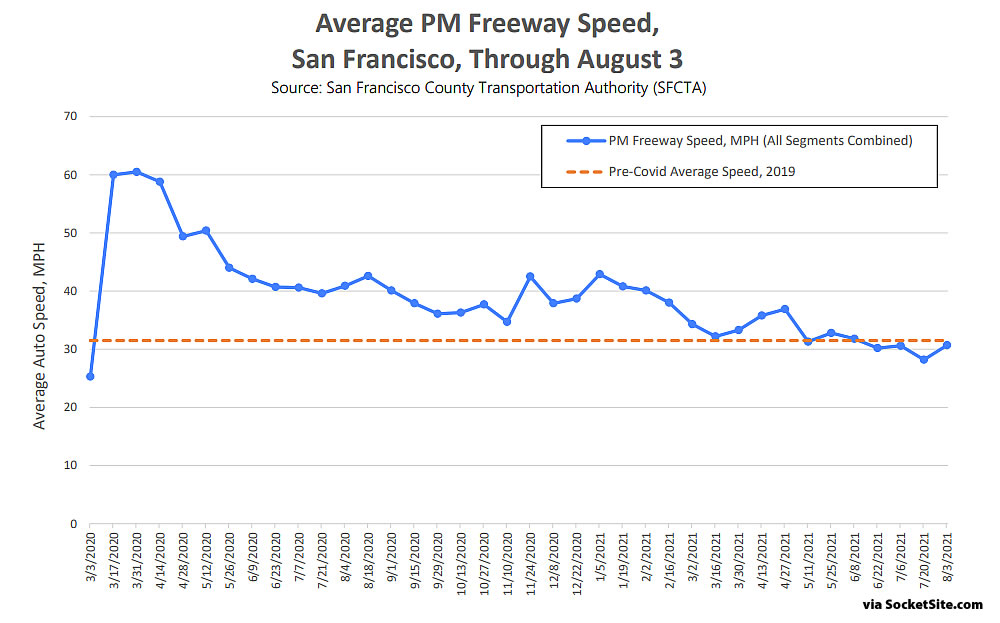

While the average moving speed on local freeways during the evening commute hours has inched back up, it’s still below pre-Covid levels, driven by a reduction in the use of public transportation versus underlying job growth.

And as we outlined last week, while the weighted average asking rent for an apartment in the city has ticked up, the implied vacancy rate in the city has actually ticked up, not down, over the past few weeks, reversing a six-month decline in inventory levels. We’ll keep you posted and plugged-in.

This thing is going to drag well into 2022. Big Tech is already pushing [RTO] to January 2022. My guess is we will a see a similar pattern as last year, which is a massive spike in cases in January related to holiday season gatherings. That won’t calm down until Feb/March 2022, so we might be looking at April 2022 for a general re-opening.

And what do you see to prevent an endless cycle of Lamda, Epsilon, double Psi, etc. variants pushing this into the 30’s??(2130’s, that is)

Hopefully, some combination of “it’s not that bad/risky,” “I’m over it,” and approaching 100% of people who are vaccinated or have antibodies from getting it.

aka: “resignation” Sounds like a plan (maybe not a good plan exactly…but a plan nonetheless)

Exactly like you see “resignation” concerning the flu, and other infectious diseases.

COVID is *never* going away. You’re either “resigned” to that, or live the rest of your life in fear.

You give two options: “resign” to it being permanent or living in fear. You’re leaving out the third: get vaccinated.

@SFRealist,

I’d assumed vaccination for both options, but feel free too add it separately.

COVID is still never going away. Vaccinated or not.

San Francisco will be one city that sees long-term negative economic impacts because of the virus and the virus just accelerated trends that were already in place. San Francisco will not return as as strong a business/tech center as it was pre-pandemic and it will not reach the population peak it hit a few years back.

