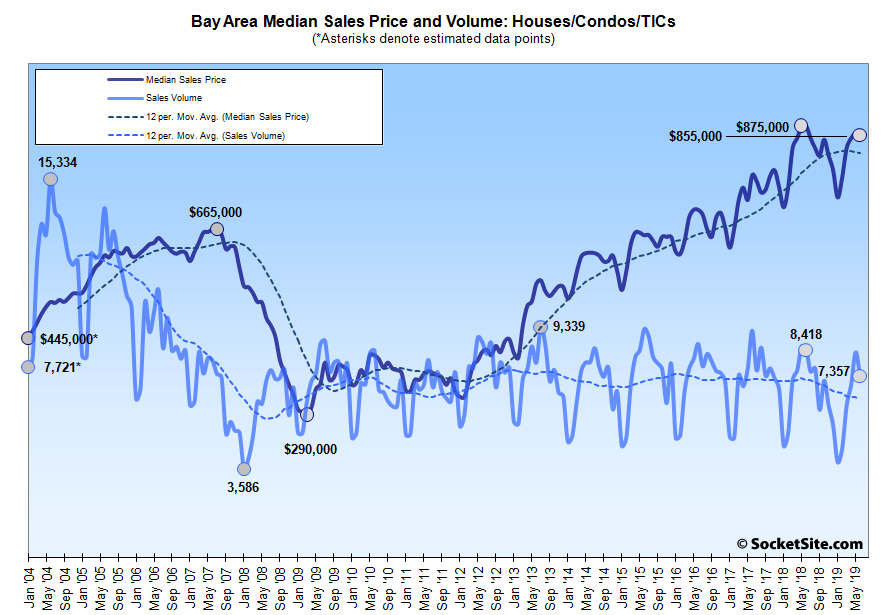

Continuing to follow a trend which shouldn’t catch any plugged-in readers by surprise, the number of single-family homes and condos that traded hands across the greater Bay Area dropped 11.4 percent from May to June, versus typically ticking up, and total sales (7,357) were down 12.6 percent on a year-over-year basis, according to recorded sales data from CoreLogic.

In fact, last month’s sales were only 3 percent higher than in June of 2008 and marked an eleven-year seasonal low.

At the same time, the median sale price for the Bay Area homes that traded hands last month slipped 0.6 percent to $855,000, which is down 2.3 percent versus the same time last year and marks the fourth straight month with either a year-over-year decline or no gain, prior to which there were 83 consecutive months of recorded year-over-year gains.

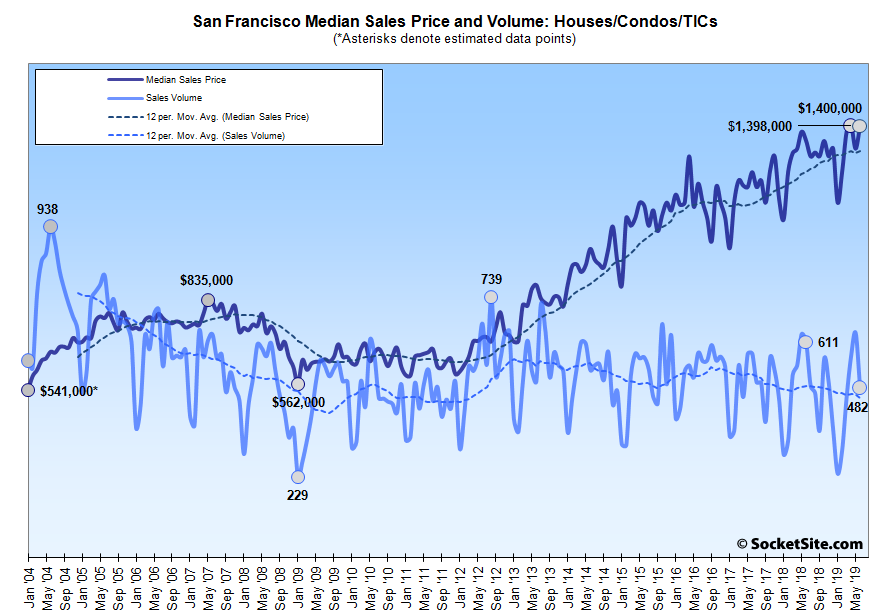

In San Francisco, recorded sales plummeted 24.3 percent from May to 482 in June, which was down 21.1 percent on a year-over-year basis and the fewest June sales in over 15 years. And in fact, the pace of home sales in San Francisco has since further slowed.

On the eastern side of the Bay, homes sales were estimated at 1,580 in Alameda County last month, down 13.5 percent on a year-over-year basis. Sales in Contra Costa County totaled 1,486, down 13.6 percent. And sales in Solano County totaled 640 in June, down 2.0 percent versus the same time last year.

Down south, home sales in Santa Clara County totaled 1,502 in June, down 18.6 percent on a year-over-year basis and sales in San Mateo County were estimated at 593, down 13.0 percent versus the same time last year.

And up north, home sales in Napa totaled 137 last month, up 2.2 percent versus the same time last year. Sales in Sonoma came in at 607, down 2.0 percent. And sales in Marin totaled 330, down 6.8 percent, year-over-year.

With the share of more expensive home sales in the city having increased, the median price paid for those 482 homes in San Francisco was $1,398,000 in June, effectively matching the record $1,400,000 median price in April and 3.6 percent above its mark at the same time last year.

