Following a trend which shouldn’t catch any plugged-in readers by surprise, while the number of single-family homes and condos that traded hands across the greater Bay Area increased a seasonally driven 18.9 percent from April to May, total sales (8,310) were down 2.7 percent on a year-over-year basis.

And while the median sale price ticked up a seasonally aided 1.2 percent last month to $860,000, it was down 1.7 percent versus the same time last year, according to recorded sales data from CoreLogic, marking the third straight month with either a year-over-year decline or no recorded gain in the median sale price, prior to which there were 83 consecutive months of recorded year-over-year gains.

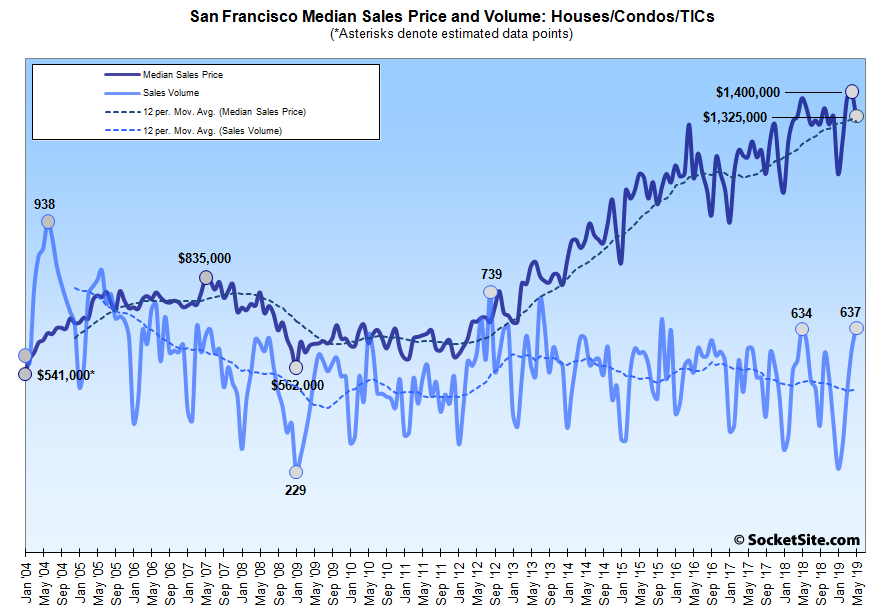

In San Francisco, recorded sales totaled 637 last month, which was 0.5 percent higher on a year-over-year basis, a nominal bump which shouldn’t catch any plugged-in readers by surprise as the pace of sales started to retreat mid-month and pending sales activity in the city is currently down around 5 percent, year-over-year.

On the eastern side of the Bay, homes sales totaled 1,762 in Alameda County last month, down 0.2 percent on a year-over-year basis. Sales in Contra Costa County totaled 1,725 (up 1.6 percent). And sales in Solano County totaled 639 in May, down 3.6 percent versus the same time last year.

Down south, home sales in Santa Clara County totaled 1,744 in May, down 11.0 percent on a year-over-year basis and sales in San Mateo County totaled 636, down 9.0 percent versus the same time last year.

And up north, home sales in Napa totaled 143 last month, up 23.3 percent versus the same time last year. Sales in Sonoma totaled 652 (up 3.3 percent). And sales in Marin totaled 372, unchanged, year-over-year.

Despite the fact that there were more expensive homes on the market in San Francisco, the median price paid for a home last month dropped from a record $1,400,000 in April to $1,325,000 in May, which was down 4.0 percent versus the same time last.

The median sale price in Alameda County was $855,000 last month, a nominal gain of 0.6 percent versus the same time last year; the median sale price in Contra Costa County was $631,000, up 0.3 percent versus the same time last year; and the median sale price in Solano County was $436,500, up 1.5 percent versus May of last year.

The median sale price in Santa Clara County was $1,127,500 last month, down 6.0 percent versus the same time last year while the median sale price in San Mateo County was $1,432,000 and 3.8 percent higher, year-over-year.

The median sale price in Marin was $1,200,000 in May, up 1.3 percent versus the same time last year while the median sale price in Napa ($670,000) was 5.1 percent higher on a year-over-year basis and the median sale price in Sonoma ($596,000) was down 2.5 percent.

And as such, the median home sale price across the greater Bay Area was $860,000 in May versus $875,000 at the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, especially as sales volumes drop, as opposed to movements in the Case-Shiller Index.

What happened to the tech-pocalypse that was supposed to “eat San Francisco alive“?

It was countered by the exodus of Chinese buyers and Trust fund kids being ordered out by their trustees due to state and local taxes not being deductible, and was based on a misunderstanding of how RSUs work. Stock options are largely gone and RSUs are basically shares in lieu of pay at a fair market value when you are hired.