From the SF Business Times:

Wells Fargo’s chief economist recently said he expects San Francisco will still be a powerful draw for the young and unattached. But for families and employers, it’s a different picture. “We’re seeing that a number of companies are choosing to move out — or move their headquarters out, or just get rid of the whole concept of a headquarters in markets like San Francisco or New York, where it’s very expensive to house peoplel Brex and Coinbase have hopped on that train. The two companies were once based in San Francisco before embracing a no-headquarters model.”

Ironically Wells Fargo’s Project Falcon is rumored to be a search for a new headquarters for the banking company which has recently been rumored to be planning its own departure from San Francisco.

This week the SF Business Times listed another 4 companies that recently announced their moves out of SF. Since those announcements and just this week Homelight announced their departures and several weeks ago Zynga said it will close its Townsend headquarters as it departs SF – and in the process is putting almost 200K feet of space up for sublease at its Townsend Street headquarters. .

As some companies choose to use hubs rather than a large headquarters the Bay Area hub that makes sense is Oakland and the East Bay because of its proximity to most of the BA and its great transportation links. Hence the residential real estate market is booming in Oakland. Oakland last year built more than double the number of new residential units than did SF with thousands and thousands of additional units set to move forward.

On top of that SF’s hotel industry has seen the worst recovery of any city in the US. Worse even than NYC’s. And what does the City want to do – raise the hotel room tax. Until SF cleans up its streets (a daytime murder occurred on mid-Market a week or so ago as well as a shooting outside of the Disney store) tourists and convention won’t come back.

Eventually there will be a recovery of sorts but it will not return San Francisco to its previous status in terms of a business and tourist center.

Generally agree. One area I disagree with is about Oakland becoming the most strategic location for an HQ. An Oakland HQ is a downgrade for those in SF, Marin, the Peninsula and most of the San Jose area. Most of the knowledge workers live in those areas, not in the East Bay. It’s also a downgrade for young people who want both city life the most (SF is better than Oakland) and office life the most regularly.

I think you’re more likely to see companies maintain a smaller but trophy location in SF.

You keep on sighting are really nothing, and a drop in the bucket. Zynga was half way out the door – big deal. I have friends at Zynga, they still like living in downtown SF, despite the HQ moving. HQ’s may move, people won’t necessarily do so – especially with a flexible hybrid schedule.

We have several friends (all in tech, as am I) who are all returning from Texas – it turns out, Texas is full of Texans and they don’t fit in. And, it’s just not a great place.

Sure, SF will be a slower than NYC return, but here are some facts:

-Major tech companies are worth literally double of what they were a year ago. They need to build products to make money to justify that market cap. That means hiring – a lot of people.

-People who like to live on the west coast, know that the Bay is the best area on the west coast. LA is just boring, and a bedroom community, and Seattle sucks because of the rain.

-My condos can still fetch the money they would have a year ago at this point. Maybe a 5-10% loss, but no big deal.

-I bought another condo, and it shot up significantly. Desirable neighborhoods it turns out, hold their value.

The great condo collapse really never happened. It bottomed out last year and will only keep climbing at this point.

At this point, with Covid eventually getting sorted out, the cities can only benefit from that. And, in time it WILL happen. You have to be delusional to see that’s it’s going to get worse going forward in SF.

“People who like to live on the west coast, know that the Bay is the best area on the west coast.”

Which is why Los Angeles and San Diego are the 1st and 2nd most populated West coast cities, respectively.

Try third best.

And, too, why Seattle is the fastest growing West Coast city.

That and it doesn’t throw up impediments to building.

Lets see what LA looks like in 10 years of global warming.

There is a reason the prices are highest in SF proper. Supply, demand – desirability.

LA is a giant middle class city.

“They need to build products to make money to justify that market cap.”

This statement is so backwards. Your whole thing reads like desperate wishcasting by an overleveraged condo holder.

Hmm, but how will that ‘trophy’ location look on the quarterly reports? Sounds more like pipe dreams of management who don’t want to move (aka uproot and lose real estate value given downturn) or commute…

Given how many families moved from SF recently, Oakland is actually a more central and favorable commuting location. All that SF has plus more, including BART, ferries, AmTrak, airport, and many more (redundant) highways to mainland.

