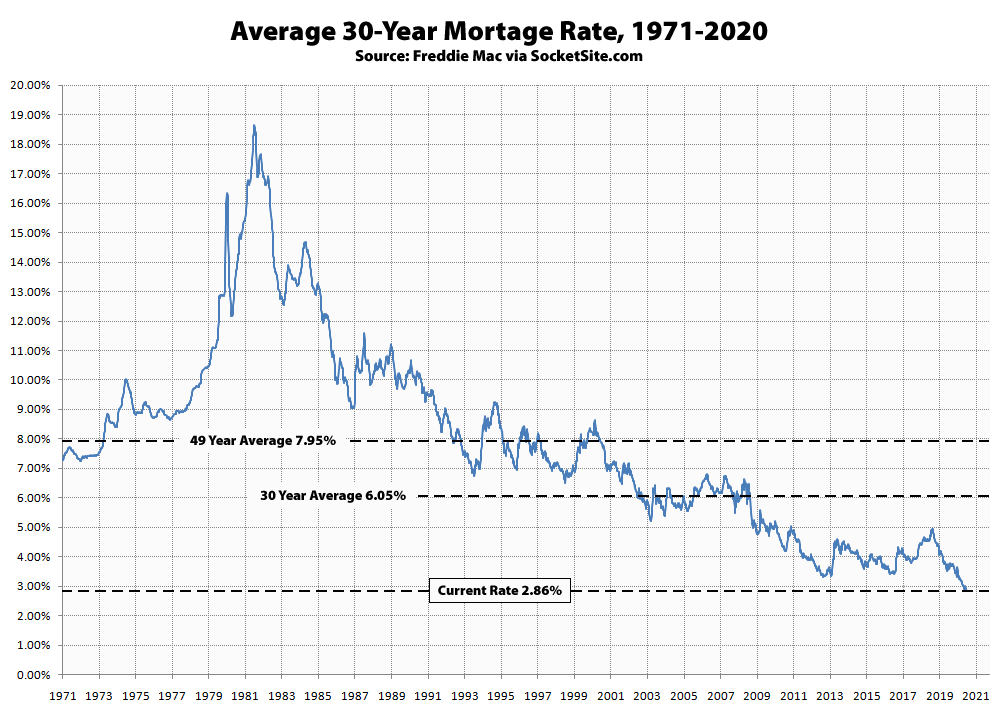

Having shed 7 basis points over the past week, the average rate for a benchmark 30-year mortgage has dropped to a new all-time low of 2.86 percent, which is 70 basis points below its mark at the same time last year and 2 basis points below its previous low of 2.88 percent last month, according to Freddie Mac’s Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage dropped 5 basis points to 2.37 percent, which is 72 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable jumped 18 basis points to 3.11 percent, which is 25 basis points below its mark at the same time last year and an inverted 25 basis points higher than the average 30-year rate, representing the largest rate inversion since the first month of 2009.

What type of loans are actually getting this rate?

I’m trying to refinance a jumbo loan for a 30-year fixed and no lender is quoting me anything below 3%….and I have credit score over 750. I’m ready to bite on one quote but feel like I’m losing out if I do.

You are correct. I have a similar loan and probably at least 40% equity and super credit. I am at 3.375% and struggling to get anything much below that. My broker is barely responding to me.

This is because jumbo loans are priced differently and are more expensive. Sub 3% standard conforming loans are plentiful at the moment.

And for investment unconforming loans, there is simply no offering of any rates. I was lucky to refinance my investment properties down to 3.8% before COVID, you can’t get anything now.

Investment conforming Loans at 3.5%

You can get 2.8-2.9 for a 30yr fixed. The other products are also in that range. It helps to have a “private bank” relationship vs trying to get attention from the main-line banks amongst the hoi polloi. (In other words, fat chance with Wells Fargo)

Consider shopping for a conforming loan instead. I just locked at close to 2.5% for a 30y FRM.

for a refi?

Data point: 3 weeks ago I just closed a High balance conforming refi, balance about 600k, 2.25% on a 15 year. We went through Simplist and the lender we picked was quicken loans. Best part is that rate was actually with a small credit – and we skipped having a payment 9/1. Closing costs were under $900. We were thrilled.

The New York Times lists Jumbo 30 year fixed rate (which is what matters in the Bay Area), at around 3.1% now, if you can find someone making a loan. Located at NYT > Business section > Money > Markets > Consumer Rates.

Majority of Bay Area mortgages are conforming loans.