Example: Nearly every Uber employee hired in the last 4 years got RSUs, which are shares that vest over time, that had a fair market value of $47.88. If you got 1000 RSUs vesting each year as part of your compensation plan, you took a $47,880 cut in pay to get them. Each year they vest, you pay ordinary income tax on them at the fair market on the date they vest. Uber’s fair market value was $47.88 during all 4 years. So they paid about 35% in state and local taxes, usually in the form of the company just reducing the number of shares you actually received while the company uses the rest to pay the taxes. So you got 650 RSUs instead of 1000.

So now, 4 years later, you are the lucky holder of 650×4=2600 shares for which you took a cut in pay of around $192,000 in total. You can sell those shares for $117,338. That isn’t the 10,000 millionaires we were led to believe by our always truthful realtors. That is a 20% down payment on a $600,000 condo, and not many people buy real estate when they just recognized a loss. If those are the only remaining buyers, prices would have to fall, by a lot. But hey, maybe Uber will go up enough to get out for what they paid.

What’s actually surprising about the real estate sales numbers is that interest rates have fallen by 20% since last year. I fail to see why prices wouldn’t go up in that environment.

this is not accurate. most early pre-IPO employees get stock options and not RSUs. There is a switch to RSUs but not until the company has gotten more established. There are thousands of employees in UBER, SLACK, LYFT with stock options.

regarding interest rates, i just locked a 30yr refi for 3.49% and am asolutely amazed as never thought it would happen

jimbo is right on this one.

Yes, I agree that I’m completely wrong. Like for example, here’s a guy from 3 years ago, very senior PhD engineer at Google earning about $305K at Google. Uber offers him $143K base salary + $180K/yr in RSUs (he doesn’t specify, but usually they vest over 4 years).

So I’m just completely wrong about RSUs and not options, because clearly, this guy got ZERO options and more than half his salary in RSUs. That means everyone is getting options, and not RSUs, right? /s

And clearly I’m wrong about a pay cut because his pay was cut by more than 50%. Obviously, a greater-than-50% pay cut is not a pay cut at all, according to the poster below. Because tech is too competitive: Uber would just hand out RSUs, which had an actual, provable, fair market value, as if they were worthless. I mean, how could I have not seen that, as it’s so logical? /s

Thank you for “correcting” me. I was obviously completely wrong about this and I am sorry I sullied this board with my incorrect facts. /s

that what is called an antidote. and yes you are wrong. stock options are very common.

uber is now more established so may offer more RSUs, but they still offer options. RSUs vest at 1st year and then 1/36th per month after that, meaning he virtually got paid $323K per year, but much more if the stock went up. for start-ups and companies less than 5 years old, and most pre-IPO offer options much more than RSUs. after companies are public, RSUs may become more common.

Aren’t options worse in cases like this where the company has dropped in value? Uber is at $44 now. Someone with RSUs at $47.88 is only down 10%. But someone with options at $47.88 has nothing. Correct?

yes, options have more upside but can also be worthless. getting options when the company is pre-IPO can be life changing though. plenty of uber employees (there more than 3 yrs) got options priced under $2

Uber@$2 was a $3.4B valuation. Six years ago in 2013 they were valued at $3.7B. Their Dec 31, 2012 global headcount was 159 people.

I am not sure what you mean by “most” but the reason for this switch is due to a change in how the IRS categorized compensation. Stock options (non qualified, the kind most non executives get) have a value based on their duration, volatility, etc. Previously this value was not taxed before the mid 2000s. The IRS decided that these have some value and so should be taxed as compensation.

The tax on grants is paid at vesting by the employee instead of grant time by the company so they are more efficient income wise from a company standpoint. Unfortunately this does mean that normal employees get shortchanged if the company is successful compared to the dot com days.

I wouldn’t be surprised if the IRS actually takes in less total revenue as a result of this change but no one said their decisions were monetarily efficient. I would guess that the decision of grants versus options depends on the valuation of the company at time of grant which would be calculated based on the last investment round.

Heh. I don’t know. A lot of them are going to be waiting until after next April or so, for one. The other thing is, what does this data show really? nominal amounts down, in median, from all time high price? What’s that to you? nothing? Looks kind of like a stasis at all time price high to me. And then the editor mentions Case Shiller, and links to it, which is nominally up YoY. So what’s that? Nothing? But yeah by all means you’ll figure everything out by being as snarky as possible. Keep the quest for truth alive in your heart, please.

Next April Now?

