With the number of newly proposed units of housing to be built in San Francisco having ticked up in the fourth quarter of last year, the number of apartments and condos under development in San Francisco (i.e., the city’s housing pipeline) ended 2019 at a new record high and 4 percent higher on a year-over-year basis.

In fact, the number of units which are currently under construction and should be ready for occupancy within the next year or two has ticked up to over 10,000, which is the most in over a decade, 26 percent more than at the same time last year and nearly 70 percent above the average number of units under construction across the city at any point over the past ten years as well. Of course, construction on some of the smaller projects is currently suspended.

At the same time, the net-new number of units of housing for which building permits have either been issued, approved or requested – but for which the ground has yet to be broken – has ticked up to nearly 17,000, which is the most in over a decade as well, while the number of units in projects that have already been approved but not yet permitted (which still includes the majority of the 10,500 units by Candlestick, 7,800 units on Treasure Island and 5,680 units at Parkmerced, projects which have overall timelines measured in decades, not years) has ticked down to 30,600.

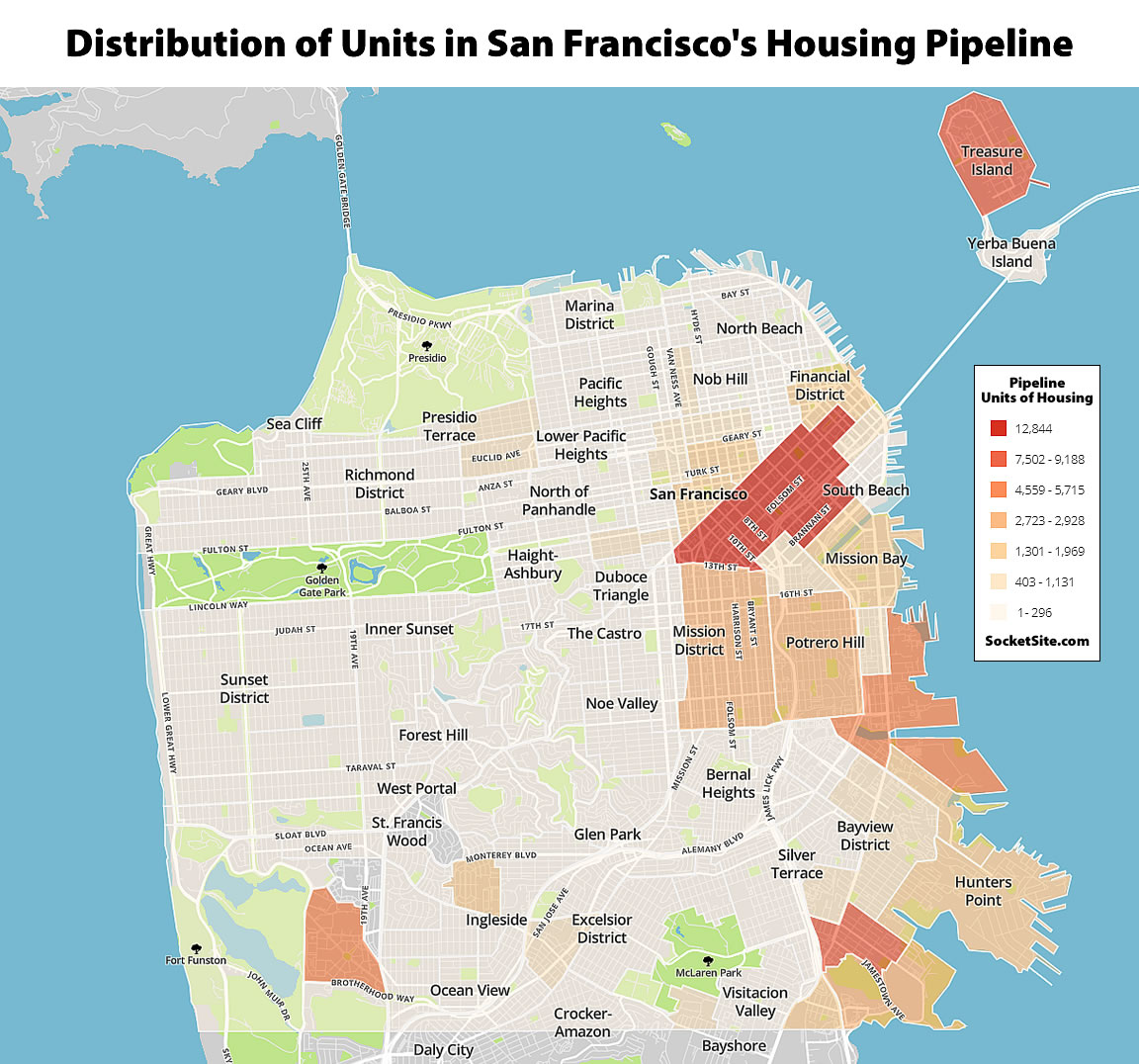

And with proposals for another 16,000 units of housing now under review by the City’s Planning Department, which continues to be bolstered by the passage of San Francisco’s proposed Central SoMa Plan, San Francisco’s Housing Pipeline totals a record 73,819 units, which is 954 more than in the first quarter of 2019, which was the previous high water mark, including over 14,000 units of “affordable housing” which are to be offered at below market rates, according to our latest accounting of Planning’s databases as newly mapped and distributed above.

