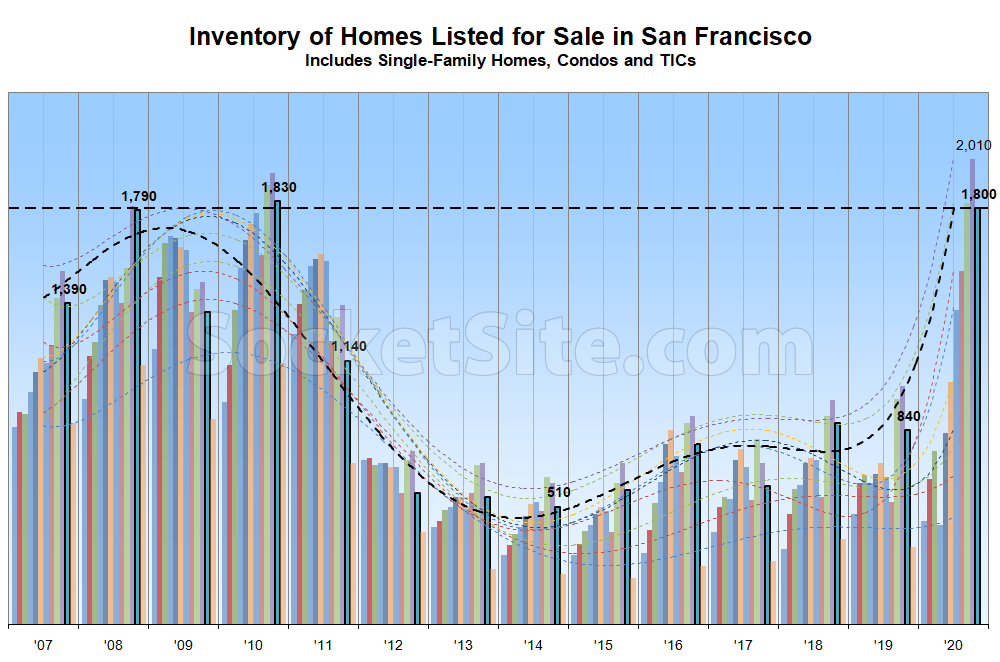

Having ticked down 11 percent since hitting a two-decade high last month, which shouldn’t have caught any plugged-in readers by surprise, the number of homes on the market in San Francisco, net of new sales and contract activity, both pending and closed, inched up one (1) percent over the past week, driven by a slowdown in the pace of sales while listing activity held firm.

As such, inventory levels are now over twice as high on a year-over-year basis, with the number of condos on the market, which remains a leading indicator for the market as a whole, holding at 1,380 (representing 150 percent more condo inventory on the market than at the same time last year) while the number of single-family homes on the market inched up to 430 (which is 50 percent higher, year-over-year).

Expect inventory levels to drop, at least in the absolute, over the next six weeks, and reductions to rise, before climbing again in January.

It is quite shocking TBH that in spite of the exodus which will continue, growing tax burden, falling quality of living, and general city’s downfall, some people are still buying at these ridiculous prices.

Not really. The exodus is largely renters. Recent transplants came for the big bucks in tech and when they leave the pressures on housing and the city in general, will recede and the quality of life will be better.

the quality of life will only be better if the city actually does something about the homeless/drug epidemic

This.

And also work with other counties in the Bay Area to not shift the problem elsewhere with the area.

Spend that “drug” money on improving school districts across the larger bay area. Better educated kids are a better long term investment.

You’re responding “This”, but what you followed it up with comments that contradict what the previous commenter, “jimbo” was asserting.

The only way that The City can do anything substantive about the homeless/drug epidemic is to fund widespread treatment and put more drug dealers in jail to reduce pushers creating more drug addicts faster than the rate at which current addicts get clean and sober. And this is the problem with so-called “progressives” and glib libertarians who think we can just stop “the war on drugs”, both of those options are insanely expensive, and will consume more money than is available.

Did you not hear that about 8,500 more injection drug users than the nearly 16,000 students enrolled in San Francisco Unified School District’s 15 high schools?

I don’t know of any legal way to redirect large portions of the social services budget from San Francisco into other districts across the larger bay area in order to make those districts more attractive to people currently living in S.F. in the hopes that they will re-locate on their own accord and leave behind the adult theme park for the rich that anarcho-capitalists want S.F. to be.

