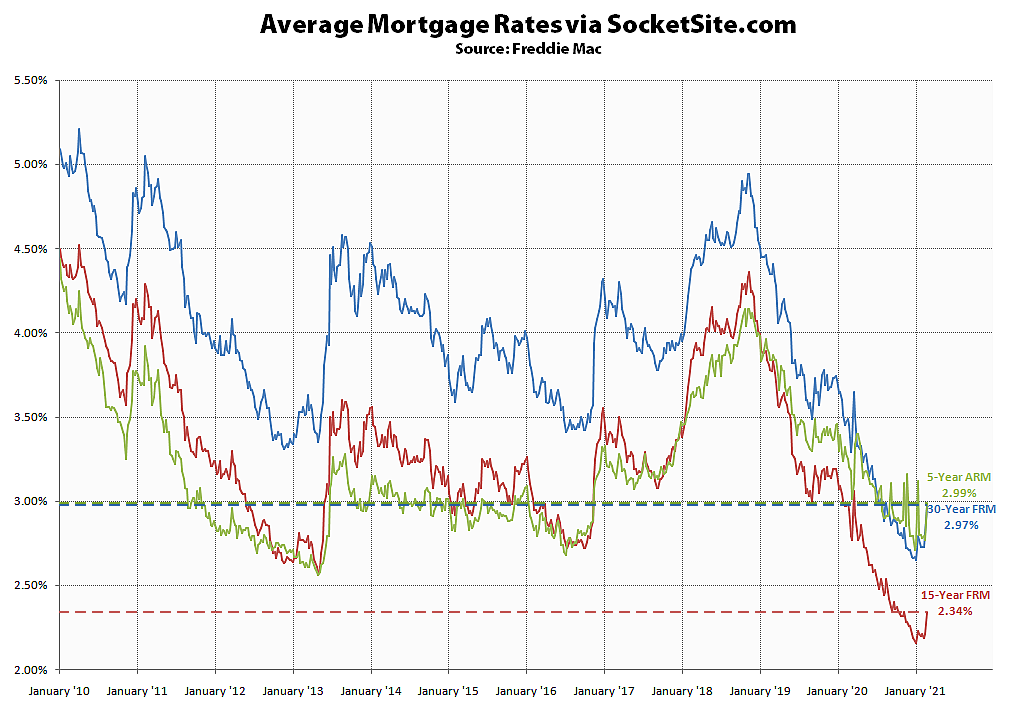

Having inched up 8 basis points (0.08 percentage point) to a three-month high last week, the average rate for a benchmark 30-year mortgage has since jumped another 16 basis points to 2.97 percent, which is the highest average rate in six months.

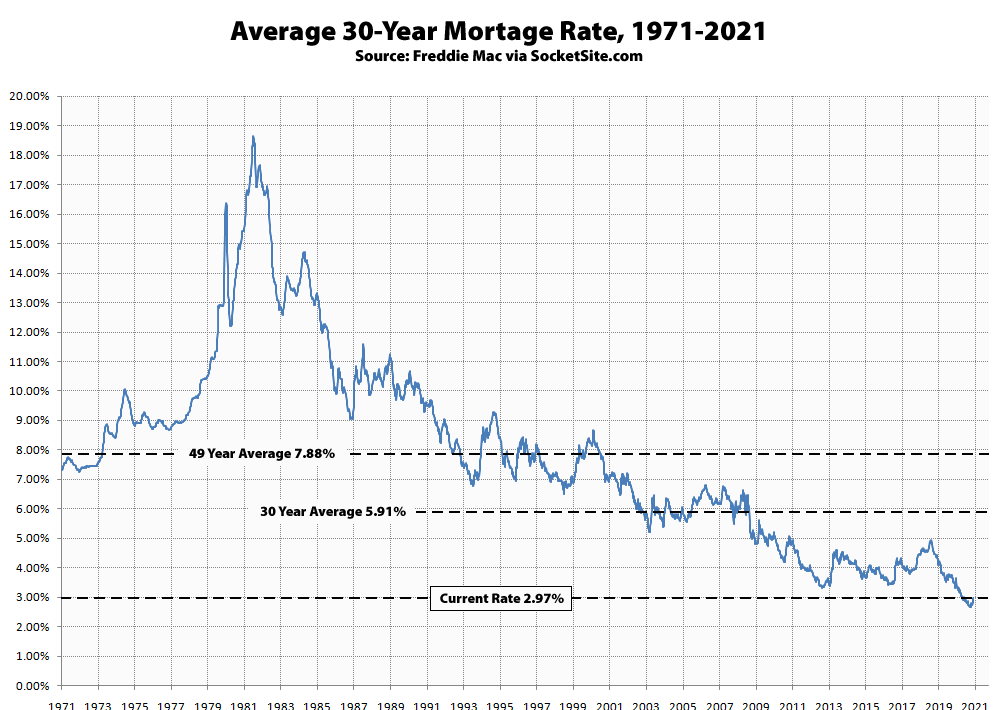

That being said, the average 30-year rate is still 48 basis points below its mark at the same time last year, only 32 basis points above its all-time low of 2.65 percent last month and half the average 30-year rate over the past 30 years. But mortgage loan application volumes are dropping.

At the same time, the average rate for a 15-year fixed mortgage has ticked up 13 basis points to 2.34 percent, which is still 61 basis points below its mark at the same time last year, and the average rate for a 5-year adjustable has jumped 22 basis points to 2.99 percent but remains 21 basis points below its mark at the same time last year.

sell! Sell!

please do!

Perhaps the 40 year bull market run for bonds is coming to an end. Perhaps the Reddit gang is getting tired of Gamestop and will attempt to short squeeze the 20 Trillion long end treasury market.

Brace yourself, rates are much higher than you think. 30yr is 3.22% today and may be trending higher.