In terms of city life for young people, it has been Oakland leading the way for a few years now already. Proximity to 40,000 UC Berkeley students can’t hurt. At some point SF pre COVID SF just became too expensive and challenging. More shockingly we have multiple examples of businesses that have actually relocated from SF to Oakland.

All part of the Great Unwinding…

Multiple? (Blue Shield, Square, PG&E) OK, we’ll let that one pass…namely ‘cuz it seems to be true. That having been said:

(1) Oakland’s ever present crime problem has surged – whether it the same infection or a new variant I can’t say, but probably doesn’t matter which – and while that probably doesn’t affect the ‘movers and ‘shakers’ that much – at least not directly – it still drives the narrative(s)

(2) there’s still a huge infrastructure deficit b/w the West and East Bays (institutions, hotels, retail, Gazillionaires who lay their a$$es down on the sheets at least a few nights a year): that’s going to take a long time to bridge…even proximately.

Oakland is a more central and favorable location…for families in the East Bay. It’s a worse commute for SF, Marin, Peninsula or South Bay families.

– Caltrain is superior to Amtrak.

– There are no ferries from Marin, San Mateo or San Jose to Oakland.

– Oakland’s airport is dying. They are losing airlines left and right who are consolidating to SFO.

– SF dwarfs Oakland for young person amenities. The number of bars/restaurants/nightclubs/music venues or city parks for hangouts is not comparable. Not even close. The only reason Oakland popped is because SF was unaffordable. Downtown Oakland is *dead* at night outside of a block or two near the Fox Theater.

OAK is hardly “dying”: it IS losing fringe airlines – Norwegian, Jetblue – that provided a handful of long-distance routes, but that was never a strength anyway. And at the moment, it’s doing the best – or least badly, if you will – of the three BA airports.

I wouldn’t say OAK is dying, but American has “permanently” (obv they could return) left OAK.

American is not a fringe airline.

Let me clarify: “fringe” in the context of operations at Oakland; I think American offered one or two flights before it bailed. In fact almost every carrier other than Southwest might be called fringe, tho some like Hawaiian or Alaska have large shares on certain routes (Hawaii, PNW).

It’s true that it isn’t back to what it was pre-Great Recession, either in market share or absolute volume, but it’s hardly “dying”. The one – at the moment at least – that’s on-the-ropes is SFO, which has seen huge losses in international and business travel. 30m/yr looks great, to you realize the underlying costs that need to be supported.

The last slide uses traffic jams as a proxy for economic health? I can see the correlation but this is still perverse.

I agree, altho that isn’t quite what they did: they used speed; but since said speed has already returned to norms, and is still at norms, it seem like a pointless inclusion.

If you want a transportation measure that looks sickly, use this: daily updates related to riders returning to BART. 23%?!?! 🙁 Ay…yay…yi

Or as we outlined above, the dramatic drop in freeway speeds during the evening commute has been “driven by a reduction in the use of public transportation versus underlying job growth.”

But more to the point, there are those who are likely to confuse the slowdown/congestion they’ve observed, with their very own eyes!, with the economy/employment having fully rebounded, which is why it’s helpful to understand why that’s not actually the case.

The number of company headquarters leaving San Francisco is unprecedented. A study issued by the Hoover Institution three days ago found this:

“For the first six months of 2021, the number of companies relocating their headquarters out of California is running at twice the rate of recent years and is showing no signs of slowing … The research provides the most detailed and comprehensive data on relocations of California business headquarters from 2018 to the first half of 2021, documenting that departures during the first half of this year are double the rate for each of the three previous years.”

Los Angeles County lost the most company HQs, at 47, followed by San Francisco at 47, which lost some giants firms such Bechtel Group, McKesson Corp., and Charles Schwab, and smaller firms such as GetSales. HomeLight and Moov Technologies. Overall, The top three states that California company HQs relocate to are Texas, Tennessee and Arizona, in that order.