First: “The Juul wealth creation happened, and they’re buying things that are written about on Socketsite. So there you go, word.” (Posted by Ohlone Californio, 4 months ago)

Then you get busted on that so it’s April 2019: “No. I’m saying next month, mid-April ’19 start taking notes.” (Posted by Ohlone Californio, 4 months ago)

That didn’t happen so now it’s next April 2020? Maybe April 2021, the “Two Tax Seasons After IPO-Effect”?

I think I called it with the ‘Make up some reason why now is the best time to buy-Effect’!

Juul did happen. Some of those people did buy / are buying. In SF we have seen this spring maintain, and indeed even increase upon 2018’s record prices. Finished, well built houses in desirable neighborhoods have gotten record prices left, right, center. A half block off Valencia, 7.4M. An average Church st Noe location got 5.3, Fairmount Heights routinely seeing 5 – 7M, etc etc etc. So what is it supposed to look like to you? Seriously, what do you think you’re supposed to see?

And yes, it’s not over. Many of the rank and file will be waiting until after the lockup period, and then after the next tax period. Feel free to go back and pull up the quotes that I issued along those very lines as well. In the meantime, a word to the wise. Put your little “gotcha,”/ whataboutism card back in your pocket and save it for when you might actually need it.

Jeez. I even said as much in the very response to you that the editor was so kind to link to:

“Moving forward I think we’ll see all sorts of things taking shape around the IPO events. Some people will have already cashed out in secondary markets. Some will necessarily wait for the actual events and the lockup periods to expire. Others will wait for both those things plus the subsequent year’s tax consequences”

The popularity of whataboutism / gotcha type parsing has been a really lousy thing for the internet. Despite people’s differences of opinion on this website, most folks are actually better writers than that. So step your game up dude.

Aside from all of the inaccurate math – this post completely misses the point. As someone who actually works for a recently IPO’d company – let me actually clarify. None of the recent slate of IPOs have allowed a single employee of any of these companies to benefit. And – no one took pay cuts to work at successful pre-IPO internet companies (the market for software engineering talent is just too competitive).

The real point: Due to a mandated 6 month lock up period – an employee with pre-IPO equity (options, RSUs, or other) can not sell a dime of their equity today. Towards the end of 2019 when these lock-ups start to expire – you will see whether or not tech employees impact the SF real estate market. Your guess is as good as mine. But – by no means has the impact been felt quite yet.

I believe that Slack, because of the way it went public, is the exception to your rule. Those employees can sell stock immediately.

You are correct, Slack is an exception. There is no lock-up for direct listings.

However – it is a much smaller company – with a large presence in Vancouver. I consider Slack a “San Francisco” company that was founded (and still maintains) a significant engineering office in Vancouver.

Not a single?? What about the pre-IPO secondary markets? Secondary market sales have kept more than one Telsa dealership humming with buisness.

Nope. No secondary market sales for the majority of the more successful pre-IPO companies (I’ve seen it inaccurately report on several times in the media – which is completely false). Strictly forbidden (unless done illegally). It’s part of employment contracts for most of the companies we are referencing in this thread. It’s only allowed at the Board of Directors discretion which is never given.

Now – I did read that some brokerage offered to “lend” a sum of money using the locked up equity as collateral. But, the details sound bogus to me.

agree. the pre-IPO secondary market is severely embellished. most employees have to wait until lockup

That might have been true in the past when this was done against the companies consent. (Usually through “mirror” transactions where two parties would agree to a contract that mirrors the economic effect of selling the stock without technically selling it. This likely violates the employees employment contract, but hard for the company to find out. And since it doesn’t transfer voting rights not much motivation for them to look too hard) Some companies are more neutral and require a “right of first refusal” whereby they can opt to be the buyer for any shares that are sold. But recently this has actually been sanctioned by many companies.

This last crop of companies have gotten very large while remaining private and have been private for a long time. Employees were clamoring for liquidity. See this and other articles like it.

The main reason companies were against this in the past was loss of voting control to unknown parties. And secondarily retention/motivation issues. But now many of these companies have a super-voting class of shares above the employee class and/or the percent of the shares owned by rank and file is small. And for retention/motivation employees were demanding this. Plus having someone on the hook for a large mortgage they hope to pay off with options/RSU’s is motivation for them to work to make that equity worth something.

“Now – I did read that some brokerage offered to “lend” a sum of money using the locked up equity as collateral. But, the details sound bogus to me.”

