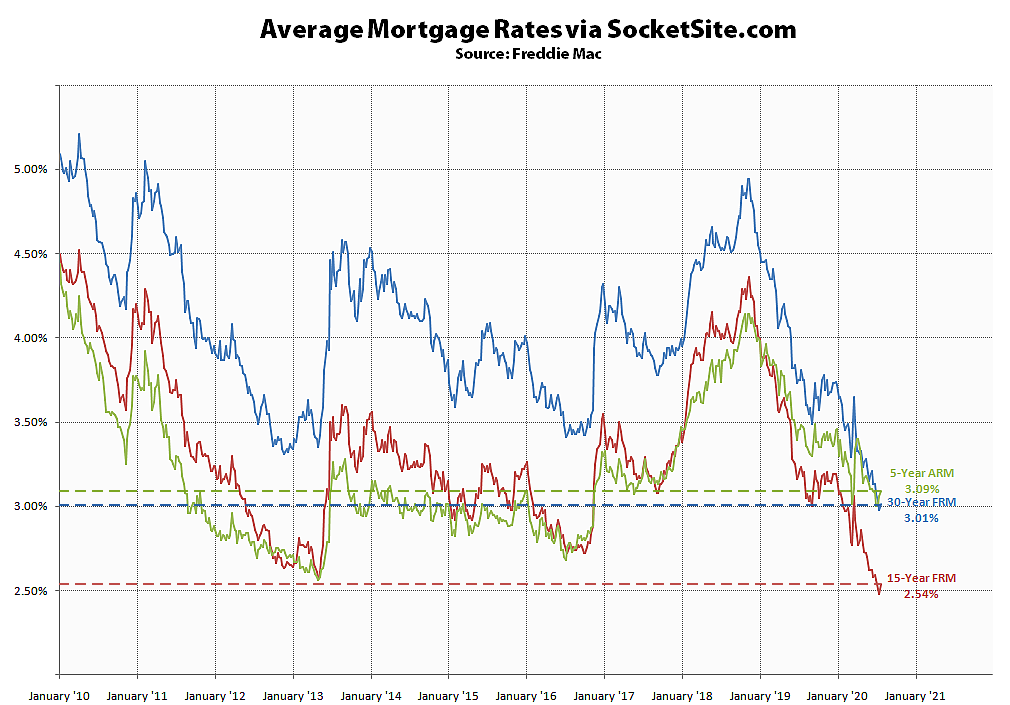

Having dropped to an unprecedented sub-3 percent rate last week, the average rate for a benchmark 30-year mortgage has since inched up 3 basis points (0.03 percentage points) to 3.01 percent, which is still 74 basis points below its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data, and roughly half the historical average for the 30-year rate.

At the same time, the average rate for a 15-year fixed mortgage has inched up 6 basis points from an all-time low to 2.54 percent, which is 64 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable inched up 3 basis points to an inverted 3.09 percent (which is 38 basis points below its mark at the same time last year).

And while refinancing activity ticked up another 5 percent over the past week and is now running 122 percent higher versus the same time last year, purchase activity across the U.S. only inched up 2 points and is running 19 percent higher, year-over-year, according to the Mortgage Bankers Association.

Lower rates support higher prices. So rates dropping by almost half since January 2019 has provided a lot of price support.

Rates can’t go much lower – so what happens next with prices?

There are countries with near 0% long term mortgages.

From July 24, Super-low mortgage rates: A blessing or ominous sign of next housing downfall?:

The same story says that more than half of mortgage borrowers experienced income loss due to the coronavirus pandemic, so a price drop of 9% seems pretty reasonable.