The study period ran from Jan. 1, 2018 through June 30 this year, and since the cutoff date another 6 San Francisco companies have begun packing their HQ bags for out-of-state locations.

Bbbbbbut … Tesla…. facebook … stock price.

Aligns exactly with what the WF analyst said. The argument that companies will keep small trophy offices in SF is not likely given the headquarters tax that exists in SF.

The other trend are the moves within the Bay Area – from SF to Oakland and other Bay Area cities. Or to SOCAL as a few companies have exited SF for SOCAL. BTW, Twitter recently signed a big Oakland lease which will see workers moved from its SF office to Oakland.

Not as bad as downtown Seattle, tho.

If I was a CEO in San Francisco, I’d move out just because of the marxist CEO tax. Let all the CEO’s leave and then the “homeless”, San Francisco spends billions to cater to, can take their place. What a lovely future San Francisco has !

The Hoover Institute is Fox News wearing a Brooks Brothers suit.

Very true. Remember when they projected the Covid would kill 500 people?

Perhaps they should stick to their own expertise (i.e. a business oriented organization addressing business issues).

That having been said, the bias is apparent in the full title “Company Headquarters Leaving California in Unprecedented Numbers for States With Lower Taxes, Sensible Regulations and Friendly Public Officials” (emphasis added,,,and it’s the title of the article, not the study itself); and while the numbers may well be correct, they lack any context of how many companies moved-to or started here, and how many companies there are overall.

im trying to lease office space for about 20 people in embarcadero area and strangely they are not willing to budge on price. Cant understand how leasors are not feeling the burn to fill up the spaces

It depends of the mix of the empty space in buildings. If most of the vacant space is up for sublease then the original leaser’s are committed to paying the rent though 2025 or whenever the lease expiration date is. In this scenario a building owner can leave space that is actually vacant (not up for sublease) empty and not lower asking rent without taking a big hit.

The downward pressure on office rents in SF will come as the subleased spaces’ original leases start to run out and the owner’s lease income actually dries up. The Townsend Street building being vacated by Zynga and AirBnB is or will soon be 80% vacant but both companies are committed in multi-year long leases so the owner of the Townsend building won’t take much of a hit – for now. .

Curious, isn’t it, jimbo? Historic high vacancy rates and record low demand, yet _some_ rates have dropped somewhat while others barely or not at all. It’s almost as if there’s a flaw(s) in the S&D model that says prices will drop in response to a collapse in demand and restore “equilibrium.” it’s almost as if what passes for “law” in economics is fuzzy voodoo. It’s a real puzzler! ?

(the answer is in the many unaccounted-for variables that the textbooks ignore, but acknowledge the possibility of with the vague, all-purpose, hand-waving exemption of ceteris paribus).

Among the factors preventing the price discovery S&D implies: LLs in the Embarcadero tend to be institutional entities, possibly multi-national, and often more concerned with maintaining asset values than with cash flow; they keep prices up to avoid the hit to value that price discovery would bring. Other LLs defer price discovery in order to avoid lender penalties that lower rents would trigger. Keeping rates high fends off current tenants who would demand renegotiated terms. Keeping rates high helps maintain the illusion that demand is still high.

And so on…

“the S&D model that says prices will drop in response to a collapse in demand and restore equilibrium”

There is a “model” you would see only in a third grade textbook.

Both supply and demand are curves (or schedules). A renter will not simply suck it up and pay any price, no matter how high, because that is the “supply” price. The rents that a pool of renters are willing to pay is a curve. And a landlord will not simply drop rents to any price, no matter how low, for the very reasons you describe, among many others. Expectations about future prices is a key one, and I suspect SF commercial landlords expect better rents in the future (we’ll see if they are right) and so they are declining to offer lower rents right now. Supply is also a curve. Sometimes the supply curve and demand curve simply do not meet at a price or quantity equilibrium, and you don’t reach a deal. That doesn’t mean supply and demand is “wrong” but is actually an implicit feature. Eventually, in the long term, there will be an equilibrium, but it plays out over a long time with something like commercial real estate. Easy to attack a nonsense strawman definition of supply and demand.

