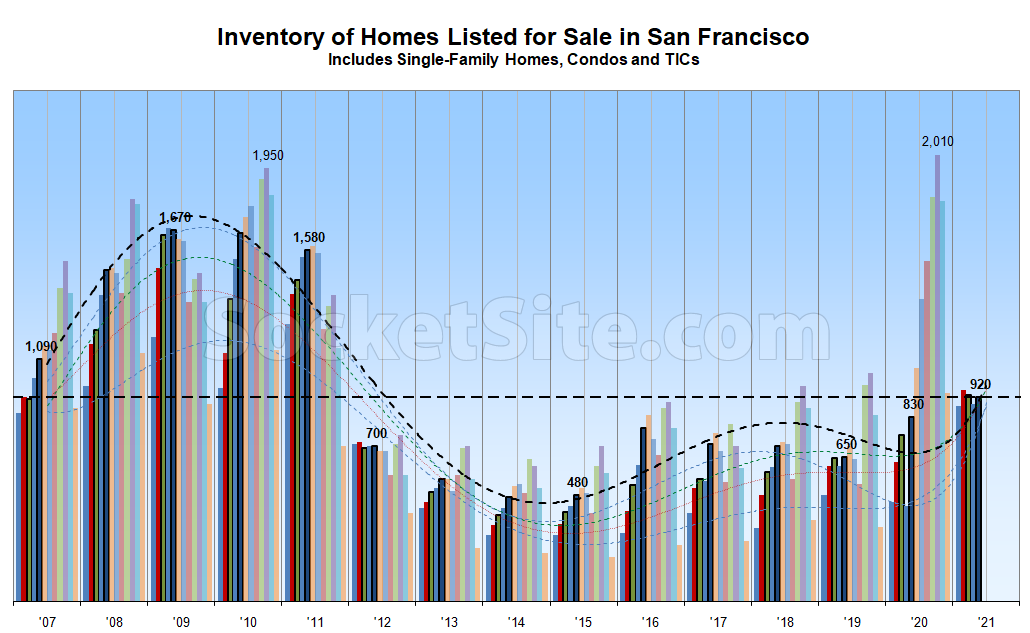

Having inched up 2 percent last week, the net number of homes for sale across San Francisco has since ticked up another 4 percent to around 920, which is 10 percent more homes on the market than at the same time last year, another 10-year seasonal high and 90 percent more inventory on the market than there was in mid-May of 2015.

At a more granular basis, listed single-family home inventory (270) is roughly even versus the same time last year while the number of condos on the market (650) is up 15 percent with the list price for 23 percent of the condos on the market having been reduced at least once, and 15 percent of the listings for single-family homes, versus 15 percent and 17 percent, respectively, at the same time last year.

And while the number of homes in contract across San Francisco is still up around 50 percent versus the same time last year, pending sales dropped 6 percent over the past week with an average list price per square foot that’s down 7 percent, year-over-year.

The SF Business Times today features an article about the exodus from SF actually picking up. A number of realtors are interviewed with stories of their client’s departures.

Of note, one phenomena is people who left SF and put their home up for rent intending to eventfully return but now deciding not to return. These folks are putting their homes on the market now which may be part of the uptick. The stories are interesting – one family who moved to Boise said it’s easy to meet ex-Californians there. So many have moved to Boise that home prices are up 33% in a year with a median price of 465K. I have properties on the Washington side of the Columbia east of Vancouver and their values have surged this year. Many buyers are from California and they often purchase via Zoom and not a personal visit.

Only time will tell is the exodus is accelerating as the article headlines.

At the same time, Apartment Rents in San Francisco Appear to Have Bottomed and rental inventory has actually dropped, at least factually speaking.

But the population of San Francisco has declined, just not by “10 percent!” (as implied by some flawed “analysis” last year).

I’ll agree that using the mail forwarding data to get to a quantitative population change number is not straightforward. The Public Comment blog did update their data to make a YoY comparison ( which showed a 5x jump in outbound mail forwarding) and report inbound forwarding during that period (which at 40k was larger then I would have expected).

But I think that qualitatively it would still be nice to see that data updated. The mail forwarding data looks to be updated at least monthly and it would provide some insight into the assertion that Dave made about the exodus picking up vs plateauing vs reversing. It certainly seems that looking at that data would be more useful then dueling anecdotes saying “Someone just moved into my building” vs “Someone just moved out of my building”

Even more useful, and quantitatively sound, are the California Department of Finance population estimates, which dovetail with the Labor Force trends we outline each month and which shouldn’t catch any plugged-in readers by surprise.

In terms of whether “the exodus [is] picking up vs plateauing vs reversing,” the rental inventory and pricing data that we’ve provided, and consistently track, isn’t anecdotal and counters the anecdotal assertion and throwaway “report” referenced above.

And while “updated,” the mail forwarding “analysis” was still flawed, to say the least. But at least it was directionally correct.

To be accurate the SF Business Times made the assertion. I said only time will tell.

Intention to move back was one reason some people bought and moved elsewhere without selling here, but others simply didn’t have the time or expedience to sell then, or wanted to hang on to the property as an investment. With housing prices surging, some people were content with leaving their properties vacant , expecting to cash in later. As always with bubbles collapses, once general recognition of the decline sets in, there will be a mad and chaotic rush to the exit.

Short of a country-wide collapse in real estate, I don’t see a collapse in SF real estate. I’ve said for several years now that SF real estate would, IMO, track or lag the national appreciation rate for the medium term future. It will also lag the appreciation in neighboring Bay Area counties. The demand is not there to cause another outsized price surge but a collapse is not in the offing either.

Speaking of demand, AirBnB just put almost 300k of its SF office space up for sublease – they’ve already put about 100k feet on the sublease market. It’s decision to move to a more flexible work situation means many less workers in SF going forward. This and all that empty office space will put a damper on home appreciation in SF.

“A number of realtors are interviewed with stories of their client’s departures.”

If it weren’t for that reveal of careful research, given the fact that…Boisie did nothing more than match California…I might mistake your example for clickbait.

Yes. Prices surged in the Sacramento Valley, Placer County, the Inland Empire and San Diego as folks from LA and SF/the Bay Area moved east – young and old, men and women alike.

And the Bay Area too (tho I’m willing to offer up the sop that SF increased the least…limited time offer: ACT NOW!!)

Yes. And the Bay Area lagged the national numbers and SF lagged the Bay Area.

Work from home (far away) is only one reason people are moving. The embarrassing way the teachers union has handicapped city kids with a year and a half of zoom classes while kids in other counties are back in school is not lost on families in SF. Lowell changing admission policies, spreading homelessness, thefts. More and more reasons to leave.

I mean, there will still be lots of jobs here, but it will take some time to reclaim lost ground.

So many companies have referenced “Aiden/Kaila not getting into Lowell” as a reason for moving their headquarters I can’t even list them here…