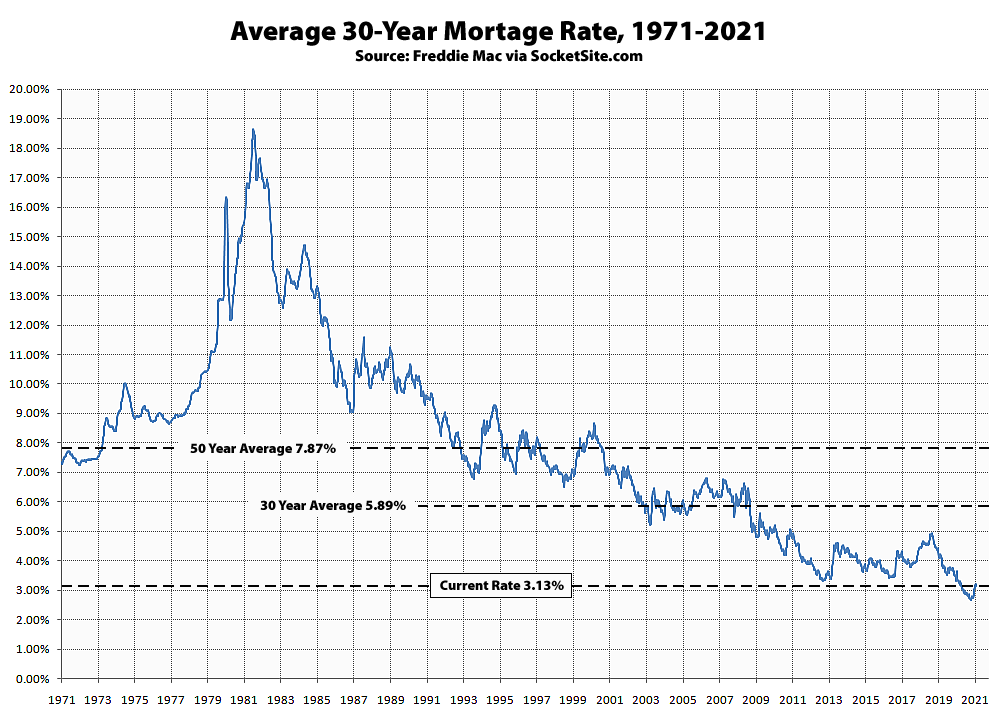

Having ticked up 53 basis points, or 0.53 percentage points, from an all-time low of 2.65 percent in early January, the average rate for a benchmark 30-year mortgage inched down 5 basis points over the past week to 3.13 percent and is still 20 basis points below its mark at the same time last year.

And while the nominal increase in rates has slowed the pace of sales, with a 4 percent drop in purchase loan application volumes over the past week and a 10 percent drop in pending home sales across the nation last month, keep in mind that the current average 30-year rate is still around half the prevailing rate on offer over the past 30 years and 20 percent cheaper than the average rate on offer over the past decade alone.