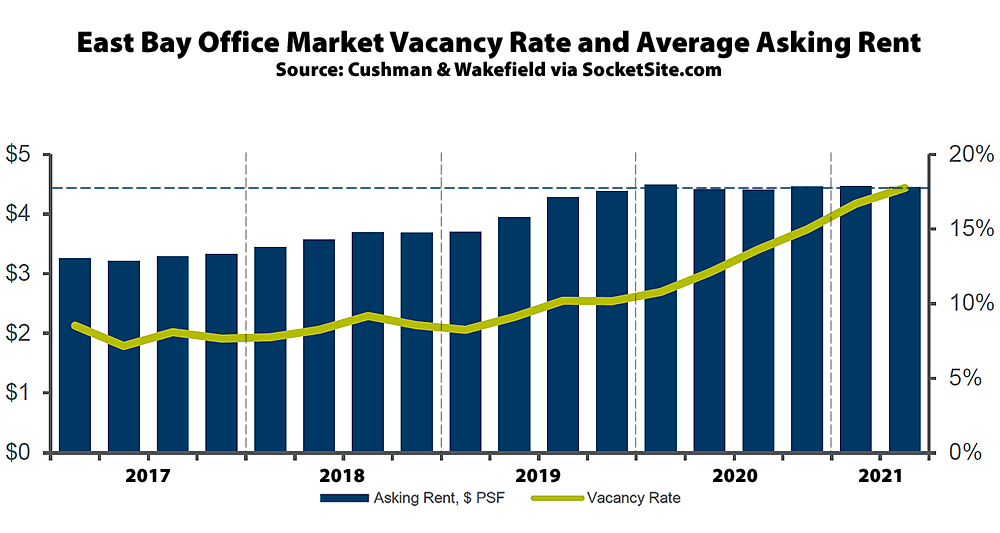

With the office vacancy rate in San Francisco having ticked over 20 percent, with over 17 million square feet of vacant space, the vacancy rate for office space in the East Bay, not including Walnut Creek or further east, has ticked up from 16.8 in the first quarter of the year to 17.8 percent as of the end of June, which includes 4.6 million square feet of un-leased space and 1.2 million square feet of space which has been leased but is sitting vacant and seeking a subletter, according to Cushman & Wakefield.

At the same time, landlords have continued to hold firm in terms of asking rents, as had been the case in San Francisco.

And in fact, the average asking rent for East Bay office space actually inched up one cent ($0.01) over the previous quarter to $4.46 per square foot per month, which is $0.04 (0.9 percent) higher than at the same time last year, but with rents in Oakland’s Central Business District (CBD) having dropped 5.8 percent ($0.31) over the past year to $5.00 per square foot per year with 3.1 million square feet of that aforementioned 5.8 million square feet of vacant space located in the CBD.

Surging vacancy rates since mid-2019, yet asking rents have hardly budged, while some quarters even show an inverse relationship between demand and price…supply & demand at your service! ?

But I thought the East Bay is crushing it while SF goes to hell?

Maybe you missed the graph showing asking in SF down by ~12% – as opposed to stationary here in the EB – and if perchance you did, the italicized “had”(been holding firm) should be a tip-off. Much ado about little? Well that’s a defendable position, I suppose… ‘course the melodrama you yourself supplied.

Meanwhile another 200K feet once was once occupied by Coinbase – which announced it was shuttering its SF headquarters earlier this year – just hit the SF sublease market. Perhaps pushing it to a new high in terms of available space.

Still too expensive!