Brahma, cave dweller and I are thinking same way. We are using homless money inefficiently by enabling drug abuse and dealers. We should crack down on dealers, increase treatment efforts, audit and cancel contracts for ineffective non-profits and also spend more money on schools. we seem to value educations less than providing for criminals

@Brahma .. I am going to commit possible heresy/blasphemy here but stay with me. Maybe it is time to try something different. Something like voting the Democrats out and giving the alternate point of view a chance? I mean this whole Silicon Valley thingamajig got started under the Republicans. A little bit of conservative attitude is good for the pocket, mind and body. What say you?

True but do you realize that the tech transplants artificially bumped up the RE price by at least 2x meaning after they are gone the RE must fall by 2x which has not happened. Seems like locals will be holding the overpriced bag and those who are still buying at these prices are really out of their mind.

That’s just not true. We’ve gone thought this exercise elsewhere on this website. But the fact of the matter is, it’s simply put very expensive to build here. The cost of materials and the cost of labor have got to come way down to fit into a 2X drop as well. One could make a case for the cost of land coming down, I guess, althought 2X is extreme. But the costs of building? How ?

I think the high cost of labor is because of negative feed-back loops. Higher cost-of-wages because of cost-of-living because of higher cost-of-rent. This also has an effect on higher cost of materials because of higher cost of storage (rent) and handling labor. Business cycle bust is a wage-rent (input vs output) re-calibration event. I do not know for certain that we have a bust. But it seems like it.

Also, the city of SF and Bay Area in general make it artificially difficult to build here — hence increasing timelines and project carrying cost for builders. This is one reason why housing stock development in Texas or Sacramento Metro Region is better and cheaper than Bay Area.

Cave Dweller: Labor cost is at least partly driven by the state wide workers compensation rates. The $/hr. for a carpenter went up from $32/hr. to $35/hr. this year. It went from $30 to $32 I think the year before. These went up for any number of trades.

The cost of lumber is way up (Tariffs), steel is way up (tariffs/china). Then yes you have the California codes and local permitting.

Sparky – Why would tariffs affect lumber prices? Imports from Canada?

Yes. Lumber from Canada.

Just my observation based on what happened in 1995-2001 and 2008-2012.

The wind-up is fast to begin. But the un-wind is slow to begin and fast in effect.

I think the stock market “boom” (because of QE) has given some staying power in the interim. Now the government can try and shore it up with more QE, which I think they are highly likely to do. But, I also think that money will chase deals elsewhere since current RE pricing in SF is not really ideal for risk diversification. Somehow, I have a feeling the next round of QE is “intended” to drive trickle down effects to areas outside of metros and across the wide swathe of the nation. But I could be wrong.

SF itself is largely renters. Look how steep the rise is of inventory and how we’ve already hit/exceeded the inventory peak of the great recession. Renters were a leading indicator because it is so much faster and easier to decamp when you are just renting.

Yes, for this reason rents (in a stable market) should be higher than cost of mortgage. The risk for renter is lower than the property owner. We have a risk inversion because of QE. Risk inversion is a huge red flag because it really means negative cash-flow incommensurate with the underlying risk.

The negative cash-flow shell game works in an inflationary market — because of the belief of (and hope in) the next greater fool showing-up. I think the music is slowing down. But I could be wrong.

Some choice articles on Bay Area Techxodus:

The Guardian: ‘Customers are calling us crying’: scams and soaring prices as Californians move out

The Wall Street Journal: California, Love It and Leave It

And from New York:

New York Post: New stats reveal massive NYC exodus amid coronavirus, crime

I personally do not think crime in SF is as bad as NY. But it is still pretty bad in addition to doodoo pies.

And realize that those people who decamped to more rural places to avoid the virus now realize the error of their ways. In fact, SF has managed COVID so much better than other areas e.g. Boise, etc I think many will return – and we will see net new buyers – next year.

SF offers: superior quality of life, govt that actually cares about people’s well being and new-found “affordability”. Money will flock here again, imo, just as it always has.

Not sure about that. Moving as a homeowner is a slow process. And anecdotally there is some pent up supply as people are wanting to move out, but are not getting the news on pricing that they want to hear from comps/their agent. People trying to move, but stay in the bay area are really getting squeezed as price weakness in SF city is not helping them on the sell size and strength/demand in greener parts of the BA is hurting them on the buy side.

That price squeeze combined with taxes/fires/power shutoffs is prompting many to look further outside the BA/CA.

