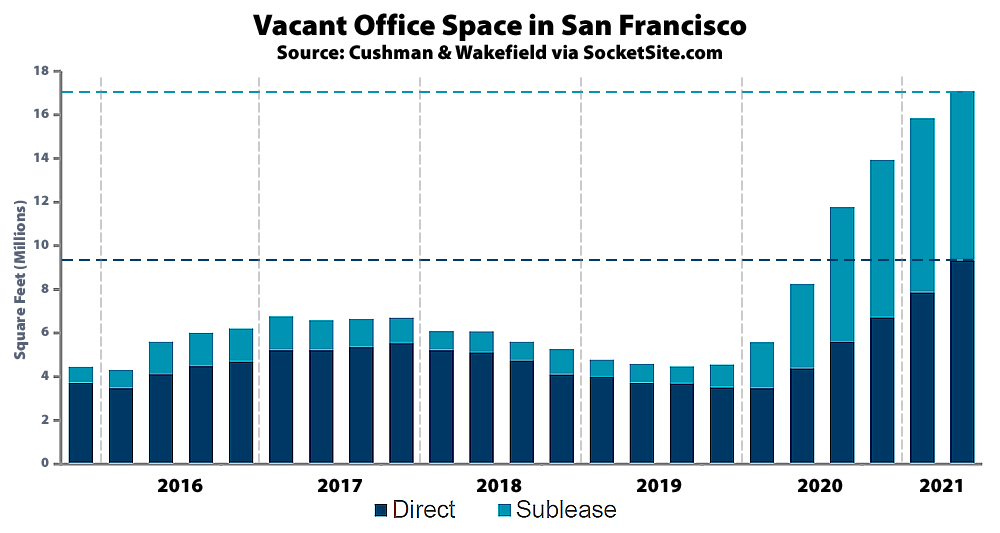

With all COIVD-era restrictions on office building occupancy rates having been eliminated last month, the effective office vacancy rate in San Francisco has ticked up to 20.1 percent, representing over 17 million square feet of vacant office space, with 7.76 million square feet of space which is technically leased but sitting vacant and actively being offered for sublet, which is down slightly from 7.99 million square feet of sublettable space in the first quarter of the year, and 9.33 million square feet of un-leased space, which is up from 7.97 million square feet in the first quarter, according to Cushman & Wakefield.

While office leasing activity in the second quarter totaled nearly 1 million square feet, which was the highest total since the first quarter of 2020 but included Levi’s renewal of 400,000 square feet of space at Levi’s Plaza, net absorption was a negative 2 million square feet which pushed the office vacancy rate up from 17.8 percent in the first quarter of 2021 and versus 8.4 percent at the same time last year.

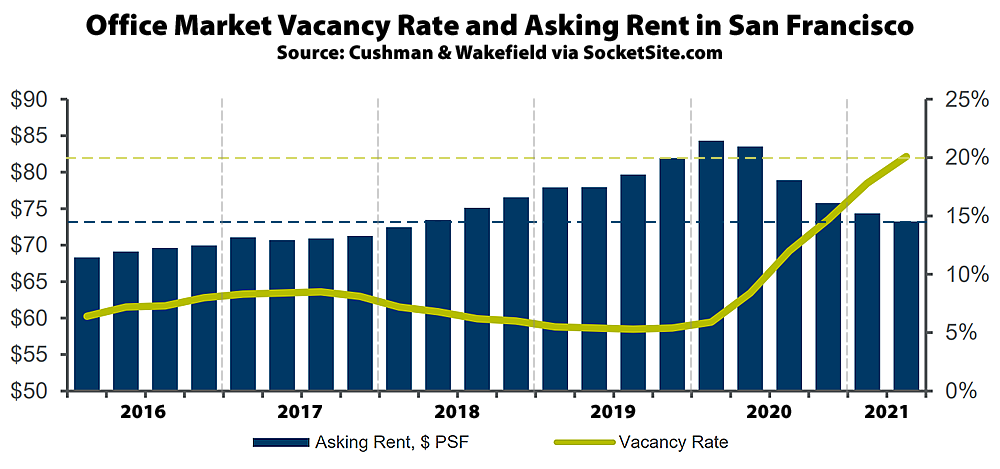

And while landlords had held firm through the second quarter of last year, the average asking rents for office space in San Francisco has since dropped 12.6 percent to $73.24 per square foot, per year, which is back to mid-2018 pricing when the vacancy rate was running closer to 7 percent, which suggests there’s quite a bit further to drop, particularly with the aforementioned increase in direct vacancy rates.