Not bogus at all. Probably the most common thing out there. Most people buy housing on credit no need to wait for full liquidity. People with much more bogus financials get large LTV mortgages. And for the bank, you come in with a illiquid equity package whats the risk? The equity package goes to zero and you lose your job before the package becomes liquid. And the number of people with big equity packages is often overhyped, but those that do get a good packages are good at what they do and can easily get another job. Even then the banks money isn’t at risk unless the housing market also drops.

price factors: i just locked in a 3.49% 30 yr re-fi, so will be surprised if the offer of cheaper money doesnt pull some people in to the market. from 4% to 3.5 make a large dent in payments

JakeSF wrote: None of the recent slate of IPOs have allowed a single employee of any of these companies to benefit. Well, clearly some did, even if the stock price didn’t do as well as planned post IPO. Garrett Camp, the multibillionaire tycoon who co-founded Uber with Travis Kalanick ponied up a record-breaking $72.5 million for a brand-new Beverly Hills estate. The sale price ranks as the most ever paid for a home in Beverly Hills, handily eclipsing the $70 million record that had stood since 2014.

California’s population just had it slowest growth ever and the state is expected to start losing population in the near future. IPOs or not the macro picture is more relevant to housing costs. The BA’s population is stagnant and could start shrinking also. Check out one-way rentals for U-Haul. From Vacaville to Boise it is almost $3K, From Boise to Vacaville about $300. Heard of one person moving to Boise from Vacaville and he flew to Boise, rented a U-Haul truck then drove to Vacaville then loaded up and drove his possession back to Boise. Saving money over having rented the truck in Vacaville. The dynamic is/will be the BA becoming less of a population and jobs center in coming years. Putting a lid on home valuations.

What Dave says is true, but a bit hyperbolic. Population growth almost EVERYWHERE is slowing due to lower birth rates, increasing deaths of baby boomers, and less immigration (legal and otherwise). Through the early years of the decade we were growing FASTER than the state as a whole. Now, there is increasing out-migration from the SF Bay Area, due largely to cost of living presumably. Interestingly, to me, the most outmigration is from Santa Clara and Alameda Counties, and SF seems to be nearly holding its own. I’m assuming it is still popular enough with young technies that that nearly equals the steady outflow. All of this is natural and cyclical, given the economic success of the region and the severe cost of living constraints that has caused.

Thank you for the link, but to me it looks like the (county-by-county) outmigration is proportional to the populations; yes SF maybe did a little better, but I wouldn’t put much faith in small differences, given the inherent unreliability of the estimates (I’m also unclear on what was being measured: was it movement out of one’s county or out of the area ?? If the latter, then Alameda and SC would logically lead b/c they’re at the edge of the region….i.e. people who move “nearby” are “leaving the Bay Area”)

Population growth in the US is around 1% and the Bay Area and California are lagging that. Despite a large inflow of legal and undocumented immigrants. That inflow is holding the state’s population steady or slightly up but it appears set to be overtaken by the growing new out-migration. Apparently LA County lost 100K residents and leads the nation in that. Population growth is surging in some places like LV, Seattle, Phoenix, Boise and many Texas and Florida cities. It is cyclical – the Golden State and the BA have had a long up cycle and are set for a prolonged down cycle just as new more dynamic areas are set for their own prolonged up cycles.

The large number of new apartments build in Seattle prevents it from getting as overpriced as the bay area and thus keeps people from fleeing.

This was a worry in the Seattle area and has been for years. They did not want to make the mistake of the BA re: housing. They have been producing 17K apartment (this figure does not include non-apartment new residential construction) units/year for a good number of years now. Far more than the Bay Area and the most new apartment construction of any city in the country per capita. It’s why Seattle is often at the top of the crane count. Unfortunately, for the Bay Area, the ship has sailed on having affordable housing for the mass of the middle class.

From March of this year, The best $5,929.10 I ever spent: moving back to the Midwest: Moving from Seattle to Cedar Rapids cost nearly $6,000, and I’m so glad I did it.

Emphasis mine. Go read the whole thing.

The reason the cost of living in the Bay Area is rising higher than inflation (if that’s true) is because it attracts more real estate greedheads from out of the area who want a docile, compliant, quickly-turning-over population to prey on, compared to other areas. But that doesn’t mean that Seattle is a cheap.

No one said Seattle is cheap. But it is far more affordable than San Francisco. Median home price is $800K in Seattle to SF’s $1.3 million. Median salary 83 K to SF’s 96K. When you factor in no state income tax in Washington the median income in Seattle is just a few thousand less than SF. Not only are rents falling in Seattle but home prices too. Because of the massive residential construction there and despite a high population growth rate – more than 3 times that of SF. The fact that rents and home prices are falling in Seattle at a time they are still generally affordable theree is a robust sign for the future of the metro. The situation is completely different in the Bay Area and the reasons for that are obvious.

Remember the BS that Millennials were settling in cities for good?

““The back-to-the-city trend has reversed,” said William Frey, a demographer at the Brookings Institution, citing last year’s census data. Millennials, the generation now ages 23 to 38, are no longer as rooted as they were after the economic downturn. Many are belatedly getting married and heading to the suburbs, just as their parents and grandparents did.”