All bets are off for projects permitted but not yet under construction – for the foreseeable future. And in particular rental projects. AB828 proposes to reduce rents in California by 25% – due to the pandemic. And, channeling Rahm Emmanuel, don’t let a crisis go to waste – look for efforts to impose statewide rent control, further restrictions on evictions and more. The added risks make many of these projects financially too risky. Not even considering a potential modest drop in home/condo prices in the Bay Area, California and the country as a whole.

Beyond the immediate “issues” is the longer term question of population and jobs in the Bay Area. Will there be a move by individuals and companies to less dense areas? If so the need for 73,819 new housing units in SF may not emerge and likewise the amount of need for new housing in the Bay Area as a whole over the next decade. Developers/investors in pipeline projects not yet permitted will be cautious and delay moving forward until there is an indication of the pandemic’s long-term effect on the Bay Area.

For additional context, in mid-2008, prior to the Great Recession, there were 36 percent fewer units already under construction in San Francisco and 200 percent fewer units which had already been approved and permitted.

“in mid-2018, prior to the Great Recession”

You mean 2008? (or has the latest episode been christened…if so wouldn’t it be GR2.0?)

Good catch, since corrected for clarity.

Thanks

(now we’ll move on to the comparatives: 36% fewer than…what exactly??

200% fewer….well, uhm THAT one is a neat trick…guess they revoked some of the permits)

🙂

What about Seattle, Dave? How is the pandemic going to effect that veritable Shangri-La? How is Boeing doing, relative to the bigger SF companies, there, Dave-arino? In light of Boeing, how does the monoculture of Amazon in Seattle pertain to the hundreds of posts you’ve made on here decrying SF’s tech dependent culture?

AMZN is doing fair-to-middlin’… compared to some companies at least. If you’re going monoculture raise corn or wheat, not kale.

We all know that Amazon is doing okay. The question posed was how the City of Seattle is doing, now that they have a single large employer (Boeing moved its headquarters out of Seattle to Chicago in 2001). I don’t think S.F. is anywhere near as dependent upon Uber as Seattle is upon Amazon, but if you have info that says otherwise, go ahead and post it.

In the Summer of 2018, The Seattle City Council passed a “head tax” to be levied on large employers in the city to help alleviate the city’s spiraling homelessness crisis. And what happened? Amazon decided to “go Gault”, Amazon Crushes a Small Tax That Would Have Helped the Homeless:

Compare that behavior to here, where Salesforce’s largest shareholder worked toward actually doing something about homelessness by supporting a gross receipts tax city ballot measure in Nov 2018, which passed. At that time, Salesforce was the city’s largest private employer.

Do you mean going “Galt?” Like Ayn Rand?

Didn’t Benioff move his conference out of SF because of the filth and crime downtown?

Dave,

AB828 is a massively disappointing bill from the otherwise pro-housing Assembly-member Ting and (co-author) Senator Scott Wiener.

If renters need assistance, it should come in the form of direct rental a$$istance from the State.

Short of that, the State and Federal governments could impose an across-the-board halt to all mortgage payments, if they intend to allow tenants to forego paying rent.

At the end of the day, it’s all about the financing — and the “buck literally stops” at the banks.

So in lieu stealing from property owners, why not declare a nationwide “bank holiday” and then, once the crisis has abated, we can all start back up where we left off. No harm; no foul.

Short of that, this is a wildly unconstitutional taking and will find itself immediately in court, if it is able to muster effort votes to pass both legislative houses and get signed into law.

That being said, I don’t see Governor Newsom applying his signature this ill-conceived and counter-productive nonsense, so the legislature is going to need a super-majority to override.

Usually “pro-housing” is understood to mean that one favors additional housing construction, not “pro-landlord.”

AB828 seems fair to me. Anyone who invested in rental property should know that all investments carry risk. It’s not in the public interest to let landlords externalize that risk by throwing people out on the street in a crisis. The bill also pauses foreclosures and auctions due to unpaid property tax. So it’s false to say it doesn’t protect property owners. You just may not get as much rent as you were expecting to get for a little while. And I don’t think you’ll find much sympathy for that when millions have lost their jobs and health insurance.

That’s a simplistic point of view. Landlords can’t legally be singled out, regardless of grandstanding assembly members. And not every landlord ‘invested’ in rental property, or have a mortgage on said property. Fir example: inheriting a house from your mother, who just passed away.

Look at all that land ripe for upzoning!

Mary Jane it wasn’t Benioff (salesforce) it was Ellison (Oracle). A much less beneficent presence.

And supposedly, the move to Vegas was more for optics bc the Salesforce conference has stolen the limelight & Oracle’s was getting stale.

I stand corrected. Thank you.