Still too expensive

You got that right!

I don’t disagree, but this graphic is marred by the same problem that mars all such “asking rent” ones: it’s “realized rent” that matters. Yeah, sure, there may be some precise – or at least openly known – relationship b/w the two, but me worries the relationship is much like “list prices” (for homes).

P.S. oh yeah, the actual topic at hand: the city ..excuse me The City is still largely vacant….bummer (some Celibate Impala assured me everything would be back to normal “by July”)

The negative net absorption continues and reflects in part the ongoing exodus of companies from SF. More recently these have been smaller companies but Twitter just leased a chunk of space in Oakland about equivalent to the space it subleased in SF a year ago. Is a move to Oakland in the offing – all Twitter will say is that for now its headquarters will remain in SF. An expansion/relocation to Oakland by Twitter has been rumored for months and fits with Dorsey’s plan to decentralize workers. Oakland provides a more accessible central office location for the company than does SF. To Oakland’s credit it has snatched a number of business relocations in the past year plus, including PG&E and Credit Karma.

SF remains plagued by negative publicity and a still over-priced glut of office space that could take well more than a decade to fill.

We had dozens of our startups (I’m an angel investor) moving to SF pre-pandemic, and folks wanted to come here for our accelerator for 12 weeks.

We are investing 2x as many companies now, and none want to come to SF — like literally zero. Also, our accelerator went 100% remote, so the thousands of investors who would fly in a year to spend time with these dozens of new startups every year are meeting them on zoom (and investing in them over zoom).

I feel this will be a LOT worse than people think because you have two major things happening at once: 1. remote work/work from home becoming the new standard for tech AND 2. SF being completely undesirable to young founders (and families, which the senior executives at venture-backed tend to have)

All-in is the sh*t. Keep kicking ass.

I’ll add another data point. My start-up (now 6 yrs old, and in the midst of raising our C-round) has grown quite a bit over the last year. Pre-pandemic, we hired locally. But due to the need to hire quickly, a tight local labor market, and uncertainty about whether/if/when we’d be returning to the office, over time, we loosened our local residency requirement for new hires. Our only requirement now is that employees share a timezone with the US.

Having gone down this road, we’ve now essentially locked ourselves into at least a hybrid, if not fully remote employment model. Once you hire a few people out of town, it becomes infeasible to impose an in-office requirement on the local employees while having a different standard for those from elsewhere.

This structural change in our work model is obviously going to impact our space needs, and I’d be surprised if we’re the only growing startup with this story.

Pre Series A companies will prefer remote, cash is king. Accelerators only invest $100K for 6%. So not having to be in SF is a good decision at that stage. But later stage is a different decision.

While large companies are not going to go 100% remote, it’s been pretty clear for a while now that things are not going back to where they were. Bloomberg just came out with an article that dovetails with much of the scuttlebutt that I’ve been hearing. Even Apple, which due to their culture and the multi-disiplinary nature of much of their work I’d expect to be one of the least remote friendly companies, is now coming around to a new decentralized reality:

“The company’s top brass for years fought against decentralization. But that thinking has changed for several reasons based on what I’ve heard from Apple employees…The chief operating officer, Jeff Williams, has internally discussed the cost benefits of a more global workforce.”

As I’ve been saying for a while, what’s uniquely happening now is that we have a pull from the employee side of people wanting to seek out higher quality of life and a push from the company/bean counter side looking at the large cost savings of moving work from the bay area. Apple in particular has countervailing pressures for centralization. But when even Apple is not going back to how things were, there is going to be a great deal of outward pressure for other companies with less cultural bias towards centralization.

UPDATE: Visualizing All the Vacant Office Space in San Francisco