The median sale price in Alameda County was an estimated $865,000 in June, effectively unchanged versus the same time last year; the median sale price in Contra Costa County was $660,000, up 4.0 percent versus the same time last year; and the median sale price in Solano County was $435,000, which was effectively unchanged as well.

The median sale price in Santa Clara County was $1,132,000 last month, down 1.6 percent versus the same time last year while the median sale price in San Mateo County was $1,360,000, which was 2.6 percent higher, year-over-year.

The median sale price in Marin was $1,212,000 last month, up 4.5 percent versus the same time last year while the median sale price in Napa ($677,000) was 1.1 percent higher on a year-over-year basis and the median sale price in Sonoma ($600,000) was down 3.2 percent.

As such, the median home sale price across the greater Bay Area was $855,000 in June versus $875,000 at the same time last year.

And as always, keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, especially as sales volumes drop, as opposed to movements in the Case-Shiller Index.

San Francisco median prices were up, to, I believe, a new all-time high. $1.58 million. Curious that you didn’t mention that when you break out SF separately every month. Could it be that your agenda trumps even the appearance of objectivity?

A funny thing happens to the median when volume drops, as it really did in San Francisco, but the share of higher-priced home sales increases (hint: it mixes the median price up). Regardless, stay tuned for the county by county breakdown. And the “$1.58 million” figure you appear to be (mis)quoting isn’t the median for San Francisco overall.

It’s not just about higher priced homes, actually. Much of it is to do with competition in the lower priced sectors. Because 1.2M and under SFR sales had basically the same volume YoY 2019(275) to today and 2018 to today’s date last year (273). But price per square foot is up $16. If you parse it out to individual neighborhoods it’s there as well. The westerly Sunset areas has gotten particularly more expensive for the same product this year. It went from $914/ft in the first seven months of 2018 to nearly 1091/ft so far this year, with a difference of one sale in volume.

Keep in mind that you’re focusing on another minor segment of the market. Overall, home sales are down over 8 percent in San Francisco through the first half of the year while the relative volume of higher-end sales is up.

I am not doing anything of the sort. I am staying on topic to sfres’ comment about price, and your response to that comment, which was to do with mix and price. I stayed on price and provided data displaying lower end volume was static and price was up. Now you counter me with a pure volume take?

I’m going to take a little break from your site. It’s all gotten a bit “reject the evidence of your eyes and ears” Orwellian for now. Take it easy

“Yes, higher end, luxury, 2M condos and 3M for sfrs.”

Last week you were hyping up the high end as saving the market, now your’re saying 1.2 and under SFR? A 21% overall YoY drop in volume is huge. Don’t miss the forest for the trees. Hint: Try getting a U-haul out of the Bay Area.

Yes. I know someone relocating to Boise from Fairfield. He flew to Boise to rent the U-Haul there as it is much cheaper. He will save hundreds of dollars and that despite having to pay for a flight to Boise.

Foreign investment in US residential real estate is down 36% per state just released by the NAR. What investment remains has largely shifted to the Southeast and in particular, Florida.

Google and twitters’ workers RSU packages just got 10% larger and FED is easy next week into a massively overheated economy

Much like the overhyped IPOs this year that we’re going to cause the SF real estate market to skyrocket further. As you can clearly see, that did not happen. I would not cheer lower interest rates either as the Fed sees many sign of a weakening global economy. For a city such as SF, that has a relatively large contingent of foreign buyers, that only spells more trouble. The buy and hold investors would be crazy not get out while they still can.

Don’t agree this is anything close to the dot-com bubble. We are entering into the early stages of a hyperinflation. I am in the market for a 1-bedroom condo. Have been watchign for about 3 months. Anything marketed as asking for 900k goes for around 1.1 million.

A million dollars isn’t a lot of money anymore. 5 years from now that will look cheap.

IPUh-Oh…”Uber to Cut About 400 Employees, Citing ‘Mediocre Results” These huge losses and slowing growth are going to be trouble in the public markets.

Don’t worry, subsidies in the market make sure everyone gets fed. I’m sure this is sustainable. One jarring finding: 28% of deliverers said that they have actually eaten food from the orders they were supposed to deliver.

As far as “a massively overheated economy” is concerned, well which economy is overheated? From Chairman Powell’s Semiannual Monetary Policy Report to the Congress:

Emphasis mine. If the economy was overheating, one would expect to see some inflation. The Fed is probably going to ease rates next week, but it probably won’t be as much as financial markets have already “priced in”, which will mean a drop in asset prices across the board in the short term.

The fact is, if you’re in the market for a $1.5-$2.5m SFH or condo in a “good” location, the market is materially tighter and more competitive than last year and this segment has about doubled in the last 5 years. That’s a 7% CAGR with no signs of slowing.

The data can be massaged to tell any story you want, but the “meat” of the market is priced well out of most folks’ touch and even those with the means will likely look back in 10 years and realize their levered returns, including carrying costs, were not so good at all

^^^ sorry. A 15% CAGR, and that might overstate a bit. More like a double since 2011

“The data can be massaged to tell any story you want”

Isn’t that exactly what people are doing when they data mine for slices of the market to make look good? Huge drop in interest in the overall market and the last few weeks everyone claims to have a segment that goes against the trend. OC/Compass says below 1.2M and above 3M SFR is hot. You say $1.5-$2.5m SFR is hot. So where’s the volume drop? SFR’s between 1.2-1.5 and 2.5-3??