And the thing is that people were only minimally moving to avoid the virus. They were given a chance to move anywhere they wanted and just revealed their preference to live elsewhere. Especially if you look at the tech demographic of young, healthy & access to good healthcare, people moved out of SF far out of proportion to how hard we got hit with COVID.

I’ll cast in with jimbo & Cave Dweller and say that if the city wants to bring people back it needs to clean up. When people can work from anywhere, we’ll need to make this a place that people WANT to work from.

The online sales figures indicate that SF suffered a much larger loss of residents than other California counties. The exodus is two-fold. Out of SF for other Bay Area locales and out of SF for other states or places like South Lake Tahoe, Sacramento and San Diego.

One common drive is a desire for more space and that makes SF doubly undesirable as the housing stock is generally on postage stamp lots with little or no front or back yards. In contrast to much of the rest of the Bay Area. I live on Mt. Davidson and, though not a prime neighborhood, it is still a nice neighborhood. With lots of families. Those families are moving out in large numbers and most of the ones I know – who’ve stayed in the Bay Area – have headed for the Peninsula.

One good friend is moving to the area between El Camino and California in Burlingame. Things are being bid up there right now and they ended up paying 2.6 million for the place they fell in love with. They sold their Miraloma home for 1.7 million. Their new neighborhood is gorgeous. Beautiful homes on generous lots with a myriad of classic architectural styles and all set under 100 year old live oaks. The Burlingame “downtown” is just as quaint as anything you find in SF but without the homeless. SF just can’t compete with places on the Peninsula and in the North and East Bay at a time when part-time telework is common. Haven’t seen comparison numbers but it’d be interesting to see the price appreciation (or not) in SFHs in the various Bay Area counties and how they stack up with one another.

not sure moving to a place that is 900k more and $1300/ft or $1400/ft is what is driving anything. I think that some people moving to the more expensive part of the peninsula has been happening forever.

Short of SSF and San Bruno, most of the Peninsula is now quite pricey. The area my friends moved to is in the “flats” and north of San Mateo and is not one of the more expensive Peninsula locations.

The Peninsula is not the only choice and, if price is a key factor, the East Bay offers many areas where SFHs cost less than in SF. You can get a spacious home with a largo yard and killer 2/3 bridge view in the Oakland Hills for 1.3 million. IMO the Oakland Hills are undervalued with many locals unaware of the beautiful neighborhoods and views there.

@Dave — A number of people traded out their overpriced condos in SF for SFHs in the peninsula back in Jan/Feb/March — prior to the lock-down and prior to March market crash. The word of pandemic and potential market crash was in as early as early January even before national conversation around the pandemic started. And yes, a number of properties in San Mateo did disappear rather quickly at the early start of the pandemic (March-thru-June). Woodside, Pacifica, Half Moon Bay, Portola Valley, Hillsborough, Burlingame, Los Altos Hills buy you a lot more home for the price of a condo in Pacific Heights and with none of the quality of life issues unique to SF. I have not really been following the market in Peninsula in the last few months, so I don’t know what the current situation is.

People have always moved from the city to the suburbs, especially when kids hit school age. SF has always had a very low proportion of school-age children compared to other major cities. So the pandemic may just be making a preexisting trend slightly more visible. I live on the Peninsula, and for what it’s worth, public school enrollment has not increased in Millbrae/Burlingame/San Mateo compared to last year. If there really was a huge exodus of families from SF you would expect to see some change, although it may take another year or two to show up.

While the Peninsula does have some nice neighborhoods, especially in Burlingame, it’s worth noting that the housing stock is generally pretty poor. Mostly small cookie cutter homes built in the 1940’s that require a lot of renovations – it’s hard to find turnkey homes, especially in the under $2M bracket that most first time buyers leaving the city are looking in.

What really is there to say but “look out below”

I don’t know. Top prices for SFRs over the past two quarters or so? That might be a thing to say.

Not on a price per square foot or apples-to-apples basis.

Speaking of which: In Contract in the Heart of Cow Hollow

Yes on a price per square foot basis and I’ve already made those points several times over. But, sigh, it is unfortunately duly noted that it’s my comment you responded to and not “look out below.”

Unfortunately, it would appear as though you’ve been working with incomplete data. And the average sale price per square foot for single-family homes over the past year is, in fact, down.

Yes, you say the MLS data you use is different than what I take directly from the database. You never proved it. But you said it a few times. Not sure why you want to go here again. I don’t. But regardless, “lookout below” was what I reacted to.

