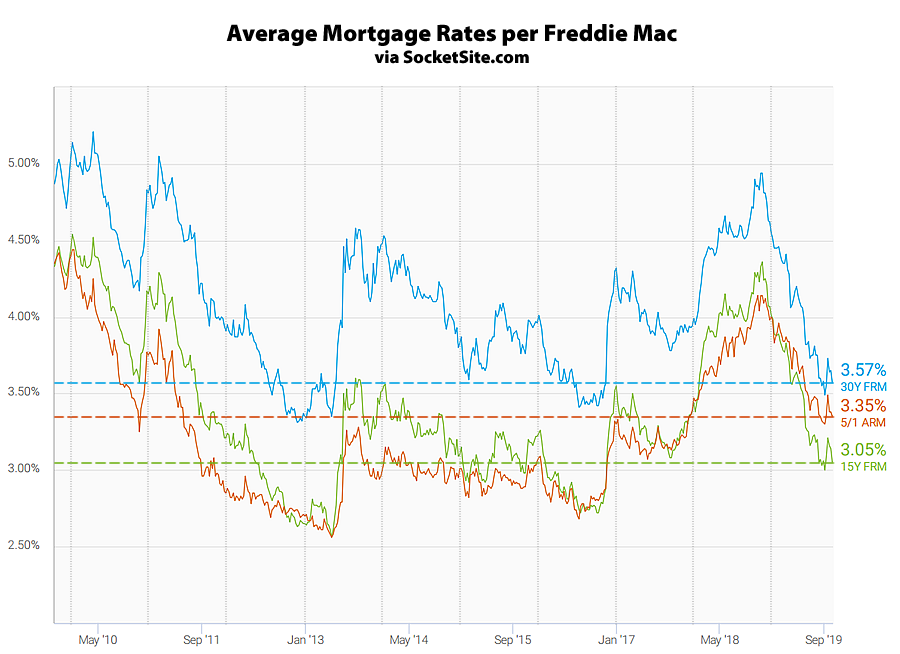

Having jumped 17 basis points in mid-September, the average rate for a 30-year mortgage has since shed 16 basis points and dropped back down to 3.57 percent, which is 133 basis points, 1.33 percentage points or 27 percent below its mark at the same time last year (and within 16 basis points of a three/six-year low).

At the same time, the average rate for a 15-year fixed mortgage has dropped 16 basis points as well, for a current rate of 3.05 percent, which is 124 basis points (1.24 percentage points) lower than at the same time last year, while the average rate for a 5-year adjustable has dropped 14 points to an inverted 3.35 percent, which is 72 basis points lower than at the same time last year.

And with respect to the odds of the Fed instituting a third rate cut by the end of the year, according to an analysis of the futures market, the probability has now jumped to 89 percent.

A while back on here someone asked, “what will happen once the Fed can’t cut rates anymore?” I replied they’ll start QE again, just like last time. And now we see this: Fed to Start Buying $60 Billion of Treasury Bills a Month

Everybody remember, “don’t fight the Fed”.

All of this intervention is going to make the next downtown one for the ages. In the meantime, I’m just about to start shopping for a refi.