I’m addressing S&D the way the real estate cadre on the board invariably invoke it. Their answer to a lack of unaffordable housing is to build more luxury condos, because supply & demand!

We all know about the curves and how the model works in the Econ 1 text most people here read (which apparently makes them all economics experts). They use this theoretical model that depends on specific conditions that aren’t met in the real world to justify certain economic activities that have failed to provide affordable housing for decades, but which have benefited themselves greatly. Their answer to that is always, “b-b-but the model didn’t fail, we didn’t build enough!” It’s a tautology.

I didn’t say S&D is “wrong” – it works perfectly in theory, on paper, where all the unacknowledged variables can be excluded.

I’m glad you mention that equilibrium is reached in the “long term.” It’s the ultimate hand-wave. Define “long term.” Show me where it’s plotted against the curves in your Econ 1 S&D model. It’s an excluded variable. As we all know, “real estate is sticky.” For the reasons I mentioned above, among others. When will “equilibrium” be reached? “At some point in the future.” How will we know when “equilibrium” has been reached, and what will it look like? “We will know we are at equilibrium when equilibrium has been reached.” Again, it’s a tautology.

Yes, at certain times, S&D can reasonably model a real estate market in the real world, but if the model doesn’t factor in speculative bubbles on the way up and “sticky” on the way down, you have a very misleading model.

Define “long term”

Most of the time in real estate, it takes days or weeks for markets to clear, ie for an equilibrium where the supply and demand curves intersect and a deal is reached. It can take longer when there is a shock to the system. For example, when no down neg-am financing was yanked in about 2007, the demand curve changed wildly because a huge pool of home buyers no longer had access to free money. But housing prices did not plummet immediately because people (and banks) do not like to sell homes at big losses. So markets froze for a little while. No equilibrium. Eventually, the supply curve shifted as owners walked away, banks foreclosed, etc. And a new equilibrium was reached. In 2020 we had a pandemic that shocked commercial real estate. Supply and demand curves again fail to meet. Something will give eventually, either landlords (and their lenders) will drop rents shifting the supply curve, or tenants will return and bid up rents shifting the demand curve. Supply and demand in action. Good models have existed for this for about 100 years.

Heck, we’ve even had pretty good models for this at the individual transaction level for about 70 years. See Nash bargaining.

I agree that “build more luxury condos” will not inevitably and immediately bring lower housing prices. But over the long term, more housing units will bring about lower housing prices (that is, lower prices than if there were fewer units) under any model of supply and demand. This is why housing in Texas is much cheaper than housing in California.

Housing is cheaper in Texas because land and labor are cheaper, they don’t have to build to earthquake and energy-saving codes, and developers have carte blanche to erect whatever garbage box they want, wherever they want, whenever they, however they want.

Also, wages are the most important factor in rents. Rents closely track wages. The 3x rule that every LL knows (and which many are now bumping uncomfortably into). Not to worry, though: based on the garbage boxes they are throwing up all over the place, many SF developers seem to have a mission of making SF more like Houston…

Construction of expensive housing will lead to more development of expensive housing and upgrades of existing units. People like living around rich people (especially when property taxes finance the public schools) and are willing to pay for that privilege. Show me how the development of expensive housing has reduced the cost of buying or renting anywhere. It has never worked that way.

Economics is really much more complicated than these simplistic [“supply and demand”] models.

Things are cyclical. Look at the grand homes along South Van Ness, for example. At a point in time that was the shabby chic millionaire’s row. Then, over time, the homes became compartmentalized and the neighborhood shifted mighily. For decades it was a very affordable area. In recent years we’ve seen very expensive sales along that boulevard, but only just recently if one takes a long view.

In related news: New Unemployment Claims Drop but Remain Historically High