The New York Times had an article a while back analyzing USPS mail forwarding requests from NYC addresses in order to quantify the NYC exodus. I had wanted to see something similar for SF and someone in my network just forwarded me this.

Looks like there were about 89,000 forwarding requests out of SF from March-October. (124,000 total forwarding requests, but 28% were to new addresses in SF) SF’s total population is about 896,000 so this seems like a significant exodus. And each forwarding request is for a household and a household can encompass more than one person.

Cellphone tracking data also showed that people left SF, but that just showed that people physically left SF. Forwarding mail out of SF indicates a move much more than just a temporary relocation out of SF.

Looks like the rate slowed a bit from the July-Aug peak, but still looks like a high rate of exodus. Vegas and Palm Beach were the top two destinations.

Unfortunately, without a baseline or context for the forwarding request data, in terms of year-over-year changes and historic trends, it’s not particularly useful. And then there’s the issue of in-migration which isn’t captured.

In terms of quantifying the actual size of the “exodus,” vacancy rates and changes in the labor force are more meaningful.

I agree that data for the previous year would be helpful as well as inbound forwarding. And I’m sure that the full data set contains that, but last I checked the USPS does not provide this data for free. So I’ll just take what I can get from people who do have firsthand access to the data.

For NYC, the Times did provide data for 2019 and they found that the March 2020 forward requests of 56k was more than double the monthly average. Then April 2020 went to 81k requests. (By eyeballing their graph this looks about 3x vs April 2019, though they describe it in the article as double)

Eyeballing the graph from the SF article it looks like for SF March 2020 was about 12.5k and April 2020 about 11k. NYC has about 9.5x the population of SF so it also looks as though there were more forwarding requests here on a population adjusted basis.

Also, there has been a narrative going around that everyone who was going to leave left early on and all we are seeing now is just the aftereffects. But this does not appear to be true. Oct Forwarding requests are down a bit from July-Sept, but up from March-May.

Again, without a baseline or context for the local market, it’s not particularly useful data, at least in terms of quantifying the trend and particularly when seasonality is in play.

For example, the “89,000 forwarding requests out of SF from March-October,” which you conclude was “a significant exodus,” gets cut in half, in terms of significance, if that’s double the historic average as in New York.

True, but that is 89,000 households and a quick web search tells me that the average SF household size is 2.3 people. So if that is double the baseline as in New York, I would still think that is significant for a city of 896,000.

Attempting to add precision to a flawed model, by layering on another assumption as to the “average” makeup of the households which were most likely to make a quick move, isn’t a great approach.

And while there are still 32,800 fewer employed people in the city than there were prior to the pandemic, the Labor Force count is now only down by 6,100, which is a 1 percent drop and totals 8,700 fewer people than at the same time last year.

The publiccommentSF “analysis” and assessment that’s being quoted is deeply flawed, to say the least.

Exactly. Of course it’d be good to have a baseline from the same period in a recent year but the implications along with online sales data is that a significant exodus has occurred. A population loss of 10% already? Given many of those 90K likely involved more than one person leaving. IMO SF will see its population decline to 750K or so over the next few years and this early data supports such a decline.

This take, which incorrectly latches on to the “89,000” figure, is exactly what’s wrong with the data as presented and subsequent analysis.

And in terms of quantifying the actual size of the “exodus,” vacancy rates and changes in the labor force are more meaningful.

It is one factor of many pointing to a large population decline – of which, to be sure, vacancy rates and labor force changes are part.

And while there are still 32,800 fewer employed people in the city than there were prior to the pandemic, the Labor Force count is now only down by 6,100, which is a 1 percent drop and totals 8,700 fewer people than at the same time last year. The publiccommentSF “analysis” and assessment you’re promoting is deeply flawed, to say the least.

there is a better article than the NYT one that just ame out 2 days ago on a new outlet called publiccommentSF. they are doing great stories and sugget you read this one. Their assessment is that 10% of SF population may be gone. but also agree that its not clear if they are gone for good

That’s the one from which wilson is quoting and linked.

And once again, without a baseline or context for the local market, in terms of the historic rate and seasonality of forwarding requests, it’s not particularly useful data, bad analysis and a miss-assessment of the exodus (other than directionally).

Yeah starting their data in March is a red flag for cherry picking. Either they are statistical [noobs] or they are hiding something. PubliccommentSF appears to be blowing its credibility early.